TIPPING POINTS

FLOWS & LIQUIDITY

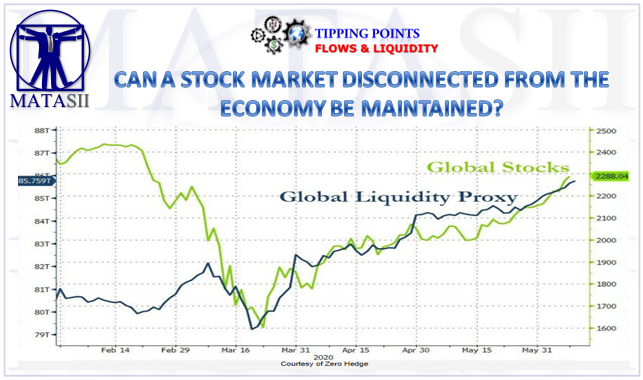

CAN A STOCK MARKET DISCONNECTED FROM THE ECONOMY BE MAINTAINED?

- FREE MARKETS can not disconnect from markets on a permanent basis. They can on a short term basis normally referred to as a “Bubble”.

- CONTROLLED (‘Nationalized’) MARKETS can disconnect from the economy on a permanent basis. They in fact are no longer freely trading markets but rather pre-determined and price controlled trading of financial instruments.

-

-

MARKETS ARE DISCONNECTED FROM THE ECONOMY

- Markets closed last week at a red flag screaming 151% market cap to GDP for the S&P 500 while the Whileshire 5000 was at 163%. There is no history, none, that shows valuations above 150% market cap to GDP are sustainable. None.

- Small Business has been crushed and a recent report from Azio, a major small business bank survey indicated that 47% of the small business owners surveyed said they anticipate shutting down, and 41% said they are looking for full-time work elsewhere.

- Forecasts are roughly $142 for the S&P 500 at the moment for 2020. Even if profits jump to just north of $160 which would be near 2019 profits, we have forward P/E multiples now already well 20x – valuations leaves little to chance of being even close to historically reasonable.

- ll this assumes corporate tax rates do not move higher – something that would happen should Biden defeat Trump and the Dems sweep Congress.

- Then there is the expectations of Covid-19 containment plus vaccines that are ready to go and inoculate tens of millions of people rapidly; which seems difficult given how poorly testing has gone.

- An engineered “V” Shaped recovery in stocks does not mean a “V” shaped recovery in the Economy. Demand destruction is enormous. The CBO Estimates it will Take 10 Years Just to Get Back to Even

- BofA’s latest Fund Manager Survey, which polled 223 participants with $651 billion in AUM, showed the vast majority of financial professionals remain incredibly bearish on the global economy. Respondents do not expect global manufacturing PMI to rise back above the contraction level of 50 until 4Q20.

-

The supply-side story in Asia has yet to be revived because the demand story in Europe and North America is offline. Without Western demand, reviving Asian factories will not be possible; thus, world trade won’t rebound. It could take several years or more for global GDP to recover back to even 2019 levels.

- The gap between current prices and discounted present value of likely future cash flows is the highest ever.

MARKETS HAVE ‘RECONNECTED’ TO THE GLOBAL LIQUIDITY PROXYSINCE THE MID MARCH 2020 LOWS THE GLOBAL LIQUIDITY PROXY HAS RECONNECTED WITH GLOBAL STOCKS

-

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.