MACRO

US FISCAL POLICY

YELLEN’S FORCED DERIVATIVE & CONTINGENT LIABILITY CARD

US Treasury Secretary Janet Yellen’s primary role is the financing of the US Government. To do this she requires the US Money Centered banks as well as the G-SIBs (Globally Systemically Important Banks). Unfortunately, that support is rapidly eroding due to the liquidity realities facing these banks. As a consequence Yellen will soon be forced to resort to more unconventional financing approaches.

The expansion of a $2.2 Quadrillion derivative market, (most specifically the $600T OTC Swaps Market within it), over the last 40 years has served to conceal the true US inflationary effects of an economy consuming more than it produces by shifting the supply of dollar credit into financial markets, away from non-financial activities. This lessened the consequences of currency expansion on the prices of goods and services, allowing the monetary authorities to suppress interest rates without apparent ill effects.

That period has now ended, and an unwind of all the distortions accumulated over the last four decades has likely begun. No one in government nor central banking circles saw it coming, and frankly they are still in denial of the full magnitude of the problem!

=========

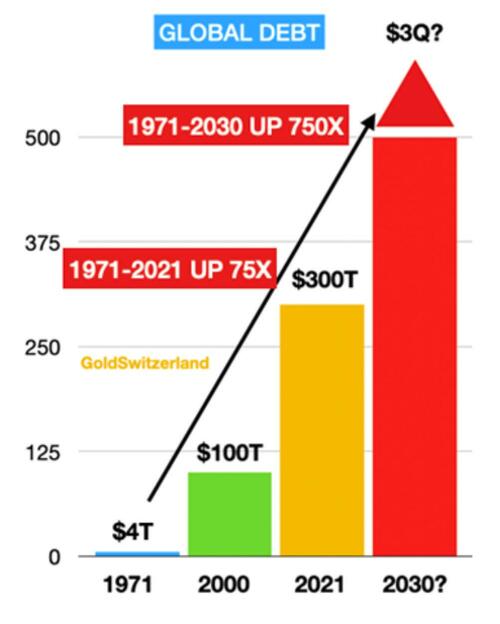

The era of pre-Bretton Woods price stability was replaced in August 1971 by the fiat dollar as the reserve currency, with demand for it engineered by Triffin’s dilemma. Effectively the Triffin Paradox fostered balancing of the export of dollars through budget and trade deficits with global demand for it. That era is now quickly coming to an end, due to rapidly rising interest rates and the credit market volatility it has fostered. The major fall-out of this has been the consequential global instability of an exploding rise in the US$.

WHAT YOU NEED TO KNOW

- YELLEN’S ROLE: FINANCING THE US GOVERNMENT

- The US Treasury is facing unprecedented challenges with the funding of the US Fiscal Debt, new deficit financing needs, Unfunded Liabilities now coming due and exposures to Contingent Liability guarantees within the Fiscal Gap.

- The traditional options available to Treasury Secretary Yellen are at risk as foreigners, central banks and G-SIBs are increasingly no longer drawn to US Treasury Notes and Bonds to the degree required to meet US obligations,

- The strength of the US Dollar has temporarily kept the US afloat but is causing escalating problems globally urgently requiring resolution similar to the 1985 Plaza Accord Agreement.

- SUSTAINABLE CREDITISM NOW A PROBLEM

- The US appears to have reached the point where it can no longer sustain credit growth at a sufficient rate to maintain economic growth (we addressed this is detail in this months video).

- Though foreigners are flooding into US Dollars, they are not choosing to hold those dollars in US Treasury Debt. This is a significant difference from “Flight-to-Safety” events that we have previously witnessed.

- Foreign Central Banks are noticeably increasing their reserve holdings with Gold.

- The Federal Reserve is walking a perceived knife’s edge by delaying a pivot away from QT in regards to the actual financing of US Debt obligations without US Treasury assistance (discussed in last newsletter)..

- Soaring US Twin Deficits (Current Account and Trade Account) and Fiscal Deficit will inevitably result in a fall in the US Dollar over the next 18 months..

