MACRO

US FISCAL POLICY

YELLEN BEGINS SHOWING HER HAND!!

n our last newsletter we suggested you watch US Treasury Secretary Janet Yellen closely. We said:

“Yellen’s new “unofficial” role is to fully contain the expected global “breakage” thereby buying the desperately needed time the Federal Reserve requires to effectively control inflation & inflation expectations.”

We didn’t have to wait long for her to show her hand! It appears US Treasury Secretary’s plan is to implement a first time ever “Operation Twist” by the US Treasury. To begin this “Soft Pivot” so the Treasury doesn’t have to pay too much to buy Long Bonds nor offer too much to sell Short Term T-Bills, it has begun ‘talking-down’ the aggressive rate hikes we have witnessed. Expect markets to react positively to these signals. The White House administration hopes a rebounding market will assist them with voters at the November 8th mid-term election polls.

=========

WHAT YOU NEED TO KNOW

Banking institutions have no longer been as willing nor capable to serve as the traditional sovereign treasury market-makers. This is because they have become burdened by the so-called Supplementary Leverage Ratio, or SLR, which requires Capital to be posted , as well as reserve holdings. This is resulting in Liquidity problems at exactly the wrong time! The Globalist’s in charge of the Basel Banking Accord have no current plans to amend this regulation.

- TREASURY’S OPERATION TWIST (TOT?)

- Yellen has been soliciting US Money Center Banks on whether the U.S. Treasury should initiate an “Operation Twist” buy back bond program.

- This will be undertaken by the US Treasury versus Federal Reserve so as not disrupt the Fed’s QT reduction of its balance sheet and to maintain mid-duration Treasury Note pressure on Inflation.

- Operation Twist will involve the BUYING of long dated treasury bonds while sterilizing this with the SELLING of short dated T-Bills.

- Operation Twist will be undertaken for a number of reasons including serious questions being raised by the Fed’s TBAC as to whether the treasury operation is currently capable of handling a March 2020 type of strain.

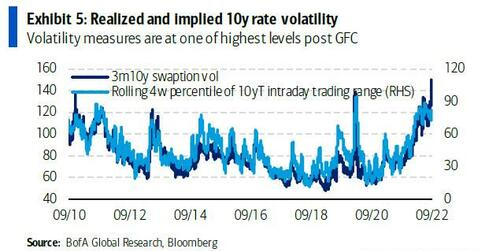

- Illiquidity has recently spiked dangerously in Global and US Treasuries. Supplemental Leverage Reserves (SLR) have reduced treasury market makers, thereby dramatically increasing volatility via selling/ buying of large institutional and sovereign lot sizes.

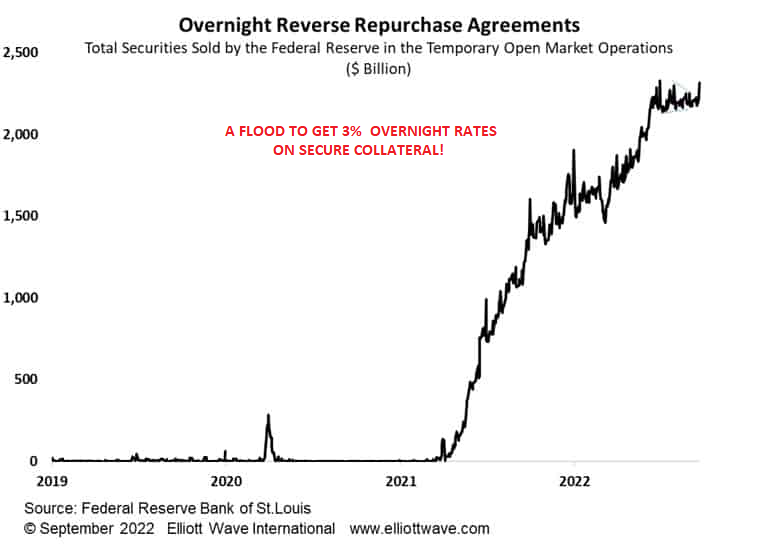

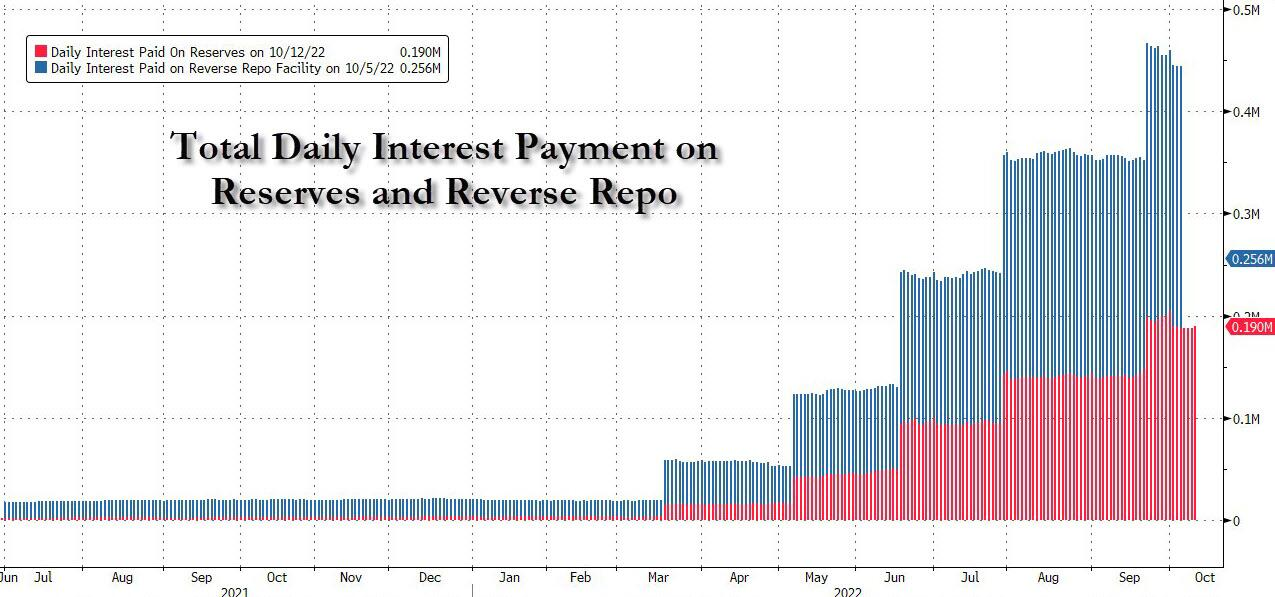

- THE FED’S $500M/DAY COSTS FOR REVERSE REPOS (RRP) IS HURTING THE FED’S CREDIBILITY (and Exposing its Independent Autonomy)

- The explosion in rates paid (currently 3.25%) and volumes of RRP’s are both embarrassing to the Fed as well as exposing it to populist political attacks which could jeopardize its independent autonomy.

- The current RRP rate is at 3.25%, and likely to increase to 4%, if the FOMC increases rates by 0.75% at the November 8th FOMC meeting. This is expected to bring heightened scrutiny on the issuance of this risk free money to large banks both domestic and foreign,

- Ideally the Fed would like to reduce the cost of RRP’s by moving it to the issuance of US Treasury T-Bills paid for by US Tax Payers.

- YELLEN’S “EXQUISITE” TIMING

-

- Yellen hopes to take full advantage of a positive market perceptions prior to the critical US Mid-Term election.

- The US Treasury’s PPT plans to take full advantage of the long term 200 Week Moving Average support to time her move. The 200WMA has been a critical support level for over 40 years.

- The US$, Real Rates and 10Y Notes appear to be nearing a point of reversal which Operation Twist can capitalize on,

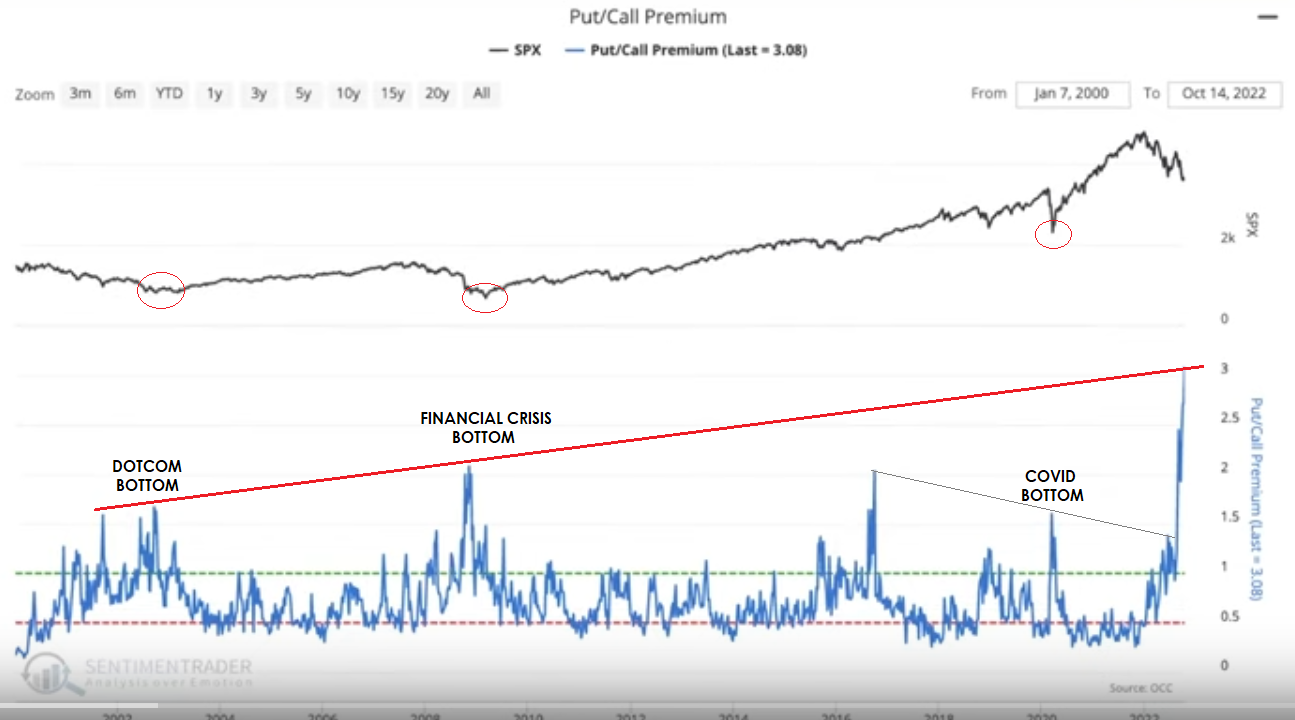

- The historic Put/Call Premium offers an important contrarian base to launch Operation Twist.

- WILL THIS BE ENOUGH – WHAT IS LIKLY NEXT?

- “A SOFT STEPPING DOWN PIVOT” – Expect lower gear “Soft Pivot” where the Fed slowly walks back its aggressive rate increase posture.

- The Fed is setting up the narrative to maintain slightly higher rates than currently exist for a longer period than currently expected.

- Treasury won’t have to pay as much (Long Bonds) nor offer as much (T-Bills) for Yellen’s “Operation Twist”.

- We should fully expect ongoing “fiddling” with Regulatory Banking, Lending and Insurance Collateral & Liquidity Requirements.

- Price Controls, Yield Curve Control (YCC), Capital Controls and Nationalization are soon be on the table in 20.

- CONCLUSIONS

- Fear and Macro Fragility have spiked the Credit Default Swaps for both the US & China. This is highly unusual. Both CDSs are particularly stable with seldom much movement.

The Initial “Fix” Is Being Out In Place … But Will It Be Sufficient?

=========

TREASURY’S OPERATION TWIST (TOT?)

We at MATASII.com have come to expect US Treasury Secretary Janet Yellen to implement a Treasury initiated and controlled version of the Federal Reserves previously employed “Operation Twist”. Here is why:

1- A MOUNTING LQUIDITY & CAPITAL PROBLEM IN US TREASURY MARKET OPERATIONS

DEARTH OF CAPITAL & INSUFFICIENTLY FUNDED MARKET MAKERS

THE SUPPLEMENTARY LEVERAGE RATIO (SLR) PROBLEM

Treasury debt outstanding has climbed by $7 trillion since the end of 2019. Meanwhile in parallel, major financial institutions haven’t been as willing nor capable to serve as market-makers. This is because they are basically burdened by the so-called Supplementary Leverage Ratio, or SLR, which requires that capital be posted against such activity (as well as reserve holdings). The SLR is the US implementation of the required compliance to the Basel III Tier 1 leverage ratio with which banks calculate the amount of common equity capital they must hold relative to their total leverage exposure. The SLR, which does not distinguish between assets based on risk, was initially conceived as a backstop to risk-weighted capital requirements.

