TIPPING POINTS

MARKET VALUATIONS

WHAT WE LEARNED FROM NVIDIA THIS WEEK

OBSERVATIONS: THE ELECTION YEAR ‘”SHELL GAME”

We have clearly returned to “old time” campaign” politics. It’s always the same pitch – Tax the Rich and Raise Corporate Taxes. The misinformed electorate swallow it everytime!

Why not vote for it? It costs you nothing and you may get something for nothing from it all. Like one of the many “free goodies” that are promised.

If you think about it for just a minute you see it is the old fashion shell game where the pea is never found!

TAX THE RICH

The rich don’t put their money in a savings account – they invest it. This creates jobs, income wealth and taxes. The Laffer Curve proved both President Reagan and Trump right on this fact! When taxes on the rich get too high, they move their businesses (and/or their income) – spend more on tax avoidance versus investing and contribute more to political lobbying versus job creation.

Simple arithmetic will also quickly tell you there are not enough targeted earners over $400,000/year to match the spending increases without taking everything they make – and more!

Hiring 84,000 new IRS agents are not needed for this. Obviously, the tax changes will in reality involve more than only the rich.

INCREASE CORPORATE TAXES

When you raise corporate taxes, thereby cutting profits, the following actions drive executives and boards of directors to take the falling actions:

-

- Cut Jobs (You)

- Increase prices (You)

- Cut Dividend payouts (Your Pension, retirement income)

FREE GOODIES

When a country is running chronic fiscal deficits of 6% plus, any new social benefits are not in fact free. They come with inflation, lost purchasing power and lost economic productivity (lower overall standards of living).

The bottom line — There is no free lunch except for the “flim-flam” politician who toutes these policies. Nothing changes except the name on the ballot.

WHAT YOU NEED TO KNOW!

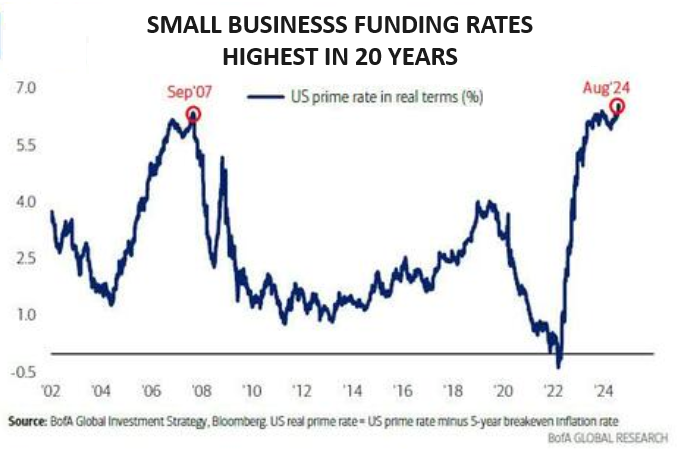

REAL RATES CRUSHING AMERICAN SMALL BUSINESS

REAL RATES CRUSHING AMERICAN SMALL BUSINESS

How do you destroy American Capitalism & Entrepreneurism?

-

- You spend $7.7T of money you must borrow,

- Thereby flooding the economy with too much money chasing too few goods,

- Which creates historic levels of inflation,

- That forces the Fed to take real rates through the roof,

- Thereby crushing small business, which is the bedrock of America enterprise.

- Then you blame businesses for price gouging!

- You then complete the economic destruction with “Price Controls”.

Wash, Rinse & Repeat — All right out of the Marxist handbook – Works Every Time!

RESEARCH

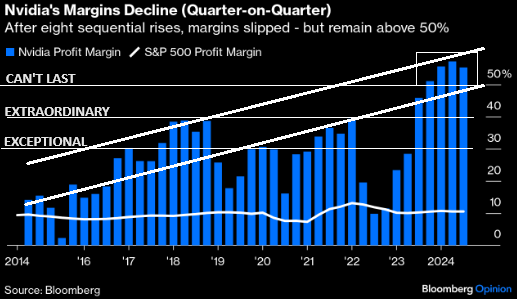

1- WHAT WE LEARNED FROM NVIDIA EARNINGS THIS WEEK!

