THE CREDIT DEFAULT SWAP (CDS) GAME

Though we touched on this in this month’s LONGWave video (I encourage you to review it if you haven’t yet), I want to take it a step further in this note.

I believe we can agree that the Covid Pandemic is likely the greatest global economic and social disaster to have occurred since the 2008 Financial Crisis. It is likely to be considered an order of magnitude worse than the GFC before the final tally is taken over the next couple of years.

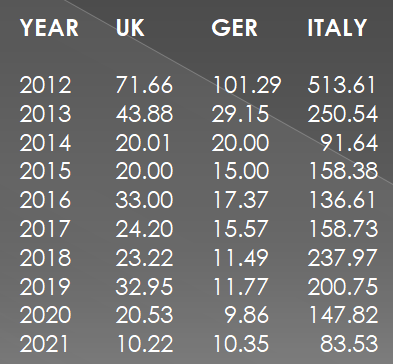

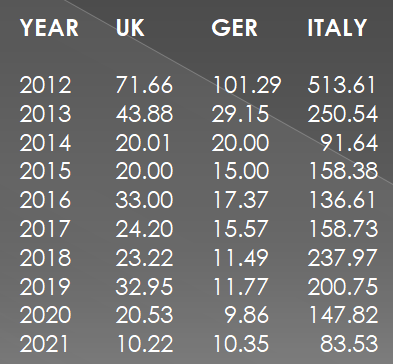

So let me ask you two questions regarding the data shown to the right:

:

-

- Why did the 2020 CDS’s not rise to even the level of the 2012 EU Financial Crisis? In fact not even close.

- Secondly and much, much more importantly, why (as shown on the left) have global CDS fallen steadily and so dramatically since the Financial Crisis?

The question is actually how can Risk insurance fall from 514 in Italy in 2012 to 84 today when the Italian industrial north is in near ruin from Covid. Why would German CDS’s fall from 101.35 in 2012 to only 10.22 today when EU T2 accounts show Germany on the hook for the debt of the all the weak EU members? Why has UK debt fallen from 71.66 to 10.22 when clearly the post Brexit nation has major inextinguishable sovereign debt problems? This drop in Credit Default Swap protection costs is the same around the world.

Quietly Credit Risk Insurance has become a fraction of what it used to be only 10 years ago, yet sovereign debt is at historic highs against GDP? What gives?

When Credit Risk insurance is so cheap you can take massive leveraged risk and yet be protected for next to nothing!

Obviously Central Bank Liquidity will rapidly be turned into Financial Flows if Risk Protection costs border on being nearly free!

How could this occur?? Who is holding the bag? Many of you may recall it was insurance companies such as AIG during the Housing debacle of the 2008 Financial Crisis. But this is about Sovereign Debt!

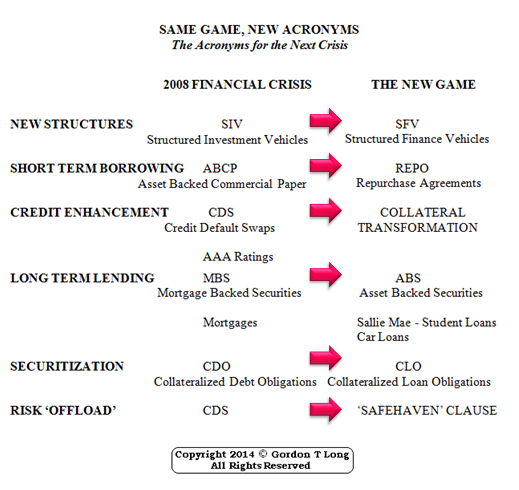

For example, as the 2008 Financial Crisis unfolded we discovered on an almost daily basis how esoteric instruments such as CDS’s (Credit Default Swaps), CDO’s (Collateralized Debt Obligations) were being used through SIVs (Structured Investment Vehicles) to fund ABCP (Asset Backed Commercial Paper) and MBS / ABS (Mortgage Backed Securites) which funded the US Housing Market. It turned out that Insurance companies were funding CDSs based on what proved to be a flawed use of accepted credit agency risk ratings.

For example, as the 2008 Financial Crisis unfolded we discovered on an almost daily basis how esoteric instruments such as CDS’s (Credit Default Swaps), CDO’s (Collateralized Debt Obligations) were being used through SIVs (Structured Investment Vehicles) to fund ABCP (Asset Backed Commercial Paper) and MBS / ABS (Mortgage Backed Securites) which funded the US Housing Market. It turned out that Insurance companies were funding CDSs based on what proved to be a flawed use of accepted credit agency risk ratings.

I believe we can agree that the Covid Pandemic is likely the greatest global economic and social disaster to have occurred since the 2008 Financial Crisis. It is likely to be considered an order of magnitude worse than the GFC before the final tally is taken over the next couple of years.

I believe we can agree that the Covid Pandemic is likely the greatest global economic and social disaster to have occurred since the 2008 Financial Crisis. It is likely to be considered an order of magnitude worse than the GFC before the final tally is taken over the next couple of years.