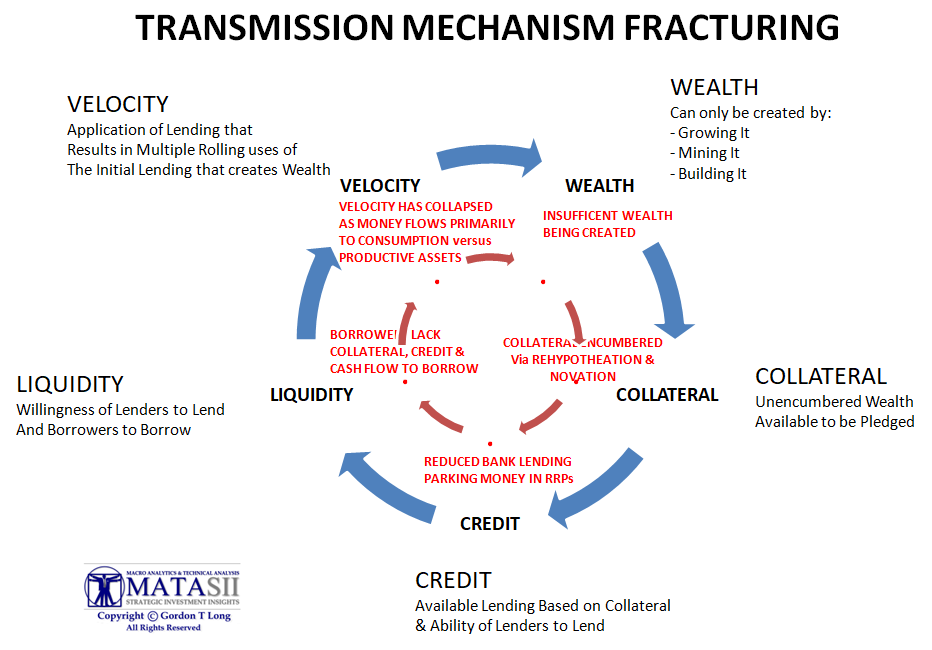

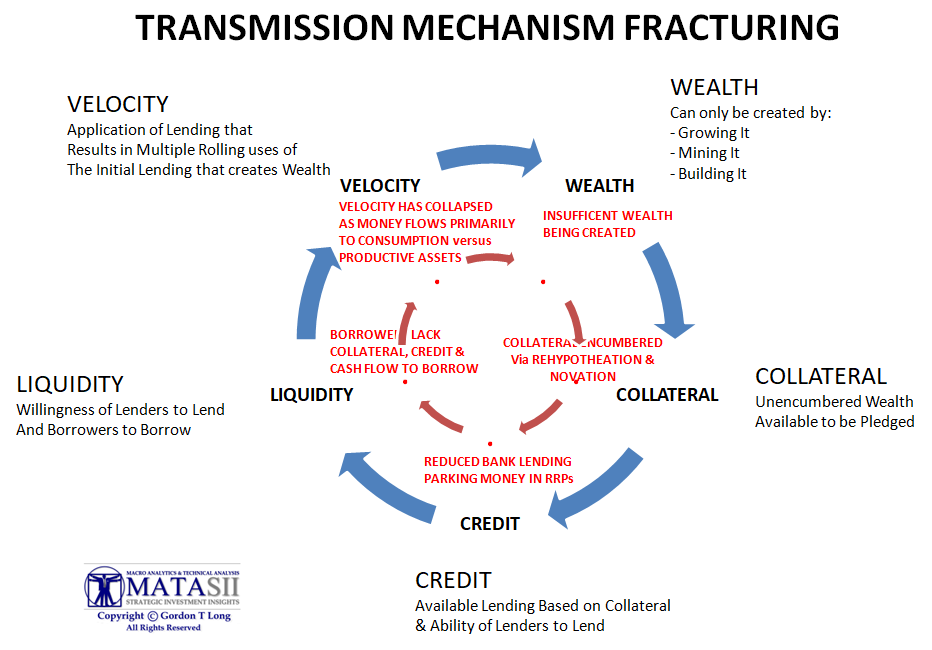

- WEALTH > COLLATERAL > CREDIT > LIQUIDITY > VELOCITY

Wealth is Capital is Collateral.

Wealth is Capital is Collateral.- Without Wealth there is no available Collateral. Without Collateral there is no Wealth creation.

- The Credit Transmission Mechanism Chain is weakening overall and broken In multiple places.

- Collateral Transformations, Rehypothecation and Novation have left the $2.2 Quadrillion Derivatives market exposed to a potential massive risk dislocation.

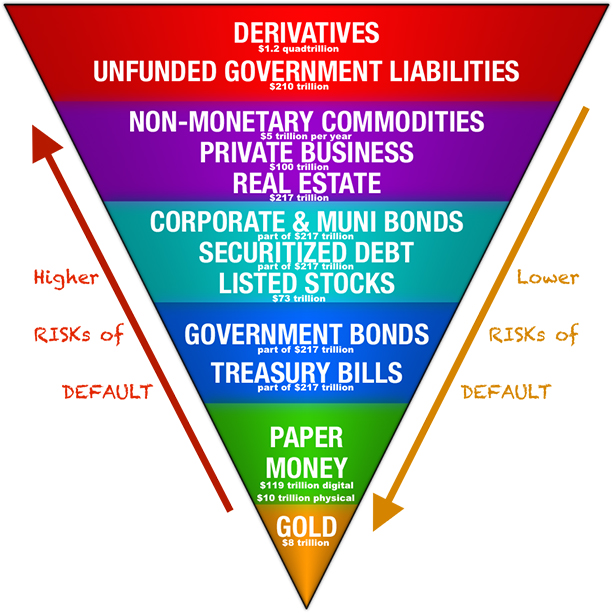

- EXTER CAPITAL PYRAMID

G-SIBs will likely soon withdraw from interest rate swap obligations. This will be very costly, if available at all, as the entire banking cohort attempts to depart from this market.

G-SIBs will likely soon withdraw from interest rate swap obligations. This will be very costly, if available at all, as the entire banking cohort attempts to depart from this market. - Undoubtedly, large losses will result, threatening the entire global banking network through enhanced systemic risk.

- A CREATIVE TRANSMISSION SOLUTION

- The Public Security Exchanges are now completely dominated and controlled by the hidden OTC operations of off-balance sheet derivative structures, vehicles and risk transfer mechanisms. This is not speculation but a fact!

- CONCLUSION

- When you distill it down, it appears that Yellen’s problems may be her only realistic solution. US Government Funding will need to operate more aggressively in the off-balance sheet world of derivatives. There is little doubt that this is already occurring, but Yellen will be forced to take it to another level.

-

- YELLEN’S LIKELY FOCUS REQUIRES:

-

-

- On-Balance Sheet Implementation of a US Treasury “Operation Twist” (see our last newsletter for details),

- Off-Balance Sheet Operations:

-

- The use of the PPT’s ~$84B of assets as well as pledging US Treasury collateral to fund massive interventions in the global derivatives market.

- Unprecedented increases in the use of swaps and contingent liabilities to stop cascading defaults (including those associated with the US Fiscal Gap guarantees) will be required.

The Initial “Fix” Is Presently Being Orchestrated … But Will It Be Sufficient?

Yellen and Powell’s Current Policy Strategies Will Only Delay the Inevitable Failure of Fiat Currencies and a Return to Sound Money.

=========

YELLEN’S ROLE: FINANCING THE US GOVERNMENT

The primary role of the US Treasury Secretary is the financing of the US government’s policy initiatives. This is a daunting task by anyone’s measure, but particularly under current economic situations. The question is how does Janet Yellen plan to finance the following:

1- Fiscal Debt: ~$30 Trillion

2- Off Balance Obligations

Unfunded Liabilities (Social Security, Medicare, Disabilities): ~$94 Trillion

Fiscal Gap (Contingent Liabilities & Guarantee Obligations): ~$212 Trillion

Serious Impediments Suddenly Facing US Treasury Funding:

-

- Foreign Buying of US Treasuries rapidly decaying,

- Global FX Reserves slowing globally,

- US Export dominance diminishing and thereby reducing need for US$’s

- Rapidly rising Interest Rates significantly increasing the cost of the existing Fiscal Debt and deficit spending,

- ~$94T of Unfunded Liabilities now coming due as outflows exceed revenues (held in US Treasuries which must now begin being sold),

- Contingent Liabilities are now at risk of coming due as a result of slowing global economic conditions.

THE US$ SPOKESPERSON

The US Treasury is the primary spokesperson for the US Dollar (while the Federal Reserve is the spokesperson for Interest Rates). Yellen therefore must also answer the question of what the US policy will be regarding the US Dollar currently crippling Emerging Markets, Eurodollar financing needs and global stability. The tentacles of the Triffin Paradox realities greatly complicate and restrict her abilities to solely focus on her US financing challenges.

A LOT OF FEAR REGARDING US TREASURIES

EXPLODING US CDS PRICING

SUSTAINABLE CREDITISM NOW A PROBLEM

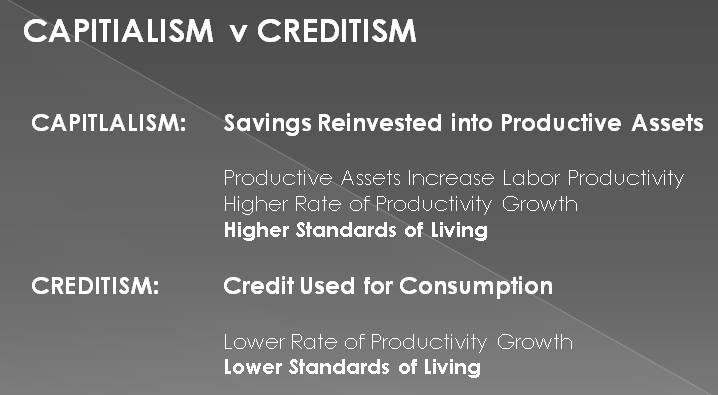

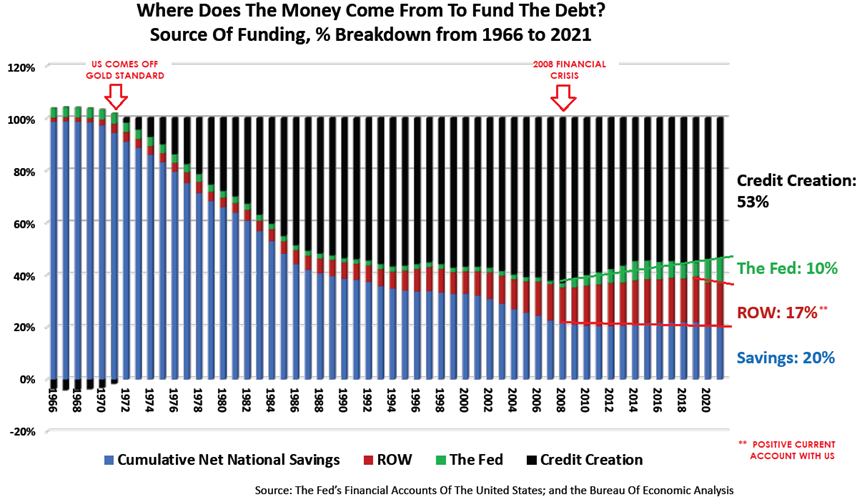

The problem Yellen and the US faces from a Macro perspective is that the US consumes more than it produces and has since the US was inevitably forced off the Gold Standard in the early 70’s. As the chart below illustrates, this coincided with a shift from the US financing itself from the fruits of Capitalism to what has come to be called Creditism. This has worked since during the last 40 year period interest rates have steadily fallen.

