TIPPING POINTS

THE US CONSUMER

THE CREDIT ADDICTED “YOLO” CONSUMER

OBSERVATIONS: THE POLITICAL CLASS HAS SIMPLY LOST THEIR WAY

Our US political leaders, (I like to call them the “Political Class” because they have become divorced from “Mainstreet”), have been very busy since the Biden Regime took control with what they perceive as important:

-

- Open Borders with ~10M homeless and unemployed Illegal Immigrants dropped on an overburdened medical, police and community social service providers

- Wars (Ukraine, Syria, Yemen …) and Economic Sanctions

- Spending ~$7T, which caused inflation and then fighting Inflation with disruptive and destabilizing interest rates

- Diversity Equity and Inclusion (DEI)

- Environmental, Social, & Governance (ESG)

- Transgenderism

- Woke (ism) and CRT

- Climate Change, Net Zero roll-out and Renewable Energy

- Vaccine rollouts and Mandates

- Pandemic Lockdowns

- Criminal charges, court cases and investigations of our political leaders

- Weaponization of Government agencies against political rivals

- Bank Meltdowns

- Government bond market meltdowns

- CBDCs, Crypto crackdowns

…. and so …. so… much more.

Shockingly (maybe not so shockingly), all of the above have absolutely no relationship to what “We The People” are facing and need, as standards of living and real disposable incomes are crushed to pay for these policies.

-

- Despite a cooling inflation rate, Americans face average food prices in U.S. cities being 20% since Biden took office.

- Gas prices are still about one-third higher than pre-Bidenomic levels.

- Gallup survey reveals that 48% of adults rated economic conditions as “poor,” the highest share in a year and getting worse.

- The University of Michigan’s monthly survey found that 20% of consumers felt their personal finances had deteriorated during Biden’s tenure.

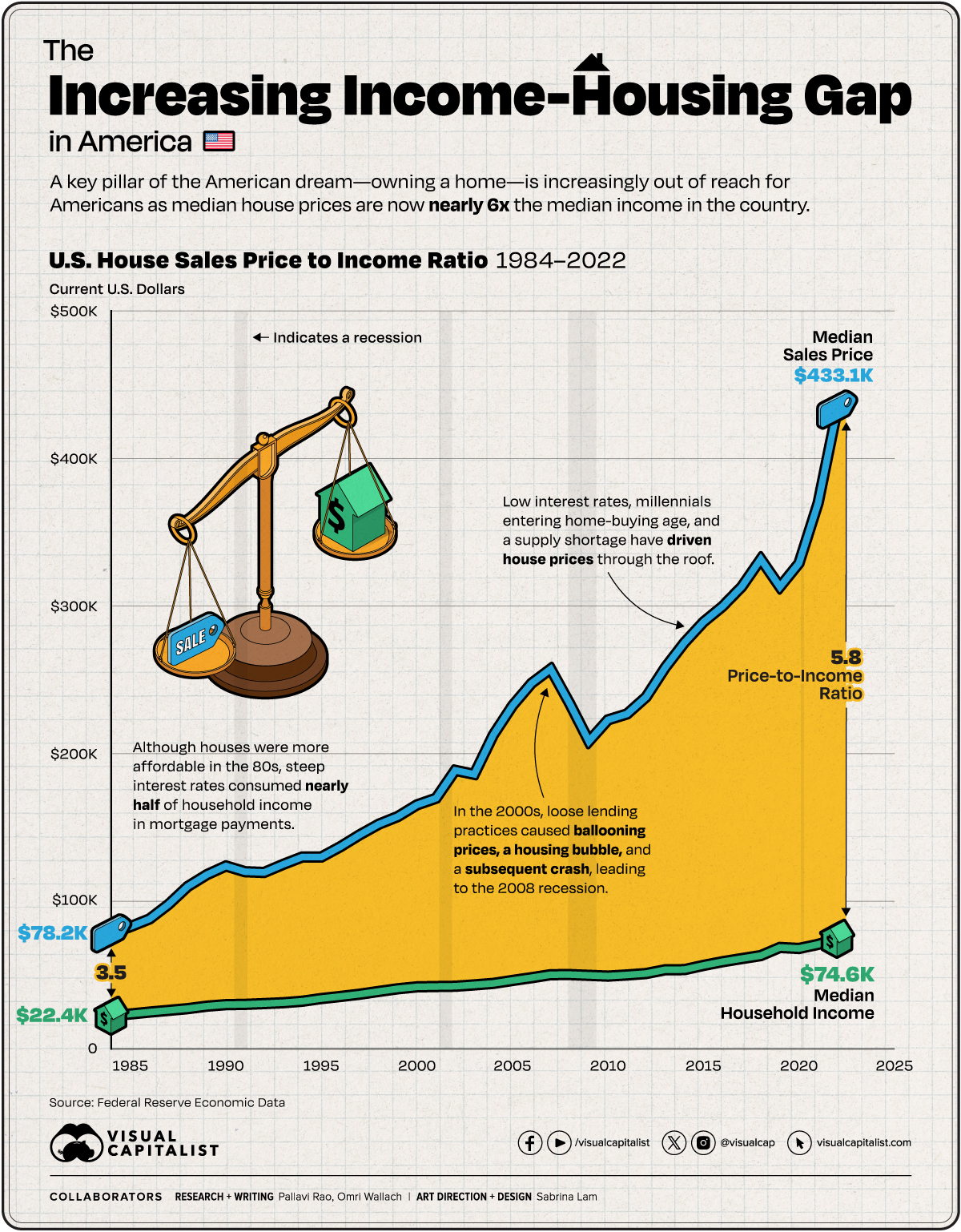

- The surging Housing to Income Gap is making home ownership unaffordable to most Americans (chart below).

