MACRO

US FISCAL POLICY

WATCH YELLEN NOT POWELL!

Everyone’s eyes are on Federal Reserve Chairman Jerome Powell. Our eyes are on Treasury Secretary Janel Yellen!

Why?

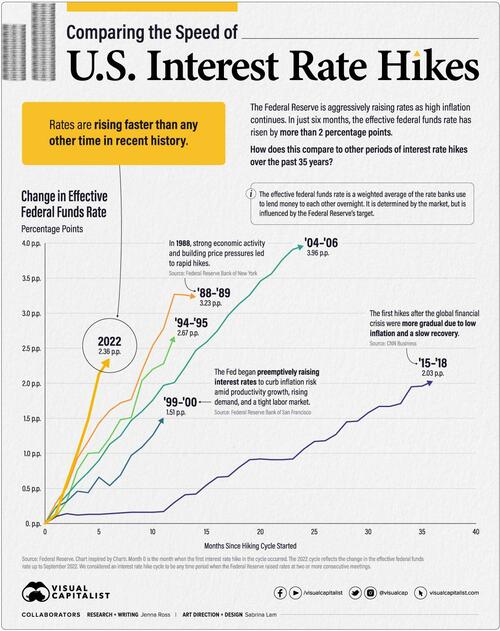

As Powell has pushed rates up at an unprecedented rate, something can be fully expected to break. Historically, the Fed has a track record of only taking rates down after something financially important breaks, which forces a monetary policy reversal. The difference this time is that the Fed needs to raise rates faster then normal to fight inflation, but also feels it will need to additionally hold rates at an elevated level for longer than expected to successfully ring inflation out of the economy. The “oil in the ointment” is something breaking to soon thereby forcing a monetary policy reversal.

This is where former Fed Chairman Janet Yellen comes in. Yellen’s new “unofficial” task is to fully contain the expected global “breakage” to buy the desperately needed time the Federal Reserve requires to effectively quell inflation. In this newsletter we discuss how we expect this to be done!

=========

WHAT YOU NEED TO KNOW

We should fully expect the “powers-to-be” to enact some form of coordinated “Kick-the Can-Down-The-Road”; Change the Accounting Rules, or other forms of deferral “cheating” to avoid the current mounting global economic crisis. Politicians and Bureaucrats have been doing this so consistently for over 25 years so that now we should expect nothing less again.

- WHAT IS YELLEN DOING BEHIND THE SCENES?

- Yellen has asked the U.S. Congress for permission to lend $21 billion in existing U.S. Special Drawing Rights (SDR) to IMF. This takes us to $81B that has now been urgently raised by the IMF to assist the crisis occurring in Emerging Markets due to recent US dollar strength.

- Yellen is presently soliciting the US Money Center Banks on whether the U.S. Treasury should initiate a buy back bond program.

- Yellen controls the Plunge Protection Team (PPT) which historically (and by mandate) is heavily involved in targeted areas of the financial markets to maintain market stability and avoid excess volatility.

- A MANAGED $18 TRILLION US ASSET DRAWDOWN WITHOUT BREAKING ANYTHING

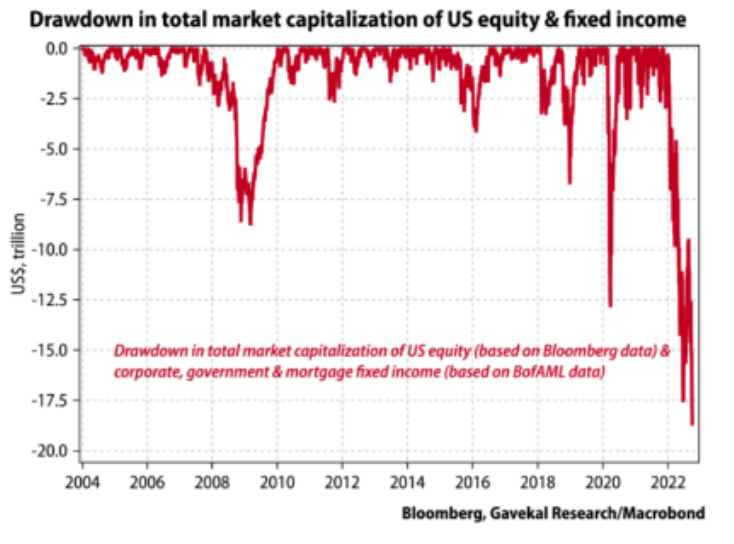

- The US stocks and bonds have created a drawdown of $18 Trillion in the US equity and fixed income markets since the beginning of the year. This is already far worse than 2008 and 2020’s market value destructions.

