CREDIT LEADS, MARKETS FOLLOW!

There is nothing more certain, other than “Death and Taxes”, than the fact that Credit Leads and Markets follow! I have witnessed this truism since the 1987 ‘Black Monday’ market crash and long ago made me a rigorous follower of developments in the Credit Markets.

MARKETS HAVE YET TO FEEL THE PAIN OF CREDIT

The Credit Markets are now in serious turmoil and recent equity market weakness is presently only a telltale of what is going on. Let me give you a heads up before you possibly get blind sided.

MARKETS ARE STILL IN “LALA LAND”!

All the pain individual stocks have felt so far – even before The Fed actually begins to tighten policy – is a “nothingburger” compared to the record levels of excessive valuation that still remains in the market. This is clearly evident in valuation measures such as the US Stock Market Cap to US GDP. This is often called the Buffet Indicator and is shown to the right.

THESE ARE MORE THAN JUST CREDIT “CRACKS” THAT ARE APPEARING

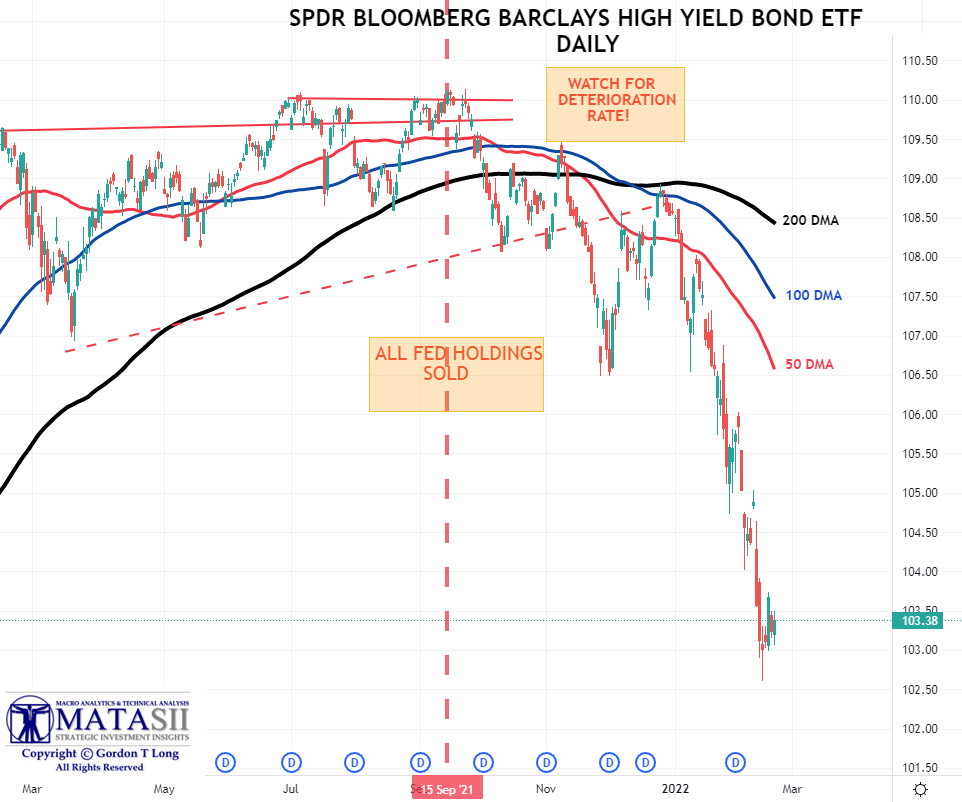

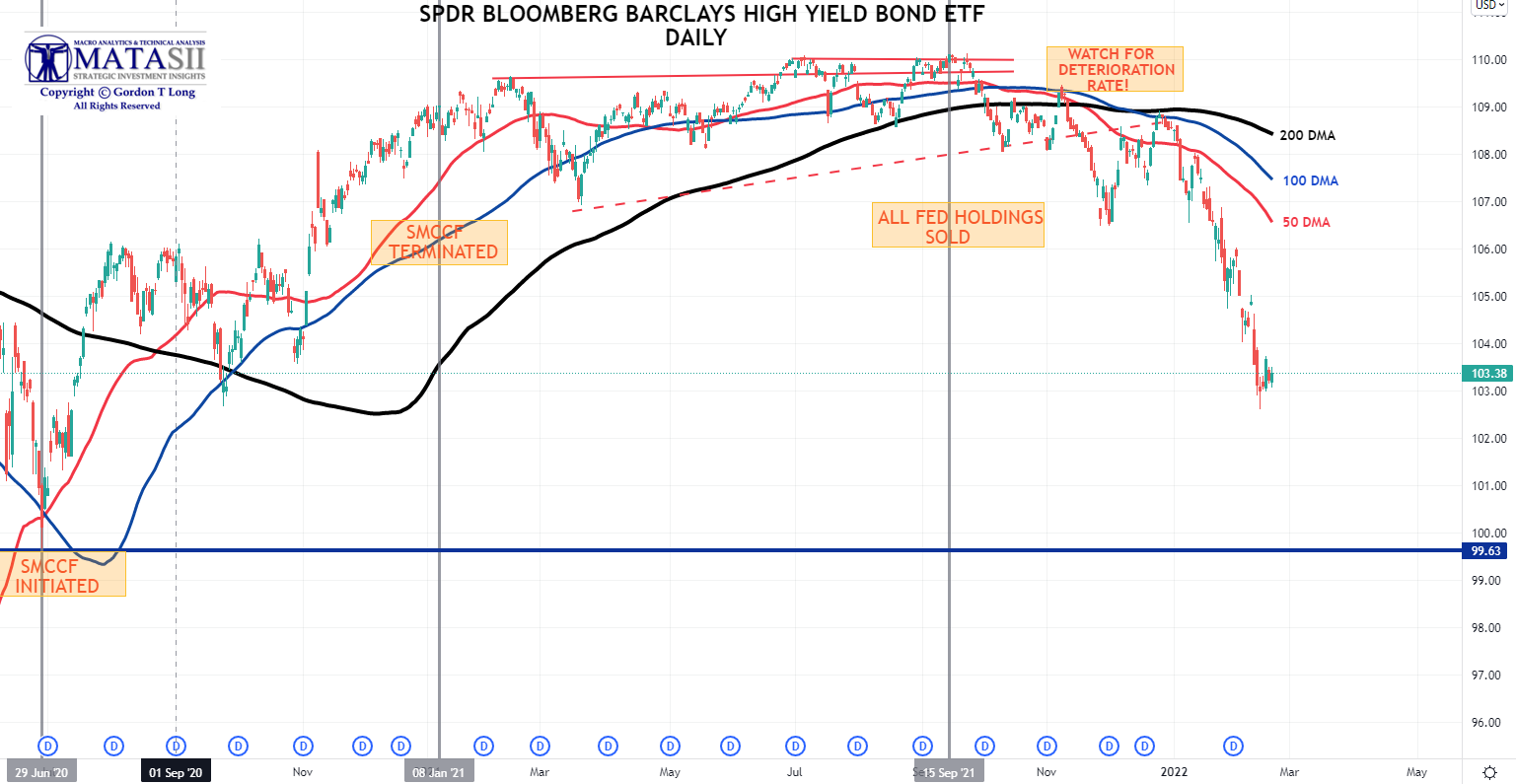

We have warned subscribers more than a few times when High Yield Credit was still at the top of the chart (Symbol: JNK) shown below. You seldom see such a drop without serious damage rapidly spilling over into the equity markets!

|

|

What few remember is that the Federal Reserve jumped into buying Corporate debt for the first time in history during the initial stages of the Covid Pandemic sell-off in the markets. As the chart to the left illustrates, Federal Reserve buying pushed prices to questionable levels. The Fed began selling those holdings in January and completed the sale of its entire inventory in September. Soon after that, prices began to fall and still have not reached the point where the Federal Reserve initiated its first purchases.