The problem Yellen and the US faces from a Macro perspective is that the US consumes more than it produces and has since the US was inevitably forced off the Gold Standard in the early 70’s. As the chart below illustrates, this coincided with a shift from the US financing itself from the fruits of Capitalism to what has come to be called Creditism. This has worked since during the last 40 year period interest rates have steadily fallen.

However, structural foundations began to change with the 2008 Financial Crisis when the US had to resort to new, never before used concepts like Quantitative Easing (Green bars below) to keep rates falling and offset weakening credit creation (Black bars below). Unfortunately since Covid-19 (Red Bars), the funding from the Rest of the World (ROW) has fallen off precipitously. The obvious question is how long can the Fed realistically not increase its balance sheet (maintain its current QT policy) yet still keep the US government funded?? Something has to give or a new approach must be brokered.

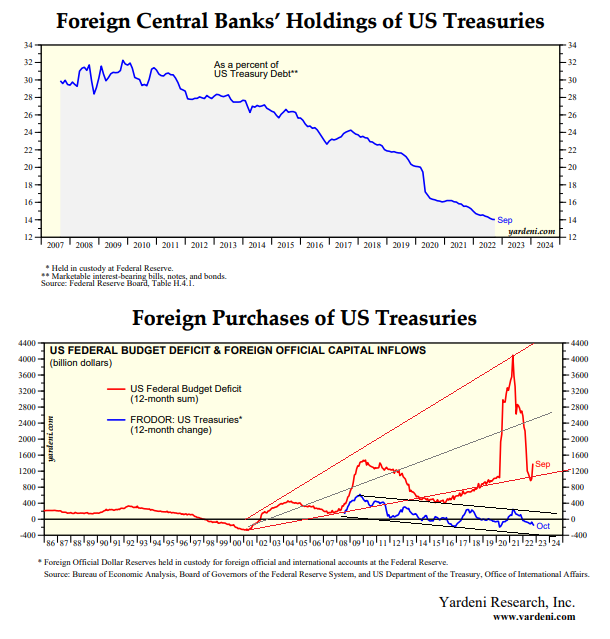

FOREIGNERS & CENTRAL BANKS NOT BUYING TREASURIES IN US$ FLIGHT-TO-SAFETY?

The charts below illustrate the points we made above that foreigners and their central banks have been reducing their rates of buying US Treasuries, resulting in a precipitous drop in their percentage holdings. In fact they have started becoming net sellers (the blue lines in 2nd graphic below), in parallel with the US Federal Budget Deficit exploding higher.

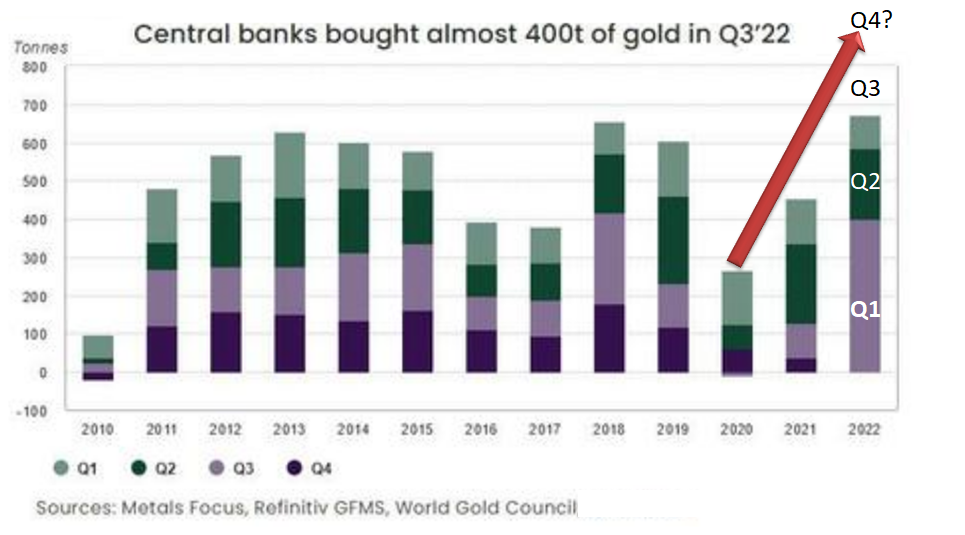

CENTRAL BANKS ARE INCREASINGLY BUYING GOLD

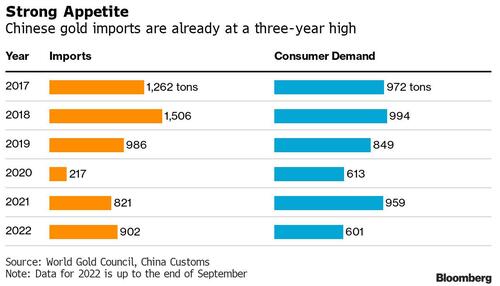

Where is the money starting to go? Well. increasingly into Gold!