- The drawdown has so far been achieved in a managed and controlled fashion. We have yet to see market trading halts, exchange lockdowns and violent market capitulation selling.

- So far the “Dynamic Duo” of The Chair of the Fed and Secretary have achieved this outcome. Presently and going forward it is our view that Janet Yellen at the US Treasury will do a significant amount of the heavy lifting quietly, while Chairman Powell will be the public face of the fight against inflation.

- CONTROLLING THE FINANCIAL CONDITIONS INDEX

- There is clearly some obvious controlling logic occurring. The controlling actions have always resulted in two outcomes:

- Markets head lower with a steady down trend,

- Markets violently counter rally whenever the downdraft becomes too great and stops when the downward trend channel is broken.

- We believe the PPT managed by the US Treasury is behind this controlled behavior.

- A DELAYED SHOCK

- Expected US Dollar Margin Calls this week began to fully sweep over Emerging Markets.

- The Federal Reserves unprecedented and rapid rise in rates has driven the dollar and US real rates parabolic. The global fall-out are truly consequential.

- Wishful thinking, misleading narratives and an unaccountable few at the Federal Reserve have unleashed on the global economy an unnecessary and deadly shock. A shock that is only now being fully felt!

- SETTING UP & TRIGGERING MAJOR COUNTER RALLIES

