|

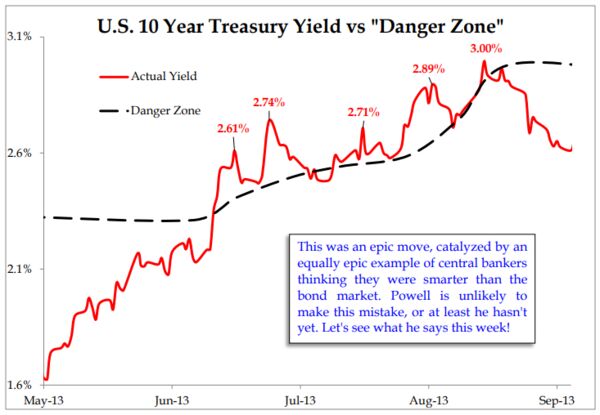

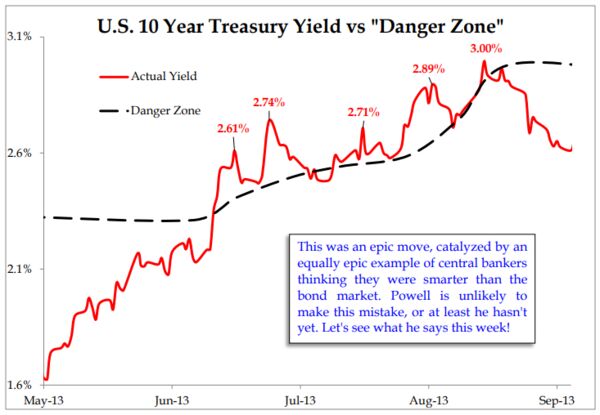

ANOTHER TAPER TANTRUM?

Compare and contrast with the infamous “taper tantrum” of 2013, when bond yields shot up in response to a shift in messaging from the Fed’s Ben Bernanke. On that occasion, yields spent the better part of two months in Tzitzouris’s danger zone. This led to an initial fall in U.S. stocks, and then to severe problems for a range of emerging markets. Compare and contrast with the infamous “taper tantrum” of 2013, when bond yields shot up in response to a shift in messaging from the Fed’s Ben Bernanke. On that occasion, yields spent the better part of two months in Tzitzouris’s danger zone. This led to an initial fall in U.S. stocks, and then to severe problems for a range of emerging markets.

Why does it work that way? Tzitzouris suggests it is because of the wide use of leverage.

For leveraged investors using popular models based on value at risk, it needn’t take a rise of more than 20 or 25 basis points to force them to close a position — which means selling stocks. That is what happens if the rise happens quickly. If the rise happens slowly, and remains below the danger zone, they can take evasive action by rotating toward stocks with cheaper valuations, rather than bailing out of equities altogether. The speed of the increase matters.

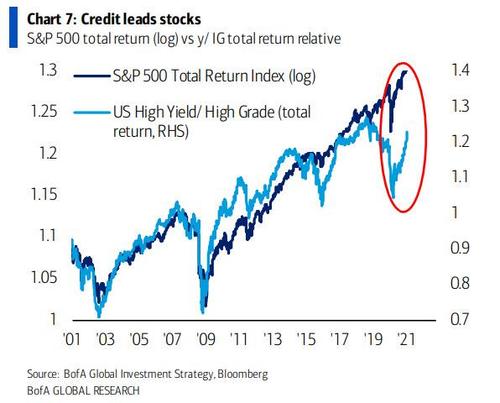

So far, the rise in bond yields has been enough to force a big rotation within stocks, but not one at the level of asset classes, from equities back to bonds.

Thinking through the intuition further, if a rise in bond yields is due to higher growth expectations (which is the case this time), and those expectations also raise expectations for future earnings, higher rates can be dealt with, at least in the models that investors use. When rates rise due to a change of philosophy by the Fed (as in the taper tantrum), or due to an attack by bond vigilantes, then this is much more damaging to the stock market.

So far, this increase in bond yields hasn’t been anything like 2013.

It is a fair guess that if real yields were continuing to move upward in a straight line, as they did in spring 2013, stocks would be staging quite a selloff. But they aren’t. The latest inflation numbers helped stall the rise in bond yields.”

