TIPPING POINTS

CORPORATE BANKRUPTCIES

US DEBT IS BOTH UNPRODUCTIVE AND INEXTINGUISHABLE!

The popular current media narrative advocates that the Fed will drive the US into a recession as a result of its current policy of raising interest rates in its fight to control inflation. This is simply wrong! Contrary to popular belief, it is Federal Reserve monetary policy of sustained cheap money which causes recessions. A US recession is either already underway or we are entering it now. Federal Reserve monetary policy over the last 10 years has not only insured a recession, but additionally the likelihood of it being a hard landing! How is that so and what are pundits missing?

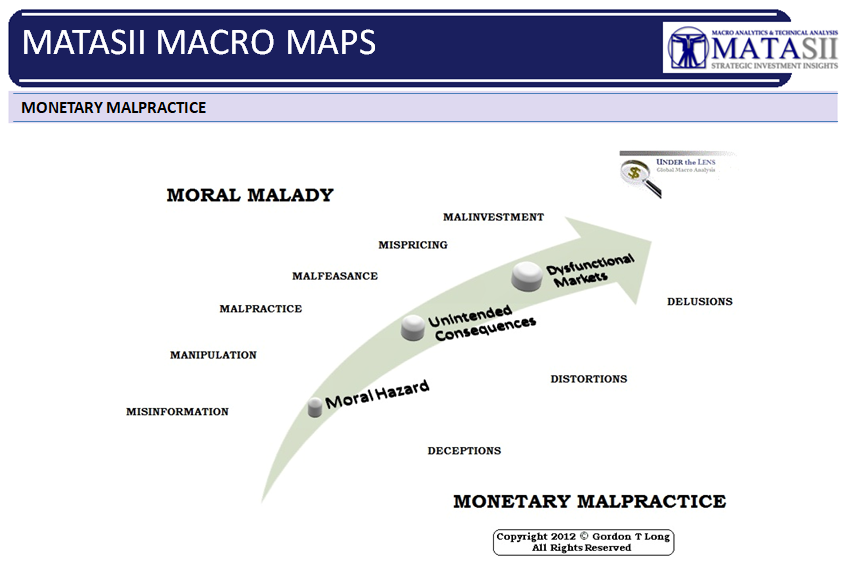

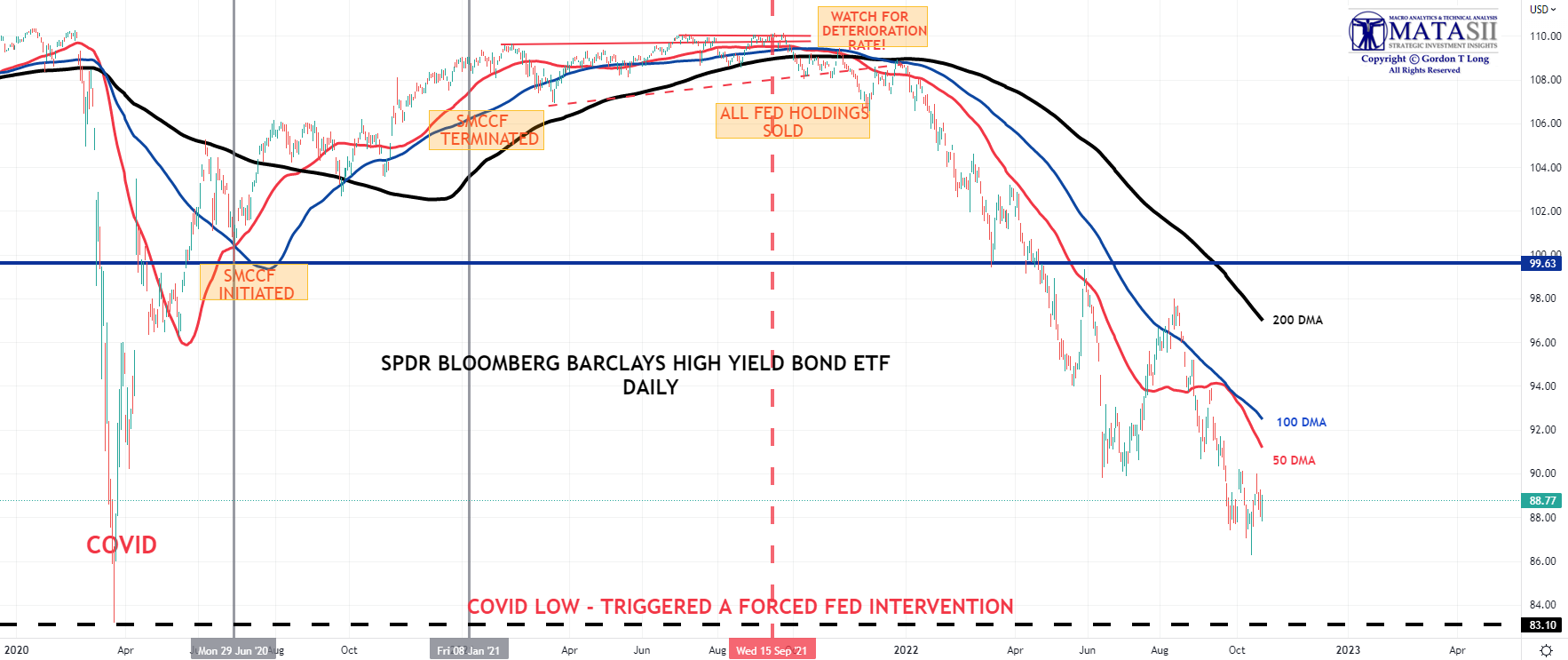

Cheap interest rates foster the malinvestment and excessive risk-taking that is the foundation upon which a recession is built. Four versions of Quantitative Easing, ‘Operation Twist’, negative real interest rates and an aggressive increase in the Fed’s balance sheet have ensured the stage is unquestionably set for the coming recession (if not something even worse!).

The reality is that the US has squandered an unprecedented amount of precious capital in unproductive assets and wasted consumption since the 2008 Financial Crisis.

=========

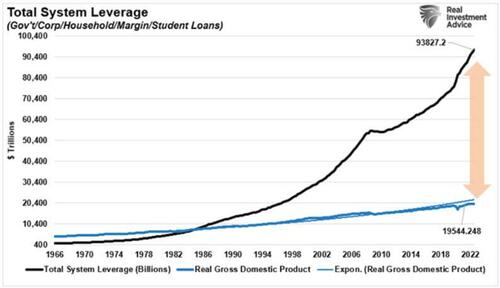

The U.S. has too much leveraged debt. As such, it has become increasingly dependent on low-interest rates to spur debt-driven consumption and to pay interest and principal on existing debt.

The U.S. has too much leveraged debt. As such, it has become increasingly dependent on low-interest rates to spur debt-driven consumption and to pay interest and principal on existing debt.

Lower than appropriate interest rates lead to unproductive debt, as can be seen with debt outstanding rising at a much faster pace than GDP. Simply the growing divergence between debt and the ability to pay for it, GDP is unsustainable.

WHAT YOU NEED TO KNOW

- THE GROWTH OF UNPRODUCTIVE DEBT

- UNPRODUCTIVE: When debt is applied to malinvestment or consumption, it is bad debt. That balance is completely misaligned in the US.

- INEXTINGUISHABLE: Increasing US Sovereign, Corporate and Consumer debt has become inextinguishable.

- INCREASING RATE OF LAYOFFS WARN OF DEPTH OF SLOWDOWN

- Amazon to layoff 10,000; Redfin lays off 13% of its staff; Meta to fire 13% of its workforce; Twitter lays off ~50% of its workforce; Cisco layoff 5% of workforce or 4000; Snap lays off 20% of its employees; Wayfair: lays off 10% of its corporate team; Microsoft fires 1,000 workers; Disney to begin layoffs, targeted hiring freeze; Re/Max to fire 17% of its workforce; Compass to layoff 10% of its workforce; Juul lays off ~1/3rd of its workforce.

-

- QUICK NOTES & CLIPS: Our readings are showing strong indications of rapidly accelerating global slowing.

- MESSAGE FROM Q3 EARNINGS

- Five Key Takeaways:

- Operating Margins are being squeezed,

- Recruiting, Hiring & Wage pressure persist (other than in Big Tech),

- Chinese Growth & Demand a major Unknown,

- Europe is viewed as problematic,

- Analysts Estimates are always too optimistic.

- Five Key Takeaways:

- VALUATIONS

- The DJI:Gold Ratio gives us a strong view of the long term inflection point the markets have now reached.

- Key ratio overhead resistance and support levels must be watched closely for indications of what lies ahead.

- There is a very strong likelihood the DJI:Gold ratio may take 18-24 months to resolve.

- 2023 S&P 500 OUTLOOK

- First Half Low ~ 3000 – 3300 (our long held S&P 500 3270 projection since 2021)

- YE 2023 ~ 3900

- CONCLUSION

- A developing global Recession and certainly a US Recession is now a near certainty. If the US is not now in one, we are certainly at the cusp with the 2s30s yield curve now at minus 60 bps.

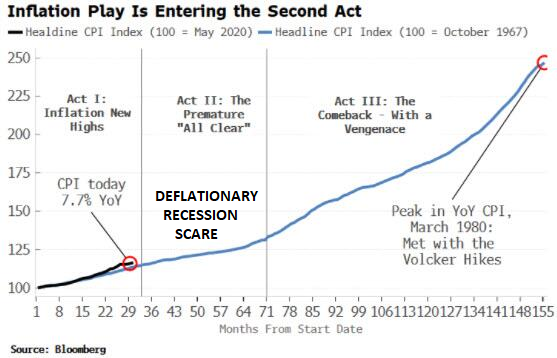

- The tide of inflation has reversed and is now rising. This tide is gradual and will temporarily be reversed by the gluts of supply that inevitably follow artificial scarcities and the deflationary impact of credit-asset bubbles popping. But these reversals will be temporary and misleading: inflation has reversed for structural reasons unrelated to credit-asset bubbles and temporary gluts.

- SPECIAL NOTE: YELLEN’S MID-TERM ELECTION TRICK

- Yellen’s plan has called for the continued injection of money into the economy despite the current bout of quantitative tightening and interest rate increases. We outline how she has been doing this.

The Long Expected and Overdue Recessionary Deflationary Scare is Soon to Arrive.

First a Seasonal Santa Claus Rally … then the Pain!

=========

Mal-Investment and excessive risk is a predictable outcome of monetary mal-practice! We created the roadmap outlined below in 2012 (see copyright date) as the post Financial Crisis policies of Quantitative Easing became clear. Today’s current economic environment suggests our thesis was unfortunately extremely accurate!

GROWTH OF UNPRODUCTIVE DEBT

GOOD DEBT IS PRODUCTIVE DEBT

Generally when debt is applied to assets that will create wealth through increased productivity it is considered good debt. When debt is applied to malinvestment or consumption it is bad debt. That balance is completely misaligned in the US.

GOOD DEBT IS EXTINGUISHABLE

Returns on the application of debt make the debt extinguishable. If there are no or poor returns, then the debt becomes inextinguishable. Increasing US Sovereign, Corporate and Consumer debt has become inextinguishable.

THE CONSEQUENCES

As a result the US faces the seriousness of the following foundational problems:

1- ZOMBIE CORPORATIONS

1- ZOMBIE CORPORATIONS

According to the Bank of International Settlement (BIS), over 20% of all corporations now produce insufficient profits and cashflows to cover their debt servicing costs. Their debt was unproductive and now inextinguishable.

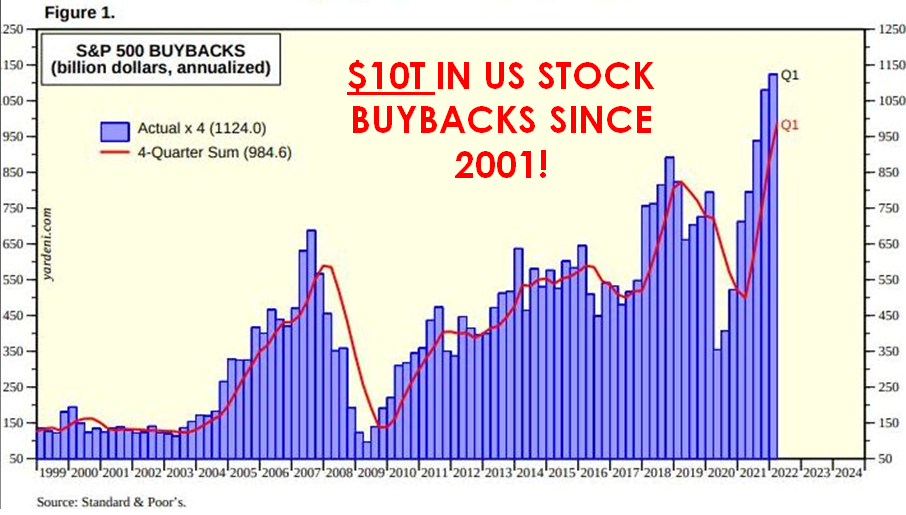

2- CORPORATE DEBT FOR EQUITY SWAPS

US corporations have increasingly incurred debt to buyback shares and to pay dividends to increase share prices. Prices are down ~ 24% since YB. Their debt was unproductive and now inextinguishable.

3-DEBT MATURITY WALL

Corporations have increased their leverage extensively over the last decade by incurring debt at low interest rates. That debt will need to be paid back or rolled over at much higher rates. Their debt was unproductive and now highly likely inextinguishable.

4- GOVERNMENT UNFUNDED LIABILITIES AND TRANSFER PAYMENTS

The US Government has ~$94T in unfunded liabilities primarily held in us Treasury debt instruments. That debt must now be paid to entitlement beneficiaries by selling the Treasury instruments. Foreigners are increasingly not buying US debt. The debt owed was unproductive and now highly likely inextinguishable.

THIS IS WHAT HAPPENS WHEN YOU CONSUME MORE THAN YOU PRODUCE & FINANCE IT WITH DEBT

IT EVENTUALLY COMES DUE!

INCREASING RATE OF LAYOFFS WARN OF DEPTH OF SLOWDOWN

NOTE: Little of the following received any mainstream media coverage during the run-up period to the US Mid-Term elections. These were primarily notes and clippings as part of my research readings and tracings. It appears my view of what is occurring is completely different to that of the mainstream media. It is why I stated earlier that I believe we are already in a recession or ‘technically’ extremely close.

I don’t recall witnessing this sudden a layoff reaction even during the 2000 Dotcom Bubble implosion!

GENERAL LAYOFFS which I recorded in my readings:

-

- Redfin lays off 13% of its staff

- Meta to fire 13% of its workforce

- Twitter lays off ~50% of its workforce

- Snap lays off 20% of its employees

- Wayfair: lays off 10% of its corporate team

- Microsoft fires 1,000 workers

- Disney to begin layoffs, targeted hiring freeze

- Re/Max to fire 17% of its workforce

- Compass to layoff 10% of its workforce

- Juul lays off ~1/3rd of its workforce

- Carvana lays of another 1500 (2500 previously)

TECH COMPANIES are now “unexpectedly” firing thousands of highly-paid, woke millennials as the US economy crumbles into the worst recession since Lehman. Here are those I recorded in October alone:

Layoffs This Month (% of Total Workers) –

-

- Twitter: 50%

- Cameo: 25%

- Robinhood: 23%

- Intel: 20%

- Snapchat: 20%

- Coinbase: 18%

- Opendoor: 18%

- Stripe: 14%

- Lyft: 13%

- Shopify: 10%

- Meta: 13%

- Apple: Hiring Freeze

- Amazon: 3%

- Cisco: 5%

- Roku: 7%

MAJOR US CORPORATIONS

META

THE POSTER CHILD FOR “MALINVESTMENT”!

“I’ve decided to reduce the size of our team by about 13% and let more than 11,000 of our talented employees go. We are also taking a number of additional steps to become a leaner and more efficient company by cutting discretionary spending and extending our hiring freeze through Q1. I want to take accountability for these decisions and for how we got here. I know this is tough for everyone, and I’m especially sorry to those impacted.”

AMAZON

Job cuts are expected to be focused on Amazon’s:

-

- Devices organization, including the voice-assistant Alexa,

- Its retail division, and

- Human resources.

“The total number of layoffs remains fluid. But if it stays around 10,000, that would represent roughly 3 percent of Amazon’s corporate employees and less than 1 percent of its global workforce of more than 1.5 million, which is primarily composed of hourly workers,” NYTimes said.

A deteriorating macroeconomic backdrop led America’s second-largest employer to announce a hiring freeze in early October. Amazon recruiters were instructed to halt all hiring for “corporate roles, including technology positions, globally in its Amazon stores business, which covers the company’s retail and operations, and accounts for the bulk of Amazon’s sales” by mid-Oct. Then in late October, the company froze hiring for its lucrative web services division, Amazon Web Services.

REDFIN

SPECULATIVE ‘HOME FLIPPING’ IS EXCESS MALINVESTMENT RISK

The online real-estate brokerage has announced the second round of layoffs, as well as an exit from its home-flipping business called “iBuying.” 13% of staff, or about 862 people, will be fired. The market in 2023 is likely to be 30% smaller than it was in 2021.