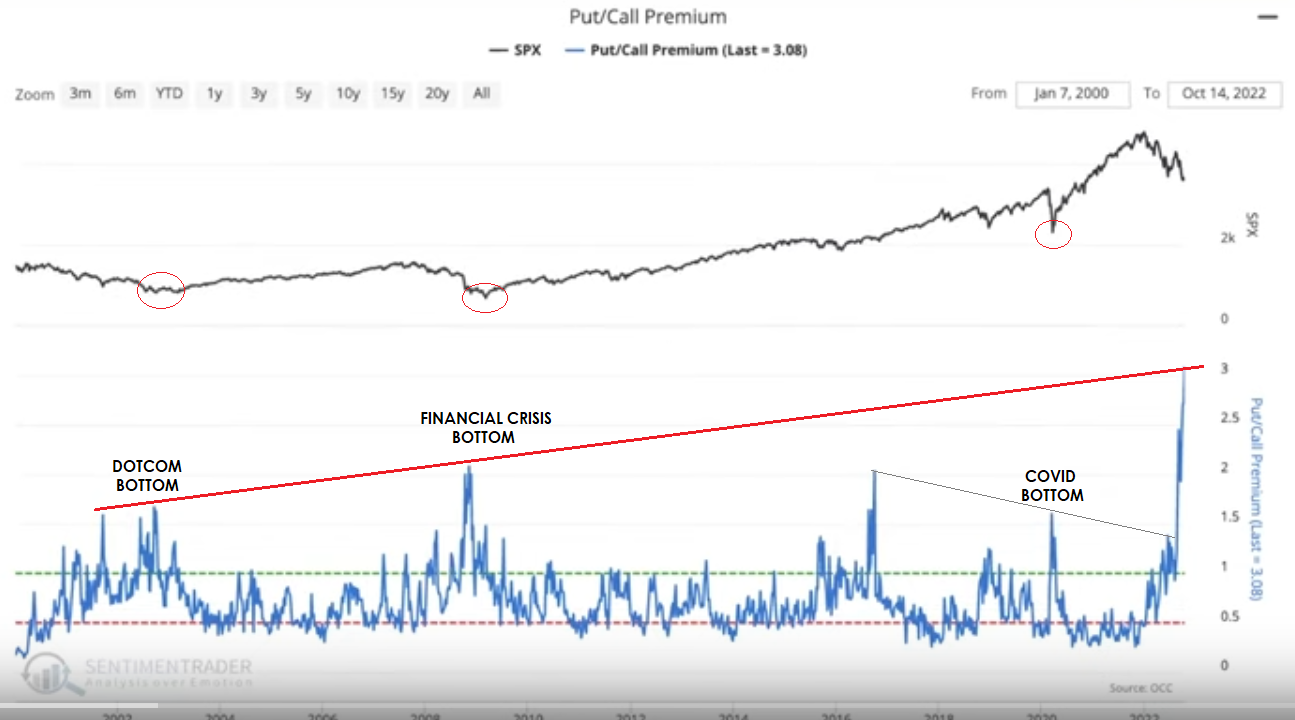

- With the current Put/Call Premium at the historic level it is, we have reached an unprecedented degree of belief that the market is about to fall in a massive way! However, history shows us this has actually turned out to be a market bottom and the best time to be buying.

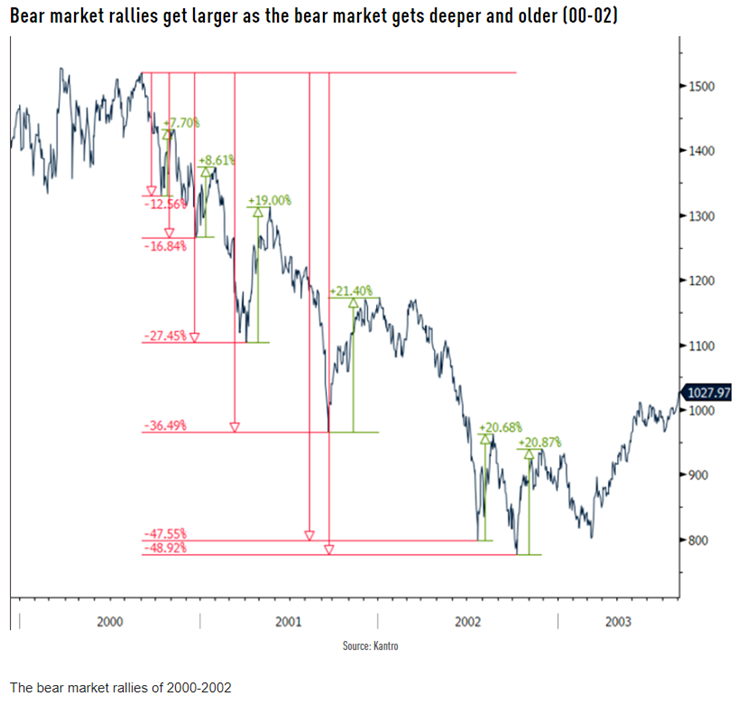

- Bear Markets counter rallies get larger as the Bear Market gets deeper and older. This was the case for both the 2 year Dotcom implosion and during the duration of the Great Financial Crisis (GFC).

- CONCLUSIONS

- We suspect this time around the “powers-to-be” will use Fiscal Policies of off balance sheet “CONTINGENT LIABILITY” accounting to “juice” the markets if they were to fall significantly below the current critical support levels.

When October is Behind Us, Expect a Major Counter Rally to Begin in November

=========

WHAT IS YELLEN DOING BEHIND THE SCENES?

EXPECT THE “POWERS TO BE” TO SOON ATTEMPT A COORDINATED “KICK-THE-CAN” ACTION

We believe it is the goal of both the Federal Reserve and US Treasury to orchestrate a managed and controlled reduction of US financial assets as a key part of bringing inflation under control.

The “wealth effect” has been a major goal of the Federal Reserve’s Monetary Policy over most of the last decade to increase demand and grow credit at sufficient level (over 2% in real terms) to drive economic growth. This has successfully worked.

