MACRO

US PUBLIC POLICY

WHY DOES TRUMP WANT TO BE THE CRYPTO PRESIDENT?

OBSERVATIONS: A RENAISSANCE TO REPAIR, REPRIVATIZE & REJUVINATE THE ECONOMY

Asset prices are fickle and long-term economic performance is the ultimate measuring stick. But recent days prove markets’ unambiguous embrace of the Trump 2.0 economic vision. Markets are signaling expectations of higher growth, lower volatility and inflation, and a revitalized economy for all Americans.

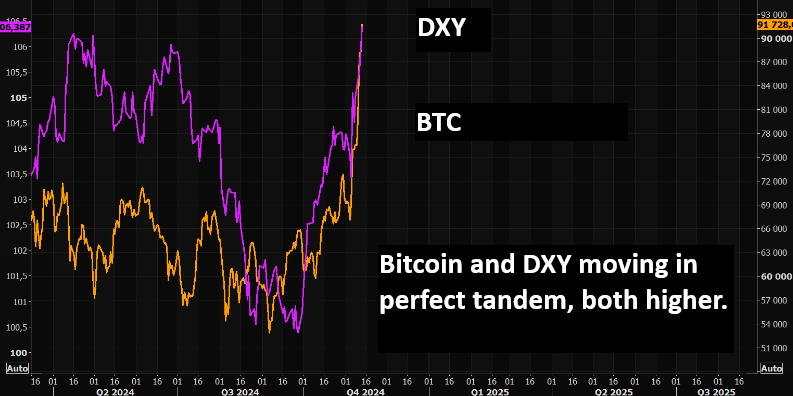

Mr. Trump’s election drove the largest single-day increase in the U.S. dollar in more than two years, and third largest in the last decade. This is a vote of confidence in U.S. leadership internationally and in the dollar as the world’s reserve currency. The Russell 2000, an index of small-capitalization stocks, also rose by the most in two years, due to investor expectations that the Trump economy will disproportionately benefit smaller businesses. An exchange-traded fund that tracks the Russell 2000 index saw its largest single-day inflow in 17 years.

The rally in equities was particularly unusual given that interest rates also moved higher. The combination of the steepening yield curve, stable inflation expectations and the rise in stocks indicates that markets expect the Trump agenda to foster non-inflationary growth that will drive private investment. Even amid the expected pro-growth agenda and the associated increased demand for energy, the price of oil fell. Energy stocks rallied at the same time, signaling expectations of more energy production and geopolitical stability.

While markets expect a reinvigorated American economy, the Biden administration’s mismanagement has created serious challenges that President Trump will need to overcome. Economic growth has been propped up by the out-of-control federal deficit, which hit 7% of gross domestic product last year. President Trump has a mandate to reprivatize the U.S. economy through deregulation and tax reform to spur the supply-side growth that he delivered in his first term. That will be essential to restarting the American growth engine, reducing inflationary pressures and addressing the debt burden from four years of reckless spending.

The U.S. economy also faces the consequences of the Biden administration’s distortion of capital allocation. U.S. competitiveness has been weakened by destructive energy policies and the channeling of investment toward a quixotic energy transition and semiconductor fabrication plants subject to government mandates that render them uneconomic. Mr. Trump will deliver a renaissance in American energy investment and ensure that trade is free and fair, supporting long-term U.S. competitiveness.

Allowing the private sector rather than the government to allocate capital is crucial to growth. The U.S. must reform the Inflation Reduction Act’s distortionary incentives that encourage unproductive investment, which has to be sustained by a lifetime of subsidies. Overhauling the regulatory and supervisory environment will encourage more lending and reinvigorate banks.

Mr. Trump must also address government borrowing. U.S. interest expense exceeds the defense budget. Treasury Secretary Janet Yellen has distorted Treasury markets by borrowing more than $1 trillion in more-expensive shorter-term debt compared with historical norms. Terming out that debt in favor of a more orthodox borrowing profile may increase longer-term interest rates and will need to be deftly handled. The only way to return to a prudent borrowing strategy without upsetting financial markets is restoring investors’ faith in the economy and preserving the dollar’s global role.

The failure of Bidenomics is clear. But President Trump has turned around the economy before, and he is ready to do so again. Twenty-three Nobel laureates might not understand this, but the financial markets have clearly spoken.

Scott Bessent, #1 Candidate for US Treasury Secretary

WHAT YOU NEED TO KNOW!

