3- CONSEQUENCES OF PRESSURES ON THE CHINESE YUAN

We are witnessing through the Evergrande debacle, the beginnings of an implosion in China’s property market with property sales growth falling to recessionary levels, driving many property developers to the brink of bankruptcy. The overwhelming consensus is that this isn’t an issue since China can ramp up its money supply and force its banks to reflate the bubble.

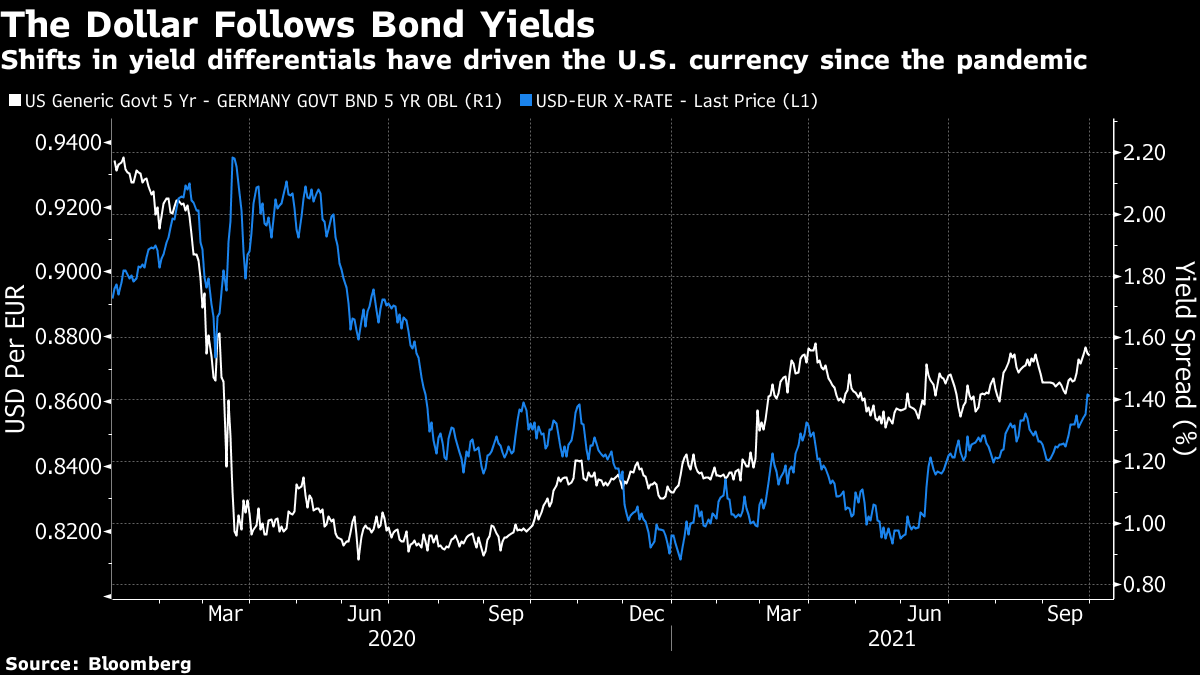

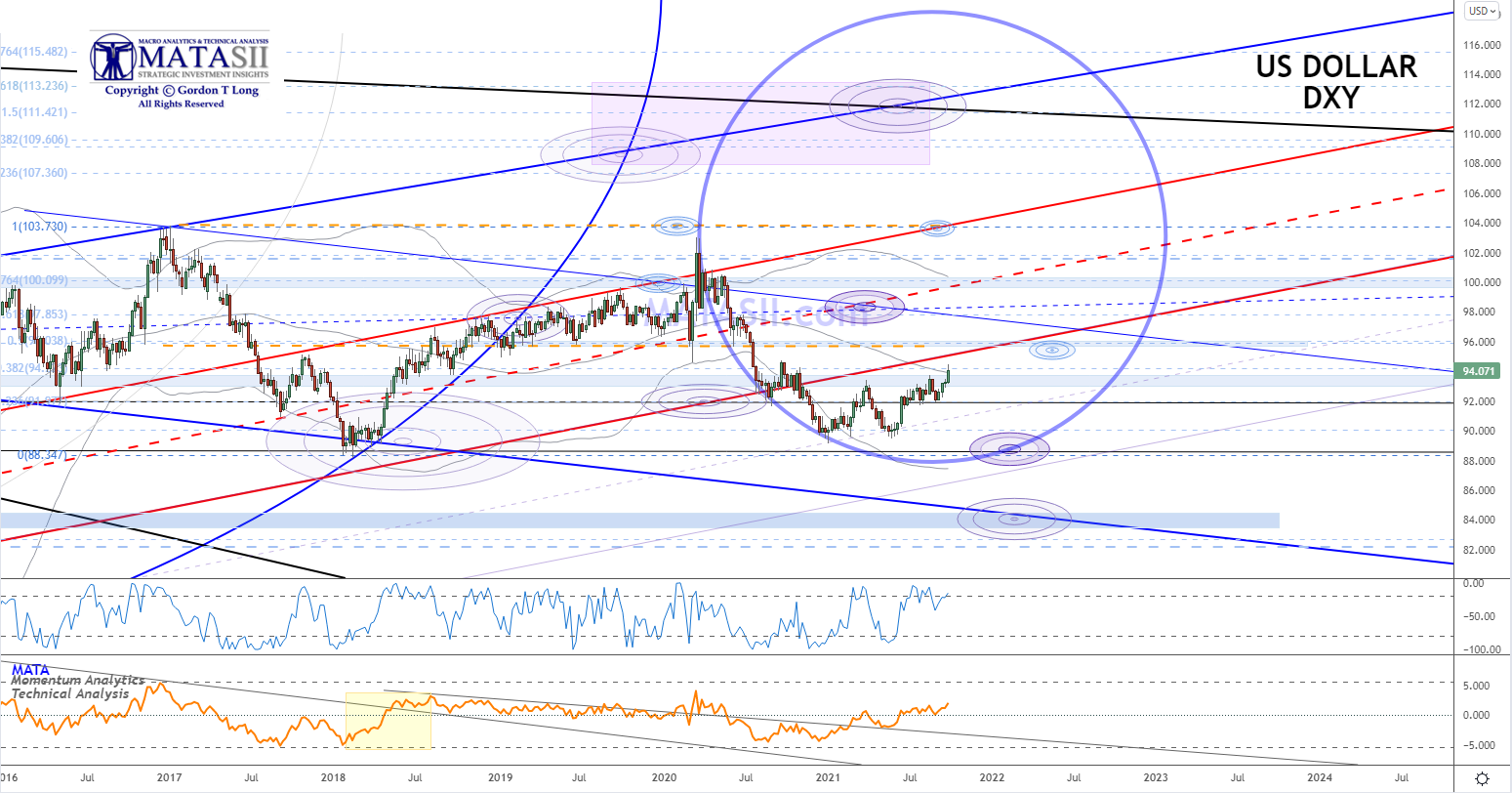