“RedfinNow Is Too Much Money and Risk: And the second problem is that iBuying is a staggering amount of money and risk for a now-uncertain benefit. We’ve tied up hundreds of millions of dollars in houses that you yourself wouldn’t want to own right now. Even before its overhead expenses, the RedfinNow properties segment will likely lose $22 – $26 million dollars in 2022. However small our iBuying loss may be compared to others, that loss is still larger than we could afford to bear again.”

COMCAST

Comcast has now joined the ranks of massive major U.S. corporations announcing layoffs. Comcast joins industry names like Verizon, Zayo and Cox Communications – as well as other major U.S. companies like Wells Fargo and, most recently, Meta – in announcing layoffs. Comcast President and CFO Mike Cavanagh said “we expect we’ll be taking severance and other cost reduction-related charges in the fourth quarter in anticipation of expense reduction actions that will provide benefits in 2023 and beyond.”

WALL STREET & CITIGROUP

The reason for the mass layoffs is that investment-banking fees at Citigroup plummeted 64% in the third quarter.

Citi is hardly unique with the banking pipeline clogged across Wall Street due to the earnings and economic recession, with Q3 investment-banking fees plunging more than 50% to $6.4 billion, the worst third-quarter performance since 2012. Citigroup may be the first major bank to layoff “dozens”, but it won’t be the last in the coming days and weeks. We can expect many similar mass layoff announcement from virtually all other banks.

GLOBAL SHIPPING: FedEx & MAERSK

FedEx CFO Michael Lenz stated that: “the company has reduced flights and parked planes to cut costs in response to soft demand for package delivery. We’ve eliminated roughly 8 or 9 international frequencies, about 23 domestic frequencies thus far. We’ve got another 8 or 9 domestic frequencies that will go in, in November.”

Maersk, the world’s largest owner of container ships, lowered its outlook for the growth of 2022 global container demand, forecasting 2023 could be worse. There are even reports that the company is canceling shipments. “There are plenty of dark clouds on the horizon,” the company wrote in its latest earnings report, adding, “this weighs on consumer purchasing power which in turn impacts global transportation and logistics demand.”

WeWork

MALINVESTMENT

Office-leasing company, WeWork Inc., which still manages to survive, after a failed 2019 IPO and then a collapse in valuation, went public via a SPAC merger with BowX Acquisition last year. Shares in the company are down more than 70% on the year. With the latest news, the company struggles to fill office spaces.

On Thursday, WeWork announced 40 US “underperforming” office locations, or approximately 41,000 workstations, will be mostly closed by the end of the month.

C. H. ROBINSON

FreightWaves reports, truck brokerage giant C.H. Robinson Worldwide Inc. is laying off between 1,000 and 1,200 employees of its approximately 17,000 employees. The move, as FreightWaves CEO Craig Fuller reports, “might be the largest layoff in the history of freight brokerages, not related to a bankruptcy or acquisition.” The labor cost reductions are to combat the impact of slowing demand and increased costs. The CEO indicated that they did not forecast truckload demand declining as rapidly as it did, as well as spot market and contract rates deflating considerably.

GLOBAL SLOWING – MISC NOTES & CLIPS

-

- Bank of America is projecting that job losses in this country will soon hit 175,000 a month…

- As pressure from the Fed’s war on inflation builds, nonfarm payrolls will begin shrinking early next year, translating to a loss of about 175,000 jobs a month during the first quarter, the bank said. Charts published by Bank of America suggest job losses will continue through much of 2023.

- “The premise is a harder landing rather than a softer one,” Michael Gapen, head of US economics at Bank of America, told CNN in a phone interview Monday.

- A Dollar General assistant manager named Travis Bennett recently posted a video on TikTok that showed unsold inventory at his store literally piling up to the roof.

- In a video with over 380,000 views addressed to “anyone inside this company that actually cares,” TikTok user Travis Bennett shows the conditions of his Dollar General. This includes boxes filling the aisles and numerous crates that have not been unpacked. Bennett says this is typical for “most Dollar General stores across the country.”

- Target Tumbles After Cutting Guidance, Warns Consumers Are Pulling Back On Spending. Both sales and earnings missed consensus as well as Target’s own forecasts while sales growth lagged behind larger rival Walmart. Also unlike Walmart which boosted its Q4 and full year guidance, Target executives lowered their financial goals for the holiday quarter “in light of an increasingly challenging environment.” Target projected a drop in comparable sales, the first decline in five years, and the CEO warned sales trends weakened sharply last month and the company is seeking up to $3 billion in cost cuts but no layoffs.

- US Industrial Production Unexpectedly Contracts In October, Capacity Utilization Slows. US Industrial Production Unexpectedly Contracts In October, Capacity Utilization Slows

- Micron Slides After Cutting Wafer Starts By 20%, Slashing CapEx; Drags Chipmakers Lower. “The market outlook for calendar 2023 has weakened…. In calendar 2023, Micron now expects its year-on-year bit supply growth to be negative for DRAM, and in the single-digit percentage range for NAND.”

- From Riches To Rags: Peloton Co-Founder Starts A Rug Company

- Amazon Makes History After Losing $1 Trillion In Market Value Amid Tech Stock Rout – Amazon has become the first publicly traded company in history to lose $1 trillion in market cap.

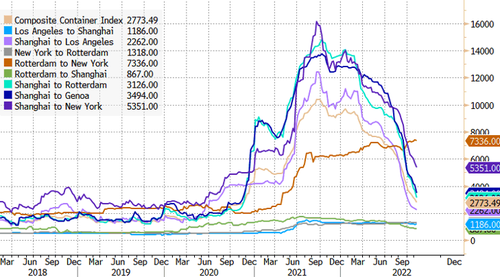

- Ports Clogged with empty containers As World Trade Stumbles – “We are in a situation where we are not able to accept new clients for some locations.”

- Bank of America is projecting that job losses in this country will soon hit 175,000 a month…

-

-

This year’s monetary tightening by global central banks take about 9-12 months to filter through the real economy, which means world trade will slow even more in the quarters ahead. The latest evidence of trouble ahead is a glut of containers at ports.

