MACRO

US MONETARY POLICY

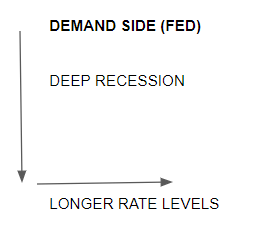

WILL THE FED’S “L” STRATEGY WORK?

The Federal Reserve’s “L” Strategy is to crash the economy to absorb excess liquidity and capital ‘sloshing’ around the global financial system and then maintain the required elevated rates until inflation is determined to be under control.

There are four critical contending forces at play that such a Monetary Policy faces!

- Demand Problems,

- Supply Issues,

- Political Fiscal & Public Policy Mistakes,

- Demographics & Cycles Impacts

We are in a much more complex environment than the Federal Reserve is accustomed to and the probability of avoiding an economic ‘hard landing’ is almost nil!

=========

WHAT YOU NEED TO KNOW

- DEMAND: WHAT THE FED CAN ACTUALLY CONTROL

- Central Bankers can influence Demand but have little to minimal control over Supply,

- The markets are wrong that the Fed will quickly “pivot”,

- The Fed will keep rates near 4% for longer than most yet appreciate.

- The reality is Inflation is now so embedded, that the US economy may need to undergo a deeper and longer recession than investors anticipate, before sharply higher prices can be brought under control.

- We can expect the Fed to keep up the pretense (a bluff) as long as they can. Ultimately however, they’ll show their cards and make the pivot back to lose money.

- Expect the Fed to hold rates up a quarter or two longer than the markets is presently anticipating.

- SUPPLY: THE VAGRANCIES OF GLOBAL SUPPLY CHAINS

- Supply-side issues are more powerful than demand management,

- Covid-19 Supply Chain disruptions & labor shortages are still working their way through the system,

- We can expect sustained inflation pressures in Energy & Food due to global supply problems.

- POLITICAL & FISCAL POLICY MISTAKES

- We have never tightened monetary policy during a recession and with such high levels of debt & leverage,

- We have global agendas at play by major influential powers that are global (UN, WEF, BIS, IMF, East/West alignment).

- DEMOGRAPHICS & CYCLES IMPACTS

- Longer Terms Demographics and Cycles are peaking or troughing concurrently!

SUSTAINED LABOR PRODUCTIVITY IS ACHIEVED THROUGH INVESTMENT, NOT COST CUTTING

=========

DEMAND: THE FED’S “L” STRATEGY

THE FED IS COUNTING ON A RECESSION TO LOWER INFLATION.

THE FED IS COUNTING ON A RECESSION TO LOWER INFLATION.

Markets recognize that regardless of what the Fed’s present narrative is regarding a strong economy, their fight against inflation will assure the US economy enters a recession. This assumes it is not already in recession! In fact, if it is in recession, the Fed is strongly committed to making the recession worse in order to fight inflation.

What the markets haven’t figured out yet is they still think the central bank will succeed in its fight against inflation. They believe if the rate hikes don’t do the trick, that a deep recession will.

- Either way, the markets think inflation is going away.

- But the markets are wrong on both fronts.

- The current rate hike expectations and a recession are simply not going to be sufficient to get rid of inflation.

- We still have negative interest rates and the Fed isn’t even going to come close to getting rates to neutral, let alone positive real rates that would be required to actually fight inflation.

- The hard reality is that at some point the economy is going to be so weak that FOMC members are not going to be able to pretend that it’s strong. They’re not going to be able to shrug off all the evidence of a severe recession. Then we are going to get the pivot with the inflation monster still on the loose.

We can expect the Fed to keep up the pretense (a bluff) as long as they can. Ultimately however, they’ll show their cards and make the pivot back to lose money.

EXPECT THE FED TO HOLD A QUARTER OR TWO LONGER THAN THE MARKET IS ANTICIPATING.

Former NY Fed repo guru and current Credit Suisse strategist Zoltan Pozsar made an immodest proposal to the Fed: crash stocks to contain inflation, to wit:

-

- The FOMC has one big problem: inflation.

- There are two ways to slow inflation: by hiking short-term interest rates or by forcing long-term interest rates higher.

- Historically, the Fed used rate hikes to engineer recessions that generated the slack needed to keep inflation in check (“opportunistic disinflation”).

- With the Fed’s “updated dual mandate” of inclusive low unemployment and the political imperative of redistribution through firmer wage growth at the bottom of the income distribution, the Fed aiming to slow inflation via a recession is unimaginable.

- Rate hikes today then are meant to slow inflation without a recession… which is not something that the Fed has ever managed to achieve before.

