MACRO

US FISCAL POLICY

TWO VERY BAD FISCAL CHOICES!

OBSERVATIONS: RAPIDLY EXPANDING BIG GOVERNMENT

FACT: No matter who you vote for, we are going to get increasingly larger rates of debt growth and bigger government.

-

- With either candidate we are going to see over 25% of GDP being spent by the government rather than a 19th-century government at 3.5% of GDP. Why is that and what are either saying they will do about it?

- Trump has stated many times, that having built his real estate fortune on borrowing, he is proud to be the “King of Debt”.

- The Biden / Harris Regime has taken US Debt to GDP spending to levels greater than those that funded WWI or WWII. Where is the crisis to merit that?

What both fail to grasp is it’s better that the burden of funding a government be placed on consumption, NOT

i) production, ii) income, nor iii) investment. Governments must be a decreasing or flat element of an increasing economic prosperity pie! Folks, this isn’t complicated!

HARRIS / WALZ POLICIES

We are consistently told their policies are about taxing the rich and greedy corporations. How does that work?

TAX THE RICH – We have a $35T Deficits and they expect to increase it by over $5.5T to fund their new programs when:

-

- The top 1% pays 46% of income taxes.

- The top 5% pays 66%.

- The top 10% pays 76% of all income taxes.

On the other end, by contrast,

-

- The bottom 50% pays just 2.3% of total individual income taxes.

- 40% of all families pay no income tax at all.

The 84,000 new IRS hires are not going to be needed to chase the rich! They are coming after the Small Business, Corporations, Capital Gains Tax (your deferred untaxed IRA Retirement Accounts) and the Middle Class (100-400K/Annum).

Is that you??

TRUMP / VANCE POLICIES

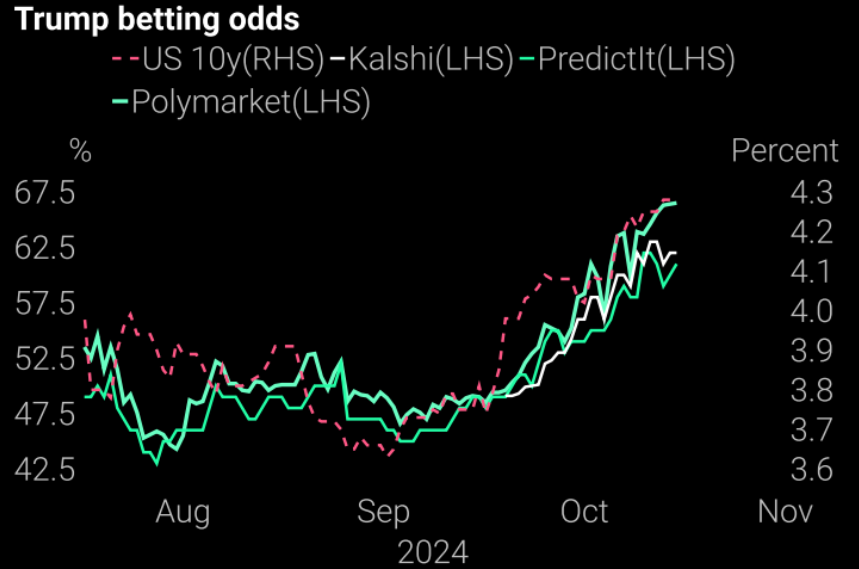

Trump’s plan is so frightening to Wall Street with his poll numbers increased that we have witnessed exploding:

-

- Bond Yields Up 70 bps in 30 days as his chances increased (bond value thereby plummeting).

- Bitcoin above $70K,.

- Gold and Silver at New Highs,.

- US Credit Default Swaps (US Default Risk) exploding higher

1- $11.5T IN REVENUE TAX CUTS

10-Year Revenue Loss:

-

- Extend the 2017 Trump tax cuts: $5.350 trillion.

- Exempt overtime income: $2.000 trillion.

- End Taxation of Social Security benefits: $1.300 trillion.

- Exempt Tip income: $300 billion.

- Exempt Income of Firemen, Policemen, Military and Veterans: $2.500 trillion.

- Trump Total Revenue Loss: $11.500 trillion.

- CBO Income Tax Baseline Revenue: $33.700 trillion.

- Trump Revenue Loss As % of Baseline: 34%.

2- REVENUES COME FROM TARIFFS

10-Year Budget Outlook with Trump Tax Cuts and Tariffs, 2025 to 2034:

-

- Individual income taxes with Trump cuts: $22.0 trillion.

- Trump Revenue Tariffs: $9.0 trillion.

- Existing Payroll Taxes: $20.9 trillion.

- Existing Corporate Tax Ex-Trump Cut to 15% on Manufacturers: $4.6 trillion.

- Other Existing Federal Receipts: $3.5 trillion.

- Total Federal Revenue Under Trump Policy: $60.0 trillion.

