|

SECOND CONSEQUENCE:

(NOTE: First Consequence Newsletter: https://conta.cc/3EfSn0U )

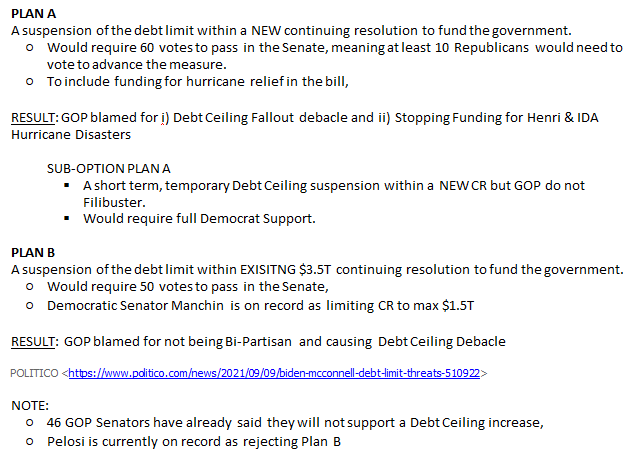

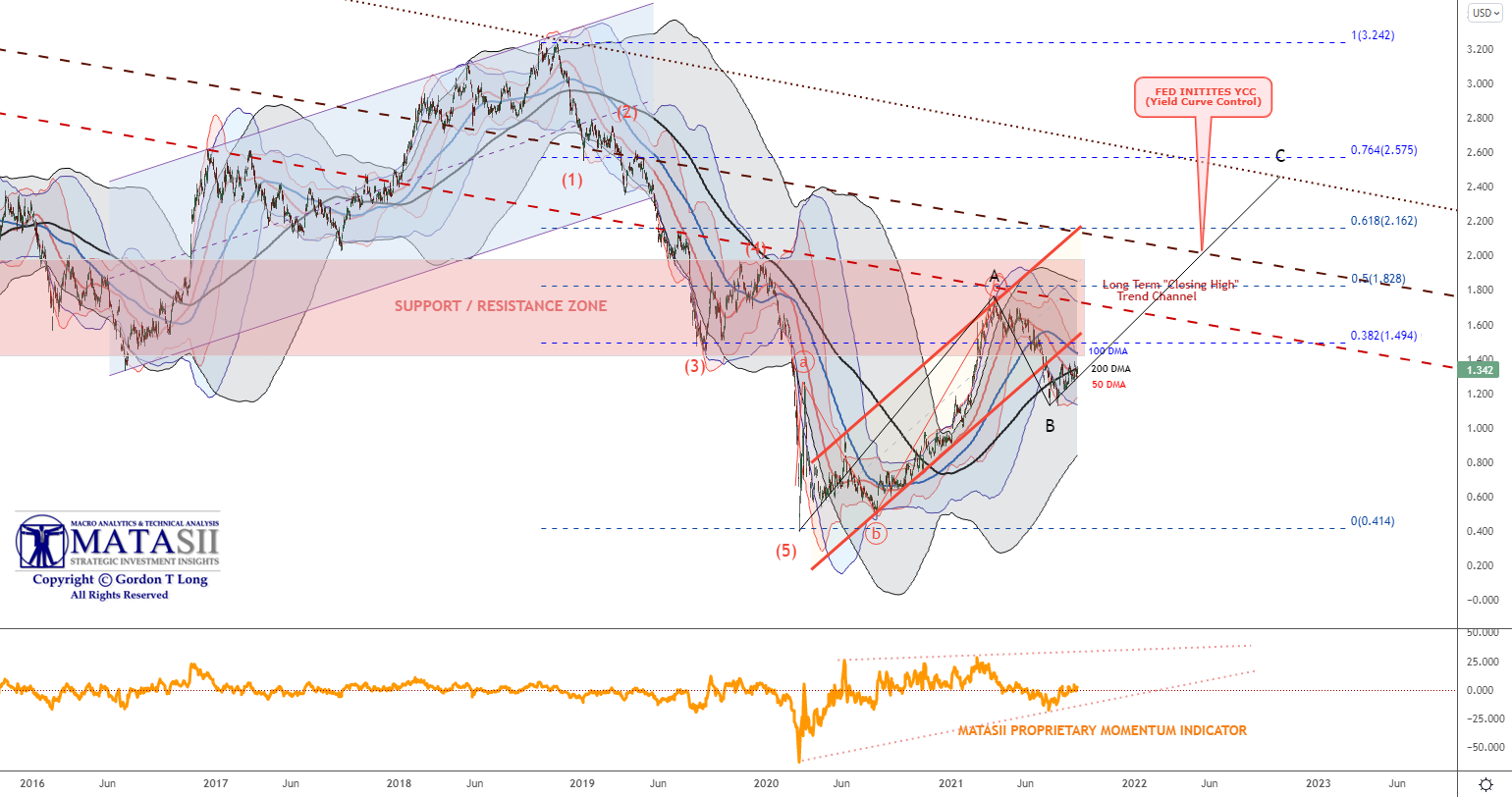

The US being politically consumed is about to unwittingly trigger the greatest Monetary/Fiscal policy blunder in US history. It is on the verge of stopping Monetary stimulus, (Taper now expected to begin in November), while exploding both taxation and bond supply higher. This is the face of the US and global economies ominously rolling over!

These policy blunders will result in a situation far worse than 70’s style Stagflation! It will potentially be called the Great Stagflation (or worse)!

