|

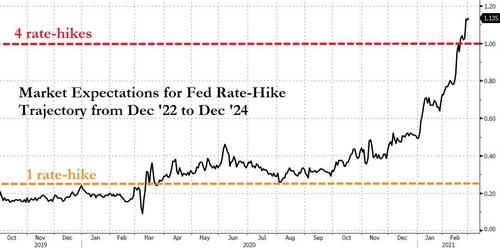

FUTURE RATE HIKES BEING PRICED IN

FED RATE HIKES

February saw a massive shift in the market’s perception of The Fed’s rate-hike trajectory. It is now pricing in more than 4 rate-hikes between 2022 and 2024

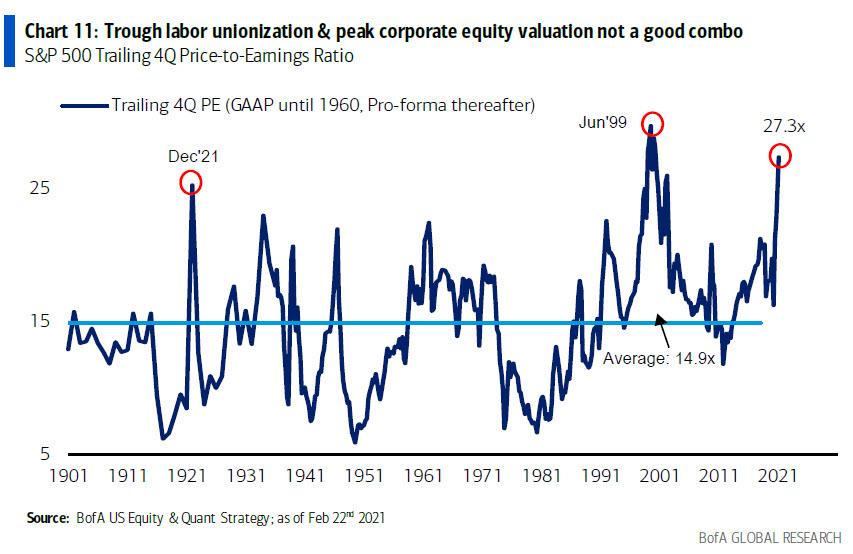

A TROUGH IN LABOR UNIONIZATION?

Watch the March 30th Alabama vote on unionization at Amazon. This maybe a straw that will break the camel’s back. A trough in labor unionization & peak corporate equity valuations is not a good combo.

As the post WWI “baby boomer” generation retires at over 10,000 per day in the US, the working age population in the West plus China will decline, which which many expect will soon help labor reclaim lost power (inflationary). Though others suggest robotic / AI technology will offset this, it will come at the expense of

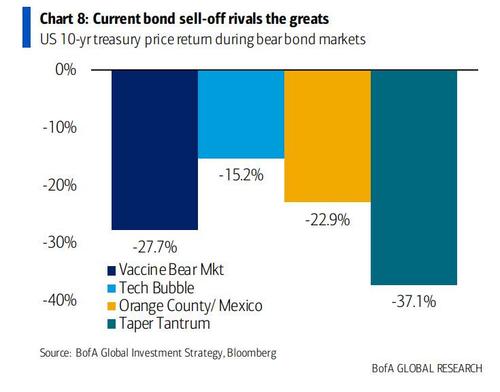

REFLATIONARY INFLATION POLICIES

Ultimately though, inflation will likely depend on how aggressive monetary and fiscal policy are and whether they work together consistently. In the post-GFC decade, they worked in opposite directions, but the early signs post-Covid are that they are moving more in the same direction. Reflationary Monetary Policy with inflation overshoots acknowledged and massive fiscal spending to support a decaying social entitlement structure and old school Keynesian stimulus spending.