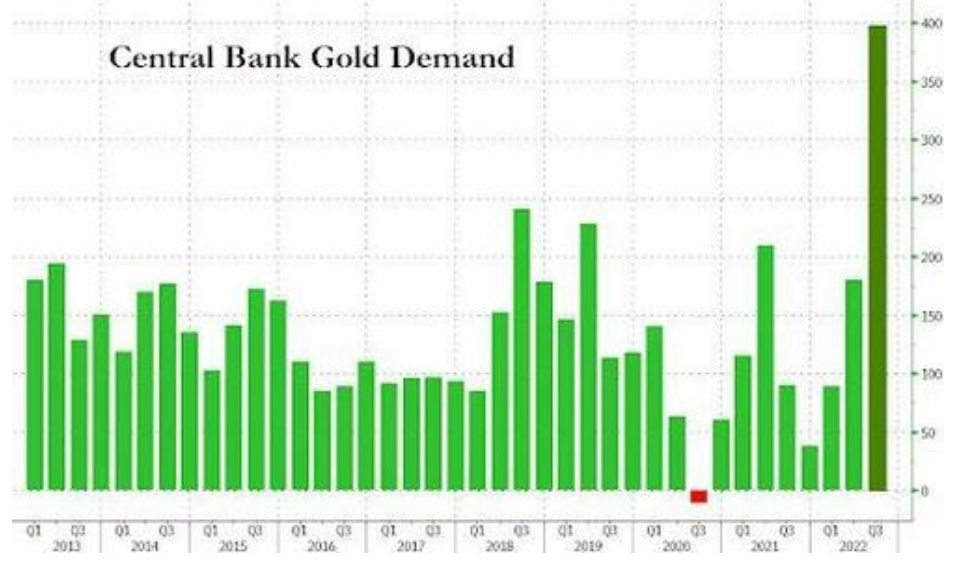

Central Banks globally have been accumulating gold reserves at a furious pace, last seen 55 years ago when the U.S. dollar was still backed by gold.

According to the World Gold Council (WGC), Central Banks bought a record 399 tons of gold worth around $20 billion in the third quarter of 2022, with global demand for the precious metal back to pre-pandemic levels. WGC says among the largest buyers were the Central Banks of Turkey, Uzbekistan, Qatar and India,

Other Central Banks also bought a substantial amount of gold, but did not publicly report their purchases (likely China, Russia, India or Saudis).

The world’s No. 2 economy rarely discloses how much gold its central bank is buying. In 2015, the People’s Bank of China revealed a nearly 600-ton jump in its bullion reserves, shocking market watchers after six years of silence.

The country hasn’t reported any change in its gold hoard since 2019, fueling speculation it may have been buying under the radar.

Central Banks bought 399 tons of bullion in the third quarter, almost double the previous record, according to the World Gold Council. Why??

Gold buying by Central Banks is already higher by Q3 2022 than any years in over the last decade!

WEALTH > COLLATERAL > CREDIT > LIQUIDITY > VELOCITY

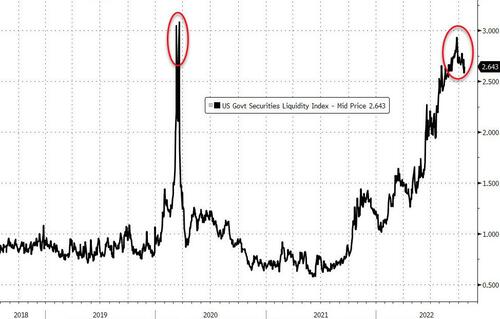

As dealers in credit, banks face the most difficult times in living memory. Austrian economists have long understood that the business cycle is driven by a cycle of bank credit. Commercial bankers are becoming acutely aware of the dangers to their business models.

At the moment, they have only a growing fear of the consequences of interest rates seemingly out of control. Having been protected from free markets by Central Banks and their regulators, this loss of statist control is immensely worrying for them. It is now dawning on commercial bankers that they have been left high and dry, with over-leveraged balance sheets, loan business rapidly souring, loan collateral falling in value and a derivative merry-go-round about to implode.

The major G-SIBs (Globally Systemically Important Banks) are beginning to realize that they must stop pandering to regulators and public opinion, and now protect their shareholders from a potential rapid unwind by dumping credit obligations as rapidly as possible ahead of the wider banking crowd. From banking deregulation in the mid-eighties, it took nearly four decades to get to this point. The unwind might take only as many months, since it is clearly evident that the credit transmission mechanism is now fractured!