Former Fed advisor Zoltan Pozsar is also confident that “lower risk assets won’t kill growth” and his solution to contain inflation and “to improve labor supply, the Fed might try to put volatility in its service to engineer a correction in house prices and risk assets – equities, credit, and Bitcoin too…” In short: crash everything.

Fast forward to today when once again the Fed has followed Zoltan’s advice to a tee with:

- Stocks in a deep bear market,

- Bitcoin in another crypto winter,

- Commodities soared then plunged (with the exception of natural gas and oil),

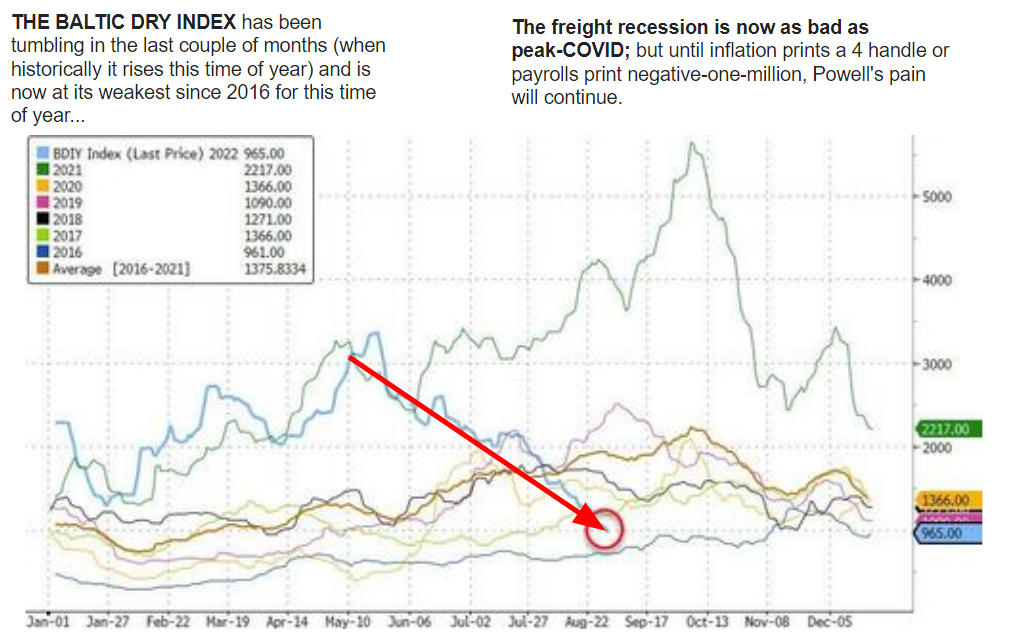

- The economy has completed two negative GDP quarters making it a consensus technical recession… while inflation remains sticky to the upside.

STICKY INFLATION

-

- The reality is Inflation is now so embedded, that the US economy may need to undergo a deeper and longer recession than investors anticipate, before sharply higher prices can be brought under control.

- Amid growing expectations that peak CPI is now well in the rear view mirror, markets have turned increasingly receptive to a dovish pivot by the Fed.

- There’s a high risk that global cost pressures will remain elevated, in large part because inflation is not just a function of excessive cyclical stimulus, but also the result of the war economy, the shift in supply-chains and other structural reasons which will not be easily undone.

- It appears that the expected path of Western policy rates rests on two hopes:

- First, inflation is about to peak and we are near peak hawkishness.

- Second, the risk with the first view is that it assumes a stable world with no geopolitical risk premia where demand management is more powerful than issues related to supply,

- In fact we live in an unstable world where

- Geopolitical risk premia are rising, and

- Supply-side issues are more powerful than demand management.

- It follows that if the first view is wrong (inflation is driven by the economic war, not stimulus), the second view is wrong also (we are not at peak hawkishness).

Pozsar postulates:

-

- Today’s conflict, a complex economic war between “empires”, drives the fourth price of money: the price level and its derivative – inflation,

- Inflation today is simply everywhere. It’s plain impossible to talk to anyone who doesn’t complain about rising prices, or to read the financial press without articles about inflation. It is also impossible to have a client meeting where inflation is not the center of discussion. As James Aitken recently noted, “inflation expectations are well anchored when nobody talks about inflation”, and by that measure, inflation expectations are becoming clearly unanchored…

BROKEN LABOR MARKET

The US labor market will remain broken for a long time with insufficient workers and a persistent wage-price spiral.

Pozsar further writes:

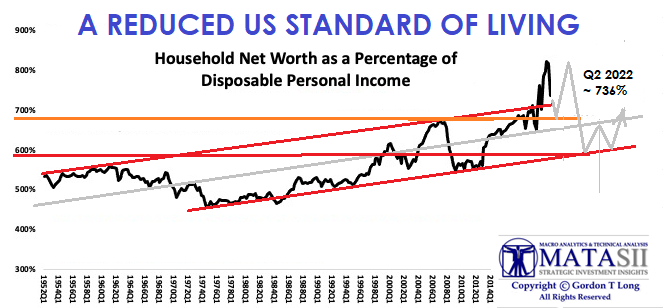

“Today we have a bigger problem: a shortage of labor, particularly in services, which is due to a mix of factors such as tougher immigration policies to appease nativists; early retirements and other labor market changes driven by the pandemic; and extreme wealth gains sapping labor force participation on the one hand (“feel rich, work less”) and driving demand for services on the other (“feel rich, spend more”). It’s a mess: it’s easier to deal with the politics of wage setting than it is to “grow” people – even in The Matrix, that’s possible only over time. Until then, we are stuck with a labor shortage, and President Biden’s top labor lawyer is the anti-Reagan: she’s encouraging the unionization of workers from Amazon to Starbucks…”

“Instead of playing “catch-up” with the pre-GFC trend of aggregate incomes, we’re now playing “catch-down” to the post-nativist, post-Covid, and post-Ukraine trend of aggregate supply. The level of economic activity needs to adjust down in an “L”-shaped manner. If it doesn’t, we will have more inflation problems…”

Others economists argue:

The market’s recession/no-recession infatuation is ridiculous. if the inward shift of supply curves across multiple fronts (labor, goods, and commodities) is the main driver of today’s inflation; if demand needs to be curbed significantly to slow inflation; and if a substantial reduction of aggregate demand means an “L”-shaped path for the economy, why is it so hard to see that we need a recession to curb inflation? Instead of the question of “whether”, why don’t we think about the “depth” of the recession needed to curb inflation?

In a global economic war, it isn’t possible for every major country but the U.S. to be engaged in “general mobilization”, and if Jay Powell is engaged in the “general mobilization” of Paul Volcker’s legacy, he also needs to engage in a “general mobilization” of U.S. consumers to spend much-much less; that is, “general mobilization” in the U.S. means a recession. A big, long-lasting one … to purge the “Super Size Me” mentality and replace it with Jimmy Carter’s theme of living thriftily (a “cultural revolution”). And that involves not only slowing the interest-rate sensitive parts of the economy (housing and durables) but also reducing demand for labor in the service sector, is a function of the level of wealth across a range of assets (housing, stocks, as well as crypto) to weed the “feel rich, spend more” and “feel rich, work less” mentality from the system. And what the Fed is telling us when it flat-out dismisses two quarters of negative GDP growth is that it it isn’t focusing as much on the rate-sensitive parts of the economy as it did in the past. Instead, it is focusing much more on the services economy and the labor market, which still remain strong. And therein lies the cautionary tale for the market…

If you think that the peak of tightening is 3.5% because inflation peaked, and that cuts are coming next year because a recession is nigh and stocks are now at the cusp of a bear market; (maybe not, because we need a recession, and lower asset prices are the path to a recession), you might be terribly wrong.

Make no mistake about it, the risk of the Fed hiking to 5% or 6% is very real, and ditto the risk of rates cresting there despite economic and asset price pain.

The market and the Fed are telling us that we will curb the biggest outbreak of inflation in fifty years with a “hiking cycle”, where the peak of the “hiking cycle” next year corresponds to negative real interest rates… unless you think that inflation moderates to target, that is 2%, by next year. If that is true, I am going to re-take Economics 101. What could I be missing?

Is Jay Powell a dark horse who is more political than serious about inflation? I do not think so. Once you go down the path of invoking Paul Volcker’s legacy, you can’t avoid making good on that promise. If you do, you damage the Fed’s reputation irreparably.

The risks are such that Powell will try his very best to curb inflation, even at the cost of a “depression” and not getting reappointed…

Between a deep recession and damaging the Fed’s reputation as an institution, a deep recession is the lesser of two evils. The former is public service and the latter is public disservice. The former is a central banker’s clear conscience and the latter is a life-long burden. Whether Jay Powell will succeed in slaying inflation is not the question; in the context of economic war, we can doubt that. Rather, the question is whether he’ll try his best to slay it. There I have no doubts.

