TIPPING POINTS

US BANKING CRISIS

TOO MANY TO FAIL!

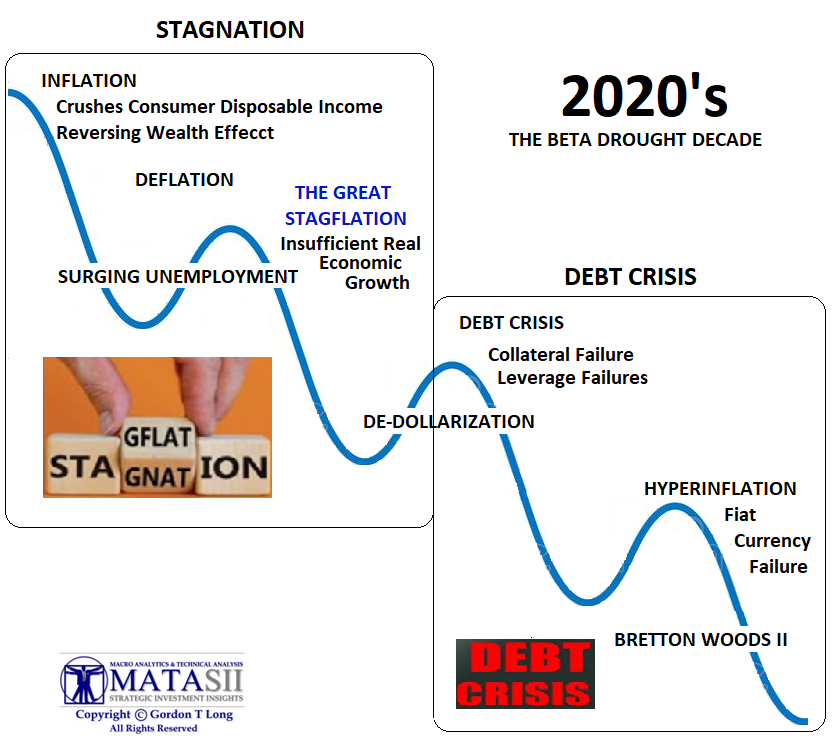

Over the recent holiday season I penned this year’s Thesis paper “A Great Stagflation“. I talked about the coming “Beta Drought Decade” that would usher in global stagflation and a series of unfolding events driven by surging global unemployment. I am not a Cassandra, but my research was pretty clear! Less than three months later I read what is seen to be startling headline announcements, such as the following:

In this month’s UnderTheLens video and the previous newsletter, I have been focused on an unfolding banking crisis that is only an early warning of what is ahead; if our initial research is correct? What I want to focus on in this newsletter is why this is, at its core, a “Structural” problem, not simply another credit crisis event.

“In 2008 it was about banks being “Too Big To Fail”. Today’s Banking Crisis is about “Too Many To Fail”. Tomorrow it will be about “Too Many to Save”!

=========

WHAT YOU NEED TO KNOW

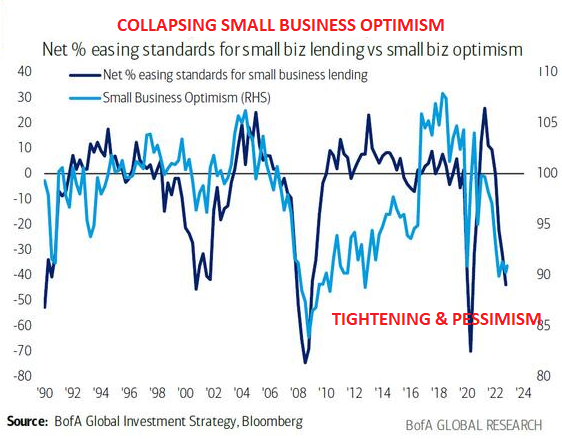

SMALL BUSINESS IS THE FOUNDATION OF AMERICA. US Public Policy and government regulators in the present environment are unwittingly “gutting” small business in America. This is further worsening a US structural problem in which the current banking crisis may be the final “nail in the coffin”. Small banks that local small service businesses critically depend on have become exposed to being taken over or “taken out”. A preoccupied Washington bureaucracy no longer prioritizes the ongoing viability and foundational importance of American small business.

SMALL BUSINESS IS THE FOUNDATION OF AMERICA. US Public Policy and government regulators in the present environment are unwittingly “gutting” small business in America. This is further worsening a US structural problem in which the current banking crisis may be the final “nail in the coffin”. Small banks that local small service businesses critically depend on have become exposed to being taken over or “taken out”. A preoccupied Washington bureaucracy no longer prioritizes the ongoing viability and foundational importance of American small business.

STAGNATE US & GLOBAL ECONOMIES: Protracted Pain to an Already Bleeding Small Business Balance Sheets

-

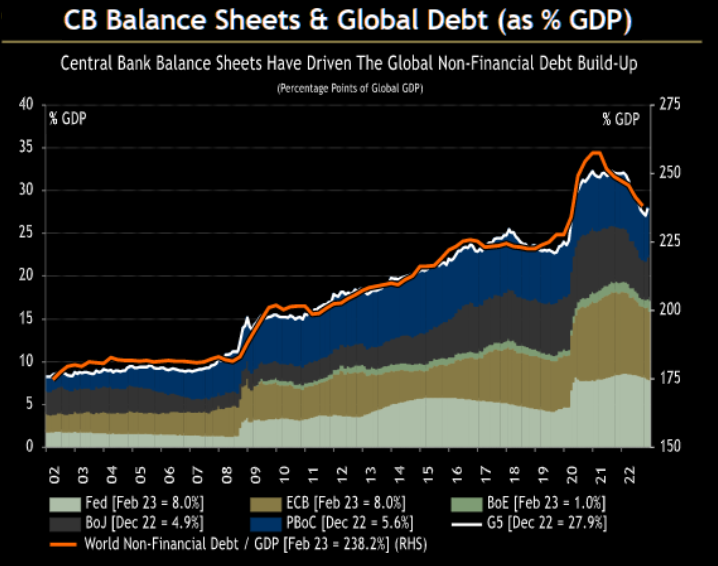

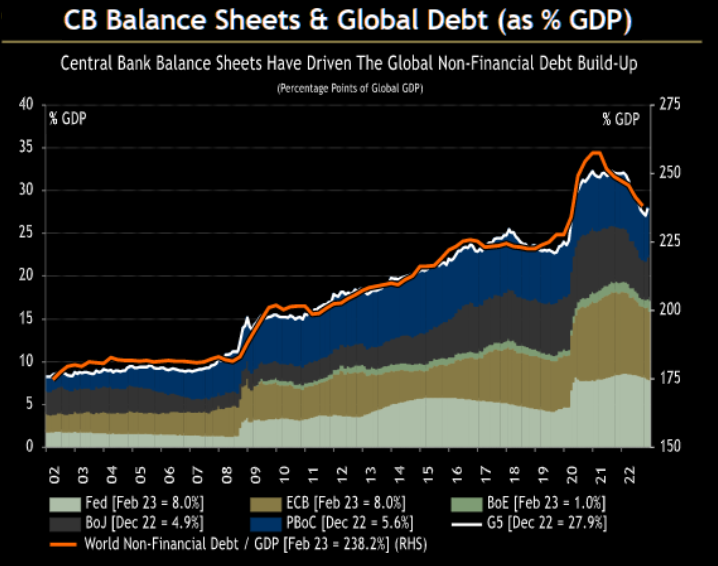

- The Banking Crisis has pushed us closer to being caught in a Debt Trap. This is because higher policy rates will fuel a systemic debt crisis that liquidity support will be insufficient to resolve.

- A severe recession appears to be the only thing that can temper price and wage inflation, but unfortunately it will make the debt crisis more severe, and that in turn will feed back into an even deeper economic downturn. Since liquidity support cannot prevent this systemic feedback loop, everyone should be preparing for the coming Stagflationary debt crisis we outlined in our 2023 Thesis Paper: “A Great Stagflation“.

- Small business with not only be impacted by a major US recession, but highly likely to see the fallout from a major global economic slowdown further impacting the broader US economy.

- The global economy’s “speed limit”—the maximum long-term rate at which it can grow without sparking inflation—is set to slump to a three-decade low by 2030 from which small businesses may not survive .

FINANCIALIZATION: Serving Corporations not Mainstreet America

-

- Wage growth drives consumption, which drives small business in America. When wage growth is under pressure, then small business is under pressure. The last 50 years have seen the almost total disappearance of “Mom & Pop” business growth with the financially leveraged capture by national chains, malls, big box stores replacing small business owned fast foods, hardware stores, auto supply, dry cleaning, restaurants, ‘mainstreet’ retailers, drug stores, grocery stores et al.

- America is quietly being turned into an enormous company town with small banks the next to be taken under – and with it increasingly small business!

REGULATORY STRANGULATION: Killing Individualism, Risk Taking and Small Business

-

- The “Covid Policy Panic” and subsequent out of control surge in Inflation has crippled small business balance sheets.

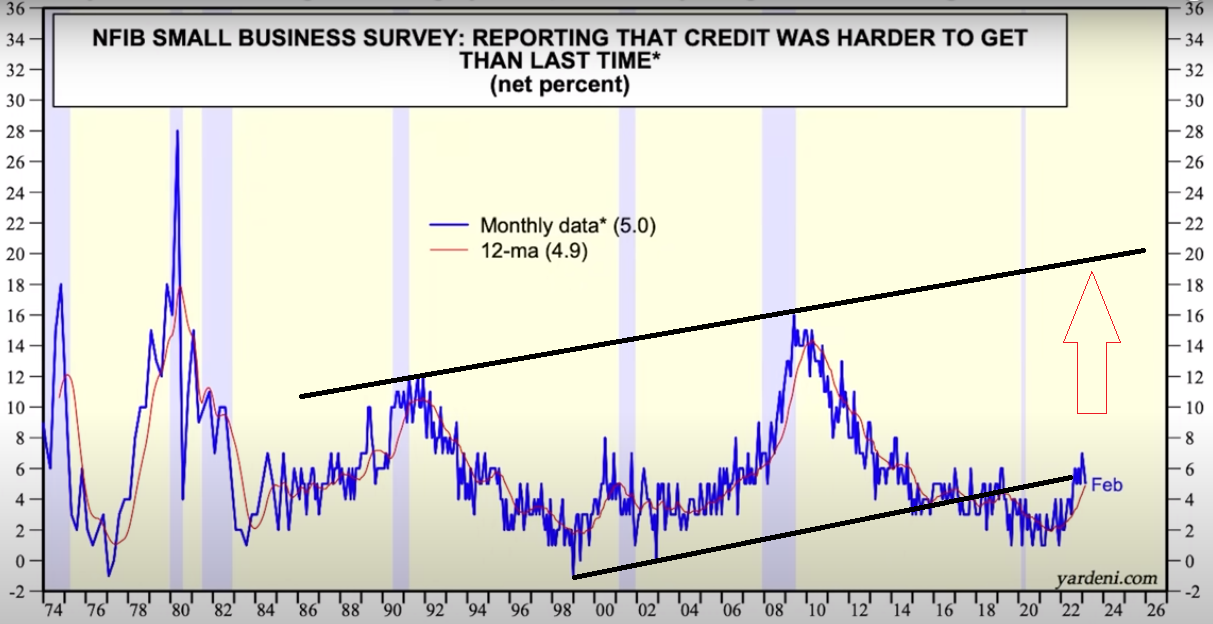

- Small Business now experiencing credit tightening, especially with their smaller banks, where they both bank and are financially captive to, are under financial pressure.

Nearly one third of small businesses fail because of cash flow problems.

Small banks have a profound influence on their potential to exist or fail!

-

- A reversal of the Trump era “De-Regulation” policies and an avalanche of new regulatory requirements are adding costs, regulatory restrictions and reporting administrative burdens to a mounting wage rate spiral.

- The looming recession is simply something that few small businesses in America are equipped to handle.

- The US government is now under the control and influence of large corporations, which is neither what built America nor is the life blood of a 70% consumption economy.

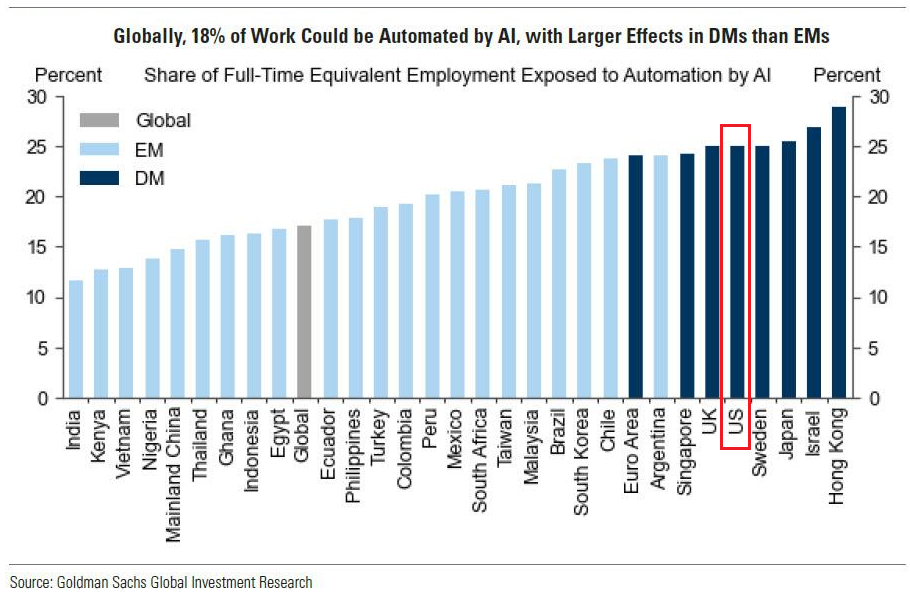

A MAJOR COMPOUNDING SHOCK: Artificial Intelligence Will Be A Bigger Impact on Labor Than the Internet

-

- Without Employment there is no Consumption. Without Consumption there is no US 70% Consumption based Economy. Without a vibrant consumer there is a crippled Small Business sector.

- Roughly two-thirds of current jobs are now potentially exposed to some degree of new advancements in AI automation.

- One-third of a billion layoffs (at least) is potentially estimated by Goldman within the US and Europe.

- Generative AI could substitute up to one-fourth of current work.

- Globally Goldman suggests that generative AI could expose the equivalent of 300 million full-time jobs to automation.

- Up to “two thirds of occupations could be partially automated by AI.

CONCLUSION

CONCLUSION

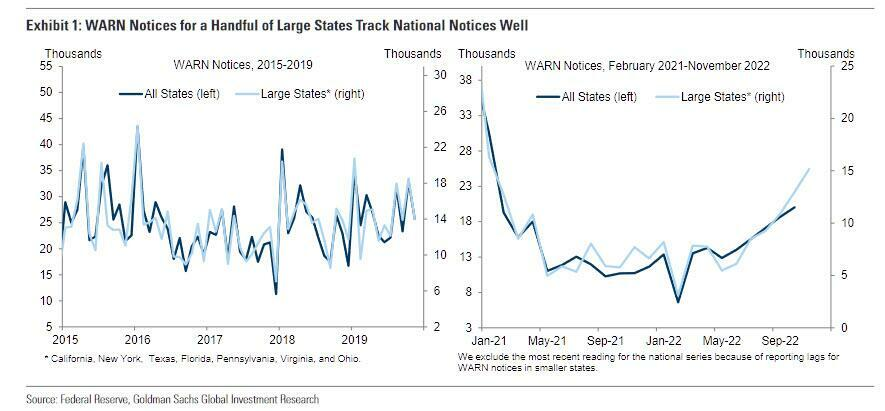

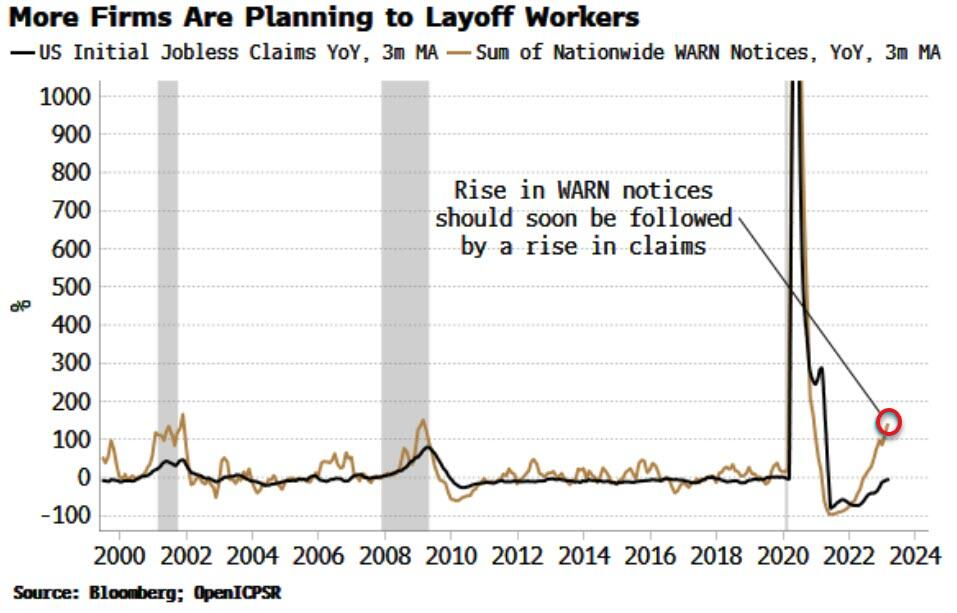

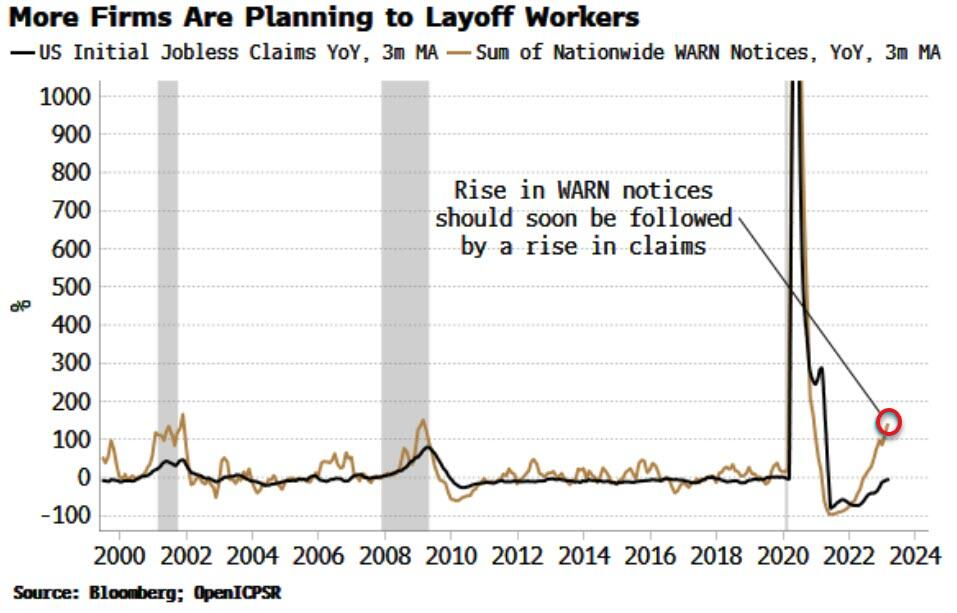

WARN ACT: Report Signaling What Lies Ahead

-

- The WARN Act obliges employers with more than 100 full-time workers to provide written notice to the state and the workers themselves at least 60-90 days ahead of planned plant closings and mass layoffs.

- Worker Adjustment and Retraining (WARN) Notices are picking up, which points to unemployment claims soon rising and a deterioration in the jobs market.

- In recent months, WARN notices have been steadily rising. This generally precedes sharp rises in unemployment claims, especially around recessions.

THE CURRENT ACTIONS ARE RESULTING IN EFFECTIVELY CHOKING SMALL BUSINESS AMERICA

THE LIFE BLOOD OF THE NATION IS ALREADY REELING FROM COVID-19.

=========

THE BIG PICTURE: Today’s “Farmers” of the Great Depression

The iconic film “The Grapes of Wrath” depicts the impact the Great Depression had on American farmers from banks seizing farming properties as a result of failed crops. In the coming great recession, it will be small business in America as small bank credit is withdrawn.

STAGFLATION AND THE DEBT TRAP

The Banking Crisis has pushed us closer to being caught in a Debt Trap. This is because higher policy rates will fuel a systemic debt crisis that liquidity support will be insufficient to resolve.

ABOVE: MATASII 223 THESIS: “A GREAT STAGFLATION”

WHAT WILL CAUSE HIGHER POLICY RATES?

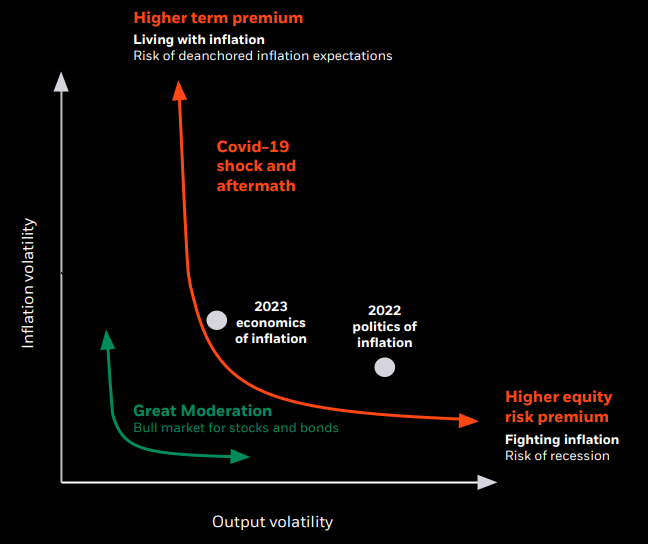

Central banks must not assume that the coming credit crunch will kill inflation by reining in aggregate demand. The negative aggregate supply shocks are persisting, and labor markets remain too tight.