The tenets of Stagflation (elevated Inflation and slow economic growth) have now forced the Fed to shift to a rapid rise of interest rates to fight seriously high inflation while the decade long business cycle expansion inevitably reverses and falls into contraction.

|

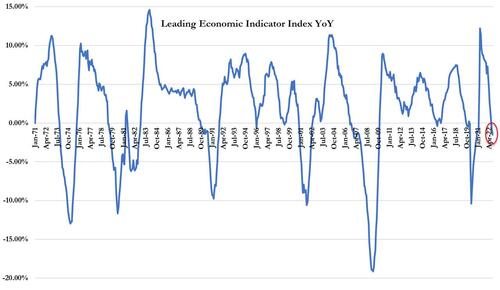

The US Leading Economic Indicators is back underwater. The Federal Reserve has never raised rates, tightened financial conditions and implemented a Quantitative Tightening (QT) program in such an environment! |

|

|

THERE MUST BE MORE GOING ON THAN MEETS THE EYE! To manage the reduction of financial assets in a controlled fashion the Federal Reserve in concert with the US Treasury must use all methods both visible and invisible to achieve this goal. There are no two better long term bureaucrats to achieve this goal than Janet Yellen and Jerome Powell. Powell is a former Federal Reserve Chair while Powell is the former Under Secretary of the US Treasury. This Dynamic Duo overlap in knowing how to pull the levers better than any two people in their positions at a single moment in time. Presently, it is Yellen and the US Treasury who must conduct the “heavy lifting” behind the veil of public awareness. |

Behind the scenes we are presently aware of the following:

UNDERWAY

- IMF FUNDING REQUIRED AS EMERGING MARKET COUNTRIES FACE CRISIS DUE TO DOLLAR STRENGTH: Yellen told a news conference that the Treasury has asked the U.S. Congress for permission to lend $21 billion in existing U.S. Special Drawing Rights (SDR) to IMF- Oct 14th- REUTERS .

- The non-partisan One Campaign, which tracks SDR pledges, said another $60 billion in pledges had been made thus far. THIS TAKES RECENT CONTRIBUTIONS TO $81B.

- The United States was looking at other ways to help boost funding available to needy countries, including through grants to food security organizations and debt restructuring efforts.

- Civil society groups and lawmakers have urged the global lender to issue another $650 billion in SDRs – something akin to a central bank printing money – to help member countries grapple with overlapping health, food, energy and inflation crises.

- QE DURING QT: U.S. Treasury asks major banks if it should buy back bonds- Oct 14th- REUTERS .

- The Treasury is asking dealers about the specifics of how buybacks could work “in order to better assess the merits and limitations of implementing a buyback program.”

- These include how much it would need to buy in so-called off-the-run Treasuries, which are older and less liquid issues, in order to “meaningfully” improve liquidity in these securities.

- The Treasury is also querying whether reduced volatility in the issuance of Treasury bills as a result of buybacks made for cash and maturity management purposes could be a “meaningful benefit for Treasury or investors.”

- It is further asking about the costs and benefits of funding repurchases of older debt with increased issuance of so-called on-the-run securities, which are the most liquid and current issue.

How are Yellen’s actions any different than Pivoting?

How are Yellen’s actions any different than Pivoting?

The effect is the same on markets if it happens. The only difference is monetary (Powell) policy works immediately, Fiscal ( Yellen) takes more time.

We discussed some of this in our recent podcast with Kerry Lutz at FSN. https://youtu.be/6onrO5rsUQk

PLUNGE PROTECTION TEAM (PPT)

- The PPT is fully engaged in the following to stop a sudden market drop:

-

- GAMMA TRADING: The PPT can be expected to capitalize on option derivative trading.

- INFLATION SWAPS: This effectively controls the Bond Break Even measure which is a key component in setting nominal bond yields.

- TIPS PURCHASES: This is key in setting US Bond Real Rates .

- FRONT RUNNING – The Fed has a very strong working relationship with the largest Front Running data provider players such as Citadel.

FINANCIAL CONDITIONS INDEX

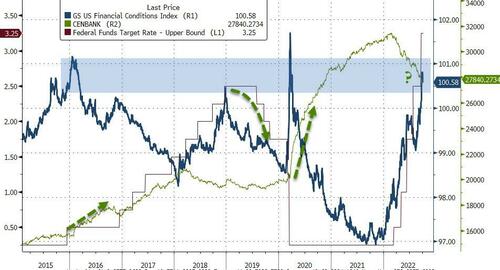

- It has become clearly evident that the Fed is manipulating the FCI to control and orchestrate a “managed” market decline and a reduction of the wealth effect. We have shown this in prior newsletters (we discuss it further below).

PUBLIC ACTIONS TAKEN

A MANAGED $18T US DRAWDOWN WITHOUT BREAKING ANYTHING

NO TRADING HALTS NOR CAPITULATION PANICS – YET!

US stocks and bonds have underwent a drawdown of $18 Trillion in the US equity and fixed income markets, far worse than 2008 and 2020’s market value destruction. Frankly, the dynamic duo needs to be congratulated! They have achieved quite a feat – so far!

Yet, despite this the Fed maintains that a “soft landing” is still attainable in this downturn. We believe this “soft landing” will be about as accurate as their prior contention that “inflation is transitory”. The narrative is intended only to assist in the controlled and managed drawdown underway.

The US Asset Drawdown still has further to go over the next COUPLE OF YEARS.

So far the managed control has been heavily executed via Financial Conditions & the FCI

CONTROLLING THE FINANCIAL CONDITIONS INDEX (FCI)

FCI’S CYCLICAL MANAGEMENT

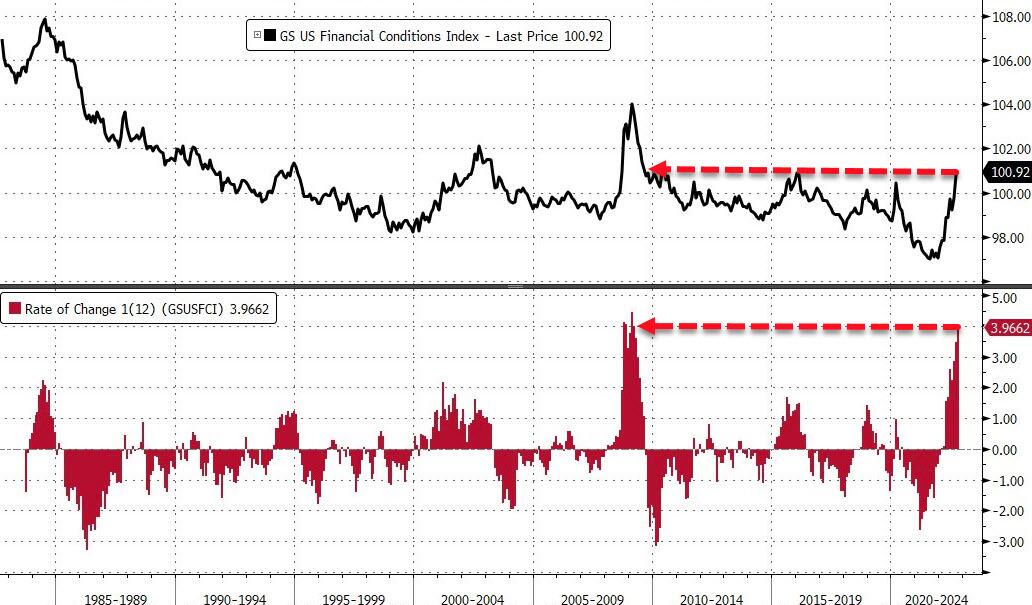

I outlined on a number of occasions during the falling equity market in the first half of this year how the FCI continuously oscillates in a strange and timely fashion. (Example chart to the right taken from the August 15th newsletter: A BEAR MARKET COUNTER RALLY OR SOMETHING ELSE??)

There is clearly some obvious controlling logic occurring.

The controlling actions have always resulted in two outcomes:

- Markets head lower with a steady down trend.

- Markets violently counter rally whenever the downdraft becomes too great and stop when the down downward trend channel is broken.

We believe the PPT managed by the US Treasury is behind this controlled behavior.

Financial Conditions are again at their tightest (on a month-end basis) since July 2009 and the last 12 months have seen an almost unprecedented tightening of financial conditions (see below). Normally, we would expect a significant counter rally to soon occur as the FCI suddenly falls (see section below entitled “Setting-Up and Triggering a Major Counter Rally”).