A POLICY DISASTER WAITING TO HAPPEN!

A $3 TRILLION TAX HIKE IN A SLOWING, END OF CYCLE ECONOMY??

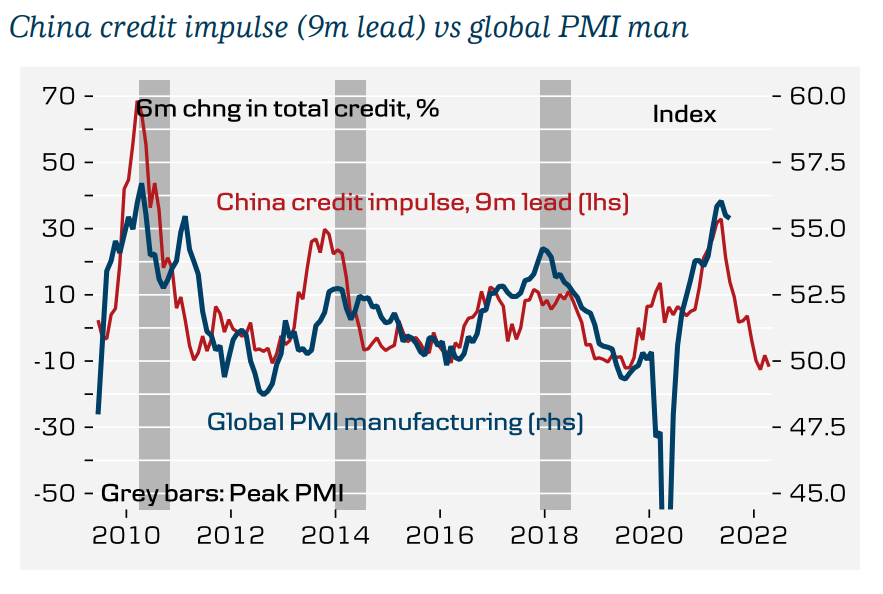

In the September UnderTheLens video we featured 10 Global PMI slides against many of the world’s leading indicators. The video slides made it quite evident that the Global economy is slowing significantly.

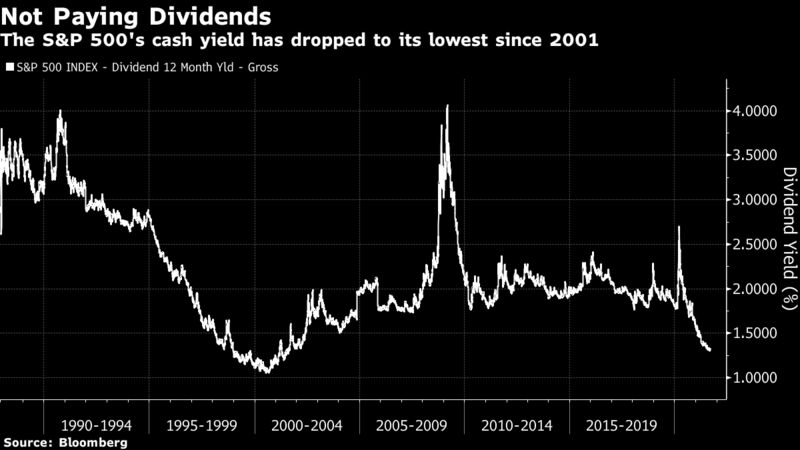

PEAK PROFITS BEFORE MASSIVE TAX INCREASES??

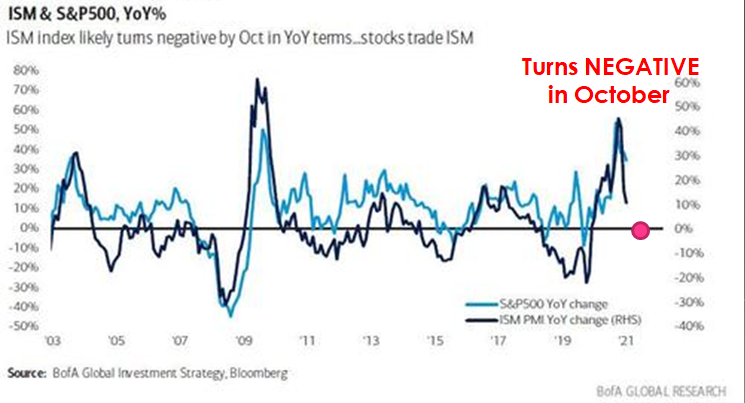

The BofA Global EPS model says global EPS peak was ~40% in April (model is driven by China FCI, Asia exports, global PMI and the US yield curve). Global EPS is now projected to decelerate very sharply to ~9% by November.

We expect this to be driven by a combination of:

-

- Inflation,

- Supply bottlenecks,

- Unwillingness of companies to increase inventories given Delta,

- Peak US consumption,

- China economic weakness,

- Fiscal cliffs and Geopolitical risks.

Since the 2008 Financial Crisis, the Chinese Credit Impulse has been one of the most important indicators to follow. Chinese Credit was directly responsible for taking the global economy out of the fallout from the US Financial Crisis. It is now clearly signalling where we can expect the US economy to be headed (Chart to the right)

… while we now are about to implement a $3 Trillion tax hike??

|

Global corporate debt as a percentage of GDP has exploded since the 2020 Covid market sell-off.

Global corporate debt as a percentage of GDP has exploded since the 2020 Covid market sell-off.