A severe recession is the only thing that can temper price and wage inflation, but it will make the debt crisis more severe, and that in turn will feed back into an even deeper economic downturn. Since liquidity support cannot prevent this systemic feedback loop, everyone should be preparing for the coming Stagflationary debt crisis we outlined in our 2023 Thesis Paper: “A Great Stagflation“.

CHART ABOVE: We should expect higher term premiums associated with de-anchored inflation expectations, as well as higher equity risk premiums associated with fighting inflation and the risk of a deep seated recession.

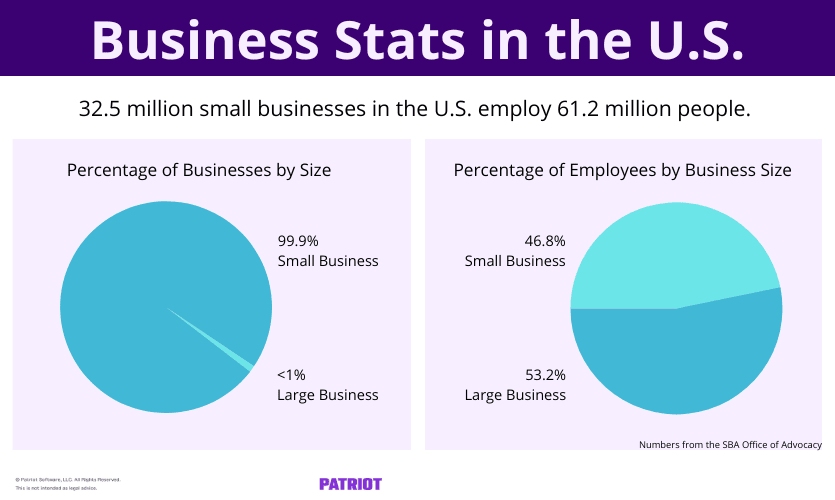

CHART BELOW: Small Business in America employs 61.2M or 46.8% of the total US work force.

AN ADDED GLOBAL PROBLEM

Small business with not only be impacted by a major US recession, but highly likely to see the fallout from a major global economic slowdown further impacting the broader US economy.

Small business with not only be impacted by a major US recession, but highly likely to see the fallout from a major global economic slowdown further impacting the broader US economy.

WORLD BANK: Inflation Is Defining a New Speed Limit For Economic Growth

A ground breaking report has just been released by the World Bank entitled; “Falling Long-Term Growth Prospects: Trends, Expectations, and Policies“, which offers the first comprehensive assessment (564 pages) of long-term potential output growth rates in the aftermath of the COVID-19 pandemic and the Russian invasion of Ukraine. These rates can be thought of as the global economy’s “speed limit.” The global economy’s “speed limit”—the maximum long-term rate at which it can grow without sparking inflation—is set to slump to a three-decade low by 2030.

The report documents a worrisome trend: nearly all the economic forces that powered progress and prosperity over the last three decades are fading. As a result, between 2022 and 2030, average global potential GDP growth is expected to decline by roughly a third from the rate that prevailed in the first decade of this century—to 2.2% a year. For developing economies, the decline will be equally steep: from 6% a year between 2000 and 2010 to 4% a year over the remainder of this decade. These declines would be much steeper in the event of a global financial crisis or a recession.

“A lost decade could be in the making for the global economy. The ongoing decline in potential growth has serious implications for the world’s ability to tackle the expanding array of challenges unique to our times—stubborn poverty, diverging incomes, and climate change. But this decline is reversible. The global economy’s speed limit can be raised—through policies that incentivize work, increase productivity, and accelerate investment.”

Indermit Gill, the World Bank’s Chief Economist and Senior Vice President for Development Economic

The analysis shows that potential GDP growth can be boosted by as much as 0.7 percentage points—to an annual average rate of 2.9%—if countries adopt sustainable, growth-oriented policies. That would convert an expected slowdown into an acceleration of global potential GDP growth.

“All measures of global potential growth consistently show steady declines over the past decade, with all the fundamental drivers of growth gradually losing momentum. The weakening of potential growth was highly synchronous across countries: in 2011-21, potential growth was below its 2000-10 average in 96 percent of advanced economies and 57 percent of emerging market and developing economies. Adverse events, such as the global financial crisis and the COVID-19 pandemic, with their ensuing global recessions, contributed to the trend decline. At the country-level also, national recessions left legacies of lower potential growth even five years after their onset, by about 1.4 percentage points on average. The persistent effect of recessions on potential growth operated through weaker growth of investment, employment, and productivity.”

“All measures of global potential growth consistently show steady declines over the past decade, with all the fundamental drivers of growth gradually losing momentum. The weakening of potential growth was highly synchronous across countries: in 2011-21, potential growth was below its 2000-10 average in 96 percent of advanced economies and 57 percent of emerging market and developing economies. Adverse events, such as the global financial crisis and the COVID-19 pandemic, with their ensuing global recessions, contributed to the trend decline. At the country-level also, national recessions left legacies of lower potential growth even five years after their onset, by about 1.4 percentage points on average. The persistent effect of recessions on potential growth operated through weaker growth of investment, employment, and productivity.”

TIGHTENING LENDING STANDARDS: Too Many To Save

-

- In 2008 it was about banks being “Too Big To Fail”.

- Today it is about “Too Many To Fail”!

- Tomorrow it will be: “Too Many to Save”!

Nearly one third of small business fail because of cash problems. Small banks have a profound influence on their potential to succeed or fail!

Nearly one third of small business fail because of cash problems. Small banks have a profound influence on their potential to succeed or fail!

“Anytime a bank fails, it is cause for serious concern. Regulatory requirements have been loosened in recent years. I believe it is appropriate to assess the impact of these deregulatory decisions and take any necessary actions in response. A 2018 roll-back of bank capital requirements and stronger supervision for smaller and mid-size banks with assets below $250 billion should be reevaluated”. Janet Yellen – US Treasury Secretary

TRANSLATION: Smaller & Mid-Sized Banks can expect expensive compliance & insurance rules to be applied, which will be quickly passed on to small business America to absorb!

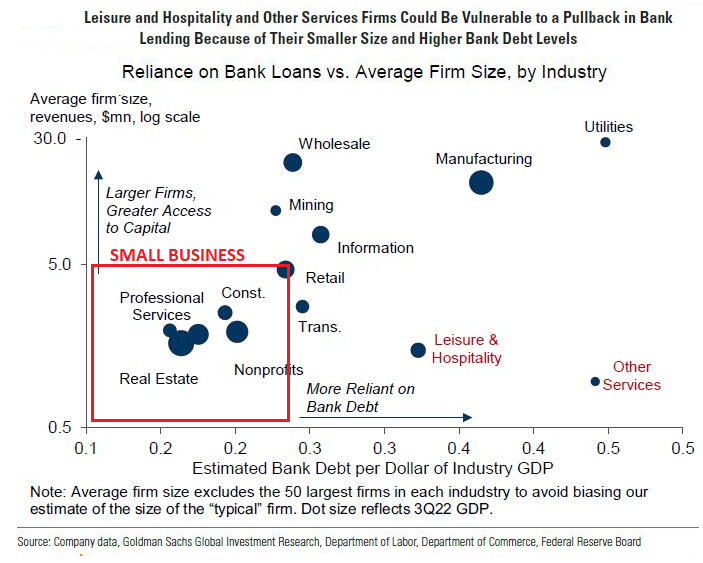

The large share of capex by the manufacturing and real estate sectors – imply that the coming tightening in bank credit availability will affect the economy in part through its impact on these two industries. Additionally, as discussed here, commercial real estate loans are skewed towards small and midsize banks, which are currently more vulnerable to deposit outflows.

The large share of capex by the manufacturing and real estate sectors – imply that the coming tightening in bank credit availability will affect the economy in part through its impact on these two industries. Additionally, as discussed here, commercial real estate loans are skewed towards small and midsize banks, which are currently more vulnerable to deposit outflows.

GOLDMAN SACHS: Small, Medium Banks Account For 50% Of C&I Lending, 45% Of Consumer Lending And 80% Of All Commercial Real Estate Lending

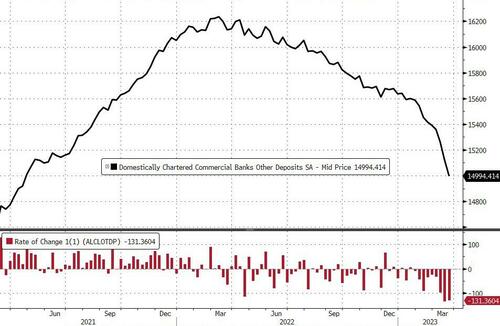

Outflows from bank deposits into money markets, (which hit a new fresh record highs of $5.2 trillion Thursday – with 54.5bn of inflows last week), continue to accelerate (thanks to The Fed)…

The last 3 weeks (including SVB’s exodus) has seen $304 billion of inflows, a record surge outside of the COVID lockdown crisis. This is consistent with ongoing deposit flight from the banking system as depositors indirectly invest their cash into government securities via money funds and shun bank credit. This answers the question of ‘where is the money going once it leaves the banking system?

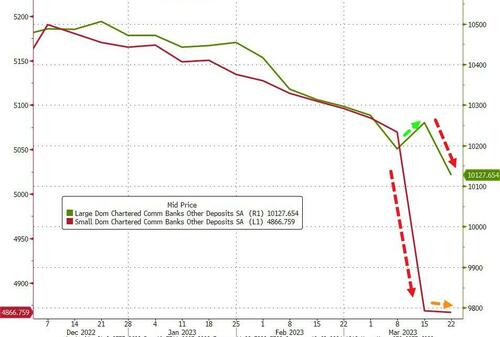

2nd wave of deposit outflows on it’s way

Barclays: “We expect flows into money market funds to grow by several hundred billion dollars…we are in a midst of a two-stage shift…the second stage is emerging now…”

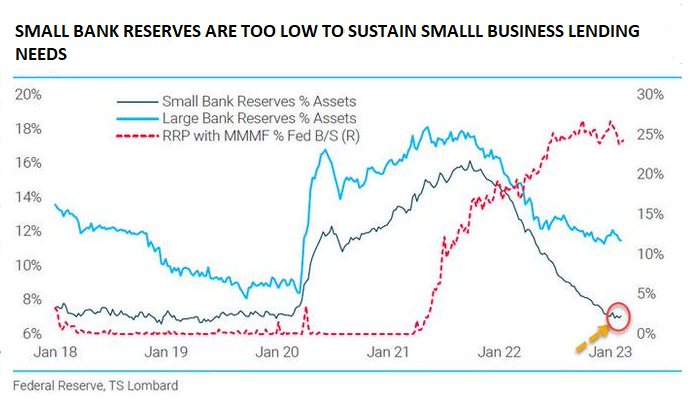

The chart above shows data taken in January 2023. Below is what has been happening since.

US Banks have been consistently suffering outflows for a year. This is the 9th straight weekly decline in deposits. (This data excludes ‘large time deposits’).

Both Large and Small banks saw deposit outflows (on a seasonally-adjusted basis) with large banks losing a huge $129bn of deposits – the highest weekly outflow ever.

REGULATORY STRANGULATION: Killing Individualism, Risk Taking and Small Business

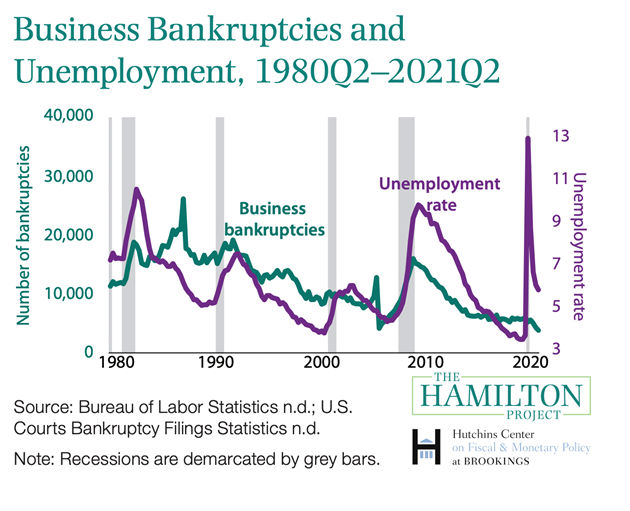

Our 2023 Thesis paper outlined the expected major surge in unemployment (chart top right) that will unfold in the Beta Drought Decade. A big part of these layoffs will be within small business America for a number of reasons, but quite significantly will be about tightening lending standards.

The current banking crisis impacting small banks is only a precursor of what is to come.

ABOVE: Expected Unemployment levels during the next US recession.

Taken From: MATASII 223 THESIS: “A GREAT STAGFLATION”

Banking Crisis – Cripples Lending

The “Covid Policy Panic” and subsequent out of control surge in Inflation has crippled small business balance sheets.

Small Business now experiencing credit tightening, especially with their smaller banks where they both bank and are financially captive to, are under financial pressure.

ABOVE: Business bankruptcies dramatically increase during recessions. A recessionary hard landing, following Covid-19, within a crippling small banking crisis may be just too much for many small businesses to endure.

Regulations – Cripple Risk Taking

A reversal of the Trump era “De-Regulation” policies and an avalanche of new regulatory requirements are adding costs, regulatory restrictions and reporting administrative burdens to a mounting wage rate spiral.

The looming recession is simply something that few small businesses in America are equipped to handle.

The US government is now under the control and influence of large corporations, which is neither what built America nor is the life blood of a 70% consumption economy.

A continuously advancing “Regulatory State” will increasingly be a death knell for small business!

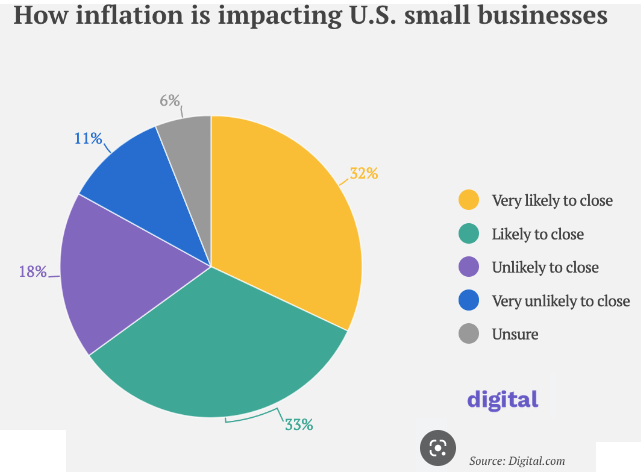

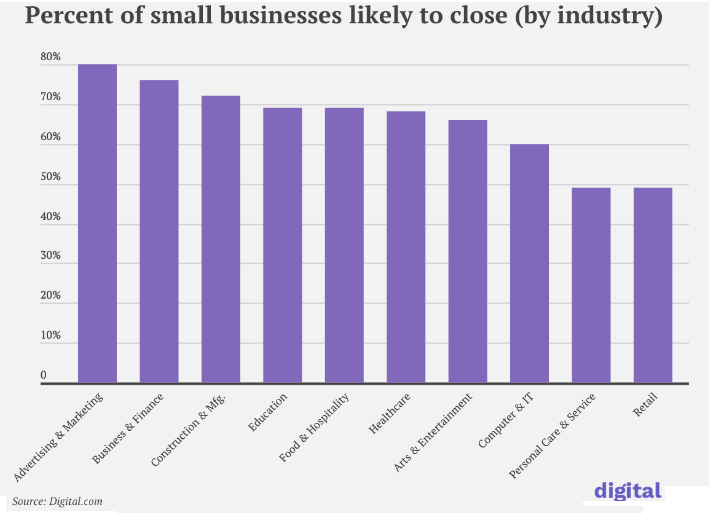

CHART ABOVE: Inflation is a serious problem for Small Business!

ABOVE 29% of small businesses fail due to running out of cash.

CHARTS BELOW: There are increasing studies showing the serious problems with the US Small Business sector.

FINANCIALIZATION: Serving Corporations not Mainstreet America

Wage growth drives consumption which drives small business in America. When wage growth is under pressure, then small business is under pressure. The last 50 years have seen the almost total disappearance of “Mom & Pop” business growth with the financially leveraged capture by national chains, malls, big box stores replacing small business owned fast foods, hardware stores, auto supply, dry cleaning, restaurants, ‘mainstreet’ retailers, drug stores, grocery stores et al.

Wage growth drives consumption which drives small business in America. When wage growth is under pressure, then small business is under pressure. The last 50 years have seen the almost total disappearance of “Mom & Pop” business growth with the financially leveraged capture by national chains, malls, big box stores replacing small business owned fast foods, hardware stores, auto supply, dry cleaning, restaurants, ‘mainstreet’ retailers, drug stores, grocery stores et al.

America is quietly being turned into an enormous company town with small banks the next to be taken under – and with it increasingly small business.

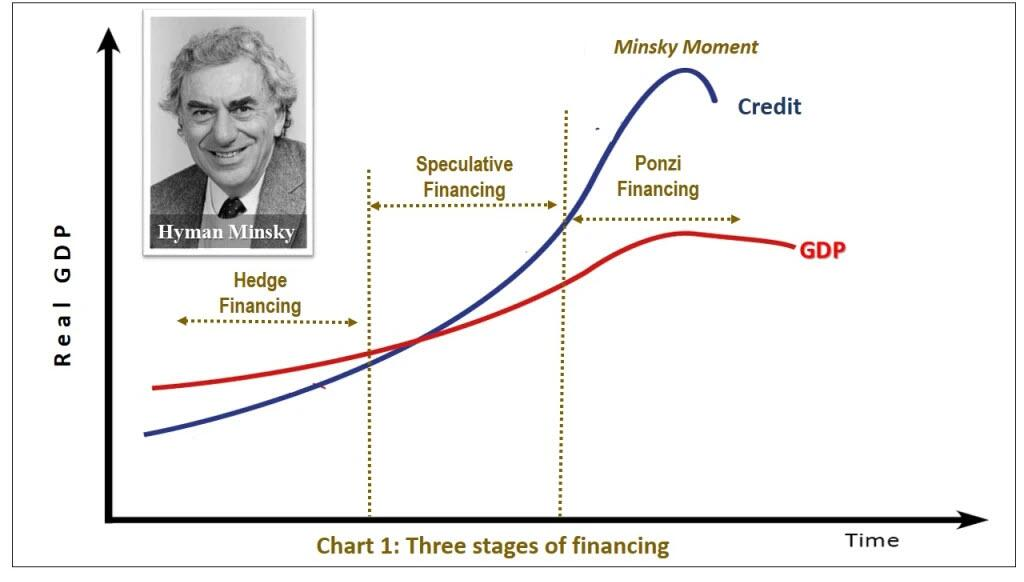

he “Financialization” of the US economy along with the shift from Capitalism to “Creditism” has left us in Stage 3 of a Minsky Moment (chart below), when investment can best be described as “Ponzi Financing”.

When bank “deposits” are technically no longer deposits but investment vehicles, we are in Ponzi Financing because risk has been transferred to the “naïve” and “uninformed”.

NOW A MAJOR COMPOUNDING SHOCK: Artificial Intelligence Will Be A Bigger Impact on Labor Than the Internet