As a result US Treasuries are no longer fully serving the purpose for which they have evolved into — a cash substitute. Presently the intermediation mechanism is not sufficiently robust ,since there are serious questions at to whether the treasury operation is capable of handling a March 2020 type of strain. We are now witnessing this occurring again. However, this is additionally a serious global problem.

CONSEQUENCES: A SPIKING ILLIQUDITY PROBLEM

Charts below sourced from ZeroHedge.com

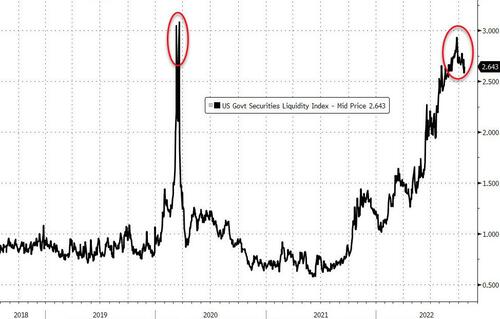

US GOVERNMENT SECURITIES LIQUIDITY

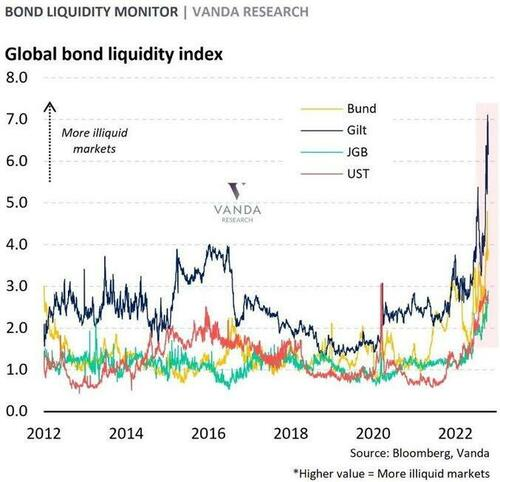

GLOBAL BOND LIQUIDITY

SITUATION ANALYISIS (BLOOMBERG)

It’s getting harder and harder to buy and sell Treasuries in large quantities without those trades moving the market. Market depth, as the measure is known, recently hit the worst level since the throes of the Covid-19 crisis in the spring of 2020, when the Federal Reserve was forced into massive intervention.

With rising risks of a global recession, escalating geopolitical tensions and the potential for further defaults by developing nations — not to mention disruptions in a developed economy such as the UK — investors may not be able to rely on Treasuries as the reliable haven they once were.

“We have seen an appreciable and troubling deterioration in Treasury market liquidity. Regulators really haven’t delivered yet any substantial reforms. What we are seeing at the moment is a reminder that the work is really important.”

Krishna Guha, Head of central bank strategy at Evercore ISI.

When the Treasuries market broke down amid a panicked rush into dollar cash in March 2020, the Fed swooped in as buyer of last resort. While it now has a backstop facility allowing the exchange of Treasuries for cash, volatility (if extreme enough) could still force the Fed into action.

That’s particularly awkward now, when policymakers are not only raising interest rates but actively shrinking the portfolio of Treasuries. So-called quantitative tightening is supposed to be playing an “important role” in tightening monetary policy, as part of the central bank’s battle to contain inflation.

“The biggest nightmare for the Fed now is that they have to step in and buy debt. If the Fed has to step in — when it’s in conflict to monetary policy — it really puts them in a bind. That’s why I think regulators need to fix the market structure.”

Priya Misra,

Global Head of Rates Strategy at TD Securities

2- THE US TREASURY LIQUIDITY PROBLEM CAN NO LONGER BE IGNORED!

Since the US Treasury Note is considered the global risk free benchmark, all global sovereign treasury markets are impacted as they experience their own problems with inflation impacting their treasury rates and currencies.

As a consequence global volatility in Credit, Bonds and Currencies has become unprecedented and simultaneous.

The result, which we discussed in our latest two newsletters (HERE, HERE) is….

THE DE-STABILIZATION OF THE UNREGULATED $600T OTC CURRENCY & INTEREST RATE SWAPS MARKETS

TREASURY ADVISORY BOARD COMMITTEE (TBAC)

When the US Treasuries last financing plan was released in August, the department’s industry advisers on the Treasury Borrowing Advisory Committee (TBAC) recommended further analysis of the issues we discussed above. Subsequently the 25 primary dealers were asked for a detailed assessment of the merits and limitations of a buyback program for government securities. (We highlighted this in previous newsletters.) That feedback was part of the quarterly survey of primary dealers, released 10-21-22 in connection with the overall treasury financing plan to be announced Nov. 2nd.

OPERATION TWIST – But from the US Treasury NOT the Fed!

It appears the conclusion is to launch an “Operation Twist” like program by the US Treasury. This would involve:

-

- The US Treasury BUYING long term dated US Treasury Bonds in the open market. This would be expected to drive yields lower while raising prices (collateral & capital values),

- The US Treasury would sterilize the buying by SELLING short dated T-Bills which would be expected to lower prices and raise rates. These rates would highly likely be competitive to the overbought $2.4T Reverse Repo (RRP) market conducted by the Fed.

WHY YELLEN & THE US TREASURY?

The Fed doing Twist, or any other “NOT QE” intervention, would no doubt be met with outrage and fury by politicians – especially with inflation still running red hot. This would be seen as a capitulation of the Fed’s tightening ambitions resulting in potentially catastrophic political credibility consequences for the Fed!

THE FED’S $500M/DAY COSTS FOR REVERSE REPOS IS HURTING THE FEDS CREDIBILITY?

The growth in US short term borrowing has increasingly been powered by the Fed’s Reverse Repurchase (RRP) facility. Cash is being parked at the Fed at 3.25%, backed by Treasury Collateral. Lenders can use the Collateral to leverage up lending while at the same time making excessive yield on their cash. What’s not to like? As a result popularity and yield have both skyrocketed (chart right), when risk free short term products with no counter party risk are hard to find.

The growth in US short term borrowing has increasingly been powered by the Fed’s Reverse Repurchase (RRP) facility. Cash is being parked at the Fed at 3.25%, backed by Treasury Collateral. Lenders can use the Collateral to leverage up lending while at the same time making excessive yield on their cash. What’s not to like? As a result popularity and yield have both skyrocketed (chart right), when risk free short term products with no counter party risk are hard to find.

A POLITICAL FED LAND MINE EXPOSED

The quiet ‘nodding’ between the Fed and Treasury is that the Fed is currently spending half a billion dollars every day to pay interest on reserves and reverse repos to countless banks (many of whom are foreign) leading to record losses for the Fed. This is an outrageous act in itself yet one which the broader public has no idea is taking place.

Secondly, the Fed will soon reach the point where the amount of outlays will exceed the interest income it collects on its $8.75 trillion balance sheet. Interest expenses on IORB and RRP could reach $200bn next year from $100bn in 2022. These expenses were just $6bn in 2021.

In September the Fed’s net income has – for the first time ever – turned negative, and losses will deepen with outlays growing as the policy rate rises, resulting in ever more negative “remittances” to the Treasury. It appears that years of monetary malpractice are about to come back and haunt the Federal Reserve, maybe even to the point where the central bank loses its independence and is taken control of by the Federal government.

Something has to be done immediately to fix; liquidity, capital, a market dislocation and Fed credibility!

YELLEN’S EXQUISITE TIMING

As I outlined in November’s UnderTheLens video with Put/Call Premium chart below:

My experience in the markets is when everyone is on the same side of the boat in their thinking, the underlying basis of that thinking is found to be flawed. Experienced and cynical traders simply suggest that “the purpose of the market is to extract as much money as possible from its unwitting participants!”

As the chart below clearly illustrates with the current Put/Call Premium, we have reached an unprecedented belief that the market is about to fall in a massive way! However, history shows us by the red circles this has actually turned out to be a market bottom and the best time to be buying. Our cynical traders would suggest this is the point where the market extracts the maximum amount of money and pain! What will it be this time?

YELLEN HAS HIGHLY LIKELY WAITED FOR THIS TIMING TO ORCHESTRATE “OPERATION TWIST”

US Treasury Secretary Janet Yellen, being the political animal she is, has tried to fully manipulate, with the assistance of the PPT, the optimum timing for maximum leverage:

-

- Yellen wanted to take full advantage of a positive market action prior to the critical US Mid-Term election.