- CBO Baseline Federal Outlays: $85.0 trillion.

- 10-Year Trump Deficit: $25.0 trillion.

WHAT YOU NEED TO KNOW!

THE TRUMP TRADE & PUTIN

THE TRUMP TRADE & PUTIN

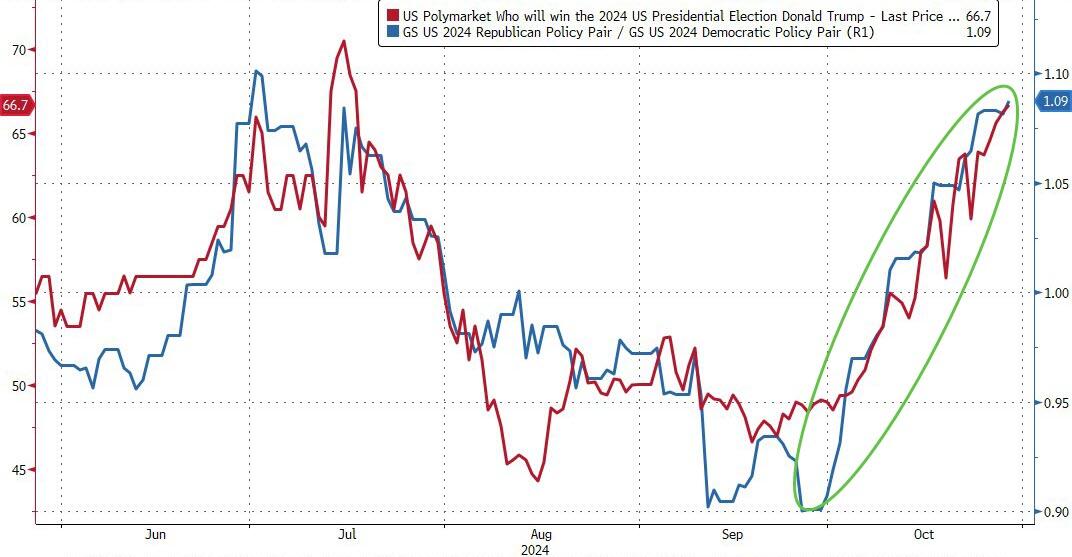

As the big day gets closer, the so-called ‘Trump Trade’ continues to propel higher stocks, crypto, gold, silver prices, as well as Bond Yields and even the US dollar., The Republican policy basket is dramatically outperforming the Democrat policy basket, if you can believe the Polymarket and PredictIt betting odds.

Since October 4th, when four large foreign accounts began betting big on Trump, it has “swayed’ the US media narrative around a Republican Presidential win., As the betting increased, it has broadened into the expectations of a Republican Sweep., However, when we look into it deeper we see the betting of the largest of the four accounts totals $45 million in the names of Princess Caro, Theo4, Michie, and Fredi9999., This means that for $45M you have been able to change the US election narrative. ,Seems like small potatoes for Putin or any Tech Titan, if they want the “piece” and “stability” that Trump promises to quickly deliver?

IF BY CHANCE TRUMP WINS, IT IS HIGHLY LIKELY THE DEMOCRATS WILL ASSERT FOREIGN COLLUSION!

RESEARCH

1- THE RAPIDLY RISING HIDDEN COSTS IN HOUSING

1- THE RAPIDLY RISING HIDDEN COSTS IN HOUSING

-

- The first hurdle of your Mortgage Rate is only the ante to an expensive seat at the table of Home Ownership!

- The other four cost pillars may not be as easy!

-

-

- RISING PROPERTY TAXES: Property taxes in the U.S. have risen 29.2% since 2019, helping to drive up homeownership,

- EXPLODING INSURANCE COVERAGE: Premiums Up 33.8% (2018-2023) with Deductibles also rising.

- UTILITY COSTS:. In 2022, the average cost of electricity increased more than 15%, gas (55%), water and sewage (53%), and internet (32%).

- SERVICES: .It now costs, on average, $6548 per year to maintain a single family home.

-

2- Q3 EARNING – BIG TECH MAG-7 REPORT

-

- For Q3 2024, (with 70% of S&P 500 companies reporting actual results), 75% of S&P 500 companies have reported a positive EPS surprise and 60% of S&P 500 companies have reported a positive revenue surprise.

- Earnings Growth – For Q3 2024, the blended (year-over-year) earnings growth rate for the S&P 500 is 5.1%. If 5.1% is the actual growth rate for the quarter, it will mark the 5th straight quarter of year-over-year earnings growth for the index.

- Earnings Guidance – For Q4 2024, 37 S&P 500 companies have issued negative EPS guidance and 18 S&P 500 companies have issued positive EPS guidance.

- Valuation – The forward 12-month P/E ratio for the S&P 500 is 21.3. This P/E ratio is above the 5-year average (19.6) and above the 10-year average (18.1).

- History repeatedly shows high market concentrations (i.e. Magnificent Seven) end badly!

DEVELOPMENTS TO WATCH

SURGING POLITICAL POWER OF THE BETTING MARKETS

SURGING POLITICAL POWER OF THE BETTING MARKETS

-

- The trade volumes of Polymarket, currently the world’s largest prediction market, have just surpassed $2 billion, which is a lot.

- The total capitalization of all US stocks is about $56 trillion, which is much more. However, Polymarket seems to be generating far more interest than stocks right now and is effectively driving the US political narrative!

- All the money is on Donald Trump winning in one form or another. The issues of potential manipulation are very real.

- The gap that has opened up between the average predicted vote share for Trump and the average probability put on his victory in betting markets, (as gauged by Real Clear Politics), may not be as bizarre as it looks

INCREASING GOVERNMENT DEPENDENCY & UBI

-

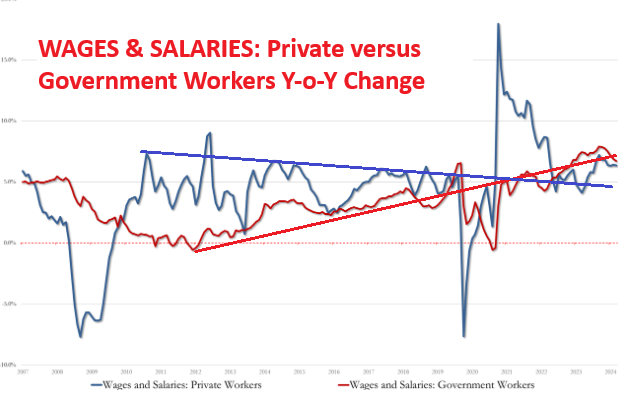

- Friday’s disaster of a jobs’ increase of only 12K (versus last month of 254), with Private payrolls dropping to negative 28K, illustrates the growing imbalance and dependency the US has on the Federal Government. If it wasn’t for government jobs growing by 40K, the US would be shrinking its total employed workforce.

- Payments from the government have become the fastest-growing source of income for Americans, according to a report by the Economic Innovation Group (EIG), a public policy research organization, titled “The Great Transfer-mation”. It states that Americans have become substantially more dependent on government support, with the share of national income coming from transfer payments more than doubling over the past 50 years.

- More and more political talk out of Washington is about the increasing need for Universal Basic Income (UBI) – especially with over ~15M in new immigration paroles.

- The evidence shows UBI would cause people to work less and relax more. Insofar as the case for UBI is built on unleashing the stifled engine of human creativity, it seems like UBI just isn’t up for the job!

GLOBAL ECONOMIC REPORTING

EMPLOYMENT – LABOR REPORT (NFP)

EMPLOYMENT – LABOR REPORT (NFP)

-

- The report was an unquestionably a disaster and off 3 Sigma from expectations.

- Headline NFP rose by just 12k in October, well short of the expected 113k and down from the prior (revised down) 223k, with two month net revisions at -112k (prev. +72k).

INFLATION – CORE PCE

-

- The Fed’s favorite inflation indicator – Core PCE – printed hotter than expected in September (+2.7% vs +2.6% exp), flat with August’s 2.7% rise.

- The so-called SuperCore PCE (Services Ex-Shelter) rose 0.3% MoM, leaving the YoY change ‘sticky’ at around 3.2%.

- On a M-o-M basis, PCE appears to be accelerating with Durable Goods and Services costs picking up.

- Private wage growth 6.4% in Sept, unchanged while Government wage growth was 6.7% in Sept, down from 6.9%, and well below record high 7.9% in March.

US ECONOMIC HEALTH – GDP, DURABLE GOODS & ISM MANUFACTURING PMI

-

- ADVANCED Q3 GDP: Data showed the US economy growing 2.8% in Q3, short of the street consensus of 3.0%.

- US Manufacturing Survey Hits 16-Month-Lows But Prices Paid Spiked In October.

ISM MANUFACTURING PMI

-

- The Headline ISM Manufacturing PMI eased to 46.5 from 47.2, missing the 47.5 analyst consensus.

- Employment remained in contractionary territory, rising to 44.4 from 43.9, while new orders rose to 47.1 from 46.1.

- Analysts at Capital Economics write “The decline in the ISM manufacturing index to a 15-month low in October suggests that the sector continued to struggle as hurricanes and the ongoing strike at Boeing disrupted manufacturing activity further in October”.

PRICES PAID

-

- The highlight of the report was the notable increase in the Prices Paid, which rose to 54.8 from 48.3, returning to expansionary territory – and above all analyst forecasts.

- Adding that the “rise in the prices paid index adds to the sense that the risks to inflation are shifting to the upside.”

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.