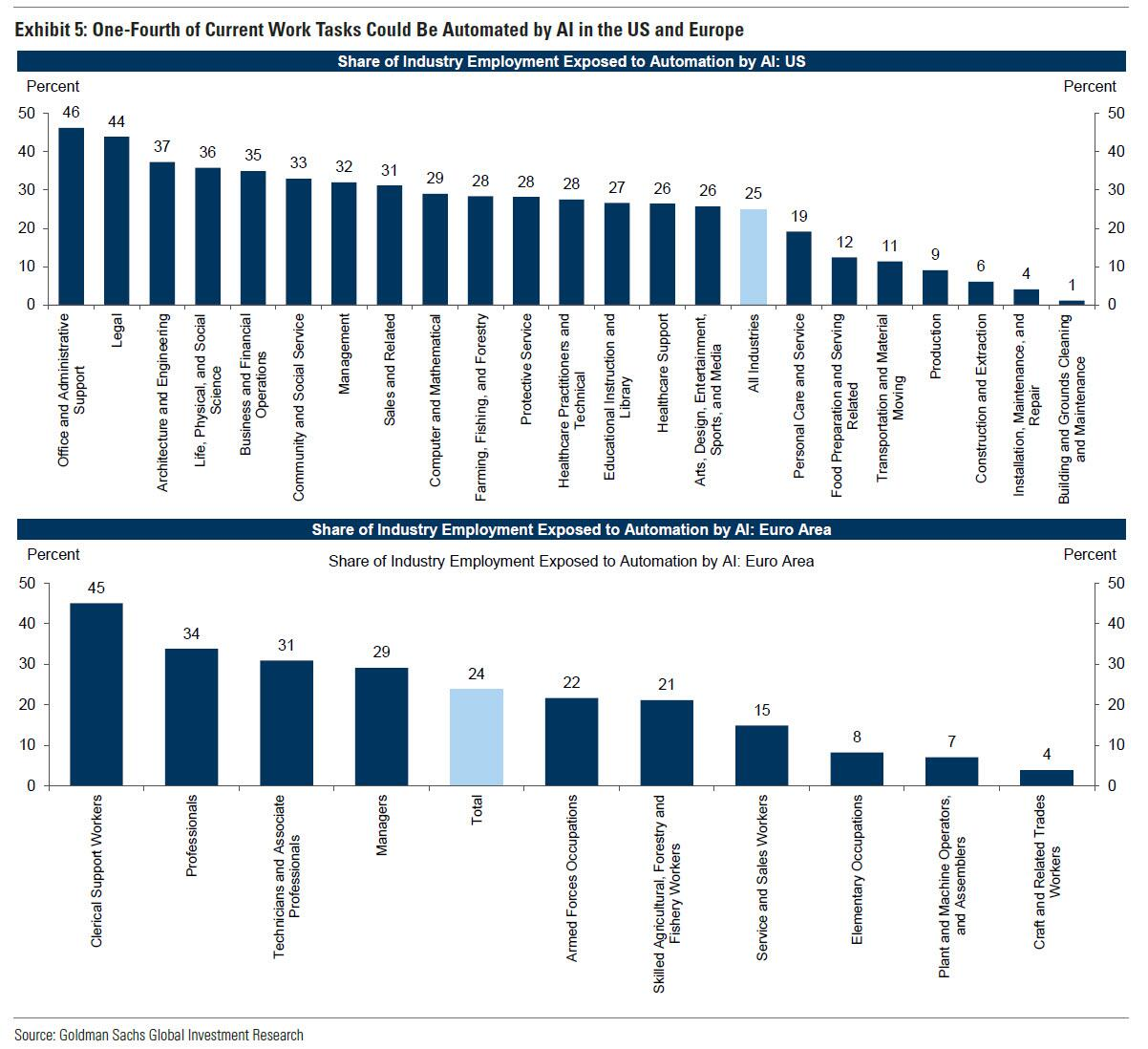

Goldman Sachs has just published a major study on the impact coming AI advancements will have on the developed nations of the EU and US!

Goldman Sachs calls it a “significant disruption” for labor markets across not just the US but all developed countries.

-

- Roughly two-thirds of current jobs are exposed to some degree of AI automation.

- Generative AI could substitute up to one-fourth of current work.

- Globally Goldman suggests that generative AI could expose the equivalent of 300 million full-time jobs to automation”.

- Up to “two thirds of occupations could be partially automated by AI”.

- One-third of a billion layoffs (at least) in the US and Europe.

Think of it as the robotization of the service sector.

CONCLUSION

The Monetary policies that are required to fight inflation are policies that few US Small businesses, trying to recover from devastation of Covid-19 to their balance sheets, will survive!

The Monetary policies that are required to fight inflation are policies that few US Small businesses, trying to recover from devastation of Covid-19 to their balance sheets, will survive!

A “HARD LANDING” AND A PROTRACTED RECESSION IS SOMETHING FEW US SMALL BUSINESSES ARE PREPARED FOR!

CHART RIGHT: The Banking Crisis has pushed us closer to being caught in a Debt Trap. This is because higher policy rates will fuel a systemic debt crisis that liquidity support will be insufficient to resolve.

THE “WARN” ACT

Worker Adjustment and Retraining (WARN) Notices are picking up, which points to unemployment claims soon rising and a deterioration in the jobs market. The WARN Act obliges employers with more than 100 full-time workers to provide written notice to the state and the workers themselves at least 60-90 days ahead of planned plant closings and mass layoffs.

Worker Adjustment and Retraining (WARN) Notices are picking up, which points to unemployment claims soon rising and a deterioration in the jobs market. The WARN Act obliges employers with more than 100 full-time workers to provide written notice to the state and the workers themselves at least 60-90 days ahead of planned plant closings and mass layoffs.

In recent months, WARN notices have been steadily rising. As the chart to the right shows, this generally precedes sharp rises in unemployment claims, especially around recessions.

Bloomberg observes: The Cleveland Fed has done analysis on WARN notices and they show lead other labor-market indicators, including claims, changes in the unemployment rate and changes in private employment, with the strongest lead relationship over one month. The rise in WARN notices coincides with a sudden rise in the number of US states showing at least 25% annual rise in their claims.

Often when this measure hits its current threshold, it jumps considerably higher, culminating in a recession.

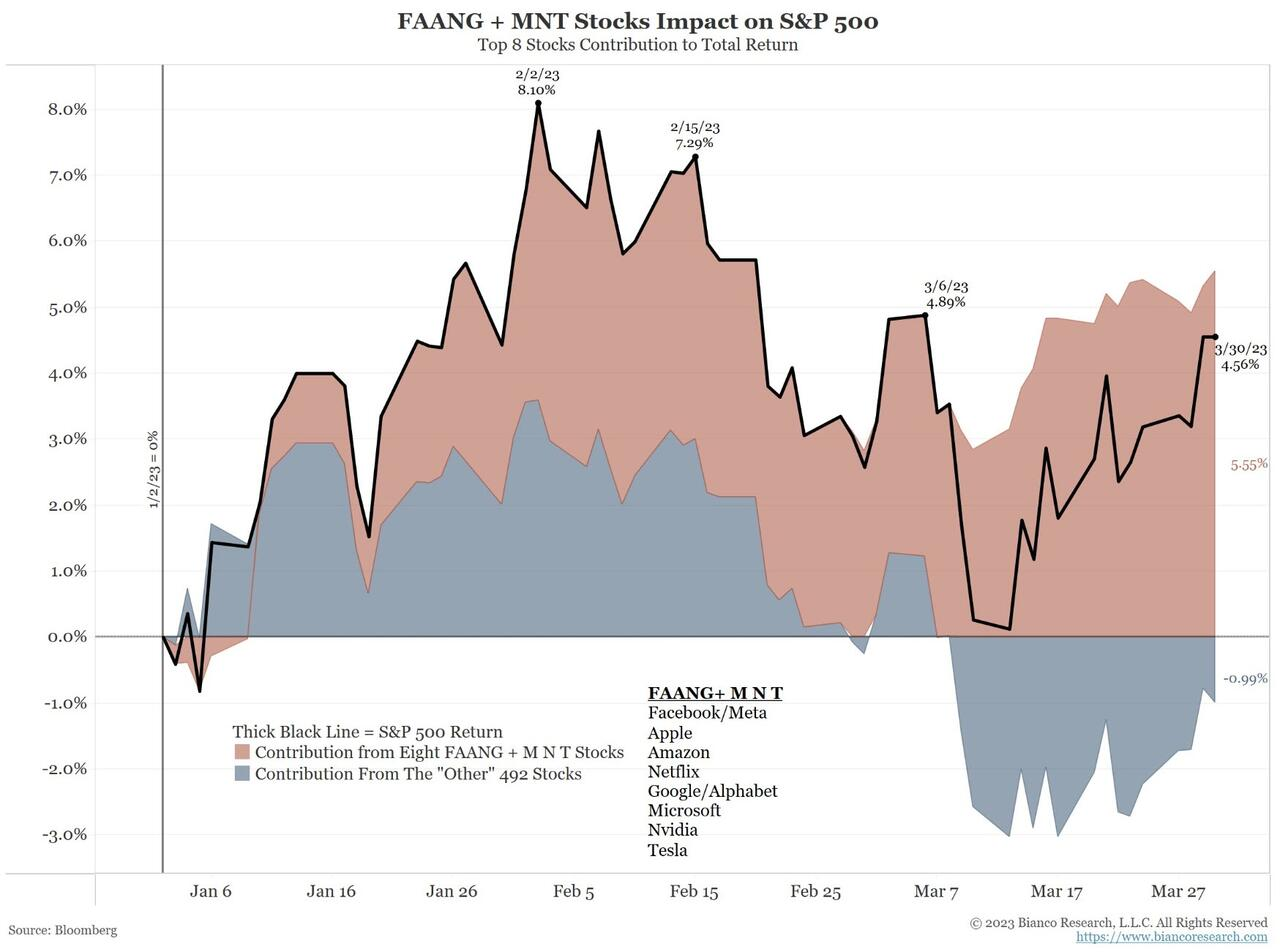

NIFTY 8 v WILSHIRE 5000

SMALL CAPITALIZATION COMPANIES UNDER PRESSURE

In this week’s newsletter we highlight the pressures that small business are under in America. The Wilshire 5000, Russell 2000 and