This year’s monetary tightening by global central banks take about 9-12 months to filter through the real economy, which means world trade will slow even more in the quarters ahead. The latest evidence of trouble ahead is a glut of containers at ports.

- FedEx Freight, the less-than-truckload arm of FedEx Corp. and the nation’s largest LTL carrier, said Saturday it will furlough an undetermined number of drivers starting in early December.

- LA Port Head Says October Was ‘Quietest’ Month Since 2009. LA Port Head Says October Was ‘Quietest’ Month Since 2009. Ports are coming to a crawl during the peaking shipping season, ahead of the busiest shopping period of the year. There’s no longer a massive amount of container ships outside the ports of Los Angeles and Long Beach, California, which handle 40% of all cargo containers entering the country. The backlog has all but dissipated.

-

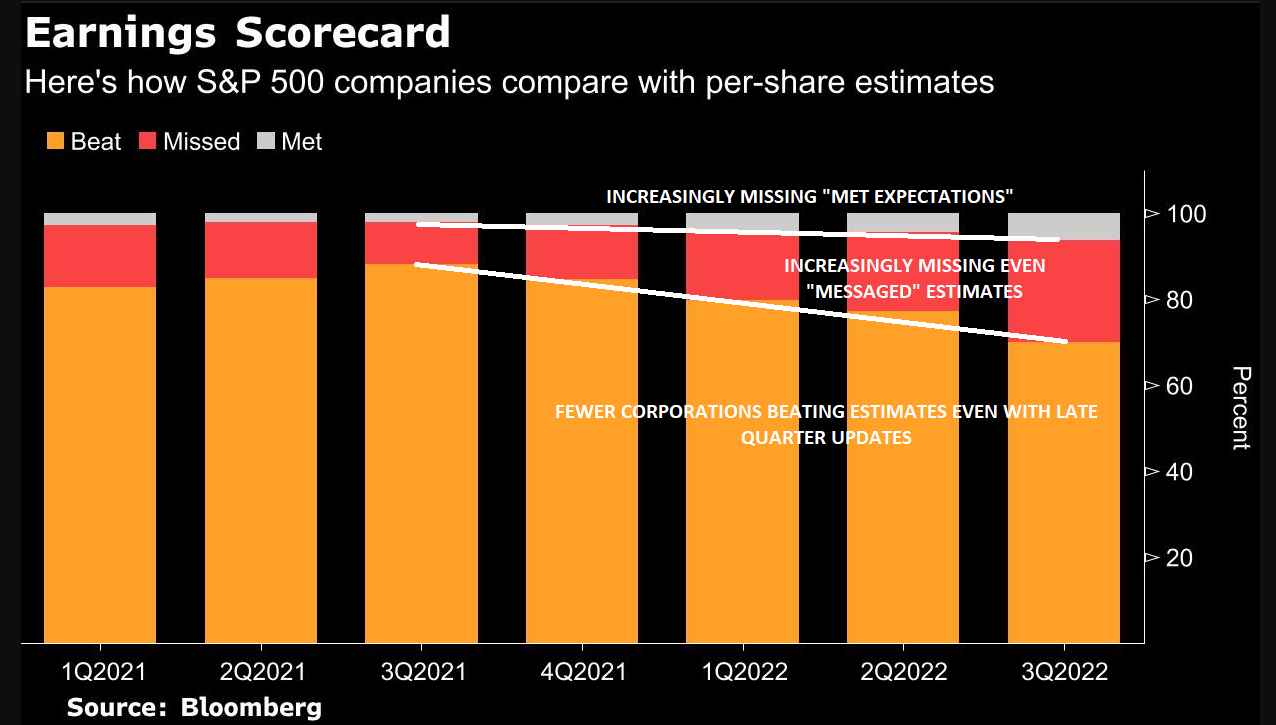

MESSAGE FROM Q3 EARNINGS

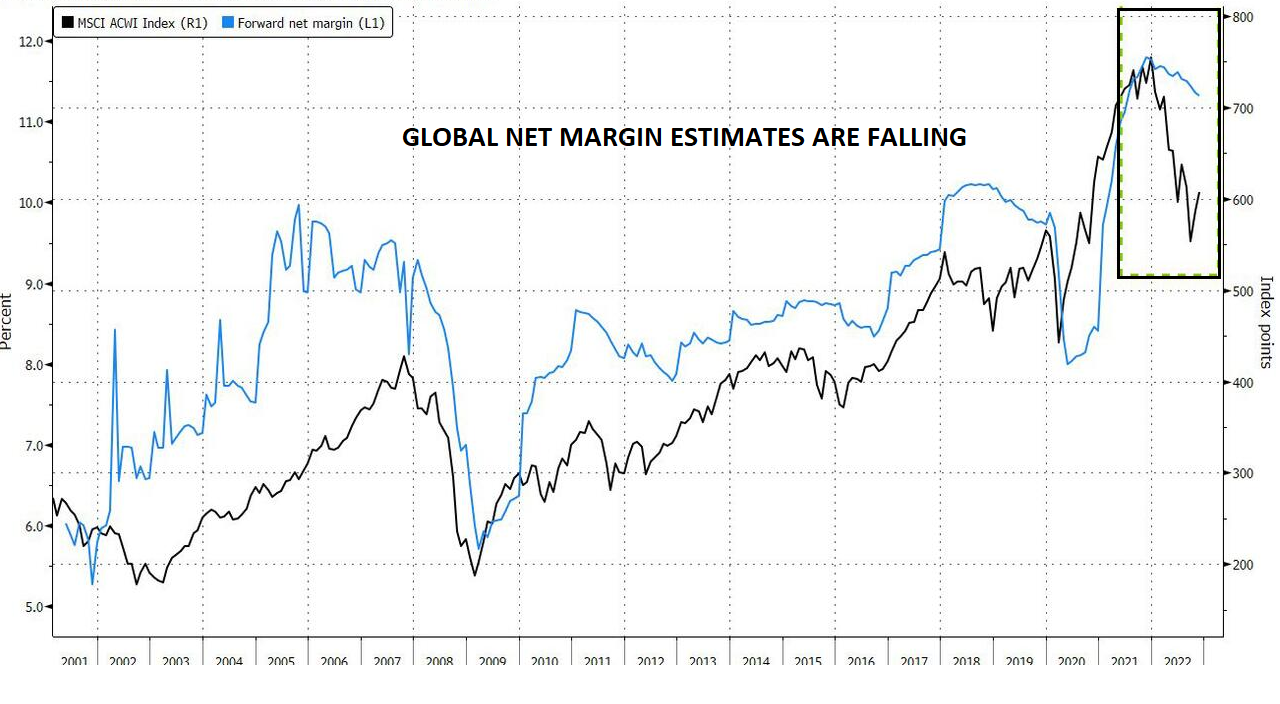

Earnings estimates have started to come down but they don’t yet reflect the economic outlook and need to fall much more.

investors will need to assess how slower growth and rising costs will affect margins going forward, as well as how prepared companies are for a raft of other factors — from staffing to the impact of China’s reopening.

FIVE KEY TAKEWAYS FROM Q3 EARNINGS SEASON

OPERATING MARGINS BEING SQUEEZED

OPERATING MARGINS BEING SQUEEZED

- Increasing pressure on margins in the quarter as companies faced higher costs for:

- Materials,

- Energy and

- Labor.

- Additionally seeing slowing consumer demand which is limiting their ability to raise prices.

- Management teams in general were now less optimistic about maintaining high margins.