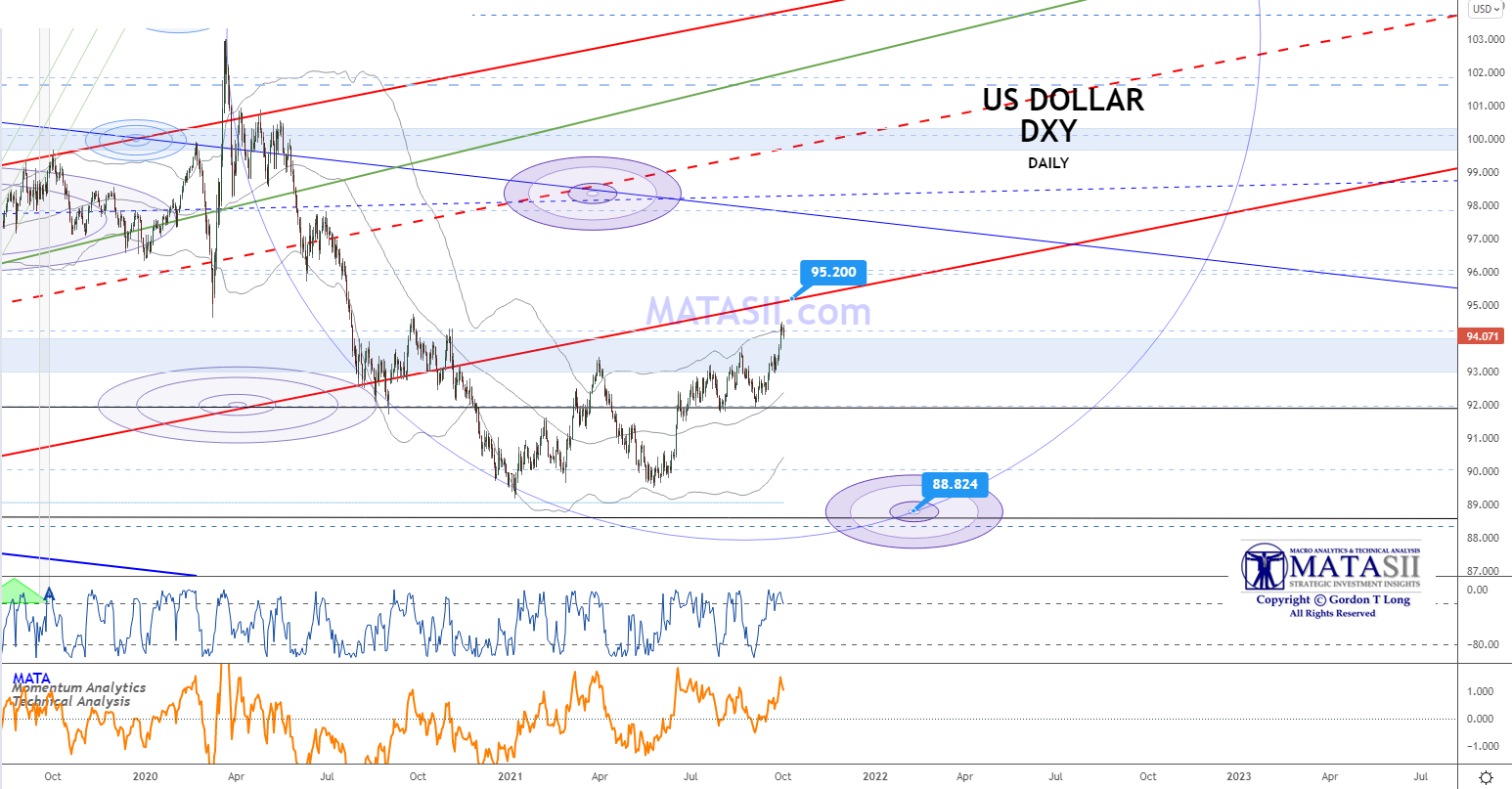

This could have been true if the yuan was the reserve currency of the world, but it isn’t. China has significant demand for U.S. dollars to facilitate trade and maintain the stability of the yuan. To the extent that dollar inflows into China weaken, this makes it very difficult to ease monetary policy while simultaneously keeping the yuan stable.

Dollar inflows into China are already weakening and this will be made worse when a risk-off sentiment driven by Fed tightening takes hold. When liquidity is abundant, investing in emerging markets is attractive, as an opportunity to take advantage of higher growth rates and lower valuations. The opposite is true when monetary conditions tighten, particularly when an emerging market is on the brink of a structural downturn in growth, like China.

China will be forced into monetary easing just as the Federal Reserve heads in the opposite direction.