NASDAQ, with the exception of a handful of stocks, reflect some of the pressures of inflation, a labor rate spiral and regulatory burdens. Even 492 of the S&P 500 are well below the performance of the “Big 8” (FAANG + MNT) stocks.

NOTE:

-

- FAANG = Facebook/META, Apple, Amazon, Netflix, Google/Alphabet

- MNT = Microsoft, Nivida & Tesla

The Mega-Cap Stocks are in control of this current rally.

According to Bianco Research, META, AAPL, AMZN, NFLX, GOOGL, MSFT, NVDA, TSLA have accounted for all of the S&P’s YTD return.

They are up +4.6%. The other 492 stocks collectively are down for the year (-.99%).

Mega-Cap techs saw market caps soar with AAPL back above $2.5 trillion, MSFT back above $2 trillion, AMZN back above $1 trillion, and META and TSLA back above $500 billion.

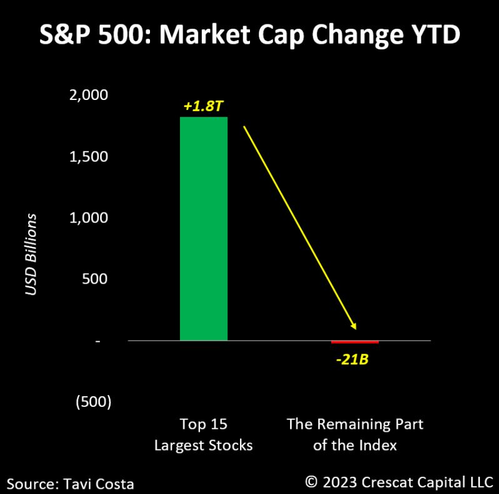

TOP 15 S&P 500 STOCKS

The Top 15 stocks’ Market Cap is positive with the rest of the market’s market cap still negative!

CHART BELOW

The Divergence is only comparable to the NIFTY 50 which proceeded the 1974 Inflation driven Stock Market Crash!

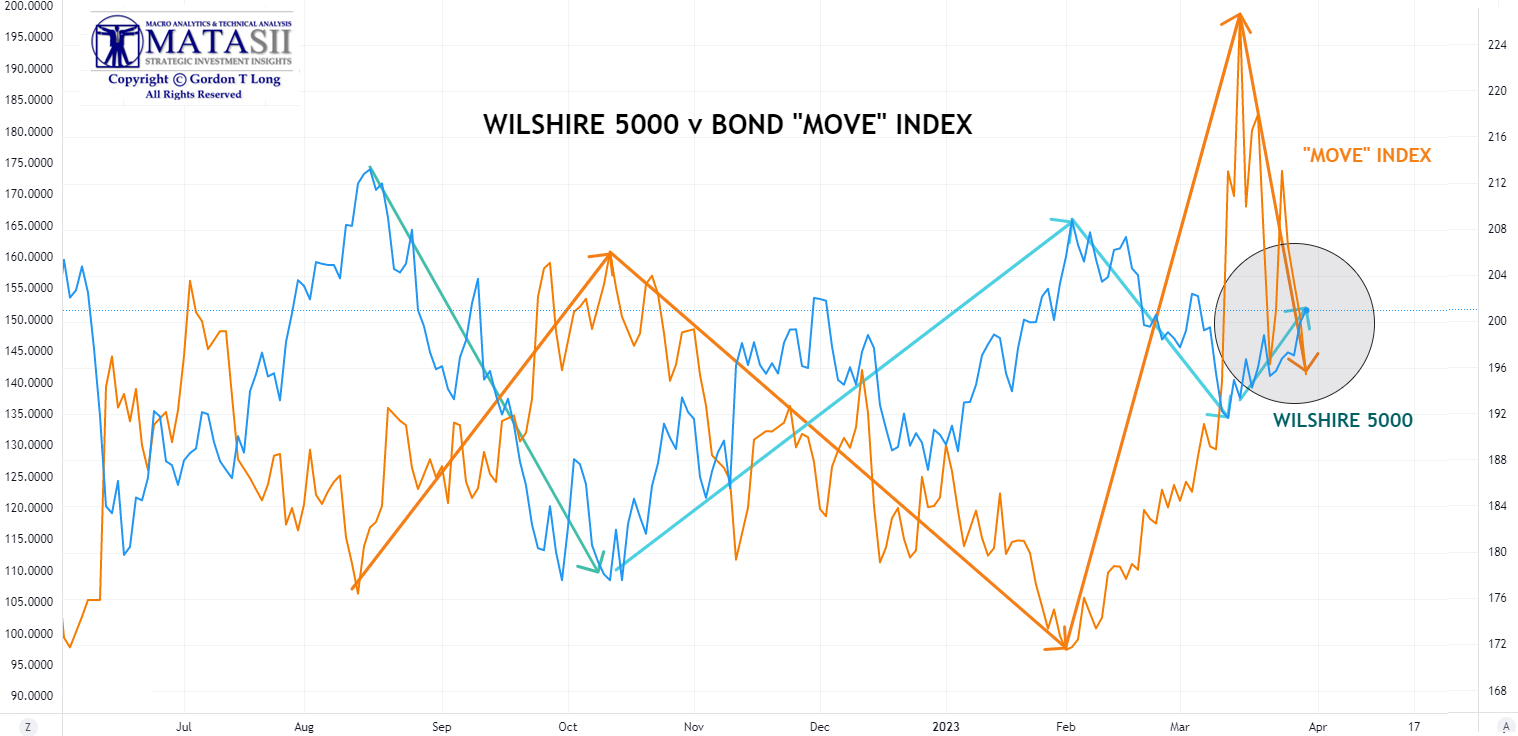

MOVE INDEX

The markets overall have been tracking closely with the Bond Markets “MOVE” index. The Wilshire 5000, when compared to the “MOVE” index, is clearly at a major inflection point. This market may have been taken up just about as far as it can be.

YOUR DESK TOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart Above: SUBSCRIBER LINK

PROPRIETARY MATASII CROSS

The proprietary MATASII Cross is close to giving a buy signal for the Wilshire 5000. The end of Quarter fund managers’ portfolio “Window Dressing” had a lot to do with Friday’s close. It brought the MATASII Cross close to a BUY, but still needs to see follow through buy activity next week!

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.