|

2- POWELL SIGNALS POSSIBLE “SLIGHTLY” NEGATIVE RATES!

AGAIN IT IS ABOUT SHORT TERM LENDING COLLATERAL

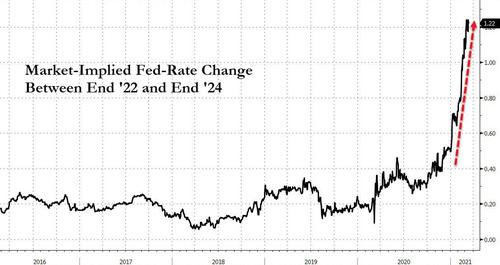

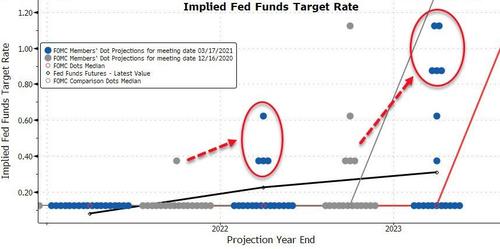

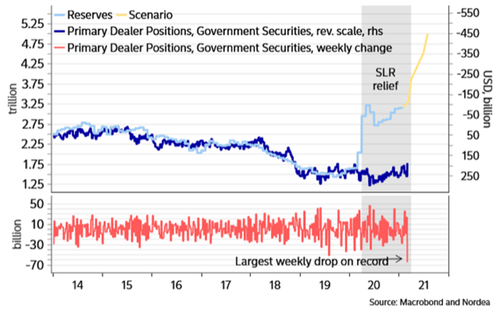

The FOMC meeting came with a subtle (but not so subtle) increase in the RRP (Reverse Repo Program) counter-party limit from $30 billion to $80 billion per counter-party.

Repurchase agreements (also known as repos) are conducted only with primary dealers; reverse repurchase agreements (also known as reverse repos) are conducted with both primary dealers and with an expanded set of reverse repo counter-parties that includes banks, government-sponsored enterprises, and money market funds. Reverse repo transactions temporarily reduce the quantity of reserve balances in the banking system.

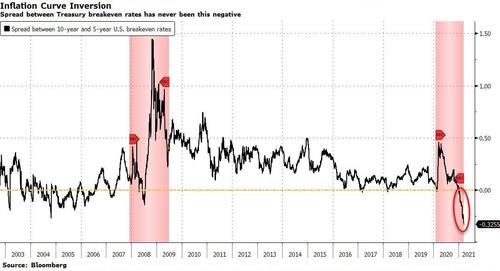

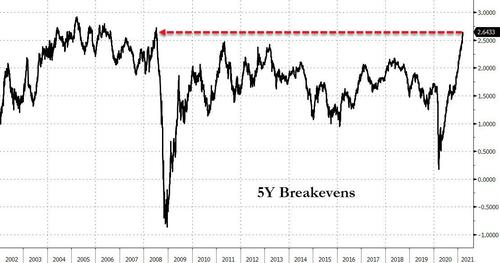

While at first look seems quite benign it implies the Fed is very comfortable with rates here at zero, but though they don’t want them to drop into the negatives zone, they now seem to be ok with rates dipping occasionally into the red (as they have done recently in General Collateral Repo).

NOTE: The GC is a set or basket of security issues which trade in the repo market at the same or a very similar repo rate, which is called the GC repo rate. GC securities can therefore be substituted for one another without changing the repo rate much, if at all. RRP counter-parties invest cash at the Fed in exchange for Treasury securities at a rate of 0.0%. If the cash investors can’t get collateral from the Repo market, they go to the Fed. Surprisingly, there was no RRP activity on Monday and today, and only $702 million on Tuesday. Rates are close to zero and the market isn’t even using the RRP window.

|

MARCH 31st ANNIVERSARY

MARCH 31st ANNIVERSARY

There is a strong possibility that the Fed will:

There is a strong possibility that the Fed will: