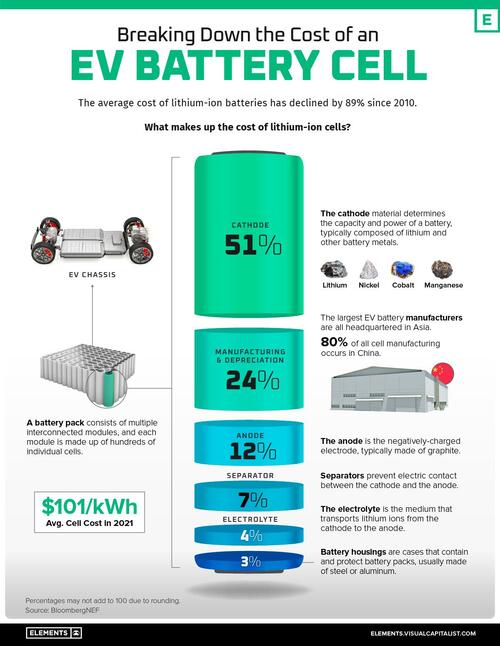

WHY ARE CATHODES SO EXPENSIVE?

The cathode is the positively charged electrode of the battery. When a battery is discharged, both electrons and positively-charged molecules (the eponymous lithium ions) flow from the anode to the cathode, which stores both until the battery is charged again.

That means that cathodes effectively determine the performance, range, and thermal safety of a battery, and therefore of an EV itself, making them one of the most important components.

They are composed of various metals (in refined forms) depending on cell chemistry, typically including lithium and nickel. Common cathode compositions in modern use include:

-

- Lithium iron phosphate (LFP)

- Lithium nickel manganese cobalt (NMC)

- Lithium nickel cobalt aluminum oxide (NCA)

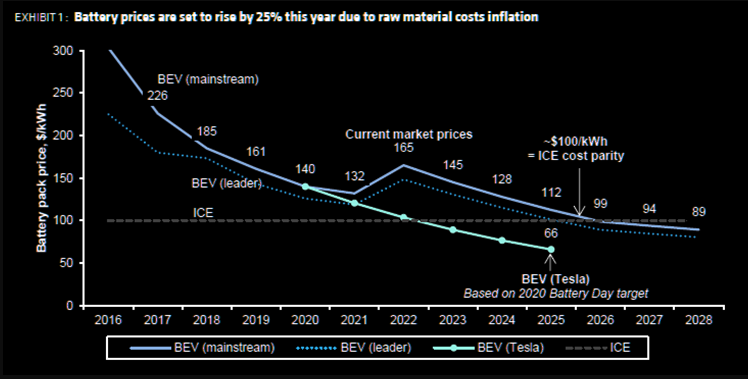

The battery metals that make up the cathode are in high demand, with automakers like

Tesla rushing to secure supplies as EV sales charge ahead. In fact, the commodities in the cathode, along with those in other parts of the cell, account for roughly 40% of the overall cell cost.

OTHER EV BATTERY CELL COMPONENTS

Components outside of the cathode make up the other 49% of a cell’s cost.

The manufacturing process, which involves producing the electrodes, assembling the different components and finishing the cell, makes up 24% of the total cost.

The anode is another significant component of the battery, and it makes up 12% of the total cost—around one-fourth of the cathode’s share. The anode in a Li-ion cell is typically made of natural or synthetic graphite, which tends to be less expensive than other battery commodities.

EV IS NOT THE FUTURE DUE TO SUPPLY REALITIES

GREEN HYDROGEN IS THE FUTURE

SOLAR PANELS AND WIND IS NOT THE FUTURE DUE TO STORAGE & CAPACITY LIMITATIONS

NEW NUCLEAR TECHNOLOGY IS THE FUTURE

(For more on the above statements see the 2022 Thesis Paper: “SUSTAINABILITY: For Whom?”)

The current Green Energy movement is flawed for the most basic and practical reasons. However, that is not the concern of those currently driving the Zero Carbon and eradication of Fossil Fuels narrative. Their goal is a shifting of power and a New World Order.

In parallel with Biden’s “Incredible Transition” comments the Global Elite, who are the drivers of the “Incredible Transition” or “Great Reset”, met in Davos for the first time since Covid-19. Their focus has expanded from Green Energy to a Global Food Famine in advancing their Globalist Agenda.

HERE ARE SOME HIGHLIGHTS: