TIPPING POINTS

FLOWS & LIQUIDITY

-

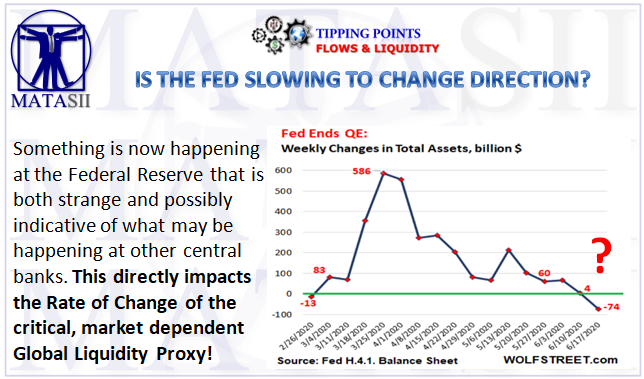

PLUNGE IN REPO BALANCES: Repo balances dropped by $74 billion. The Fed is still offering theoretically huge amounts of repos every day, but it has tweaked the offering terms, so that there is now almost no appetite for them, and what’s left on the balance sheet are older term repos that unwind and are gone. On today’s balance sheet, the repo balances dropped by $88 billion from the prior week to $79 billion, the lowest since September 18.

-

PLUNGE IN LIQUIDITY SWAPS: Central bank liquidity-swap balances dropped by $92 billion.The Fed’s “dollar liquidity swap lines” with other central banks had been roughly flat for seven weeks, after the $400 billion surge in early April. But this week some swaps matured and were unwound, and the balance dropped by $92 billion to $352 billion. Of that drop, $75 billion came from the swap line with the ECB, $9 billion from the Bank of Japan, and $7 billion from the Bank of England (country data via the New York Fed)

-

JUNK BOND & ETF BUYING STALLS: Fed doesn’t wanna buy junk bonds and ETFs anymore. This is where much of the media hype has focused on, following the endless announcements by the Fed. The Fed says that these bailout schemes are authorized under Section 13 paragraph 3 of the Federal Reserve Act, as amended by the Dodd-Frank Act. And Powell calls these creatures “thirteen-three facilities.”

-

TREASURY BALANCES RISE BY ONLY $26B: The Fed added $26 billion of Treasury securities during the week, bringing the total to $4.17 trillion. Over the past four weeks, the balance increased in a range between $9 billion in $26 billion, about the same range before the outbreak of bailout mania.

-

MBS BALANCES RISE BY$83B: The Fed has cut its purchases of government-backed mortgage-backed securities (“Agency MBS”) after the initial burst. But its MBS trades take one to three months to settle, and the Fed books them after they settle, which creates an erratic pattern. So what we’re seeing today are settled trades from some time ago. The balance of MBS rose by $83 billion to $1.92 trillion. This includes Agency Commercial Mortgage Backed Securities that the Fed started buying as part of its bailout program. But the balance of these CMBS has remained flat over the past three weeks at $9.1 billion.

-

FUNDING TO STATES, MUNICIPALITIES & BUSINESSES: The Fed has started lending to entities, including states and banks, under programs that channel funds into spending by states, municipalities, and businesses, rather than into the financial markets. These types of programs are propping up consumption – not asset prices. That’s a new thing.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.