DISINFLATION IS OVER – INFLATION IS NOT

DISINFLATION IS OVER – INFLATION IS NOT

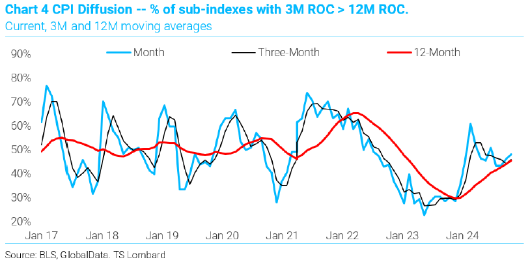

A diffusion index from TS Lombard illustrates that disinflation (decline in the rate of price rises) is over. The chart to the right shows the proportion of inflation components whose three-month rolling average is above their 12-month rolling average, an indicator of how many are trending upward.

The figure now stands at 50% , which is unremarkable, but it’s doubled since the beginning of the year. That’s hard to square with any notion that progress is still being made towards a 2% inflation target.

RESEARCH

1- WHY DOES TRUMP WANT TO BE THE CRYPTO PRESIDENT?

1- WHY DOES TRUMP WANT TO BE THE CRYPTO PRESIDENT?

TARIFFS mean TRADE WARS.

TRADE WARS are CURRENCY WARS!

CRYPTO is CURRENCY.

-

- The Coming American Funding Renaissance

- Private Equity, M&A and Cryptocurrencies

- An American Investment Magnet

2- HOW TRUMP MUST IMMEDIATELY REALLY TAME INFLATION – Wave 2 Is Coming!

-

- THE ARGENTINIAN PROOF:

-

-

- Stop The Debt Creation Machine

- Stop Short Term T-Bill Money Creation

- Historic Torching of Regulations

-

DEVELOPMENTS TO WATCH

FOREIGN DIRECT INVESTMENT HAS BEEN EVERYTHING TO CHINA!

FOREIGN DIRECT INVESTMENT HAS BEEN EVERYTHING TO CHINA!

THE US IS NEARLY 70% CONSUMPTION ECONOMY

CONTRASTED TO

CHINA IS A 44% CAPITAL FORMATION ECONOMY.

-

- China’s foreign direct investment has turned negative for the first time on record.

- Capital flight from China has become relentless as foreign companies have pulled even more money from China in the last quarter.

- This is a clear sign that some investors are still pessimistic, even after Beijing has rolled out stimulus measures aimed at stabilizing growth.

THE TEN REASONS M&A WILL NOW BEGIN RETURNING:

-

- A Material Rebound

- Both Cyclical and Structural

- More Fuel to the M&A Fire

- Animal Spirit on the rise

- Strategic Buyers

- Solid Credit Fundamentals

- The Goldman Sachs M&A Basket

- A Public/Private Tech Valuation Pap

- Get ready for ‘The Sponsors Spark’

- Fundamentals are Supportive

GLOBAL ECONOMIC REPORTING

CONSUMER PRICE INDEX – CPI

CONSUMER PRICE INDEX – CPI

-

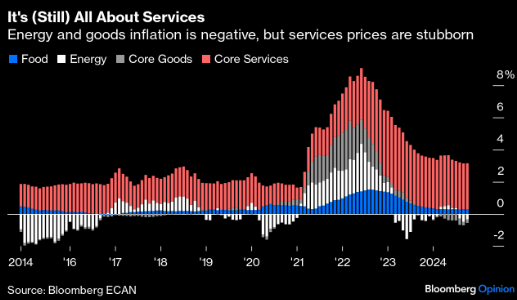

- Inflation is still primarily about Services.

- Disinflation has stalled in the core goods sector.

- Overall inflation is still above 3%, which is a problem!

PRODUCER PRICE INDEX – PPI

-

- Overall, the US PPI data was a touch hotter than expected on the Y/Y prints with upward revisions on the prior report.

- Headline M/M rose by 0.2%, in line with expectations while the prior was revised up to 0.1% from 0.0%.

- The Core numbers rose Y/Y by 3.1%, above the 3.0% forecast and up from the prior 2.9%, which was revised up from 2.8%.

- The super core metrics, ex food, energy and trade, rose 0.3% M/M, up from the 0.1% prior, with the Y/Y rising 3.5%, up from the prior 3.3%, which was revised up from 3.2%.

RETAIL SALES

-

- The disappointments were likely driven by major upward revisions to the prior month. This is highly unusual – A big outlier of an adjustment for an October?

- It’s almost as if they wanted to make the numbers look bad on purpose?

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.