TIPPING POINTS

INFLATION

THE GOVERNMENT NEEDS INFLATION,

BUT MAYBE NOT QUITE THIS MUCH!

OBSERVATIONS: THE GOVERNMENT CAN STOP INFLATION – IF IT TRULY WANTED TO!

Tax receipts and debt-driven GDP have reached the point where they will no longer be counted on to be sufficient to extinguish the exploding US debt. We have crossed that Rubicon when the US became a “Zombie” government – a government that has to borrow to pay the interest on its existing debt.

The US government has been acutely aware that this was coming since at least the 2008 Financial Crisis. Those in the know fully realized that the only option forward would be inflation.

Up until the 2008, GFC the perception was that Financial Repression through the use of Negative Real Rates was the proven solution to excess government debt. It solved the debt problem resulting from WWII and could be counted on to do the same again. The Global Covid Shock abruptly changed everything!

Contained inflation was suddenly released. Like a coiled spring, once released it quickly becomes unmanageable! Initially the result of Supply Chain disruptions, it was stocked by relief payments, rent forbearances and government fiscal stimulus efforts. Never wanting to let a crisis go to waste, the Biden Administration saw this as an opportunity to mount a fight against Climate Change and a historic shift towards renewable energy, contributing to a ~$6.7T insertion of government spending into an already destabilized situation.

The predictable result was Inflation not seen since the 1970’s. We have a 7 percent budget deficit at full employment which has previously has been unheard of. There are no free lunches and there are consequences of those policy decisions which we must now shoulder.

The government is quite willing to let the public believe that inflation is caused by greedy corporations, opportunists and any other mistaken belief. The simple truth is that inflation is first and always a Monetary event. Issuing more currency than the private sector demands, erodes purchasing power and creates a constant annual transfer of wealth from real wages and deposit savings to the government. Inflation is effectively a hidden tax that you pay not through a check to the government but by your money being worth less in buying power. Unfortunately only one in a hundred people ever grasp this.

If Biden wants to cut inflation, all he must do is eliminate the deficit by cutting expenditures. The reason why government should never oversee monetary policy and be allowed to monetize all deficits is by virtue of no administration being willing to cut its size to defend citizens’ wages. This is a result of nationalization by inflation and taxes being the goal of “big government” to create a dependent and hostage economy.

WHAT YOU NEED TO KNOW!

THE GREAT BIDENOMICS DISTORTION

THE GREAT BIDENOMICS DISTORTION

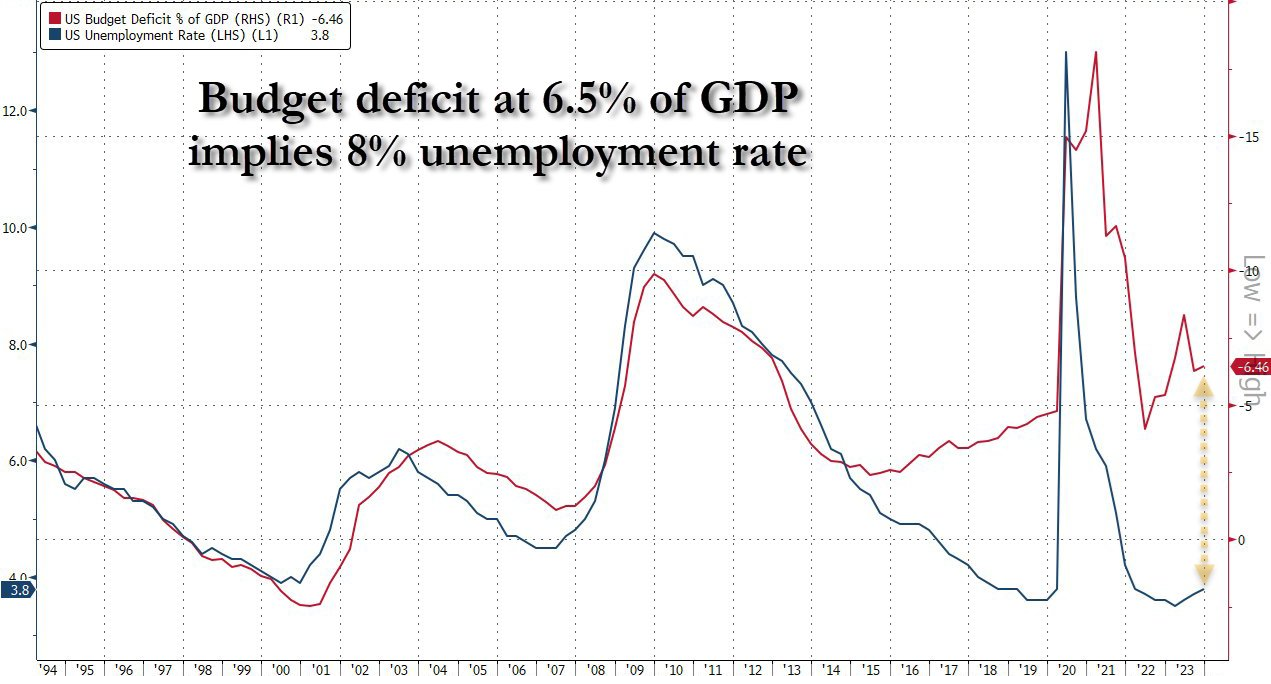

The current US budget deficit at ~6.5% of GDP is rising quickly with fiscal spending reaching $1T in the last 100 days alone. This level of spending is unprecedented with the reported US economy at full employment!. The chart to the right shows the close relationship between Employment and effectively fiscal deficit spending. The current Bidenomics distortion is unprecedented!

The already spent 6.5% deficit to GDP should be expected to be required only if unemployment was 8% – NOT 3.9%??

If the US was to economically slow, how exactly would the government try to moderate or address it? It seems this administration has already “eaten our seed corn” and will be leaving us to go hungry when the inevitable contraction arrives.

RESEARCH

A US RECESSION IS LOOMING: THE HAPPY TALK WILL SOON END!

-

- Recession risk is increasing. This is being driven by the weakening in soft data in recent weeks, which is coinciding with hard data that remains fragile.

- Though the probability of a near-term recession is currently viewed as low, in a month’s time it could be much higher – by Q3 it is likely to be increasingly seen as a much higher probability.

- When you consider what is happening with the ISM, PMI and LEI, it is reasonable to assume that over the next 3-4 months the hard date will follow.

- Recessions follow the “S” curve which is why though they may be anticipated. They seem to occur so abruptly and are hard to time. Data is often revised lower very quickly, which is why recessions can happen faster in “revised time” than in real time.

THE “CRIPPLING” OF THE ENERGY SECTOR: STILL A STRONG RECESSION CATALYST!

-

- Cheap and Abundant Energy is the cornerstone of a vibrant and healthy economy. Disruptions historically bring economic problems and wars!

- The current “War on Fossil Fuels” is clearly disruptive to US Oil production and energy industry.

- This has the clear and obvious potential for being a catalyst for serious US economic problems.

- However, for some reason it is “old news” and gets almost no mainstream news coverage? Minimally it should be watched closely versus what appears to be “don’t talk about it”.

- Even hard core Climate and Green Energy advocates should want to ensure the transition away is not taking the US into a economic death spiral!

- Despite Biden’s best efforts, U.S. oil production has soared to record levels, over 13 million barrels per day, boosted by commodity price increases following Russia’s 2022 invasion of Ukraine.

- Investors have seen substantial returns, with mammoth ExxonMobil seeing its shares doubling since Biden’s inauguration.

- These achievements have happened despite White House policies! Europe is even now reversing many of its prior energy positions out of shear necessity leaving the US alone and appearing to the world as still naively tilting at “windmills”.

- We believe the direction and goal of the US is sound, however, its political implementation and plan is so amateurish as to be nothing short of laughable and doomed to what is occurring.

- It would appear that Biden quite simply can’t even shoot himself in the foot at point blank distance!

DEVELOPMENTS TO WATCH

ECONOMIC GROWTH IS A PRECIOUS COMMODITY REQUIRING CONTINUOUS ATTENTION!

ECONOMIC GROWTH IS A PRECIOUS COMMODITY REQUIRING CONTINUOUS ATTENTION!

-

- Economic Growth is hard, sustaining it even harder!

- History is replete with the fact that the stars of today are not necessarily the stars of tomorrow. Canada, Chile, Germany, South Africa and Thailand, as “breakdown nations” all carry lessons.

“Smart countries somehow turned stupid. One basic mistake or miss, and any country can find itself stuck — until it finds the leadership and vision to chart a way out.

For current stars, the message is a warning: don’t take growth for granted!”

THE NEW ACRONYMS OF A COMING CRISIS: YOLO, BNPL & “PHANTOM DEBT”

-

- The new development is the degree to which “Buy Now, Pay Later” (BNPL) has exploded and is being hidden by what is being identified as “Phantom Debt”. This fact is camouflaging the degree to which consumer debt has degraded.

- This missing data is projected to reach almost $700 billion globally by 2028.

GLOBAL ECONOMIC REPORTING

1- THE “OER” ELECTION YEAR SET-UP IS IN

1- THE “OER” ELECTION YEAR SET-UP IS IN

-

- The CPI is driven by 43% of it being Owner Equivalent Rent (OER). The next 9-12 months rent/OER inflation will now begin to surprise to the downside as it catches down to stale lagged real-time data, even as rents are actually rising right now. However, the BLS won’t observe this until early 2025.

2- WEEKLY JOBLESS CLAIMS

-

- With perfect timing for Yellen and Powell, the Initial Jobless Claims for the week ending 4th May shot up to 231k from 209k in the prior week, above the consensus of 215k and above the top end of the forecast range where the largest estimate looked for 220k.

- It is also the highest Initial Jobless Claims print since August of 2023, and the largest weekly increase since January (weather related), but before that it would be the largest increase since June last year.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.