THE US (& GLOBAL) CREDIT CYCLE IS IN THE PROCESS OF FRACTURING

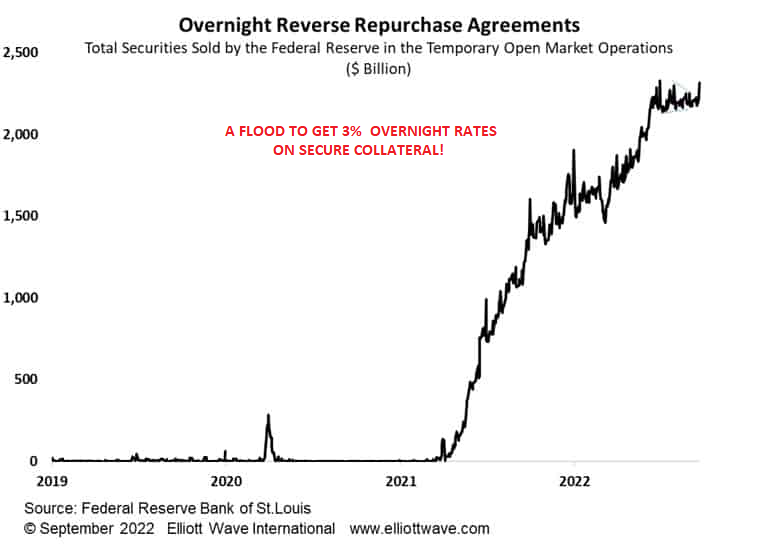

RRP RATES AND VOLUMES HAVE BOTH SKYROCKETED SINCE LAST YEAR!

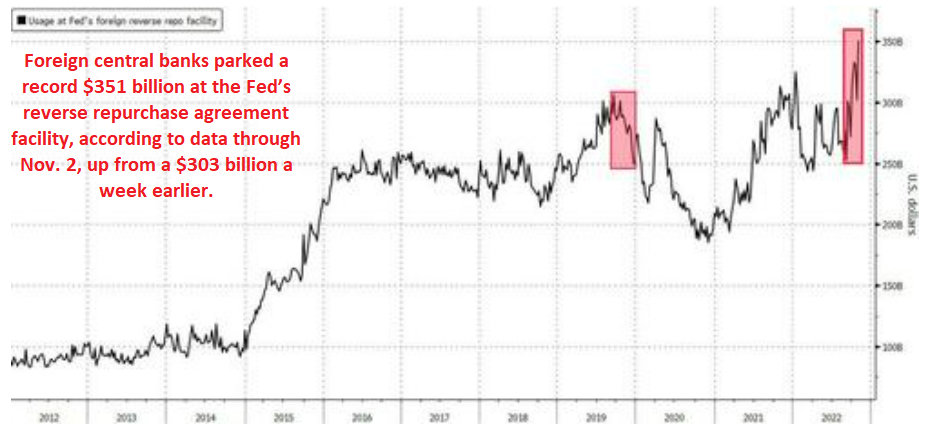

MORE & MORE OF THIS MONEY IS GOING TO FOREIGN BANKS??

The growth in US short term borrowing has increasingly been powered by the Fed’s Reverse Repurchase (RRP) facility. Cash is being parked at the Fed at 3.25%, backed by Treasury Collateral. Lenders can use the Collateral to leverage up lending while at the same time making excessive yield on their cash. What’s not to like? As a result, popularity and yield have both skyrocketed when risk free short term products with no counter party risk are hard to find.

The growth in US short term borrowing has increasingly been powered by the Fed’s Reverse Repurchase (RRP) facility. Cash is being parked at the Fed at 3.25%, backed by Treasury Collateral. Lenders can use the Collateral to leverage up lending while at the same time making excessive yield on their cash. What’s not to like? As a result, popularity and yield have both skyrocketed when risk free short term products with no counter party risk are hard to find.

Foreign central banks are now parking a record $351 billion at the Fed’s reverse repurchase agreement facility, according to data through Nov. 2, up from a $303 billion a week earlier.

A POLITICAL FED LAND MINE EXPOSED

The quiet ‘nodding’ between the Fed and Treasury is that the Fed is currently spending half a billion dollars every day to pay interest on reserves and reverse repos to countless banks (many of whom are foreign), leading to record losses for the Fed. This is an outrageous act in itself yet one which the broader public has no idea is taking place.

Something has to be done immediately to fix liquidity, capital, a market dislocation and Fed credibility!

The question we need to really ask ourselves is: What is the future for the $600 trillion derivatives mountain now that the long term trend in interest rates appears to have reversed. It was born out of the long-term decline in interest rates from the mid-eighties, which likely ended last year. It is almost entirely distributed through banks and shadow banks. It is centered on the default risk of the bank current holdings and how to protect its balance sheet. Derivatives today are a major element of all global bank operations.

Yellen knows this! Derivatives are both her problem and her solution!

EXTER CAPITAL PYRAMID

According to the Bank for International Settlements, OTC derivative market interests in the global banking system amounted to $600 trillion equivalent of notional amounts outstanding last December. Being based on only seventy dealers in twelve countries reporting to their respective central banks, the statistics are not the whole picture, capturing an estimated 94% on average of their wider triannual survey covering an additional thirty nations.