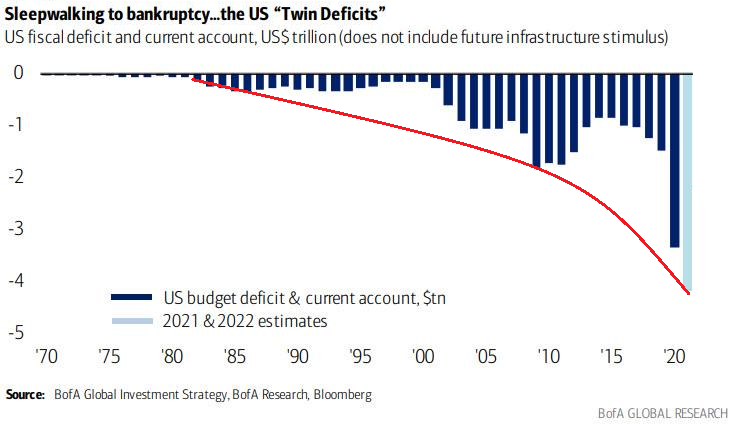

THERE IS NO SIGN OF A SECULAR SHIFT IN INFLATION (CURRENCY DEBASEMENT: YES!)

It could be a while before we can discern the outlines of whether we truly have a secular shift toward higher inflation.People who seldom get these things wrong, like Dr Lacy Hunt say no to any evidence of such a secular shift as he continues to stay long the US long term bond.

If we consider non-fiat money like Gold and Black Gold, it suggests things are only trying to normalize towards a post Covid era..

|

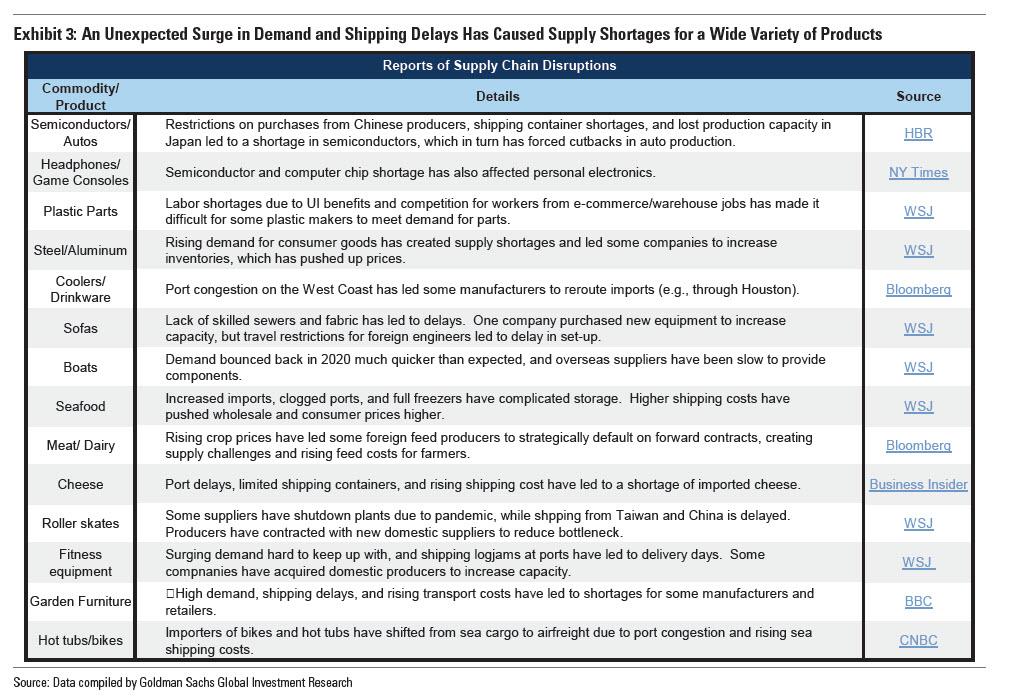

The five-year five-year forward break-evens are suggesting that the market is expecting prices to cool and average almost exactly 2% over the coming years. That suggests positive reflation over the next few years, but not a return to a true inflationary regime and psychology. The present inflation pressure is significantly about global supply chains being broken and shortages of

The five-year five-year forward break-evens are suggesting that the market is expecting prices to cool and average almost exactly 2% over the coming years. That suggests positive reflation over the next few years, but not a return to a true inflationary regime and psychology. The present inflation pressure is significantly about global supply chains being broken and shortages of

Compare and contrast with the infamous “taper tantrum” of 2013, when bond yields shot up in response to a shift in messaging from the Fed’s Ben Bernanke. On that occasion, yields spent the better part of two months in Tzitzouris’s danger zone. This led to an initial fall in U.S. stocks, and then to severe problems for a range of emerging markets.

Compare and contrast with the infamous “taper tantrum” of 2013, when bond yields shot up in response to a shift in messaging from the Fed’s Ben Bernanke. On that occasion, yields spent the better part of two months in Tzitzouris’s danger zone. This led to an initial fall in U.S. stocks, and then to severe problems for a range of emerging markets.