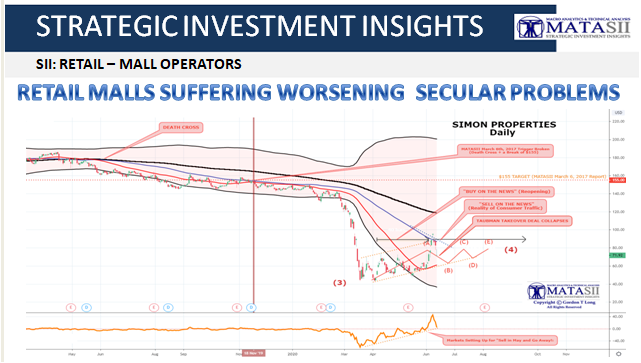

SII: RETAIL

MALL OPERATORS

RETAIL MALLS SUFFERING WORSENING SECULAR PROBLEMS

-

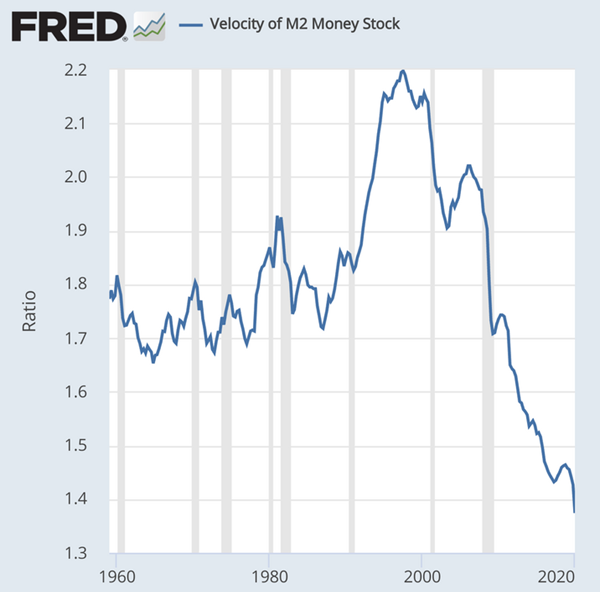

- The middle class is being forced to buy at the lowest cost outlets for perishables and basic needs. These outlets are national chains such as Walmart, Dollar Discount, Costco, BJ’s, Targets etc. which effectively suck revenue out of the local community like a “vacuum cleaner” thereby reducing the Velocity of Money (see chart below) which once made local communities possible and vibrant. The foundation for the American Dream.

- The middle class is additionally forced to buy all other goods online where the best discounted price can be found. Payments are made to companies like Amazon that have no presence in the local community thereby further sucking money and employment out of local economies.

- America is a 70% consumption economy dependent on the middle class. The change in buying behavior is gutting the “MainStreet” wealth engine of America for the “WallStreet” Economy which has singly funded these consumer outlets and the local manufacturers that outsourced and downsized their employee jobs to foreign shores.

-

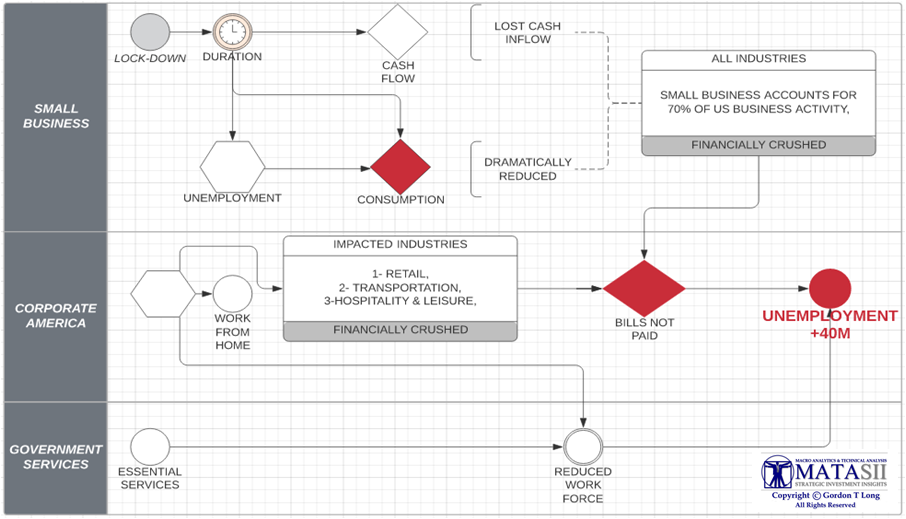

- Small businesses employ 58.9 million Americans, making up 47.5% of the country’s total employee workforce. It’s absurd to think the economy is going to come roaring back when nearly half of small business owners expect to shut down.

- Small Business has been crushed and a recent report from Azio, a major small business bank survey indicated that 47% of the small business owners surveyed said they anticipate shutting down, and 41% said they are looking for full-time work elsewhere.

- Less than half of participants, 38 percent involved in Azlo’s just completed survey, applied for PPP (Payroll Protection Program) loans. Of those who did apply, 37% said the program was slow to distribute funds and 20% described the process as ‘painful’.”

- The Census Bureau’s Household Pulse survey showed in the last five weeks through June 2, 31% of households said they had “little or no confidence” about paying rent next month.

- The survey showed 11% of households with a mortgage skipped servicing payments last month, and 16% said they wouldn’t be able to make payments in the future.