- Analysts have been cutting margin expectations — but some say more is needed. “Input costs should be plateauing, but that won’t be enough to erase the pain for the bottom line” next quarter, said Sophie Lund-Yates, an equity analyst at Hargreaves Lansdown. “It isn’t just costs that are pinching margins, but weaker revenue growth too.”

- Increasing pressure on margins in the quarter as companies faced higher costs for:

- RECRUITING, HIRING & WAGE PRESSURES

- Executives are still facing staffing headaches.

- Though Big tech firms are embarking on huge layoffs in a new age of austerity for the industry most companies in other sectors are struggling to find enough staff in a tight labor market.

- Wages continue to be a pain point as workers contend with soaring living costs.

- CHINESE GROWTH & DEMAND A MAJOR UNKNOWN

- China’s Covid Zero policy continued to have a global impact,

- China generates about 6% of revenue for companies in the Russell 1000 Index, with technology, energy and consumer companies set to benefit the most from a reopening, according to Bloomberg Intelligence.

- Apple Inc. saying shipments of its latest iPhone models will be lower than previously expected after lockdowns disrupted factories. As the country relaxes restrictions, investors are counting on a boost to global earnings.

- The impact on inflation from China, as demand for commodities and the Yuan rises is yet another unknown.

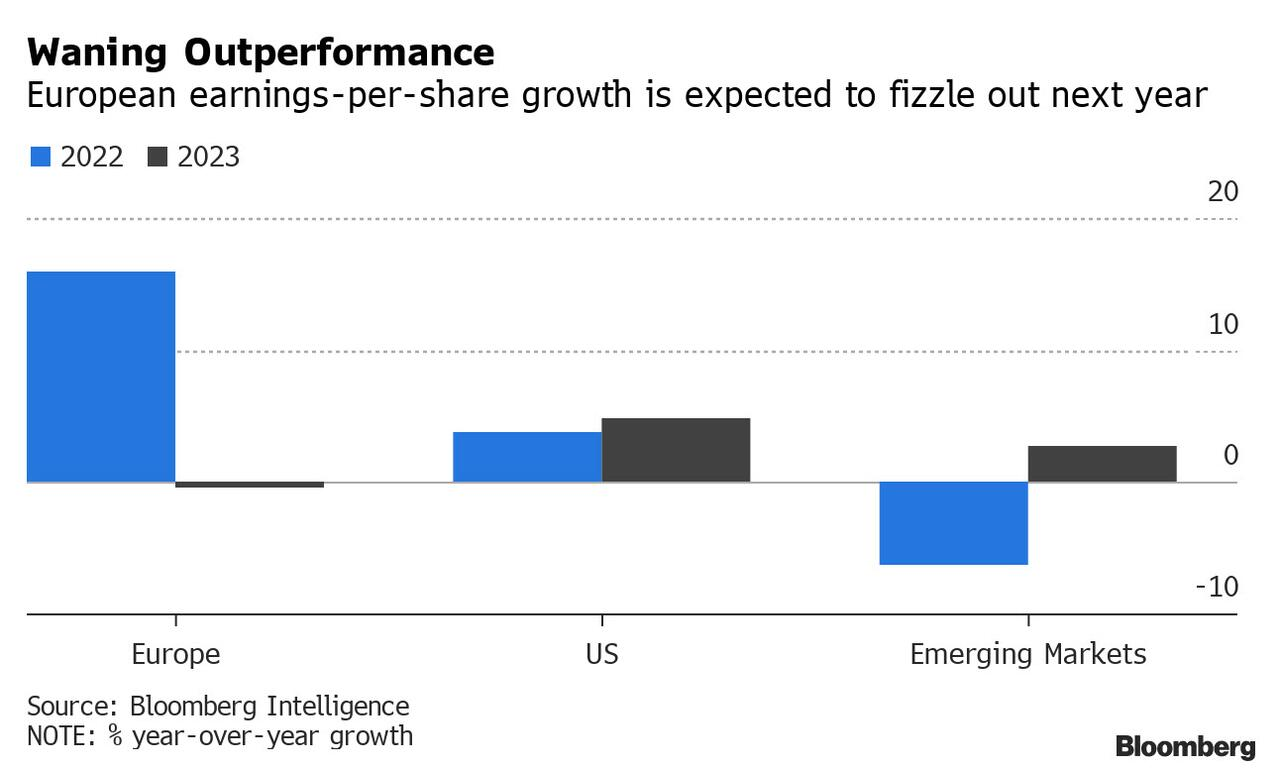

EUROPE IS VIEWED AS PROBLEMATIC

EUROPE IS VIEWED AS PROBLEMATIC

- A sharp increase in energy company profits and euro weakness has resulted in European earnings holding up far better than those in the US and emerging markets. However many feel the region may be in for a shock next year.