There was a strong reason that the Fed felt compelled to buy Corporate Debt. That is because a high number of them are Zombie Corporations. That is their earnings don’t cover the interest on their debt and must borrow to stay solvent. Even “Investment Grade” Corporate Bonds are dominated by “CCC” rated players. This is the lowest credit level allowed for Institutions to buy where their covenants specify “IG” holdings only. Any problems in Credit had to be quickly addressed in 2020 by the Fed. Now the Fed is near the complete stoppage of QE bond buying (i.e. Taper), signaling a rapid rise in rates to combat out of control inflation and tightening of credit. This is certainly a scary scenario.

|

|

|

INSTITUTIONAL PLAYERS EXITING

As you would expect we are witnessing the initial wave of Corporate Bond Investors hurriedly heading for the exits! Significant fund outflows and spreads above the five-year average are a dire early warning sign of stress.

|

|

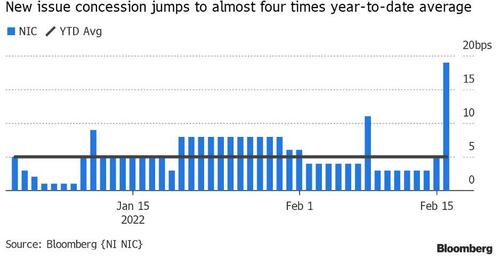

Higher new issue concessions are also a clear warning sign of the: “Canary Singing in the Coal Mine”!

This means that Zombie Corporations desperate for debt issuances to continue operations must now concede to more lucrative incentives to attract Credit Investors.

As shown below, credit markets blew out further this week. High Yield (HY) spreads were up for the 4th week of the last 5 to their widest since early Dec 2020.

|

|

All of which leaves credit risk notably decoupled from equity risk.