1- WHAT WE LEARNED FROM NVIDIA EARNINGS THIS WEEK!

-

- If there is dissatisfaction with Nvidia profit margins above 50%, it also suggests that the AI excitement may be past its peak.

- Though Nvidia still accounts for around 20% of all single stock traded options, this is way lower when compared to the peak we saw in May/June. For a momentum stock this is a bad sign!!

- News stories about AI have been declining slowly for a few months. Chat GPT ignited the commotion, which peaked last November, when Nvidia results combined with the drama of Sam Altman’s brief dismissal as OpenAI’s CEO.

- This doesn’t mean Nvidia is going to burst quite yet, as it is still enjoying phenomenal growth. However, if the excitement fizzles and speculative froth is removed, (taking the stock lower just in time for rate cuts to come to the rescue), that’s probably healthy for yet another BTD burst from lower levels? Just guessing here!

2- JAPANESE CARRY TRADE – Too Soon To Take Your Eyes off this Ball!

-

- To believe the Yen Carry Trade scare is behind us is premature and dangerous! It also hides some important dynamics underway.

- Given current expectations for monetary policy at home and abroad, institutions that have relied on a soft yen must seek a new funding strategy or bring money home. Especially since the Bank of Japan is expected to hike a third time by the year’s close. Its July hike, which sparked the carry unwind and tighter policy, should further disincentivize investors from using the yen for carry trades.

- Could another currency take over the global carry trade mantle? Analysts are starting to consider it could be the euro? The compelling case is primarily based on a weakening eurozone, which backs the argument for more rate cuts than the market is pricing in along with a high US natural long coupon rate.

DEVELOPMENTS TO WATCH

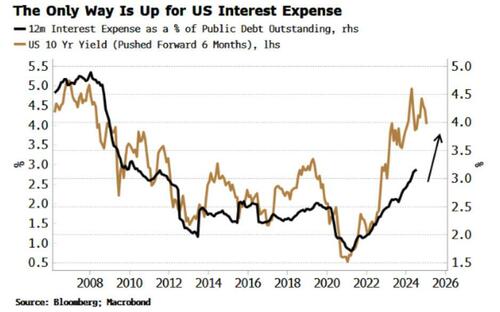

RATE CUTS DON’T NECESSARILY MEAN LONG RATES DRAMATICALLY FALL!!

RATE CUTS DON’T NECESSARILY MEAN LONG RATES DRAMATICALLY FALL!!

-

- The US Government’s interest bill is rising as increased issuances continue to grow.

- What the market appears to be forgetting is that the 10y yield historically leads interest expense by about six months.

- Fed rate cuts or not, the bill is set to keep rising, which means Fed rate cuts won’t necessarily or dramatically move the dial on long rates over the longer term.

BERKSHIRE HATHAWAY – Warren Buffett, the King of the Indirect Exchange!

-

- Berkshire-Hathaway is cash rich, with a pristine balance sheet and book value greater than that of Nvidia, Apple Inc., Tesla Inc., Meta Platforms Inc. and Amazon.com Inc. combined.

- So with Buffett’s own Indicator at extremes, what is he preparing for as he sells more of his BoA bank stocks?

- Very little is currently better value than Berkshire. Dominated by insurance, Berkshire is cheaper than the average US insurance company, and much cheaper than the S&P 500 Value index; it’s better value than value. As for the Magnificent Seven, they trade at 13 times book. Nvidia traded at 63 times its book value before its results were reported.

- When markets get in trouble, value is where everyone tries to hide.

GLOBAL ECONOMIC REPORTING

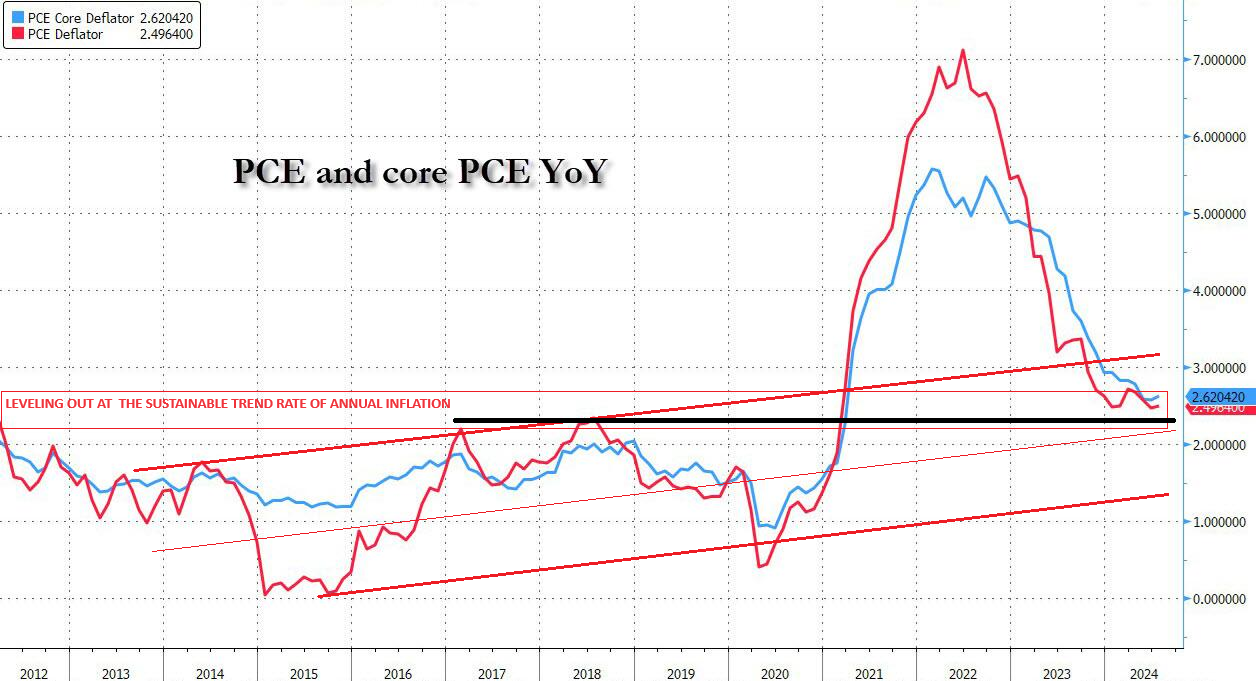

PERSONAL CONSUMPTION EXPENDITURE (PCE)

PERSONAL CONSUMPTION EXPENDITURE (PCE)

-

- Durable goods deflation continues to drag Core PCE lower while Services costs continue to rise.

- Even more notably, the so-called SuperCore PCE rose 0.2% MoM, the highest in 3 months, and which pushed YoY super-core to 3.25%, which remains awkwardly stagnant at elevated levels.

- This was the 51st straight monthly rise in SuperCore prices with virtually all costs except transportation rising.

- On A MoM basis, income growth was stronger than expected (+0.3% vs +0.2% exp), while spending came in line as expected at +0.5%.

- The problem, however, is that spending growth continues to tick far above income growth, and on a YoY basis, spending continues to outpace incomes.

LOW END CONSUMER SPENDING HAS HIT A WALL!

-

- We witnessed yet another month of declining savings. In July, the US savings rate as a percentage of disposable personal income, dropped below 3.0% for the first time since Covid, – 2.9% to be precise – from 3.1%. This was the lowest print since June.

- Dollar General, Big Lots and Five Below were this week’s highlighted retailers facing serious slowing in their targeted low end, discount markets.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.