- 88% of states are reporting a rise in unemployment while Federal Government reports the U.S. economy added 353,000 workers last month. Economists have spotted “oddities” in the data since “Full-time employment has plunged by nearly 1.4 million people over [the] past three months”??

- Increasing numbers of critics argue that Bidenomics actually misallocates resources and disrupts market signals.

- High inflation, interest rates and bank failures have been attributed to unwise Bidenomic policies.

- The list goes on (see more below in “THE CREDIT ADDICTED “YOLO” CONSUMER “).

How is it that our elected politicians (of both parties) have managed to avoid the disastrous consequences of all the US government policies gone wrong? In Europe, the consequences are plain to see. People are taking to the streets and abandoning the mainstream political parties, like it matters who you vote for. A 2022 survey found trust in government in the EU had fallen from 4.7 out of 10 to 3.6. Can you imagine what it is at now? However, in the US not so much as a beep?

I sense that below the surface, the frustration in the US has reached the point that the mainstream media is now unable to deflect coverage. The political class is certainly well aware of that.

The question is whether they can accept a loss of voter confidence across the board without raising the stakes? Or are we going to discover a new disease, asteroid, or social cause imminently to justify a new round of eye-watering government intervention in our lives? Get ready, I smell it coming!

WHAT YOU NEED TO KNOW!

THE SURGING HOUSING COST TO INCOME GAP

THE SURGING HOUSING COST TO INCOME GAP

As of 2023, an American household, hoping to buy a median-priced home, needs to make at least $100,000 a year. In some cities, they need to make nearly 3–4x that amount. In 1984, the median annual income for an American household stood at $22,420, and the median house sales price for the first quarter of the year came in at $78,200. The house sales price-to-income ratio stood at 3.49. Meanwhile, the majority of low-income Americans are considered “rent-burdened,” meaning more than one-third of their income goes toward housing costs.

It is important to note that the graphic (right) does not make allowances for:

1- Actual household disposable income, nor

2- How monthly mortgage payments change depending on the interest rates at the time, and

3- Datasets are in current U.S. dollars, meaning they are not adjusted for inflation.

BOTTOM LINE: Housing Affordability is making the American Dream a frustrating nightmare!

RESEARCH

THE CREDIT ADDICTED “YOLO” CONSUMER

-

- Americans are falling behind on their credit card payments with 1 in every 12 credit card holders in arrears.

- Americans added a whopping $50 billion to their credit card balances last quarter, bringing credit card debt to a new all-time high of $1.13 trillion.

- Credit card balances in “serious delinquency,” or at least 90 days past due, rose to 6.4%. That’s 59% higher than the previous year.

- According to a third-quarter survey by Clever Real Estate, 23% of Americans acquire more debt every month just to pay the bills.

- The personal savings rate for U.S. households fell from 5.3 percent in May to 3.9 percent in December.

- Compared with pre-pandemic levels above 8 percent, recent figures represent the lowest personal savings rates since before the global financial crisis, when households were stressed by rising adjustable rate mortgages on homes they simply could not afford.

- Not only are they saving less, but Americans are also depleting their savings accounts. Aggregate personal savings has fallen by over 27 percent since December 2019.

- Eventually the party will end, and the hangover will be painful.

DEVELOPMENTS TO WATCH

THE FED “PIVOT” & THE TREASURY “PUT”

-

- The Fed’s Pivot, along with the US Treasury’s willingness to run persistently large election year fiscal deficits, will likely lead the US dollar in 2024 into resuming its downtrend from its 2022 highs.

- This will also likely be a positive tailwind for the new bull market in stocks.

“IN ALL HISTORY, THERE HAS NEVER BEEN A RACE OF THIS MAGNITUDE!”

-

- NVIDIA GAAP earnings jumped 765% year-on-year. No one had ever seen something like this for a company of its size. But of course, no one has ever seen something that combines elements of the space race, the nuclear arms race and a race to create a super-human species.

- In all history, there has never been a race of this magnitude which we are witnessing in AI. In a rapidly changing world that is becoming digitized, it may even be that this is what the early stages of a hot war looks like. The world’s most powerful nations, and those companies that have already attained sovereign-like status, are now in an existential competition to find the Holy Grail.

GLOBAL ECONOMIC REPORTING

-

- JANUARY PERSONAL CONSUMPTION EXPENDITURE (PCE): Super Core Services Is The “TELL”!

- The last time this type of core-services inflation occurred – in the 1970s and 1980s – there were clear signs that inflation was cooling sharply. Analysts thought repeatedly that the high interest rates at the time had beaten inflation back down, which caused the Fed to ease, only to find out that we’d fallen for an inflation head-fake, and then the Fed jacked up rates even further. The head fakes occurred over the 15 years between 1966 and when core services inflation finally peaked at 11% in 1981.

- From the Fed’s perspective it is the Services inflation ex-Shelter and the PCE-equivalent. They actually ticked up on a Y-o-Y basis to 3.45%, thanks to a large 0.6% M-o-M jump – the biggest MoM rise since Dec 2021.

- Under the hood, the SuperCore, on every sub-element rose M-o-M

- WEEKLY CONTINUING JOBLESS CLAIMS: We refuse to report the BLS nonsense. Instead read this analysis .

- JANUARY PERSONAL CONSUMPTION EXPENDITURE (PCE): Super Core Services Is The “TELL”!

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.