A DELAYED SHOCK

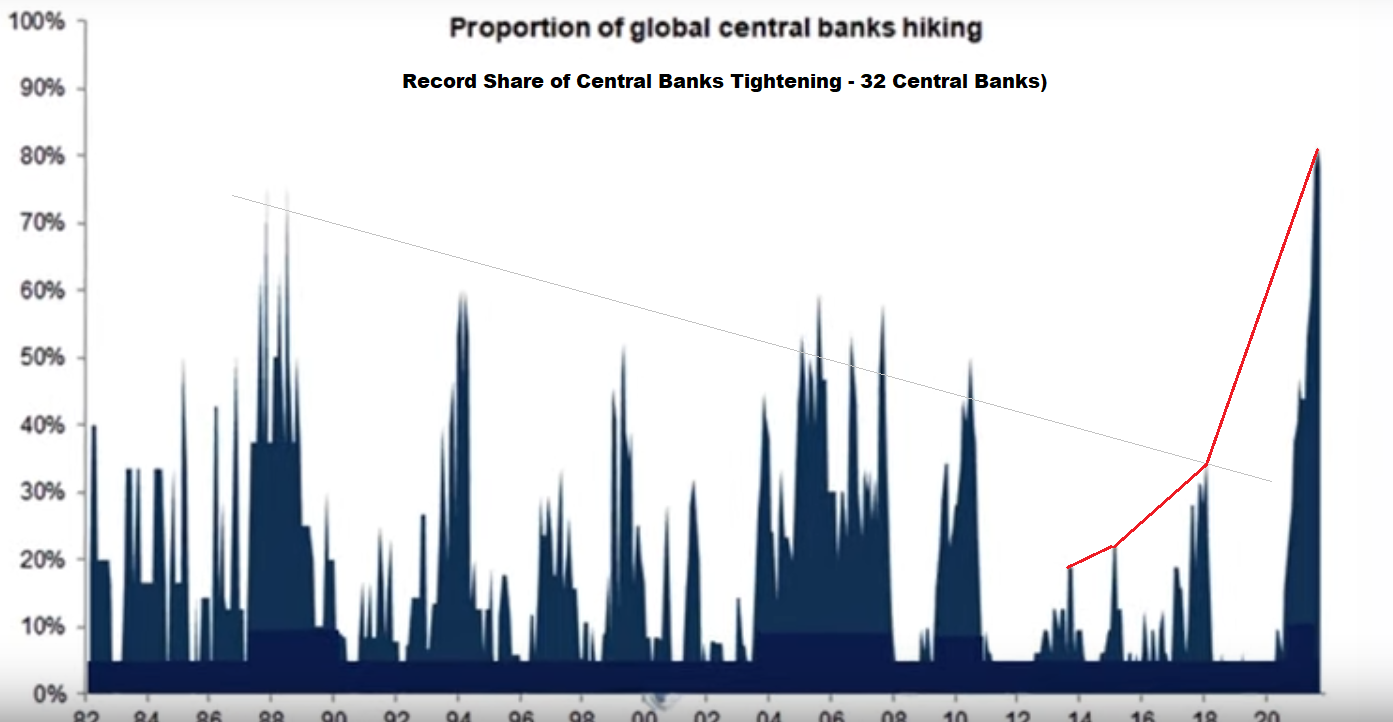

AN UNPRECEDENTED SHOCK – BOTH THE NUMBER OF CENTRAL BANKS INCREASING (32) & THE RATE OF THE FED FUND INCREASES!

Wishful thinking, misleading narratives and an unaccountable few at the Federal Reserve have unleashed on the global economy a series of unnecessary and deadly shocks. Shocks that are only now being fully felt!

The Federal Reserves unprecedented and rapid rise in rates has driven the dollar and US real rates parabolic. The global fall-out are truly consequential.

