SII

RETAIL

REITS TRAPPED IN A LOSING “CATCH-22”!

- Force these companies out of business or

- They can reduce or waive rent while operations are slow.

- What makes the COVID-19 pandemic unique is that it’s causing a correlated downturn in almost every business. Hotels are empty, malls have been shut down, and there may be millions of small businesses closed down over the next year. The former head of the Small Business Administration, said recently that 20% to 30% of small businesses may fail “even in a good scenario.”

- Small & Medium businesses are ultimately the ones that pay rent to mall owners, organize business trips and stay in hotels. When they are failing en masse, it’s having a devastating effect on associated REITs.

- REITs are no better than the consistency of the individuals or companies who pay their bills. If malls are empty, Simon Property Group and Brookfield Property REIT are in trouble. And if hotels are empty, Host Hotels and Apple Hospitality will be in the same boat. The same can be said for any industry REITs serve.

- We’ve seen mall REITs like Simon Property Group (NYSE:SPG) and Brookfield Property REIT (NASDAQ:BPYU) plunge 61% and 50.9%, respectively, so far in 2020. Hotel REITs like Host Hotels & Resorts (NYSE:HST) and Apple Hospitality REIT (NYSE:APLE) are down 39.2% and 44.3%, respectively.

- REITs were supposed to be a safe place to put your money in an economic downturn, but this one is fundamentally different!

- MALL ANCHOR: JC Penney Strikes $500 Million Bankruptcy Financing Deal; Expected To File Next Week

- MALL ANCHOR: Neiman Marcus Strikes Bankruptcy Deal With Creditors As ‘Rona Rout Claims Latest Victim

- MALL ANCHOR: Saks Fifth Avenue Is Latest Mall Anchor To Prepare For Bankruptcy Filing

- MALL ANCHOR: Can Macy’s Survive this Crisis Without Filing for Bankruptcy

- MALL RETAIL: J. Crew Preparing To File For Bankruptcy As Soon As This Weekend.

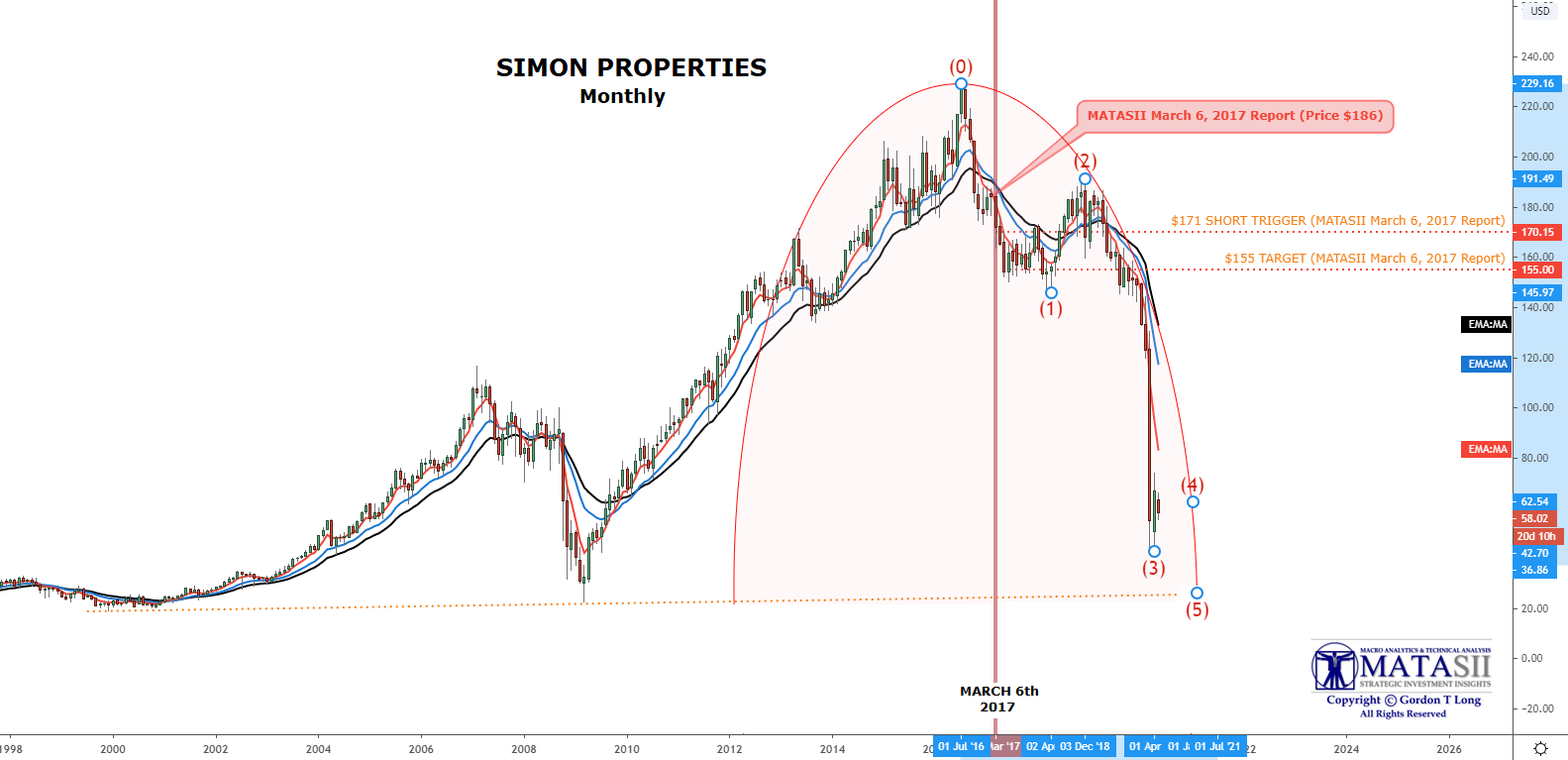

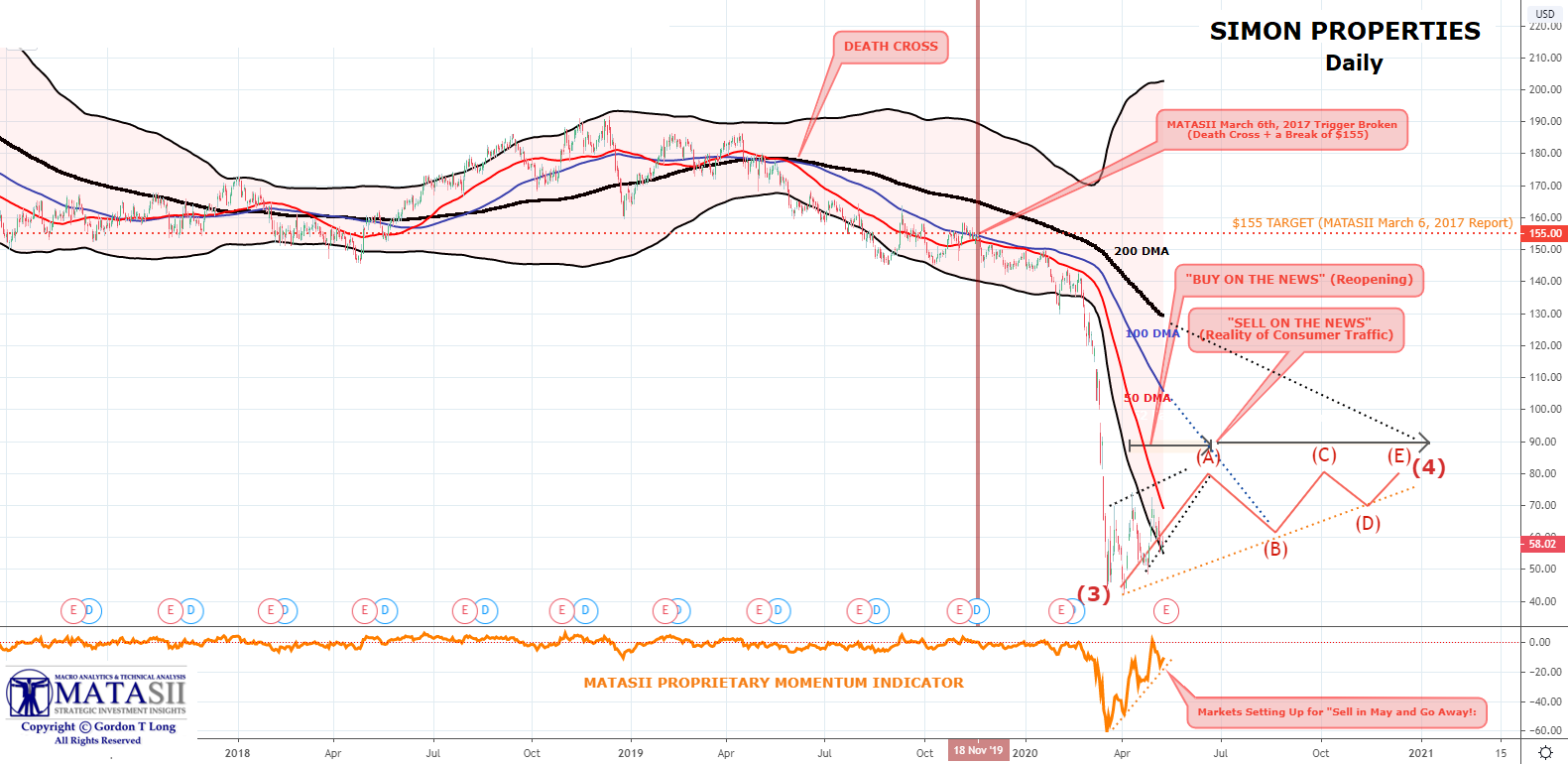

The Death Cross and a break of $155/share prepared MATASII subscribers in advance of the CoronaVirus retail lock-down. We now expect a consolidation to once again unfold, likely in the fashion shown below. We feel there is more downside ahead.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.