To this can be added a further $40 trillion in regulated futures and options markets, in which banks play a major counterparty role. To give an idea of the sheer scale of these activities, global GDP is estimated at roughly $100 trillion.

The credit nature of OTC derivatives is poorly understood, and therefore widely ignored by commentators.

Nevertheless, these are credit obligations which are only extinguished after the terms of the individual derivative contracts have been satisfied. But being purely financial, they differ from a contract which has on one side the delivery of goods or a service, and on the other a settlement invariably in bank credit. A financial transaction, be it a forward settlement, a swap, or an option exercise, involves both debt and credit obligations. Since debt is synonymous with credit, because one always balances the other in both parties’ books until a financial obligation is settled, there is twice the notional credit involved.

In round figure terms, all other OTC derivatives in the BIS statistics total about five times the recorded foreign exchange total. They include in the BIS’s notional amounts:

- Interest rate contracts — $475.2 TRILLION

- Equity-linked contracts —$7.28 TRILLION

- Commodity contract — $2.22 TRILLION

- Credit derivatives — $9.06 TRILLION

- Credit default swaps — $8.80 TRILLION

- Not otherwise classified — $337 TRILLION.

According to an expert far more knowledgeable about the risk than me:

Interest rate derivatives make up the vast bulk of all OTC derivatives, with the notional contract amount of interest rate swaps totaling $397.11 trillion, and forward rate agreements adding a further $39.44 trillion. A swap is a financial derivative in which two parties agree to exchange payment streams based on a specified notional amount for a specified period. And a forward rate agreement is a contract in which the rate to be paid or received on a specific obligation is for a set period of time, beginning at some time in the future.

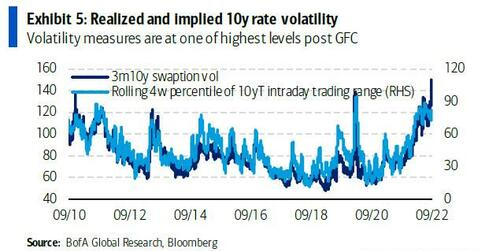

What concerns us here are the consequences of a rising trend of interest rates for the values of these contracts. FRAs might continue thrive if interest rate relationships along yield curves permit. But an environment of rising counterparty risk might be a hurdle too high for participating banks to overcome. A far more important consideration is the future for interest rate swaps.

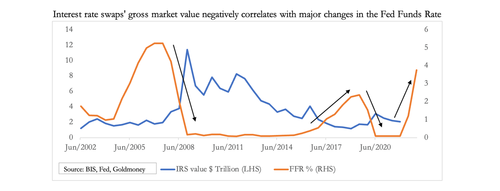

Interest rate swap notional amounts are not bank credit obligations. The credit commitments of both parties are only for the income streams on a notional amount. An originator, usually a bank, funds a fixed interest stream from a floating rate, rather than the other way round. A clue to the relationship between the gross market value of these contracts and interest rates is illustrated below, which is of interest rate swaps only originated in US dollars.

The chart confirms what we would expect: that major falls in the Fed funds rate stimulate the gross market value of interest rate swaps; and increases in the funds rate correspondingly leads to falls in their gross value. From this, we confirm that declining interest rates lead to profits for banks taking floating rates and offering fixed rates. This is the protection that customers from the gamut of pension funds to homeowners seek from higher rates. While over the long-term interest rates were declining, interest rate swaps were a profitable form of insurance product for the banks to offer. And we can now see that with sharply rising interest rates, not only will these profits vanish, but the banks are bound to exit this market entirely.

This is the heart of The Great Unwind. It will be a surprise to observers to see the BIS’s OTC derivative statistics collapse as interest rates rise further. Existing contracts with time to run can be closed down by buying out counterparties, entering offsetting swaps, selling the swap to another party, or entering an option on offsetting swaps.

Over the last 50 years since 1971, Governments and Central Banks have globally contributed to the creation of almost $300 trillion of new money plus quasi money in the form of unfunded liabilities and derivatives of $2.2 quadrillion.

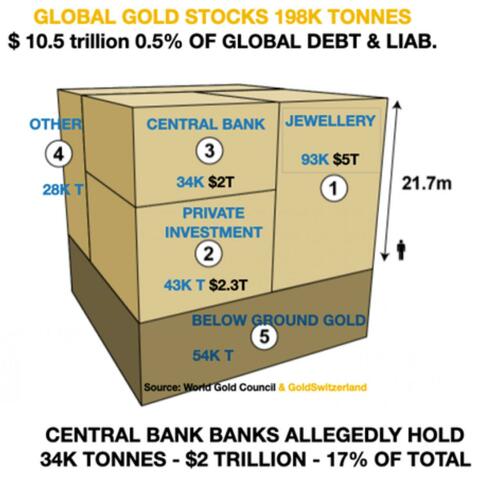

Total gold ever produced in the world is $10.5 trillion. Most of this gold is in jewelry. Central Banks around the world hold $2 trillion. That includes $425 billion that US allegedly hold. Many people doubt this figure.

