MACRO

US PUBLIC POLICY

THE “TRUMP” TRADE

OBSERVATIONS: FISCAL INVESTMENT versus FISCAL SPENDING

President Ronald Reagan got it and so did Donald Trump (sort of) in his first term. There is a major difference between Government Fiscal Investment and Government Fiscal Spending. Both will potentially grow GDP, but the former in a powerful way, the latter through chronic deficits.

The Reagan Economic miracle took time and cost him his first term’s mid-term elections, but it began to work and secured his second term. What was the Fiscal Investment that created the miracle? It was about investment the people that power the economy. He built it on two cornerstones to empower Fiscal Investment:

-

- Reduce Strangling Regulations,

- Reduce Corporate and Personal Taxes

Trump did both of these in his first time to a large degree over an “anything but Trump” opposing congress.

What Reagan got (with a supporting congress) was the realization that the US government had grown to the point that it was now the problem! Government control, regulations, restrictions and taxation was strangling the US economic engine. Reagan’s understanding of the unorthodox Laffler Curve guided his thinking and Trump’s.

An investment is different than simply the spending of tax money. Fiscal Spending is the allocation of tax money in the form of redistribution of wealth. Today tax money and deficit spending is allocated in a fashion that it goes to toward consumer consumption in the form of transfer payments. There is no investment, but rather the consumption of money.

Fiscal Investment is not about redistribution, but rather allowing those who have the money to keep it and use it to produce personal wealth. Their success, (let’s call it personal greed, ambition or even vision), is the only proven sustainable factor to creating investment and wealth. That wealth grows taxation and increases jobs and wages. This in turn propels independence, positive sentiment, risk taking and consumer confidence. We go to a virtuous upward cycle from a a downward economic spiral.

This may all sound academic but it isn’t – it is reality of why real democracy and real capitalism works. We have been living under something that is best described as “Creditism” and is anything but Capitalism!

Capitalism is fundamentally about Savings being Invested into Productive Assets which increases the overall standard of living. Creditism is about Credit being created that is used for consumption. In a country like the US that now consumes much more than it produces, you are automatically trapped into a downward economic spiral.

There is only one way out and that is Fiscal Investment!

The problem in America is the growth in jobs is in government and consumer consumption services. Jobs need to be created in higher paying production of goods and services that are exportable. Today, that is the domain of China since the US relinquished it to the globalists and exported 54 thousand US factories to China when they entered the WTO in 2002.

FISCAL INVESTMENT

Trump’s Fiscal Investment is about using Tariffs to incent (or more apply – force) jobs and factories back into the US.

As I pen this observation, Trump’s economic advisor Scott Bessent, who is being considered for Treasury Secretary, is already working on this. Bessent favors a ‘T+X’ tariff plan that gives global firms, say, two years to build factories in the US to avoid sanctions, reducing most of their direct inflation impact, but getting all the capex, supply-side, and trade-deficit narrowing gains. Samsung yesterday said this is what they plan to do. That might mean new economic models are needed for US tariffs – if economists want to model the world as it is rather than as they (or their models) want it to be.

Trump Tariffs’ will initially likely still elevate prices, but if successful in fostering a “reshoring” renaissance it may be a only way out of this death spiral. It is no doubt a calculated gamble, but maybe the only one left on the table for a country clearly headed down a road towards a dismal and inevitable debt crisis.

WHAT YOU NEED TO KNOW!

BOND VIGILANTES SEE TRUMP AS INFLATIONARY

BOND VIGILANTES SEE TRUMP AS INFLATIONARY

President-elect Donald J Trump is seen by the global bond market as Inflationary and as a result Bond Yields have risen sharply and are staying elevated. With a “Trifecta” win he may be able to deliver on his election promises. The perception is based on:

- Trump Tariffs are seen as being highly inflationary,

- The Trump election promises he made totalled $11.5T over 10 years.

(See last week’s :observations for details.)

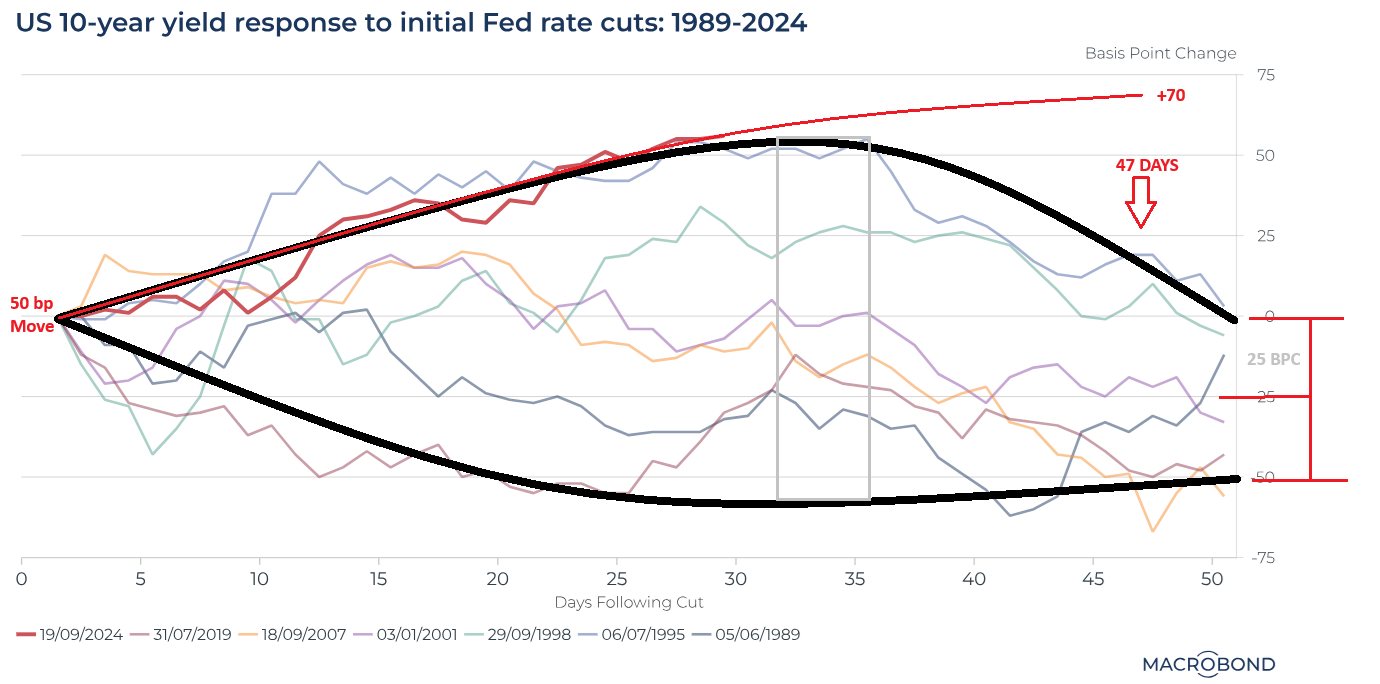

Clearly, The Fed will have its hands full with yet another politician on a reflation trajectory and a slowing economy, which has prompted the Fed to have already cut rates by 75 bps.

RESEARCH

1- THE SLOW DEATH OF THE SINGLE FAMILY HOME

1- THE SLOW DEATH OF THE SINGLE FAMILY HOME

-

- Most are aware that homeownership has become unaffordable based on housing prices and mortgage rates. However, the problem is much bigger and more complex when you look into Total Cost of Ownership.

- The monthly cost of homeownership is up 87.5% in five years.

- Homeowners can expect to pay $14,155 a year, or $1,180 a month, in hidden costs related to owning a home.

- Property taxes in the U.S. have risen 29.2% since 2019.

- Insurance premiums are up a further 23% from January 2023 while deductibles also rose significantly.

- High Utility Bills Driving 1 in 5 Americans to Downsize Their Homes.

- In 2022, the average cost of electricity increased more than 15%. The next three most common increases occurred in gas (55%), water and sewage (53%), and internet (32%).

2- THE “TRUMP” TRADE

-

- Since Trump’s Red sweep, US Sovereign Credit Default Swaps (CDS) have plummeted!

- It now appears the market was using short-dated USA sovereign CDS to hedge the possibility of the Democrats and Kamala/ Watz winning and the Democrats having another four years in office!

- This fall significantly reduces the risk premium for US sovereign debt.

DEVELOPMENTS TO WATCH

TRUMP ANNOUNCES HIS PLAN TO DISMANTLE THE DEEP STATE

TRUMP ANNOUNCES HIS PLAN TO DISMANTLE THE DEEP STATE

-

- President-elect Donald Trump immediately announced his 10 point plan to dismantle the “Deep State”.

- Trump has effectively declared War on the Washington DC bureaucracy!

- May God protect him!

TRUMP’S FIVE PILLARS FOR BORDER CONTROL & ILLEGAL IMMIGRATION

-

- Trump is expected to focus on 5 PILLARS:

-

-

- Restore policies Trump had in place that Biden jettisoned on assuming power which resulted in >15M illegal immigrants

- Prioritize the completion of his signature border wall

- Crack Down on Sanctuary Cities

- Implement the “largest deportation program” in American history

- Combat the power of the Mexican drug cartels

-

GLOBAL ECONOMIC REPORTING

FOMC MEETING

FOMC MEETING

-

- As expected the Fed reduced the Fed Funds Rate by 0.25%.

- Once Fed Chair Powell started speaking at his press conference on Thursday after the FOMC Meeting, it was clear that the uber-dovish rate-cut trajectory that so many hoped for was a thing of the past… for now.

- The Fed removed prior language that it has “gained greater confidence that inflation is moving sustainable toward 2 percent”.

BALANCE OF TRADE

-

- The trade deficit in the US widened to $84.4 billion in September 2024, the highest since April 2022.

- Exports declined 1.2% to $267.9 billion after reaching a record high level in August.

- Imports increased 3% to a new record high level of $352.3 billion.

FACTORY ORDERS

-

- US Factory Orders MM (Sep) -0.5% vs. Exp. -0.5% (Prev. -0.2%, Rev. -0.8%)

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.