- Bloomberg Intelligence strategists see Europe’s lead fizzling out as Chinese earnings return to double-digit growth and US profits pick up.

- Europe will suffer due to a slowdown in energy earnings and as companies and consumers endure a gas crisis this winter.

- ANALYST ESTIMATES ARE ALWAYS TOO OPTIMISTIC

-

- While profit estimates for the next couple of years have been coming down, the number and magnitude of misses this quarter highlighted that analysts were still too cheerful.

- Current outlook for inflation and economic growth suggests no US earnings growth for 2023. With analysts projecting a 6% increase, estimates are likely still too optimistic.

VALUATIONS

S&P 500 Performance (Jan 1 to Sep 30, 2022)

In 2022, the S&P 500 index dropped -23.9% through the end of September. Let’s take a look at some of the major trends from this year’s stock market as of Monday November 7th, 2022.

Winners

The energy sector has been the noticeable standout and performed significantly well since the beginning of the year, as sanctions surrounding Russia impacted oil and gas supplies resulting in sharp price increases.

-

- Top performing energy stocks as of September 30th, 2022 included Occidental Petroleum (OXY) up 112% year to date (YTD), and Marathon Petroleum (MPC) which rose 52% YTD.

- Traditional defensive sectors such as healthcare, consumer staples, and utilities, although down for the year, also performed better than the overall index.

Losers

Growth stocks in both technology and communication services underperformed since the beginning of this year, as the value of future earnings were impacted by rising interest rates increasing the cost of capital.

-

- Real estate, consumer cyclical (or consumer discretionary), and materials also underperformed compared to the overall index.

- The trends are reflective of the fact that value stocks like energy and healthcare historically outperform growth stocks during periods of rising rates, though there are many varying factors that can alter performance.

Major Shifts in Q4

But as October has shown, the market is far from settled.

-

- Lower-than-expected earnings and overspending caused Meta Platforms, Inc. (META) to drop 24% over five days and Amazon to drop 13%.

- And the final impact of rising interest rates have yet to be fully felt, though indexes generally fare well in the year following.

- Since 1927, the average S&P 500 return sits at around 11.5% in the 12 months following peak inflation

2023 OUTLOOK

It is highly likely that the 2023 bottom up consensus earnings are materially too high. It is more inline with another 8% lower to $195 in the base case, a reflection of worsening output from our leading earnings models. This leaves16% below consensus on ’23 EPS and down 11% from a year-over-year growth standpoint. After what’s left of this current tactical rally, we see the S&P 500 discounting the ’23 earnings risk sometime in first half via a ~3,000-3,300 price trough. Our long held 3270 low on the S&P 500 is still valid.

We think this occurs in advance of the eventual trough in EPS, which is typical for earnings recessions. While we see 2023 as a very challenging year for earnings growth, 2024 should be a strong rebound where positive operating leverage returns—i.e., the next boom. Equities should begin to process that growth reacceleration well in advance, and rebound sharply to finish the year at ~3,900.

Price leads earnings and it’s not typical to put a trough multiple on trough earnings. What this suggests is the Q1 price low is marked by a 13.5-15X multiple on a forward EPS number of ~$220.

13.5 X 220 = 2970

15.0 X 220 = 3300

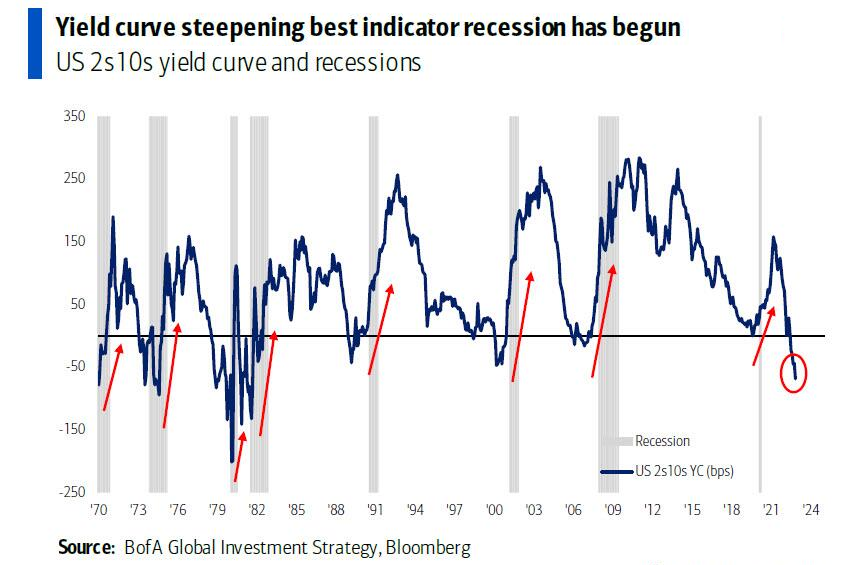

CONCLUSION

To have yield curves inverted to the degree they are is a major warning signal currently getting lost because the yield curve has been off-on inverting for sometime now. What is different this time is the degree! (also see chart in “Current Market Perspective” section)

|

2s10s INVERSION – Most since 1982

RECESSION IS NOW A REAL CONCERN!

The yield curve inversion of the 2s30s to minus 60bps (chart above left) is screaming recession about as loudly as it can! The sections above fully support this.