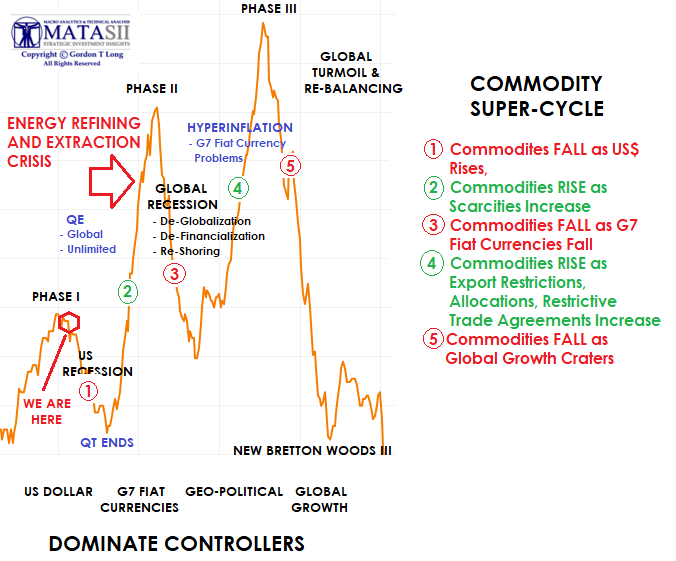

SUPPLY: THE VAGRANCIES OF THE GLOBAL SUPPLY CHAIN

GLOBAL SCARCITY PRESSURES

GLOBAL SCARCITY PRESSURES

-

- ENERGY PHASE II

- FOOD PHASE III

REFERENCES:

Phase II of the Commodity Super-Cycle in 2023

Phase III of the Commodity Super-Cycle Is A Global Food Shortage

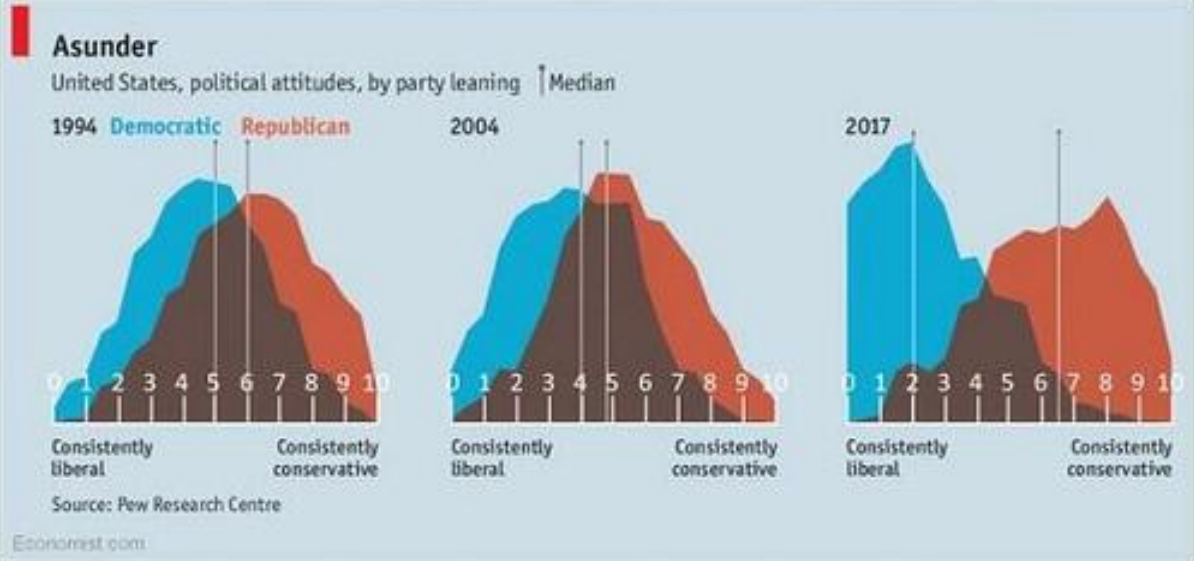

POLITICS: FISCAL & PUBLIC POLICY MISTAKES

INABILITY FOR SOVEREIGN GOVERNMENTS TO TAKE SOUND ACTION.

“A Camel Is a Horse Drawn By a Political Committee”

“A Camel Is a Horse Drawn By a Political Committee”

GLOBAL POLICY PARALYSIS — BI-PARTISANSHIP AGREEMENT HAS BECOME NEARLY IMPOSSIBLE

-

- The problem with Pozsar’s latest note is that it is too rational, too logical, and it reduces to the following – US society can be fixed at the individual level by realigning incentives, motivations and beliefs, and the Fed will do what is right even if it means the collapse of the US political system.

- Alas, that will never happen, and that’s why Zoltan’s argument fails.

