MACRO

US ECONOMICS – FISCAL POLICY

THE COST OF THE REGULATORY STATE

OBSERVATIONS: RIGHT DIRECTION, WRONG STRATEGY, TERRIBLE IMPLEMENTATION

Let me make it perfectly clear that I am a strong believer in Sustainability and Safe Guarding the environment. I believe it is the morally right direction to be taken by a responsible society. I also fully understand that such a decision will come with a cost.

The decision on direction should not be confused with the strategy to achieve it nor the implementation process chosen by the current administration. It is in regard to both that I strongly disagree and have serious concerns about.

THE STRATEGY

The strategy to achieve sustainability has many flaws in it, but the two most egregious are:

-

- The degree to which government regulation is being taken to attack, restrict and end fossil fuel protection in the name of sustainability.

- The forced regulatory strategy and government spending on the adoption of EV technology.

The crippling of the US fossil fuel industries borders on being economic suicide and minimally brazenly naive and outright stupid. To jeopardize a country’s energy self-sufficiency in anyway, rather than through a well thought-out transitional plan that maintains strategic advantage, is simply incompetence. The petroleum industry is central to 72 other industries from cosmetics to plastics which this strategy will place the US at a competitive disadvantage and increase the US cost base.

The forced regulatory strategy of the adoption of EV technology is

flawed from its inception. There is nothing wrong with the adoption of electric cars. The flaw is in both the generation and storage of the electricity required. Putting aside the electric grid and a national charging station requirements, it is the use of batteries to store the electricity where the strategic mistake was made.

Battery dependent technology is the wrong strategy. The strategy has been built by politicians who are predominantly lawyers and not engineers. The strategy should have been built on an initial adoption of Hybrids where early adoption may have used batteries in selective segments, but rather the use of onboard fuel cells for the electric drive motors burning green hydrogen in parallel with IC engines. This introductory transition stage would then have been replaced with Internal Combustion Engines using new technology green fuels – not petroleum carbon based.

Green Fuel technology has already been economically achieved by major foreign manufacturers who in the next 18-24 months will completely end the US role in the automotive and trucking industry. All of this because of a flawed political strategy that is already clearly evident to anyone actually investing in these technologies. The US would have been better off investing in the new fuel cells and green fuel, building on our proven US domestic university research & industrial strength?

THE IMPLEMENTATION

If the above wasn’t the case, why haven’t China, Japan, South Korea and other major automotive manufacturing countries not already installed nationwide electric charging stations?

Meanwhile our administration is currently funding and subsidizing through unprecedented government debt? It all reminds me of France building the Maginot Line before WWII?

The flaw is becoming obvious as EV owners are already frustrated, dealerships and manufacturers are scaling back, while fleet owners like Hertz are suffering massive residual value losses and selling their EV fleets while they still can.

THE CONSEQUENCES

The right direction was taken by politicians (with self serving spending goals) but built on a flawed strategy and an abominable implementation disaster.

Expect (the always implemented) massive government bailouts and financing to be spent to catch-up. Just maybe that spending along with the original trillions already spent was the real strategy?

WHAT YOU NEED TO KNOW!

BOTH US PARTIES ARE TALKING TARIFFS!

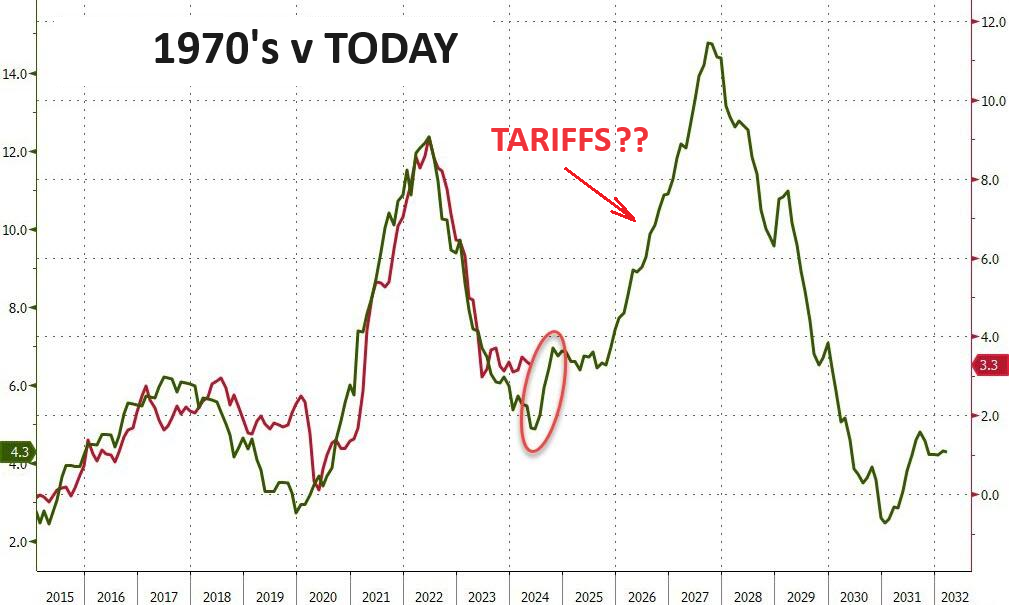

It is becoming clear that both Biden and Trump see Tariffs as the strategy to combat China. Forget what politicians believe and understand that tariffs will result in higher consumer prices.

It is becoming clear that both Biden and Trump see Tariffs as the strategy to combat China. Forget what politicians believe and understand that tariffs will result in higher consumer prices.

In a nearly 70% consumption economy like the US, rising consumer prices is a serious problem. If we learned only one lesson from the 70’s, it is that once the inflation genie is let out of the bottle it is nearly impossible to get it back in!

Tariffs will be like pouring gasoline on an already smoldering fire.

RESEARCH

INFLATION & THE INCREASING COSTS OF REGULATIONS

-

- Federal regulators often underestimate the costs and overestimate the benefits of the rules they issue.

- Regulations tell Americans how to get benefits, how to meet safety standards and how to pay their taxes. There are now over 200,000 pages in the Code of Federal Regulations.

- We all pay for government regulations. Sometimes the corporations regulated pay fees and licensing that go toward regulatory expense. Otherwise it is tax payers.

- Regulatory costs include direct costs of compliance such as costs of paperwork, equipment modifications, and testing procedures. Indirect costs result from the redirection of industrial research and development efforts and from conflicting regulations and goals.

- An average firm spends 1.34 percent of its total labor costs on performing regulation-related tasks, according to the government’s own National Bureau of Economic Research .

1- COMPETITIVE DISADVANTAGE

-

- Regulations can create barriers to entry, which can reduce competition and increase prices for consumers. These barriers can include: i) Startup costs, ii) Licensing procedures, iii) Regulatory compliance, iv) Expensive education, v) Testing, and vi) Fees

- Regulations can also create other challenges for companies, including: I) Timeliness: Regulations can change quickly, and companies may not be aware when new regulations come into effect; ii) Cost: Companies may incur significant costs when monitoring legislative changes; iii) Data: It can be burdensome for companies to stay up-to-date with the changes.

- Other unintended consequences of regulation include: i) Hidden costs: Regulatory costs are often hidden and passed on to consumers, employees, and investors; ii) Capture: Interest groups can use regulation to promote their own interests, such as restricting competition and suppressing innovation; iii) Bureaucracy: The regulatory process can be slow and out of touch with changing needs.

-

- REQUIRED APPROACH:

A. Respect market forces and the beneficial effects of competition.

B. Do more good than harm

C. Base decisions on the best available information and transparency.

D. Gather better feedback.

E. Encourage experimentation and learning.

F. Regulatory humility.

G. Address regulatory accumulation.

2- COSTS

-

- U.S. federal government regulations cost an estimated $3.079 trillion in 2022 (in 2023 dollars), an amount equal to 12% of U.S. GDP.

- Costs fall unevenly on the major sectors of the economy and on firms of different sizes; the findings indicate that compliance costs fall disproportionately on small businesses.

- Federal regulations cost an estimated $12,800 per employee per year in 2022 (in 2023 dollars).

- Small firms with fewer than 50 employees incur regulatory costs of $14,700 per employee per year – 20% greater than the cost per employee in large firms ($12,200).

- The regulatory cost disadvantage confronting small firms is amplified greatly in the manufacturing sector, with small manufacturing firms bearing more than double the cost of large manufacturing firms, or $50,100 versus $24,800 per employee.

- Fifty-eight percent of survey respondents indicated that federal government regulation was a challenge that had recently affected their firm or that they expected their business to face in the future.

- Using data provided by respondents, the estimated cost of outlays for manufacturing as a whole indicates that expenditures related to regulation in the past year were approximately $350 billion. To put this figure in perspective, it is larger than the individual economies of 29 U.S. states.

3- COMPLIANCE

-

- Compliance costs are larger than the individual economies of 29 U.S. states.

DEVELOPMENTS TO WATCH

1- CHINA – RISING INFLATION PRESSURES

1- CHINA – RISING INFLATION PRESSURES

Global excess liquidity remains buoyant, which is supporting an increase in shipping rates, as captured by the Baltic Dry Index.

GLOBAL FREIGHT RATES

==> CHINESE PPI

==> US CPI

-

- Global Freight Rates are up significantly.

- Chinese PPI leads US CPI by a few months and is following rising global freight rates.

2- NATO – PLACING THE WEST ON A “WAR FOOTING”

EXPANDED PARTNERS, FOCUS & SPENDING

-

- Expanded partners in the Pacific-Asia and Middle East Theater

- Increased focus to include Cyberwarfare, Disinformation and AI

- Increased membership defense budgets

GLOBAL ECONOMIC REPORTING

JUNE CPI – A TUMBLING LAGGING OER

JUNE CPI – A TUMBLING LAGGING OER

- It was only a matter of time before CPI started missing month after month driven by the badly lagging Owner’s Equivalent Rent, which will proceed to tumble for the “next 18 months, and since shelter is 36% of the CPI basket, inflation will soon appear low (even though real rents are rising again… so Fed is two cycles behind now”.

- JUNE PPI – CORE PPI ROSE 0.4% (2X 0.2% EXP)

- Headline PPI printed HOT at +0.2% MoM (and May was revised higher), pushing the YoY print up to 2.6% (well above the 2.3% expected).

- JUNE FISCAL BUDGET SPENDING – DEBT INTEREST 30% OF TAX RECEIPTS

- The $140 billion in gross interest spending in June was just over 30% of all US receipts (mostly taxes) for the month.

- The current $1.114T 2024 outlook is 67% of the expected deficit of $1.7T. This was the single biggest monthly interest outlay on record!

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.