|

10Y INFLATION BREAKEVEN BREAKING KEY OVERHEAD SUPPORT

There are three critical numbers to follow to understand interest rates:

- Oil Prices,

- The 10Y UST Yield and

- The US dollar

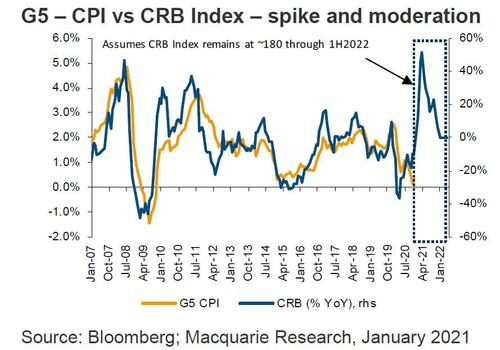

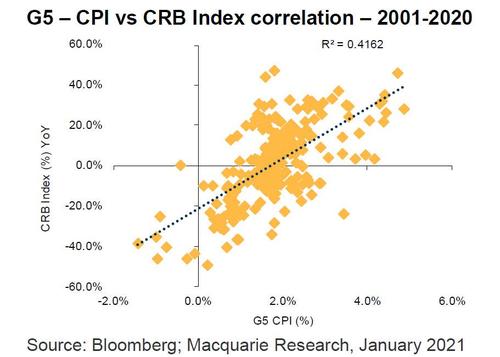

One year ago, yields were going down, oil was going down, and the Dollar was going up. Today, Treasury yields are going up, oil is going up, and the Dollar is going down!

Alarm Bells should be going off as this is exactly what happens in a poorly run “Banana Republic”!

This is because we are facing structural regime changes in the US economy.

- Real Rates are negative in the US and are now one of the lowest in the world. A year ago, the Dollar was the only major currency offering positive real rates. Money follows real rates like water flowing downhill. As a result the US Current Account can soon be expected to come under pressure.

- The US Election has solidified the fact that the US is moving away from sustained energy independence with the Biden executives orders cancelling the Keystone pipeline and the halting of oil and gas activities on Government land.

- Oil production in the U.S. is collapsing.

- The Texan wildcatters have lost out in the price war against the Saudis and the Russians.

- U.S. oil production has already gone down 2.5 million barrels per day and is slated to go down by another 2.5 million over the next twelve months, because every major oil company is cutting capital expenditures.

- Chevron and Exxon capital spending plans over the next five years are at half the level they were in 2014.

- As the U.S. economy picks up after Covid, America will be importing oil on a massive scale again.

- The U.S. will be back to exporting $100 to $120 billion to the rest of the world, mostly to places that don’t like America, who will turn around and sell those Dollars for Euros. (This is bearish for the Dollar.)

- The US Twin Deficits (Current Account and Trade Balance) can also be expected to reverse and re-accelerate lower with MMT polices looming ahead.

These factors almost assure the US dollar will weaken, likely starting sometime in the spring.

As a result we can initially expect 10Y UST yields to rise since they mirror the 5Y Nominal GDP rate which is recovering along with higher budget deficit financing costs (required to attract Foreign Direct Investment).

The US is trapped. The decision will soon be to either let inflation run unabated or let the US$ fall (or likely some combination)!

|