- After all, it’s far easier to simply print a few trillion (again), kick the can for a few more years and dump the plate of troubles on some other unhappy politician.

- It’s also why the gating constraint here is not inflation but the dollar reserve currency status: at the end of the day, the Fed will devalue the dollar to permit both more monetary and Fiscal easing, thus keeping both the lower and upper classes happy It will keep doing so until it risks hyperinflation – pushing the dollar-based system to the point beyond which the world will no longer accept it. After all, that was the endgame since the day the Fed was launched in 1913.

- Whether the system is actually pushed beyond said point, well that’s the real $64 trillion question.

POWERFUL GLOBAL POLITICAL AGENDAS AT PLAY:

Powerful Global “Cross Current” influences at play:

-

- UN: U.N. Sustainable Development Goals (SDG’s) , often referred to as Agenda 2030

- WEF: Great Reset Agenda

- BIS: Interest & Currency SWAPS Control

- IMF: SDRs & Loan Covenants

- EAST/WEST CONFLICT: New Cold War

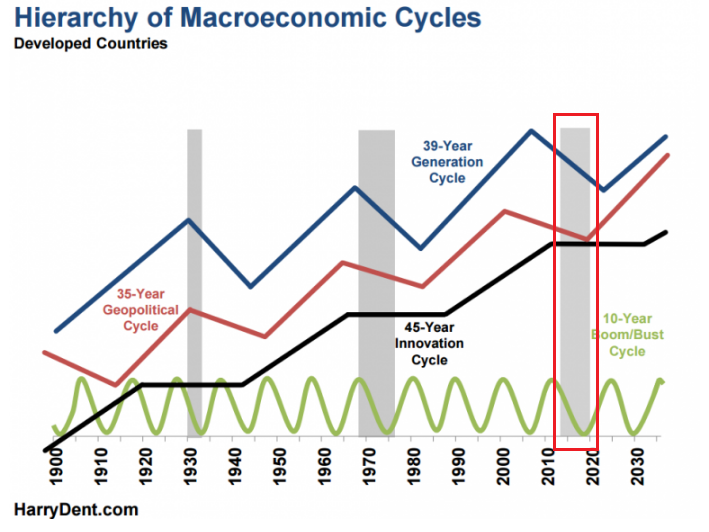

DEMOGRAPHICS & CYCLES

Demographics and Cycles all have a close alignment with tops or lows in ~2033. This supports the work of Howe & Strauss as part of the “Fourth Turning”.

MOUNTING GLOBAL SCARCITY PRESSURES

MOUNTING GLOBAL SCARCITY PRESSURES

-

- ENERGY PHASE II

- FOOD PHASE III

(see SUPPLY chart above)

Recent Videos

UnderTheLens – 08 24 22 – SEPTEMBER – US Labor Market In Productive Decline

Prior Videos

CONCLUSIONS

There are too may moving parts for the Central Bankers to bring inflation under control without significant damage! Economist Nouriel Roubini recently agreed with our view when he suggested there are two options for the US economy, given the Federal Reserve’s most-aggressive tightening campaign in decades:

-

- An economic hard landing, or

- Inflation at a persistently elevated level.

The chairman and chief executive officer of Roubini Macro Associates in an interview on Bloomberg Television’s “Balance of Power With David Westin”: Roubini, whose prescience on the housing bubble which the US financial crisis experienced more than a decade ago earned him the nickname “Dr. Doom”.

-

- “The fed funds rate should be going well above 4% — 4.5%-5% in my view — to really push inflation towards 2%. If that doesn’t happen, inflation expectations are going to get unhinged! Or if that happens, then we are going to have a hard landing. Either way, either you get a hard landing or you get inflation getting out of control.”

- “Even if you have 3.8% (the Fed’s Dot Plot), we will have inflation still well above target around 8%, falling only gradually. Markets are expecting a pivot and the Fed cutting rates next year to me sounds delusional.”

- “In the US, whenever you had inflation above 5% and unemployment below 5%, the Fed tightening has led to a hard landing, so my baseline is a hard landing.”

- “It (Inflation) might have peaked but the question is how fast is it going to fall? With the Fed still having real rates on the policy side highly negative, I don’t think the monetary policy is tight enough to push inflation toward 2% fast enough. “We are still in a severely inflationary environment, not just in the United States but around the world.”

- “Geopolitical events may contribute to further spikes in inflation, including China’s stringent Covid Zero policy, which require authorities to shut down businesses and lock down the population in the event of major outbreaks.”

- “The ongoing war in Ukraine may put pressure anew on commodity prices, particularly energy, and expressed concern on the possibility of a wage-price spiral.”

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.