GLOBAL MACRO

MONETARY POLICY

BIG WEEK FOR CENTRAL BANKS

OBSERVATIONS: PONZI & MADOFF WERE ONLY NIBBLING AT THE REALLY BIG GAME TO PLAY!

Through the hidden tax of inflation, your income and savings are silently being confiscated by Washington, D.C. That is because the Federal Reserve creates money for the government to spend, that siphons off some of the value of all the dollars already in existence and transfers the purchasing power to the newly created money, now in the hands of bureaucrats. The lost purchasing power is a real tax, and it has cost the public about 18% of all their savings and incomes in just the last three years.

IT IS ALL QUITE SIMPLE:

-

- He who spends it first gets the full value (government spending of taxes and debt borrowing) . He who receives it later as it flows through the economy (you) get less as inflation erodes its purchasing power. Think of it as the “float” which banks siphon out of the time value of money flows.

- The government by never paying off the Debt the debt it borrowed is effectively operating a Ponzi scheme where new money pays for the debt that is long gone and is effectively “indistinguishable”.

- The hope for the operators of the scheme (government) is that the US debt will be eroded by Inflation (lenders lose from inflation since borrowers pay the money back in inflated dollars). However, the government receives future taxes in higher nominal terms.

- Like a Ponzi scheme it works until the lenders demand their money back (sell their US Treasuries). That is already beginning with major buyers (China) now reducing their US Treasury holdings and “De-Dollarization” (BRICS).

Like a Ponzi scheme, when #4 above occurs the solution is to find new buyers or in the case of governments print the money (Treasury issues more debt and the Fed buys it from the money center banks as QE).

All of this is why those wondering why they can’t afford to buy a home, need to look no further than today’s record-high home prices and a mortgage interest rate that is 2 1/2 times higher than it was three years ago. Both consequences stem from the government spending too much money, and they’ve combined to increase the cost of homeownership by almost 80%.

The cost to service the federal debt already consumes 40% of all personal income taxes, the largest source of revenue for the government.

It’s sobering to look at your pay stub and realize that 40 cents of every dollar you lose in federal income taxes is now needed just to pay interest.

The Ponzi scheme will go on until the growth in the Fed’s Balance sheet makes the US Dollar’s purchasing power so low that few will be willing to hold assets denominated in it. That level of Balance sheet holding may be smaller than many yet appreciate!

WHAT YOU NEED TO KNOW!

INFLATION BREAKEVENS HAVE BEGUN TO SOAR

The US is now running a 6.5% deficit with:

The US is now running a 6.5% deficit with:

-

- UNEMPLOYMENT: Near “historical lows” – a previously unheard of event.

- GDP: Having increased by 2.5% and no where near contraction,

- GOVERNMENT SPENDING: Calling for an increase to $7.2T in the 2025 proposed budget.

- INFLATION: Being fought by the Fed with the Fed Funds Rate at 5.25-5.50%

- FINANCIAL CONDITIONS :Being at ‘easing’ near levels seen before the Fed began raising rates.

We have a War Time Spending plan in Peace Time. Is it any wonder that Inflation Breakevens are rising while the Fed “claims” to be fighting inflation?

RESEARCH

WHAT WE CAN LEARN FROM PRIOR HISTORICAL MARKET SURGES

-

- The ongoing “Irrational Exuberance” of the equity markets makes it worth further examining past instances of significant similar market rallies, such as those of 1928, 1987, and 1999.

- While recent market gains may be encouraging, it is crucial to remain cautious and consider the broader economic indicators.

- The strength of the job market brings a sense of confidence, but warning signs from declining leading indicators warrant attention.

BIG WEEK FOR CENTRAL BANKS

-

- Markets reading of central bank meeting is they are settling on June as the month for central bank cuts.

- BOE: As expected, the MPC once again opted to stand pat on rates at 5.25%.

- The ECB seems to be in the most comfortable position – inflation is gradually falling and growth remains in stagnation territory. Markets are pricing in an 87% probability for a cut in June and around 90bp of cuts for the year.

DEVELOPMENTS TO WATCH

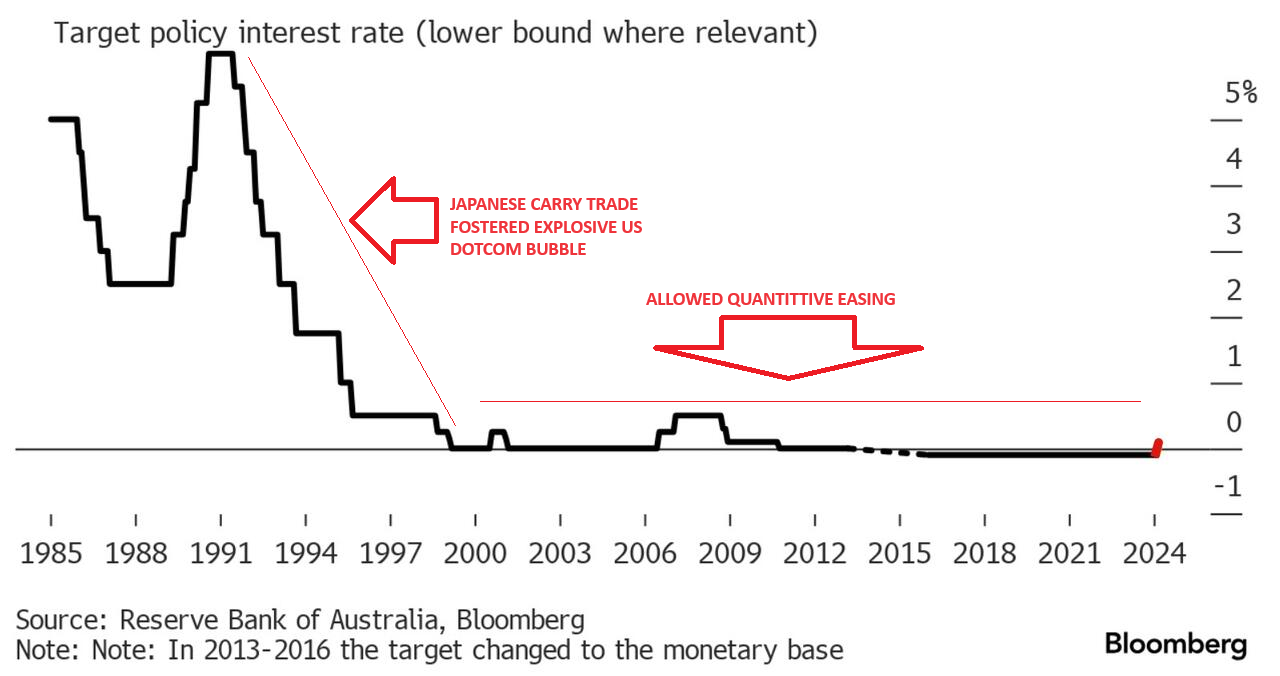

BOJ – MAJOR MONETARY POLICY CHANGE:

BOJ – MAJOR MONETARY POLICY CHANGE:

- BoJ changed its monetary policy framework in which it ended negative interest rate policy and abandoned YCC, while it will guide the overnight call rate in the range of 0%-0.1% and apply 0.1% interest to all excess reserves parked at the central bank.

- BoJ also announced to end ETF and J-REIT purchases, as well as gradually reduce the amount of purchases of commercial paper and corporate bonds whereby it will discontinue purchases of CP and corporate bonds in about one year.

FOMC – MARCH 2024

- FOMC held rates at 5.25-5.50%, as expected, while the statement was little changed in which it noted that job gains have remained strong (prev. said job gains have moderated since early last year but remain strong).

- Repeated that recent indicators suggest that economic activity has been expanding at a solid pace.

- FOMC maintained the current pace of the balance sheet drawdown and it still sees three cuts this year but the 2025 projection was increased to 3.75-4.00% (prev. 3.50-3.75%) and 2026 was increased to 3.00-3.25% (prev. 2.75-3.00%), while the Neutral Rate estimate was raised to 2.6% (prev. 2.5%).

GLOBAL ECONOMIC REPORTING

CONTINUOUS JOBLESS CLAIMS

CONTINUOUS JOBLESS CLAIMS

- Continuing Claims saw another downward revision for last week. That is the 20th straight weekly downward revision of continuing claims.

- Jobless claims continue to blow it out of the ballpark… until you realize that it’s the most “credible” of states that are behind the blowout numbers: last week, NY, this week CA

- If you doubt the accuracy of the Biden admin’s data, here’s what the most recent FOMC Minutes said:

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.