- Yellen took full advantage of the long term 200 Week Moving Average to make her move. The 200WMA has been a critical support level for over 40 years.

- Yellen waited on clear signals from the highly correlated triumvirate of US$, Real Rates and 10Y Notes.

- Yellen has tried to harness the contrarian element of the Put/Call Premium.

1- MID TERM ELECTION TIMING

-

- US Treasury Secretary is the consummate Democrat Politician. Yellen is the first former Federal Reserve Chair to then be appointed to the administration’s cabinet as US Treasury Secretary.

- No two professional politically appointed bureaucrats are better prepared to pull off an Operation Twist than Yellen & Powell – they are basically interchangeable bureaucrats. Yellen as US Treasury Secretary has already held the position as Chair of the Federal Reserve. Likewise Fed Chair Jerome Powell was former Under Secretary of the US Treasury. Together they know how to pull this off.

2- THE 200 WMA LINE IN THE SAND

2- THE 200 WMA LINE IN THE SAND

The 200 Weekly Moving Average has been an important support test for upward trends going back to the 50’s. We have a tremendous number of technical confluences at this point which signaled the importance of this test.

This would be another reason for now to be an excellent point for “Operation Twist”.

Minimally this would also be an excellent launch of “Stepping Down – A Soft Pivot”, which we will discuss below.