A fiat currency system is currently believed to allow such an experiment if the new administration proves to go down that route. All eyes will be on the US stimulus package(s) and the FED over the coming months and quarters.

|

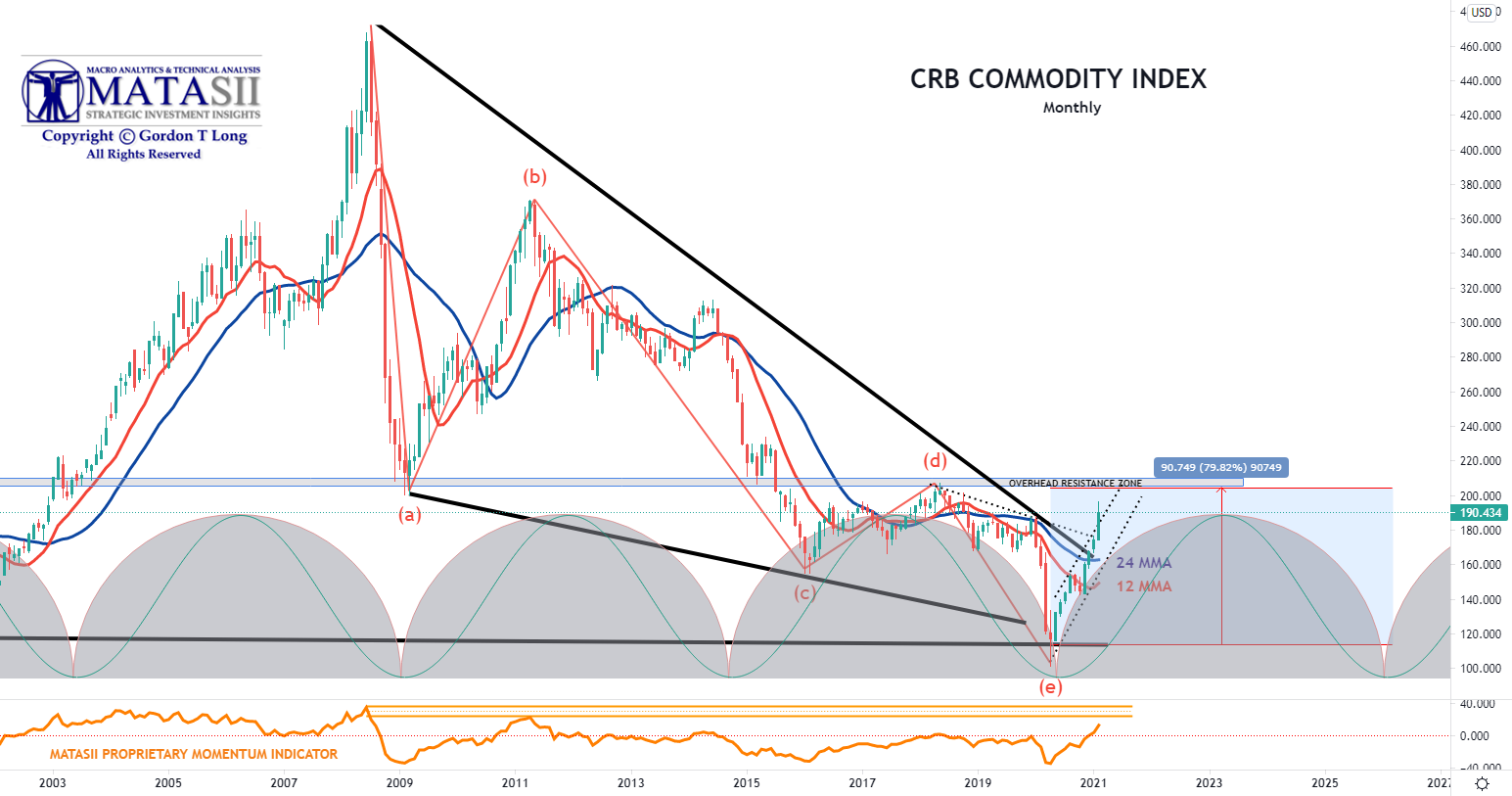

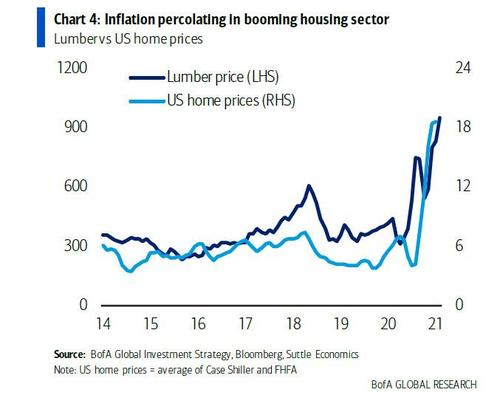

SUPPLY CHAIN PROBLEMS ARE DRIVING UP COMMODITY PRICES

SUPPLY CHAIN PROBLEMS ARE DRIVING UP COMMODITY PRICES