MACRO – CHINA

MONETARY & FISCAL POLICY

CHINA VERY NEAR A “WHATEVER IT TAKES” MOMENT!

OBSERVATIONS: FED RATES CUTS ARE BEING DONE DIFFERENTLY. SILENTLY, WE ARE NOW FOOTING THE BILL!

It appears that few people fully understand how the Fed actually reduces the Fed Funds Rate nowadays. The Fed is doing it differently behind the scenes than most imagine. The method the Fed uses to control the Federal Funds Rate is very different from the method it used before it launched Quantitative Easing in late 2008. Interest rates today would be much lower than they are – despite the government’s very large budget deficits – if the Fed were not intervening to keep them high. That is because the Fed now actually pays the banks substantial fees for their Bank Reserves and Reverse Repurchase Agreements. How did this happen? Let me explain how you are being handed the bill.

When the Fed launched Quantitative Easing at the end of 2008, it did so by buying Government Bonds and Mortgage-Backed Securities. This caused its Total Assets to surge. The Fed paid for those assets by creating and depositing Bank Reserves into the Reserve Accounts that commercial banks hold at the Fed. Before 2008, there were almost no Bank Reserves. Now there are $3.2 trillion.

- The Federal Funds Rate is the interest rate at which commercial banks lend Bank Reserves to one another.

- Normally, all the other interest rates throughout the economy, such as bond yields, mortgage rates, credit card rates, etc., follow the Federal Funds Rate up and down.

- Before 2008, the very low amount of Bank Reserves made it easy for the Fed to control the Federal Funds Rate.

PRE-2008

If the Fed wanted to cool the economy down to slow the rate of inflation, it could sell to commercial banks a few government bonds that it had bought in the past. When the commercial banks bought those bonds, the Fed would take payment by debiting the Reserve Accounts belonging to the banks that had bought the bonds. Taking Bank Reserves out of those accounts lowered the level of Bank Reserves in the banking system. As Bank Reserves became scarcer, the cost of borrowing those Reserves, the Federal Funds Rate would rise.

Conversely, when the Fed wished to stimulate the economy, it would buy some government bonds from commercial banks, paying for them by depositing Bank Reserves into the Reserve Accounts of the commercial banks from which it had bought the bonds. That would make Bank Reserves more plentiful throughout the banking system, and that would drive down the cost of borrowing Bank Reserves, i.e. it would drive down the Federal Funds Rate. As the Federal Funds Rate fell, so would all the other interest rates and lower rates would stimulate economic growth.

POST-2008

However, once the Fed had created trillions of dollars of Bank Reserves through QE, it was no longer possible for the Fed to control the Federal Funds Rate by making relatively small changes to the quantity of Bank Reserves using the method used priorly. Post-QE, Bank Reserves were far too plentiful for that. So the Fed had to find a new way to control the Federal Funds Rate, which it did. It now controls the Federal Funds Rate by paying the commercial banks interest on their Bank Reserves, something that was not legally permitted until 2008.

The Fed pays an interest rate to the commercial banks for the Bank Reserves they own. This is officially called the Interest Rate On Reserve Balances (IORB). When the Fed pays 5.4% interest on Bank Reserves, as it was doing up until it cut rates Sept 18th, that ensures that the commercial banks won’t lend to anyone at less than 5.4%. Why would they when they can earn 5.4% from the Fed?

When inflation spiked following Covid, the Fed began increasing the Federal Funds Rate by paying a higher and higher rate of interest to the commercial banks on their Bank Reserves. The rate paid by the Fed peaked near 5.4%. This is how the Fed kept the Federal Funds Rate in a range between 5.25% and 5.5% from August 2023 until last week.

Now, however, the Fed believes it’s time to reduce interest rates. So, as of last week, the Fed began paying 50 basis points less on Bank Reserves. Now, the Fed’s only paying 4.9% on Bank Reserves. Since the Fed is only willing to pay 4.9% to the commercial banks, those banks will now be willing to lend out money at 4.95%, for instance, whereas before they wouldn’t lend for less than 5.4%.

The Fed is expected to continue lowering the FFR. At its FOMC meeting two weeks ago, the Fed published the projections of the FOMC members showing that, on average, they expect the FFR to fall to 4.4% by the end of this year, to 3.4% next year, and to 2.9% in 2026. That suggests the Fed will cut the FFR by another 200-basis point over the next two and a quarter years. It will do that by paying less and less interest on Bank Reserves.

There are so many Bank Reserves washing around the banking system that the Fed has to pay interest on them to keep interest rates as high as they are now. As the Fed pays less on those Bank Reserves during the months ahead, the Federal Funds Rate will fall and so will most other interest rates throughout the economy – regardless of how much money the government borrows to finance its very large budget deficits.

That’s because the government borrowing doesn’t change the level of Bank Reserves, so long as the government spends the money it borrows. When the government spends, the money it borrowed gets re-injected back into the economy and the amount of Bank Reserves remains unchanged. When we add Bank Reserves and Reverse Repos together this amounts to $3.9 trillion of excess Liquidity that the Fed must pay interest on to prevent interest rates from falling. $3.9 trillion is a lot of Liquidity, but not as much as before. The peak was $6.2 trillion in Dec. 2021. This excess Liquidity is currently shrinking now due to QT.

BOTTOM LINE

Who cares about all this? You should because the Fed is losing significant money this way. This reduces the money it was returning to the US Treasury. Basically the money is coming out of our pockets in taxes and into the banks’ pockets. They are getting richer while we wonder why we are getting poorer? QE was an expensive “Kick-the-Can”.

WHAT YOU NEED TO KNOW!

FINANCIAL CONDITIONS LOOSENED EVEN FURTHER?

FINANCIAL CONDITIONS LOOSENED EVEN FURTHER?

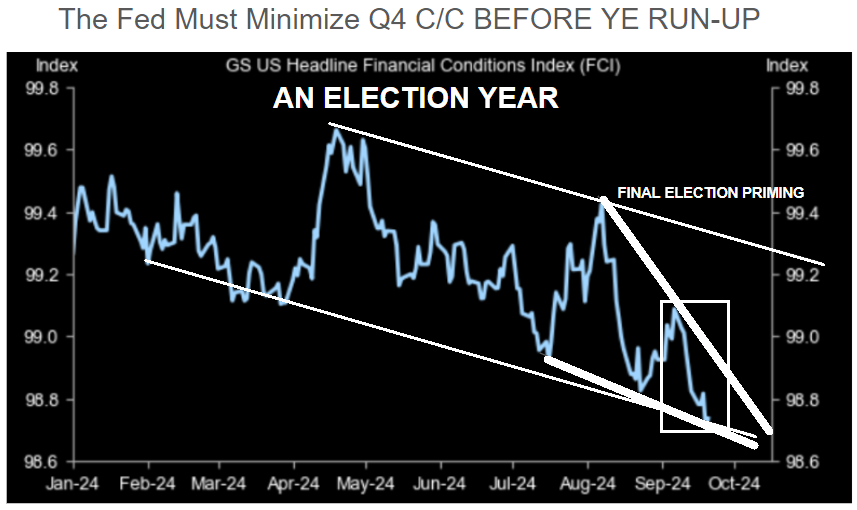

If the Fed isn’t “political”, then why is Financial Conditions (as Measured by the Financial Conditions Index – FCI) loosening EVEN FURTHER – as we close into the November 5th US Election?

The rates have been loosened all year, but recently have taken yet another nosedive lower! With China launching major reflation efforts, excess liquidity can be expected to increase further (as well as Inflation Pressures).

RESEARCH

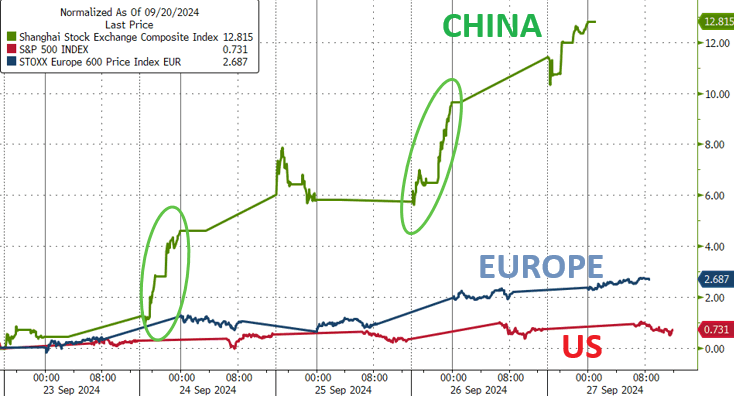

1- CHINA NEARS THE “WHATEVER IT TAKES” MOMENT!

1- CHINA NEARS THE “WHATEVER IT TAKES” MOMENT!

US LOOSENING INTO ALREADY EXTREMELY LOOSE FINANCIAL CONDITIONS

+ CHINA NOW REFLATING

+ EXTREME LIQUIDITY (Last Week’s Detail)

= INFLATION RE-IGNITED

-

- THURSDAY ANNOUNCEMENT – From the Politburo: Significant Fiscal Policy Support (Details in Research)

- TUESDAY ANNOUNCEMENT- From the PBOC: Important Monetary Policy support (Details in Research)

- SIGNALLING TO COME: Social Support (Lift Home Purchase Curbs)

- HSTECH is up some 30% over the past week. This is no small cap, this is China’s Tech Index!