- Citing the U.S. Census Bureau’s Household Pulse survey, Bloomberg reports that at least 17% didn’t pay their latest monthly rent and an even larger number of folks are worried about missing upcoming rent payments as the squeeze on households is getting worse.

- Federal Reserve Chair Jerome Powell said during a press conference: “There’s been a tremendous amount of forbearance on the part of the banks…. but those are not decisions that we hold any legal authority to make, and by the way, we have encouraged those decisions.”

The Banks are tightening credit limits for credit card holders, dramatically increasing loan loss reserves and are placing excess lending reserves at the Federal Reserve despite the Fed cutting the interest rate on reserves. These are not signs of the expectations for consumption to soon return to “normal”.

The Banks are tightening credit limits for credit card holders, dramatically increasing loan loss reserves and are placing excess lending reserves at the Federal Reserve despite the Fed cutting the interest rate on reserves. These are not signs of the expectations for consumption to soon return to “normal”.

-

- Force these companies out of business or

- They can reduce or waive rent while operations are slow.

-

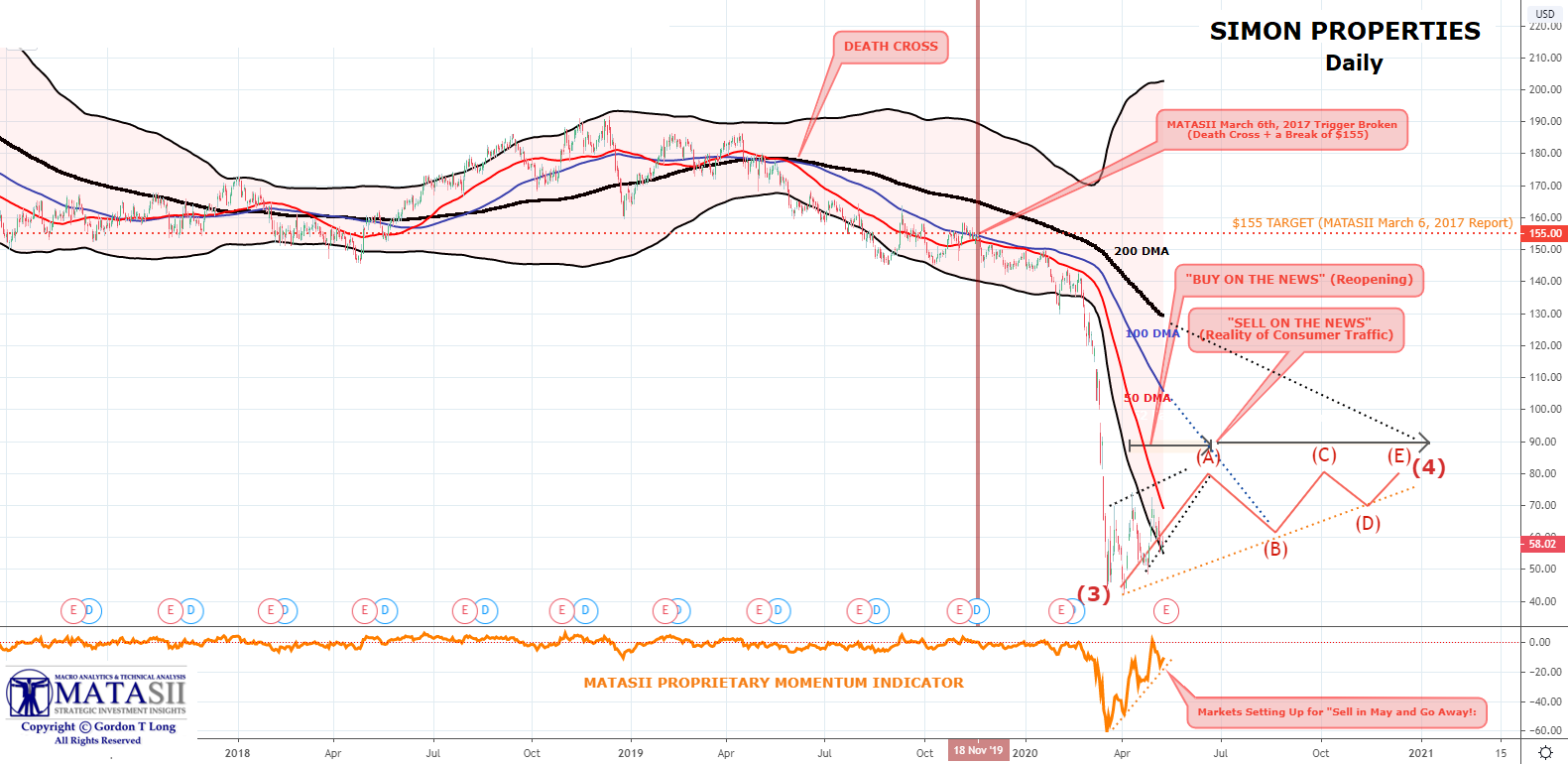

- MALL ANCHOR: JC Penney Strikes $500 Million Bankruptcy Financing Deal; Expected To File Next Week

- MALL ANCHOR: Neiman Marcus Strikes Bankruptcy Deal With Creditors As ‘Rona Rout Claims Latest Victim

- MALL ANCHOR: Saks Fifth Avenue Is Latest Mall Anchor To Prepare For Bankruptcy Filing

- MALL ANCHOR: Can Macy’s Survive this Crisis Without Filing for Bankruptcy

- MALL RETAIL: J. Crew Preparing To File For Bankruptcy As Soon As This Weekend.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.