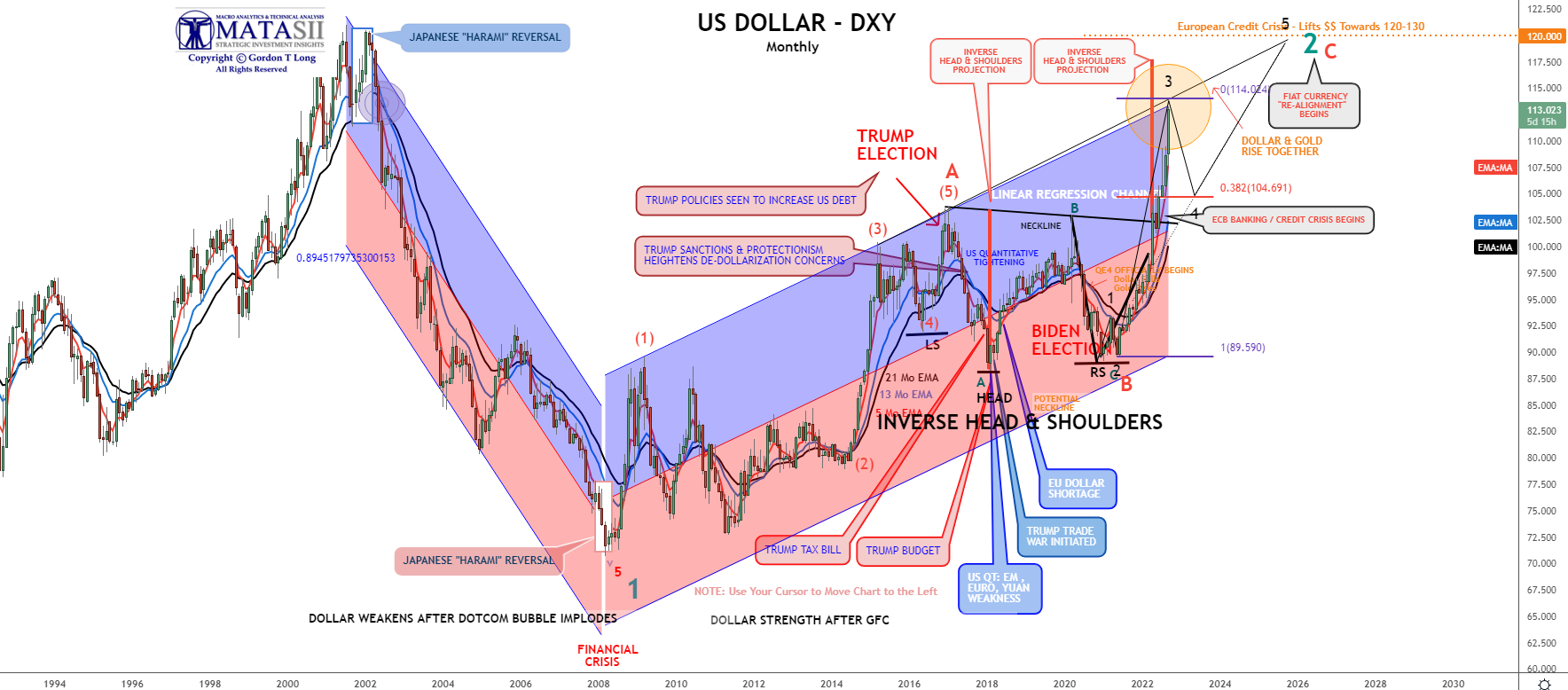

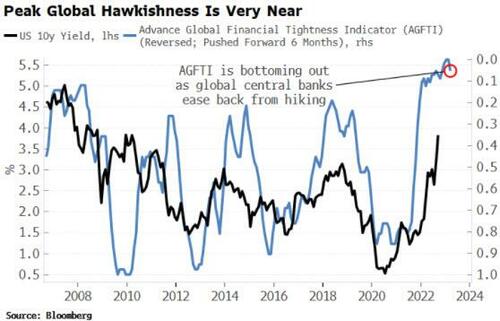

3- US$, REAL RATES AND 10Y US TREASURY NOTES

We have discussed the strong correlations currently existing between the US$, Real US rates and the US Treasury Notes in prior writings. This correlation, as the dollar chart to the right illustrates, are approaching a technical set-up for a reversal. The reversal may be only short to intermediate term, but serves the current purposes of the “powers-to-be”!

We have discussed the strong correlations currently existing between the US$, Real US rates and the US Treasury Notes in prior writings. This correlation, as the dollar chart to the right illustrates, are approaching a technical set-up for a reversal. The reversal may be only short to intermediate term, but serves the current purposes of the “powers-to-be”!

WILL THIS BE ENOUGH & WHAT IS LIKELY NEXT?

“STEPPING DOWN” – A “SOFT PIVOT”

What began with a Wall Street Journal report saying some Fed members were expressing “unease” and concerned about overtightening has quickly spread as a possible shift in Fed policy. The story reported that San Francisco Fed President Mary Daly said, “The time is now to start planning for stepping down.”

What began with a Wall Street Journal report saying some Fed members were expressing “unease” and concerned about overtightening has quickly spread as a possible shift in Fed policy. The story reported that San Francisco Fed President Mary Daly said, “The time is now to start planning for stepping down.”

What is being signaled here is a beginning of a ‘walk-back’ in aggressive Fed Policy – a shift to a “lower gear” soft pivot of the rate of increases in the Fed Funds Rate.

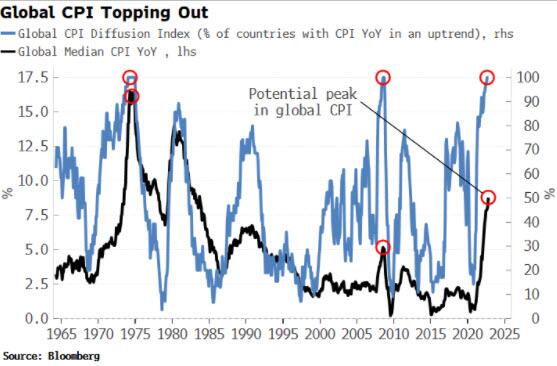

What is likely to occur is a policy of high rates for a longer than expected timeframe. As a consequence we should expect the Fed’s Inflation target to eventually be lifted from 2% to 3%.

To contain the breakage, as we have been cautioning:

Our experience is to never under estimate the “powers-to be” to “cheat” to effectively attempt to “Kick-the-Can-Down-The Road”. Anything to avoid being held responsible or blamed! In prior crisis, these hidden actions taken were altering the accounting for Derivative on the books of the Central Banks in the form of cancelling “Mark-to-Market” accounting.

We suspect this time around the “powers-to-be” will use Fiscal Policies of off balance sheet “CONTINGENT LIABILITY” accounting to “juice” the markets if they were to fall significantly below the current critical support levels.

Fully Expect more of the following:

-

- “Fiddling” with Regulatory Banking, Lending and Insurance Collateral & Liquidity Requirements,

- Yield Curve Control (YCC),

- Price Controls,

- Capital Controls,

- Nationalization

CONCLUSION

GLOBAL FEAR & FRAGILITY

In our last newsletter we concluded with concerns about market Fragility. Now we see the signals of market fear in global sovereign credit default swaps.

The US and Chinese Credit Default Swaps seldom move to any degree, even though we often see moves in most major countries reflecting particular situations or turmoil. When we see it in both China and the US at the same time it is a major red flag!

We suspect something historic is on the horizon and now appearing on global macro traders’ radar!

MAJOR SOVEREIGN CREDIT DEFAULT SWAPS SPIKING?

CHINA

USA

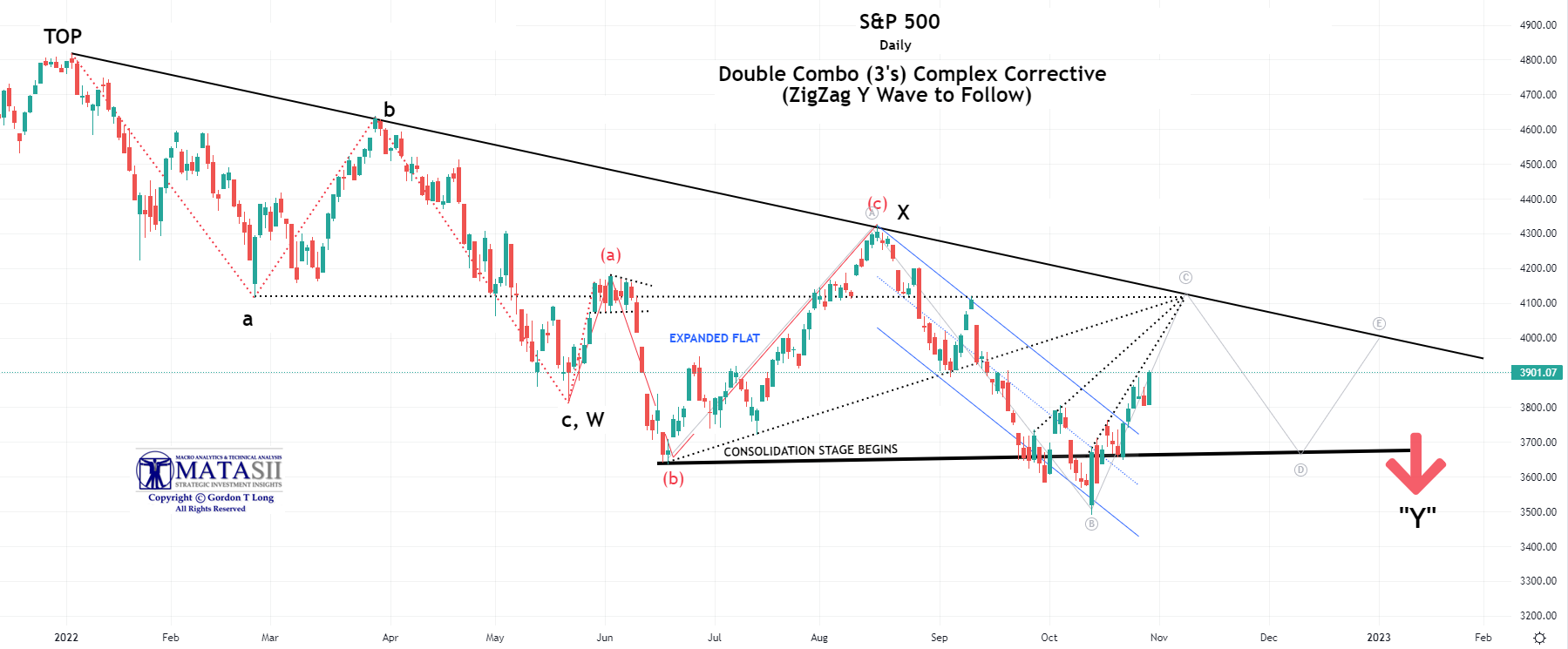

THE WORST IS STILL IN FRONT OF US,

EXPECT ANOTHER SHORT TERM BEAR MARKET COUNTER RALLY ,

FADE THE UNFOLDING COUNTER RALLY – SELL THE RIPS.

A PRE-MID-TERM ELECTION RALLY WAS FULLY EXPECTED

YOUR DESK TOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart: SUBSCRIBER LINK

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.