- CSI 300 – Best Week since 2008

2- IGNORE PUTIN AT OUR PERIL!

-

- The narrative from mainstream media is that Russia President Vladimir Putin is attempting to “blackmail” the US and NATO regarding the use of Nuclear Weapons.

- I don’t buy into this White House summation of Putin’s strategic shift.

- The truth is no matter what Putin says the Biden Administration is not listening. There is no diplomacy occurring, which only leads to mis-calculated mistakes and worse. Like the Cuban Missile Crisis it is time for Leadership. The White House is playing with matches here and no one seems to be at the helm and in charge.

3- A STEADILY RISING CORPORATE PROFITS DANCE?

-

- QUESTION: Why Are US Corporate Profits Rising So Quickly?

- ANSWER: Debt/Credit Growth =~GDP Growth =~ Nominal Profit Growth.

- PUBLIC NARRATIVE: We show how Microsoft’s AI Bot “Copilot” answered the question. Quite entertaining, but missing the essence of the question in delivering what the public might believe.

DEVELOPMENTS TO WATCH

REDFIELD LABELS IT AS “AGENCY CAPTURE”

REDFIELD LABELS IT AS “AGENCY CAPTURE”

(Further support of this month’s UnderTheLens Video)

-

- Former CDC Director Robert Redfield wrote an editorial in Newsweek on Tuesday explaining the causes for this obesity crisis are primarily due to:

“Special interest and corporate influences on our federal agencies.”

“Kennedy is right: All three of the principal health agencies suffer from agency capture. A large portion of the FDA’s budget is provided by pharmaceutical companies. NIH is cozy with biomedical and pharmaceutical companies and its scientists are allowed to collect royalties on drugs NIH licenses to pharma. And as the former director of the Centers for Disease Control and Prevention (CDC), I know the agency can be influenced by special interest groups.”

-

- Redfield acknowledges that agency capture is a serious issue, highlighting that federal agencies responsible for regulating food and medicine are possibly compromised by the food industrial complex and big pharma.

FOOD IS THE ULTIMATE WEAPON OF CONTROL

-

- We face a near-term future in which the control mechanisms will be all-pervasive.

- Elites have known for millennia, it is food that is the ultimate weapon of control.

- As former US Secretary of State articulated in 1973: ‘Who controls the food supply controls the people’.

- Professor George Kent eloquently explained in 2008, it is in the interest of the Elite that people are hungry. See ‘The Benefits of World Hunger’.

- So any critical analysis of what is being imposed on humanity must take careful account of how food – and the farming of it – is being utterly transformed.

GLOBAL ECONOMIC REPORTING

US PERSONAL CONSUMPTION EXPENDITURE (PCE)

US PERSONAL CONSUMPTION EXPENDITURE (PCE)

-

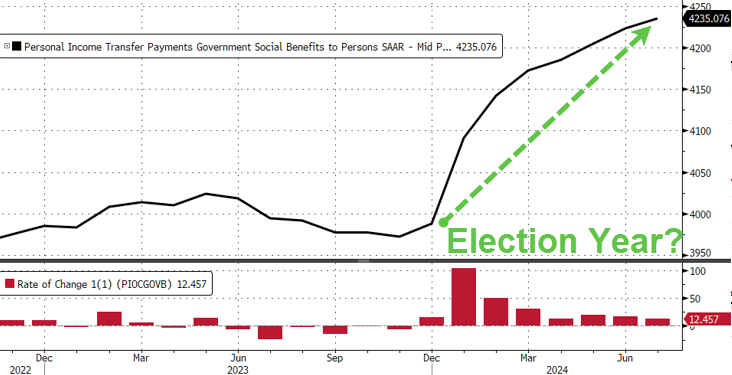

- A 2 percentage point revision higher for the savings rate?? Every effort is being pursued to mislead the consumer to feel richer than they are.

- PERSONAL INCOME GOVERNMENT TRANSFER PAYMENTS: Imagine how bad things would be if the government wasn’t sending billions to ‘we, the people’ all of a sudden. In other words, the consumer is now wiped out and yet key inflation measures refuse to drop materially. So yes, the Fed will continue to cut (election year after all) and then we can finally unleash the second coming of the Arthur Burns (1970s) hyperinflation Fed.

US Q2 GDP – FINAL ESTIMATE 3.0%

-

- What was amusing, is that the BEA decided to revise the Q2 2022 GDP print from negative (-0.6%) to positive (0.3%), effectively voiding the technical recession that took place in the first half of the year when GDP contracted for two consecutive quarters.

- GDP remains quite meaningless as an indicator. How could it be otherwise, when the Fed just started its most aggressive easing cycle after a quarter in which the US economy allegedly grew 3%?

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.