So with over $2 quadrillion (2 and15 ZEROS) of debt and liabilities resting on a foundation of $2 trillion of government owned gold that makes a gold coverage of 0.1% or a leverage of 1000X!

GOLD AT THE BOTTOM OF THE PYRAMID

A sound financial system as illustrated in the Exter Pyramid requires a very solid foundation of real money.

Quadrillions of debt and liabilities can not survive resting on a feeble amount of gold. If gold went up 100X to say $160,000, the coverage would be 10%, which is still hardly acceptable. So the $2 quadrillion financial weapon of mass destruction is now on the way to totally destroy the system. This is a global house of cards that will collapse at some point in the not too distant future.

-

- As a subset of commodity derivatives, the London Bullion Markets’ forward contracts were estimated to be $781bn on 31 December 2021, of which gold forwards and swaps represented $528bn. At that date, this was the equivalent of 8,975 tonnes compared with 1,595 tonnes in the main gold contract on Comex — a ratio of 5.6 to one

- The other side of the LBMA banks’ derivative positions is unallocated customer accounts, originally devised and expanded as a means of diverting demand for gold that would have otherwise driven up the price of bullion. The trend towards increasing quantities of paper bullion relative to the physical is likely to be reversed, because suppression of the gold price is now leading to accelerating demand for physical bullion.

- While Keynesian hedge fund managers claim that higher interest rates are bad for the gold price, rising interest rates are bound to render derivative trading unprofitable for banks which find themselves both short of derivatives, and technically short to their unallocated bullion account holders. As quickly as the London bullion market developed in the 1980s, it is likely to diminish as interest rates increase.

Obviously Central Banks will first print unlimited amounts of money, buying up to $2 quadrillion of outstanding derivatives, turning them to on balance sheet debt. This will create a vicious circle of more debt, higher interest rates and higher inflation, with probable hyperinflation as debt markets default.

No government and no Central Bank can solve the problem that they have created. More of the same just won’t work.

So these are the gigantic risks that the world is now facing.

THE CREATIVE TRANSMISSION SOLUTION

I created this chart together to bring the point home that what is going on in visible public exchanges pales in comparison to what is going on under the cover of unregulated Over-The-Counter (OTC) derivatives markets. We are talking about a $2.4 Quadrillion stealth market effectively controlling the visible public accessible exchanges.

THE FRIGHTENING REALITY IS THAT PUBLIC EXCHANGE MARKETS HAVE BEEN BECOME SO “RIGGED” BY EXTENSIVE DERIVIATIVE MECHANISMS THAT THE COMPLEXITY LEAVES NO ONE ACTUALLY IN CONTROL!

CONCLUSION

YELLEN’S PROBLEM IS LIKELY HER SOLUTION

When you distill it down, it appears that Yellen’s problems may be her solution. She needs to more aggressively operate in the off balance sheet world of derivative. There is little doubt that is already occurring, but she is likely to be forced to take it to another level.

YELLEN’S LIKELY FOCUS REQUIRES:

- On-Balance Sheet Implementation of a US Treasury “Operation Twist” (see our last newsletter for details),

- Off-Balance Sheet Operations

-

- Use of $84B PPT assets and pledged US Treasury collateral to fund massive interventions in the global derivatives market.

- Massive increases in the use of swaps and contingent liabilities to stop cascading defaults (including those associated with the US Fiscal Gap guarantees).

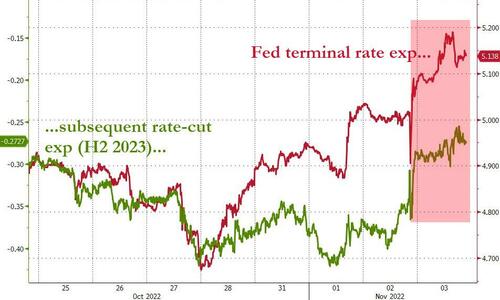

FED FUNDS RATE: Higher (Red) for Longer (Green)

FRA-OIS: Banks Don’t Trust Other Banks’ Collateral

A SOFT PIVOT UNDERWAY (BEFORE THE INEVITABLE HARD PIVOT)

Higher Fed Funds Rates for Longer (Chart Top Above)

What this means is BANKS SEE RISK WITH POTENTIAL BANK FAILURE(S) (Chart Bottom Right) because of lack of sufficient quality collateral.

CHART BELOW

The US and Chinese Credit Default Swaps seldom move to any degree, even though we often see moves in most major countries reflecting particular situations or turmoil. When we see it in both China and the US at the same time, it is a major red flag! We suspect something historic is on the horizon and now appearing on global macro traders’ radar!

US CREDIT DEFAULT SWAP PRICING

CHINESE CREDIT DEFAULT SWAP PRICING

THE WORST IS STILL IN FRONT OF US,

EXPECT ANOTHER SHORT TERM BEAR MARKET COUNTER RALLY ,

FADE THE UNFOLDING COUNTER RALLY – SELL THE RIPS.

THE MATASII.COM PARABOLIC MODEL OUTLOOK IS SIGNALING A POSSIBLE NEW INTERMEDIATE TERM MARKET HIGH

YOUR DESK TOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart: SUBSCRIBER LINK

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.