The market may have further room to the upside but we are clearly on the cusp of a knifes edge. I don’t necessarily like analogies but I am reminded strongly of how I felt in 2008 at this time.

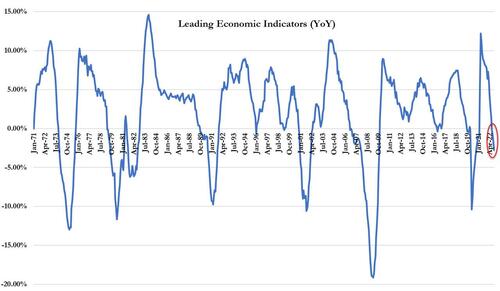

THE LEADING ECONOMIC INDICATOR

THE LEADING ECONOMIC INDICATOR

Leading Economic Indicators (LEI) are down 10 months in a row and now notable negative on a YoY basis.

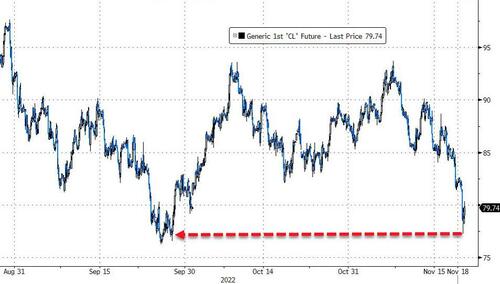

ENERGY – WTI

ENERGY – WTI

WTI tumbled to a $77 handle intraday on Options Expiration Friday, its lowest since late September.

2008 ANALOGY (Chart Below)

The accumulation of charts in this newsletter tells you why I feel that the recession is underway and we are on the cusp of it. The chart below illustrates why I feel like I have been here before!

CENTRAL BANK MONETARY MALPRACTICE

My esteemed colleague Charles Hugh Smith recently described the inconvenient reality of central bank monetary policy (what I termed at the beginning of this newsletter above as the era of Monetary Malpractice) as akin to building sand castles on the beach: when the tide is ebbing, the castles look magnificent — when the tide is rising, the sand castles are quickly washed away.

My esteemed colleague Charles Hugh Smith recently described the inconvenient reality of central bank monetary policy (what I termed at the beginning of this newsletter above as the era of Monetary Malpractice) as akin to building sand castles on the beach: when the tide is ebbing, the castles look magnificent — when the tide is rising, the sand castles are quickly washed away.

Inflation is actually a consequence of much larger forces that central banks don’t control: demographics (labor supply), social changes (quiet quitting, laying flat, let it rot), supply of essential minerals/materials, flows of private-sector capital, and most profoundly, the real-world productivity of capital, labor and state policies.

The tide of inflation has reversed and is now rising. This tide is gradual and will temporarily be reversed by the gluts of supply that inevitably follow artificial scarcities and the deflationary impact of credit-asset bubbles popping. But these reversals will be temporary and misleading: inflation has reversed for structural reasons unrelated to credit-asset bubbles and temporary gluts.

Another fantasy is that “markets are self-correcting” and will sort themselves out. The inconvenient reality is sometimes markets sort themselves out by crashing, as a good cleaning is the only cure for decades of distortion, manipulation, fraud, embezzlement and the dead hand of cartels and monopolies, whose sole reason to exit is to strangle market forces to enable unfettered profiteering and control of what’s passed off as “markets.”

Decades of central bank distortions and regulatory / market-share capture by cartels and monopolies have completely gutted “markets,” destroying their self-correcting dynamics. This is why Crash Is King.

This is the ultimate irony of the Unintended Consequences of Unintended Consequences: the more insiders and elites attempt to “fix” the cascade of second-order Unintended Consequences, the more Unintended Consequences they unleash.

Tweaking existing distortions and profiteering won’t work. Clearing the mess requires a collapse of all the distortions and profiteering skims / scams of cartels and monopolies, which is why I say Crash Is King.

SPECIAL NOTE

YELLEN’S MID-TERM ELECTION TRICKS

YELLEN’S MID-TERM ELECTION TRICKS

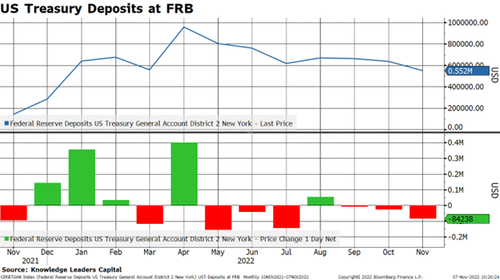

Yellen’s plan has called for the continued injection of money into the economy despite the current bout of quantitative tightening and interest rate increases.

How has Yellen been doing this?

MECHANICS

-

- The Federal Government maintains an account at the Federal Reserve. When this account increases, the federal government is taking money out of the economy. They raise funds through bond sales, but don’t spend all the money, parking the remainder at their account at the Fed.

- When the Federal Government runs down its deposit account, it releases funds into the real economy, thereby stimulating economic activity.

- The Government’s deposits peaked in April 2022 at $957 billion and have since fallen to $552 billion, for a cumulative drop of $405 billion.

- So, while the Fed took $287 billion out of the economy, the federal government was busy completely overwhelming these actions by injecting $405 billion into the economy.

- This lack of monetary and fiscal coordination is confusing and gives the appearance that the government’s left hand isn’t talking to its right hand.

The federal government has been quietly adding more money into the economy than the Fed is taking out in an effort to succeed in the mid-term elections.

THE WORST IS STILL IN FRONT OF US,

EXPECT ANOTHER SHORT TERM BEAR MARKET COUNTER RALLY ,

FADE THE UNFOLDING COUNTER RALLY – SELL THE RIPS.

HISTORICAL YIELD CURVE SIGNALS ARE APPROACHING

A RECESSIONARY DRIVEN MARKET DROP

IN THE NEAR TO INTERMEDIATE TERM

YOUR DESK TOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart: SUBSCRIBER LINK

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.