Credit Investors are notoriously better readers of the “Tea Leaves” than Equity Market Investors. They don’t invest on “hope and sentiment”. They invest based on fundamentals, valuations and discounted free cash flows!

|

|

|

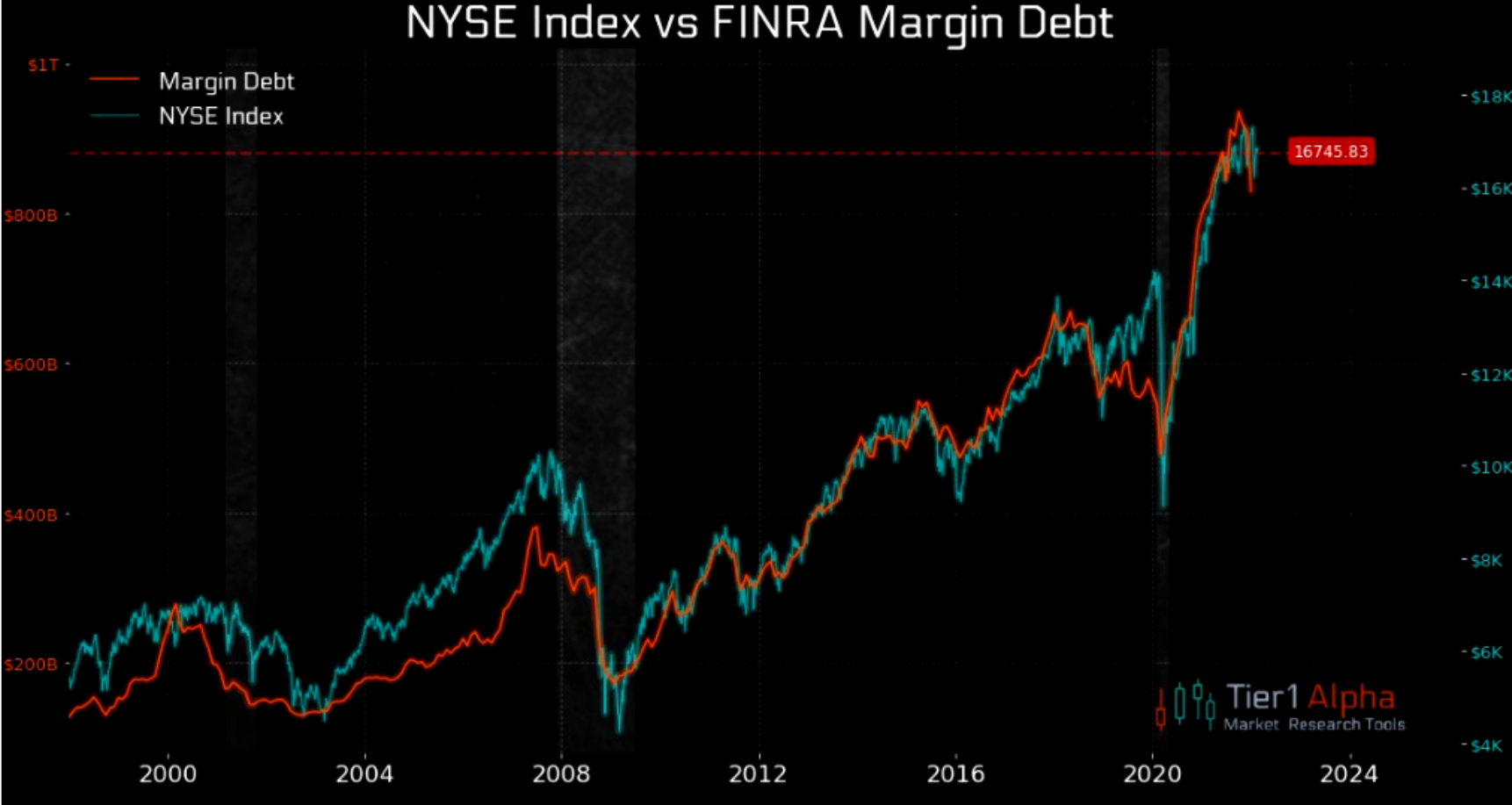

NON-INSTITUTIONAL INVESTOR MARGIN DEBT EVAPORATING

So far I have been talking about the institutional and professional market participants. However, the market “run-up” over the last few years has been fueled by “newbie”, ‘Buy-the-Dip’ traders who have used historic levels of leverage, borrowed money and option plays (i.e. the Gamma players at Robinhood et al). This historically always ends abruptly and badly.

What we see below is that the recent turmoil in the equity markets have left many on the wrong side of trades and they are experiencing “margin calls” from their brokers. They are only beginning to be squeezed and will soon learn the lessons that will last a life time. Drops as shown below normally precede important market sell-offs by 3-4 months.

There is nothing harder to find than credit when you need it!

|

|

|

CONCLUSION

A longer view suggests this is only beginning and will soon get ugly! The Fed is clearly signaling that it is not going to step in until the markets are at much lower levels. There is no longer a Fed “PUT”.

CAPITULATION COMETH!!

|

|