While at this point minor compared to the immediate, starvation-level situation wrought by the rising dollar in places like Nigeria, Egypt, Argentina, or Kenya, the full impact of the Federal Reserve’s top to bottom bungling of inflation on its major advanced trading partners has yet to fully materialize. Changes in the real economy lag changes in interest rates, but already warnings from Seoul and Delhi suggest the reversal of capital flows resulting from capital moving into treasuries is hindering necessary investment. Though, that may pale in comparison to the damage of a global recession, which the World Bank, International Monetary Fund and World Trade Organization all now warn is increasingly likely, and due in no small part to the precipitous pace of the Fed’s rate increases.

Had the Federal Reserve been bound by some version of the Taylor rule, rates would have automatically adjusted as soon as inflation began to tick up in 2021.

So far the US has been effective in delaying its impact on the US. However, the shock was only delayed not avoided. The shock is now washing ashore as slowing global trade growth.

CHART BELOW: The big shock is best assessed as the timing of the 12 month change in the Yield of the 2 Year US Treasury Bill.

THE SETTING UP & TRIGGERING OF MAJOR COUNTER RALLIES

My experience in the markets is when everyone is on the same side of the boat in their thinking, the underlying basis of that thinking is found to be flawed. Experienced and cynical traders simply suggest that “the purpose of the market is to extract as much money as possible from its unwitting participants!”

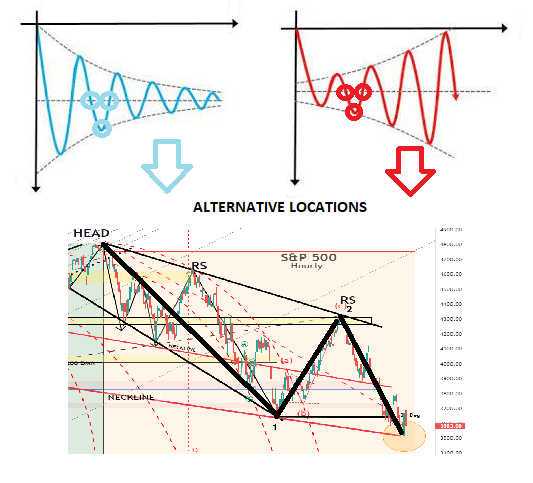

As the chart below clearly illustrates with the current Put/Call Premium, we have reached an unprecedented belief that the market is about to fall in a massive way! However, history shows us by the red circles this has actually turned out to be a market bottom and the best time to be buying. Our cynical traders would suggest this is the point where the market extracts the maximum amount of money and pain! What will it be this time?

The illustrations below suggest that as Bear Markets’ counter rallies get larger, the Bear Market grow deeper and older. This was the case for both the 2 year Dotcom implosion and duration of the Great Financial Crisis (GFC).

|

|

|

WE ARE FAST APPROACHING A MAJOR COUNTER RALLY.

THE S&P 500 COULD FALL FURTHER BEFORE THIS COUNTER RALLY OCCURS

CONCLUSION

MANAGING BOTH FRAGILITY

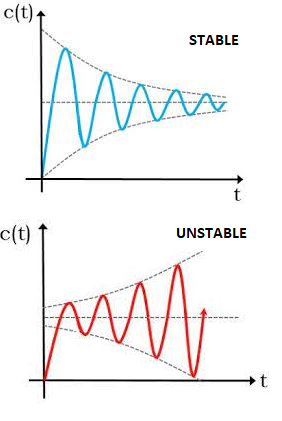

The central question is whether the Financial Markets are presently stable or becoming unstable? Both have different profiles.

We are presently at the point where either may unfold. We have reached a critical time in the markets’ direction.

So far, as we attempted to demonstrate above, the markets have been controlled. Can this continue or are the natural global forces becoming too large for Central Banks and government Treasuries to continue to manage?

Time will tell, but our experience is to never under estimate the “powers-to be” to “cheat” to effectively attempt to “Kick-the-Can-Down-The Road”. Anything to avoid being held responsible or blamed! In prior crisis these hidden actions taken, were altering the accounting for Derivative on the books of the Central Banks in the form of cancelling “Mark-to-Market” accounting.

We suspect this time around the “powers-to-be” will use Fiscal Policies of off balance sheet “CONTINGENT LIABILITY” accounting to “juice” the markets if they were to fall significantly below the current critical support levels.

THE WORST IS STILL IN FRONT OF US,

EXPECT ANOTHER SHORT TERM BEAR MARKET COUNTER RALLY ,

FADE THE UNFOLDING COUNTER RALLY – SELL THE RIPS.

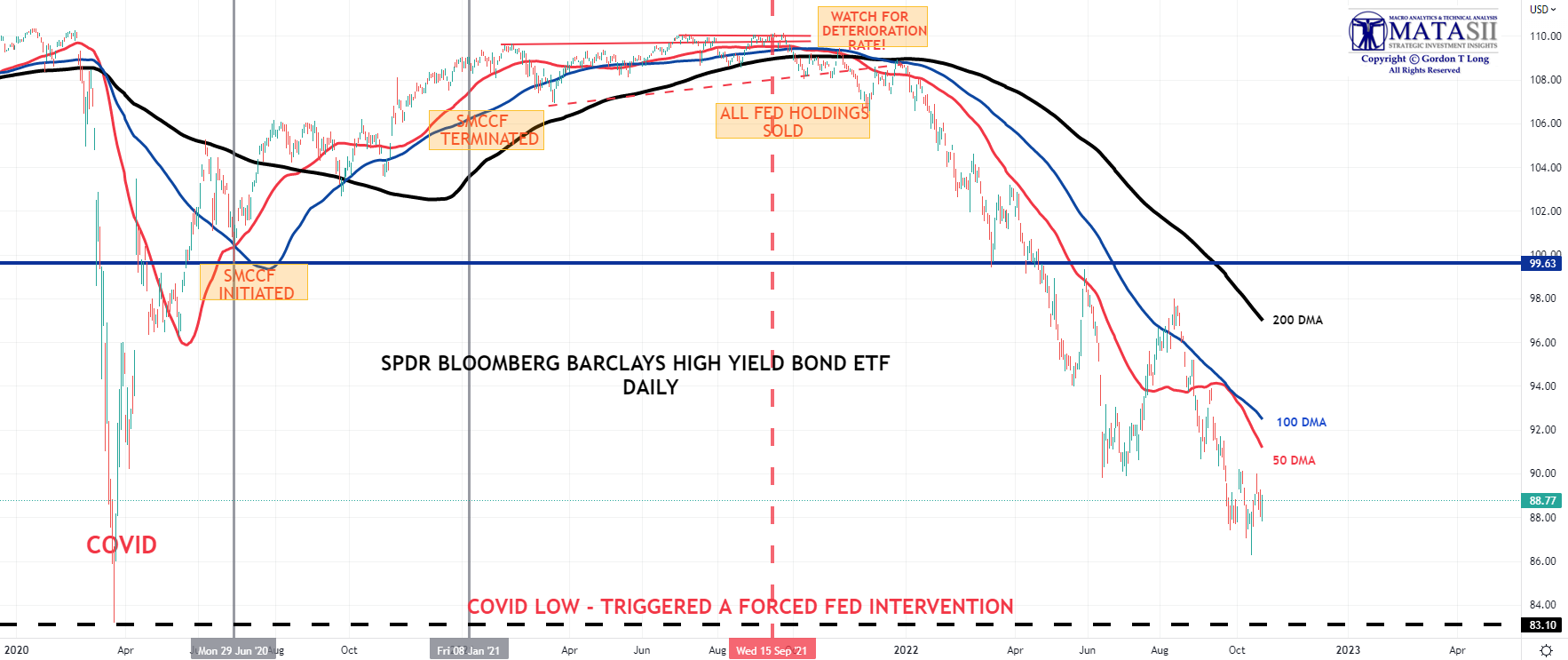

CREDIT MARKETS AR COMING APART

Credit markets are a bloodbath with LQD breaking back below $100 – the same level it traded at in Sept 2008 when Lehman collapsed and the credit market froze. For now, HYG is trading just marginally above the March 2020 COVID lockdown lows in price (when The Fed took the unprecedented action of buying junk bonds).

YOUR DESK TOP / TABLET / PHONE ANNOTATED CHART

Macro Analytics Chart: SUBSCRIBER LINK

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.