AN APPROACHING GLOBAL RISK-OFF PIVOT

The following has now occurred:

-

- Last week the ECB was the second giant to Taper bond purchases,

- Bank of Japan has already ended QE.

- Bank of Canada shed 15% of its assets.

- Bank of England & Reserve Bank of Australia are tapering.

- Reserve Bank of New Zealand quit QE cold turkey.

- Riksbank will end QE this year.

- The Fed is expected to soon announce QE Tapering and for it to begin in November.

THERE WILL BE UNINTENDED CONSEQUENCES!

|

FIRST CONSEQUENCE:

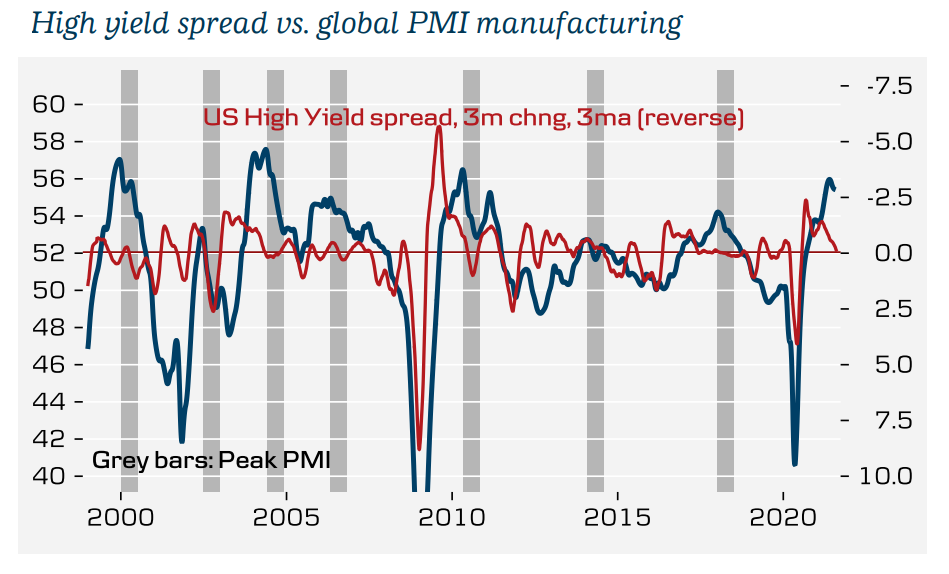

Who is going to buy the mountain of Corporate Junk Bond Debt now required to keep Zombie Corporation afloat along with its existing “rolling over”. All this as an accelerating economic slowing takes hold of the global economy and its cash positions?

WE HAVE A GLOBAL PROBLEM!

GLOBAL PMI HAS PEAKED

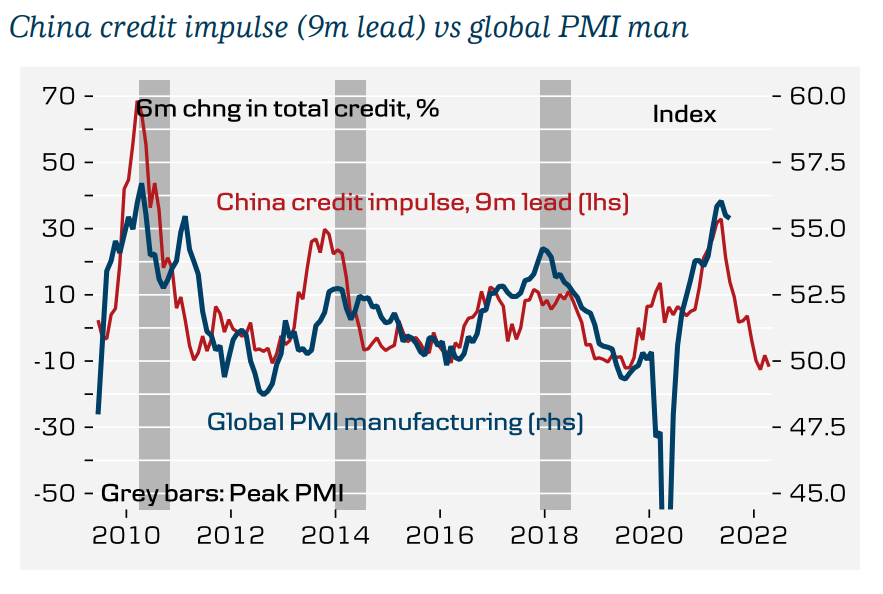

In the September UnderTheLens video we featured 10 Global PMI slides against many of the world’s leading indicators. It made it quite evident that the Global economy is slowing significantly and signaling deepening concerns. Since the 2008 Financial Crisis, the Chinese Credit Impulse has been one of the most important indicators to watch. Chinese Credit was directly responsible for taking the global economy out of the fallout from the US Financial Crisis.

|

|

|

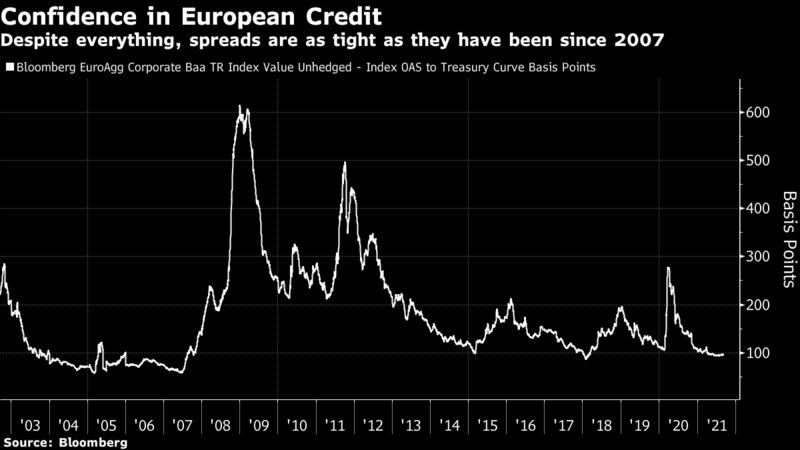

HIGH YIELD CREDIT IS TO QUIET!

A “RECALIBRATION” OF QE

Following in the footsteps of the Bank of England, which had denied in May that its tapering was tapering, and in the footsteps of the Bank of Canada, which had also denied last October that its tapering was tapering – though it has since then cut QE to nearly nothing and shed 15% of its assets – ECB President Christine Lagarde also denied at the press conference last week that tapering was tapering, and stressed that tapering was instead ….

“A Recalibration of QE”.

The hidden question and elephant in the room is:

WHO IS GOING TO BUY ALL THE TRIPLE C DEBT THAT IS GOING TO BE ROLLED OVER??

With a global slowdown happening and beginning to accelerate, High Yield Junk Bonds and HG Triple CCC debt are dramatically exposed!

IT WILL TAKE ONLY ONE PLAYER (Like Evergrande in China) to begin a Global Cascading DOMINO!

|

|

|

|

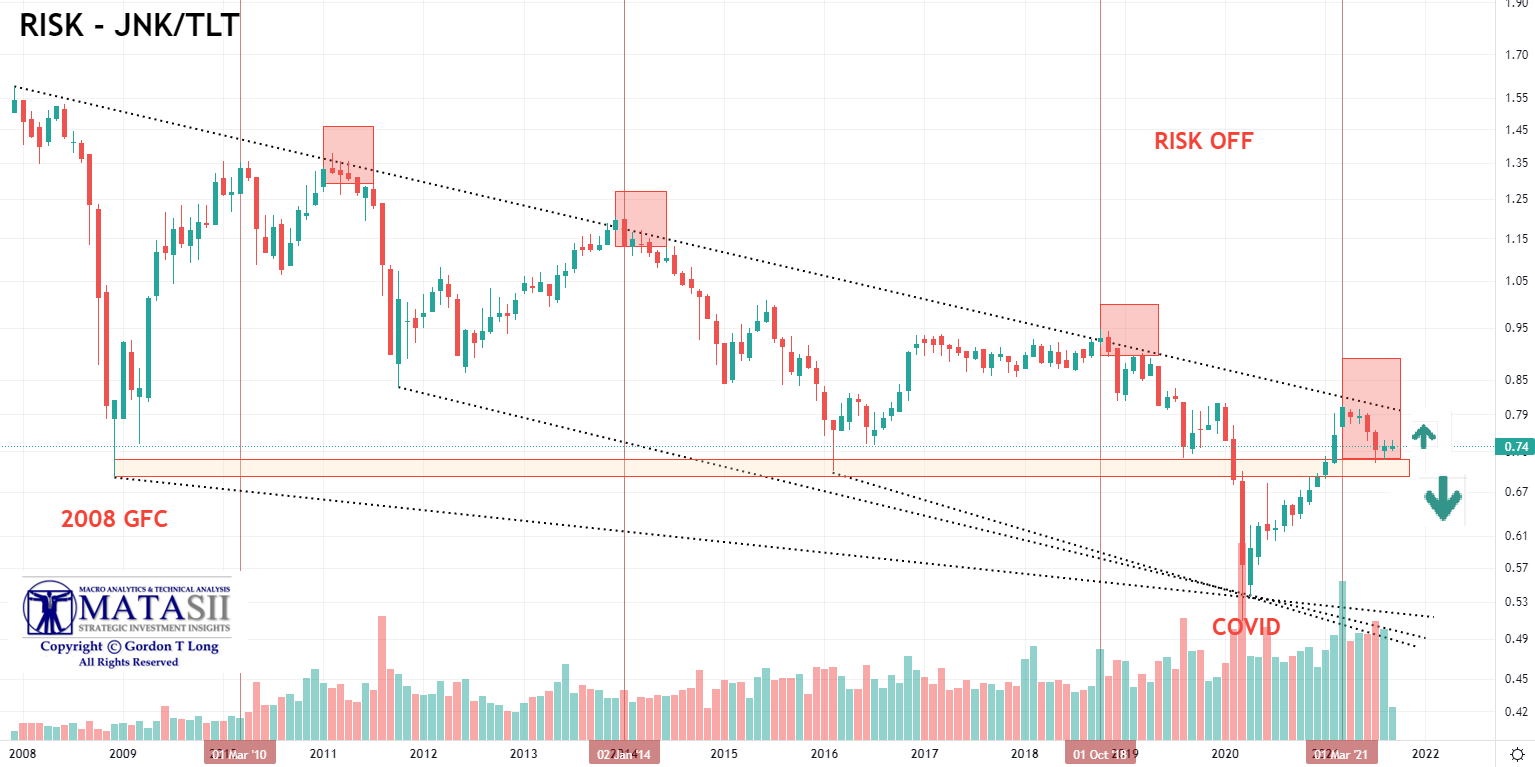

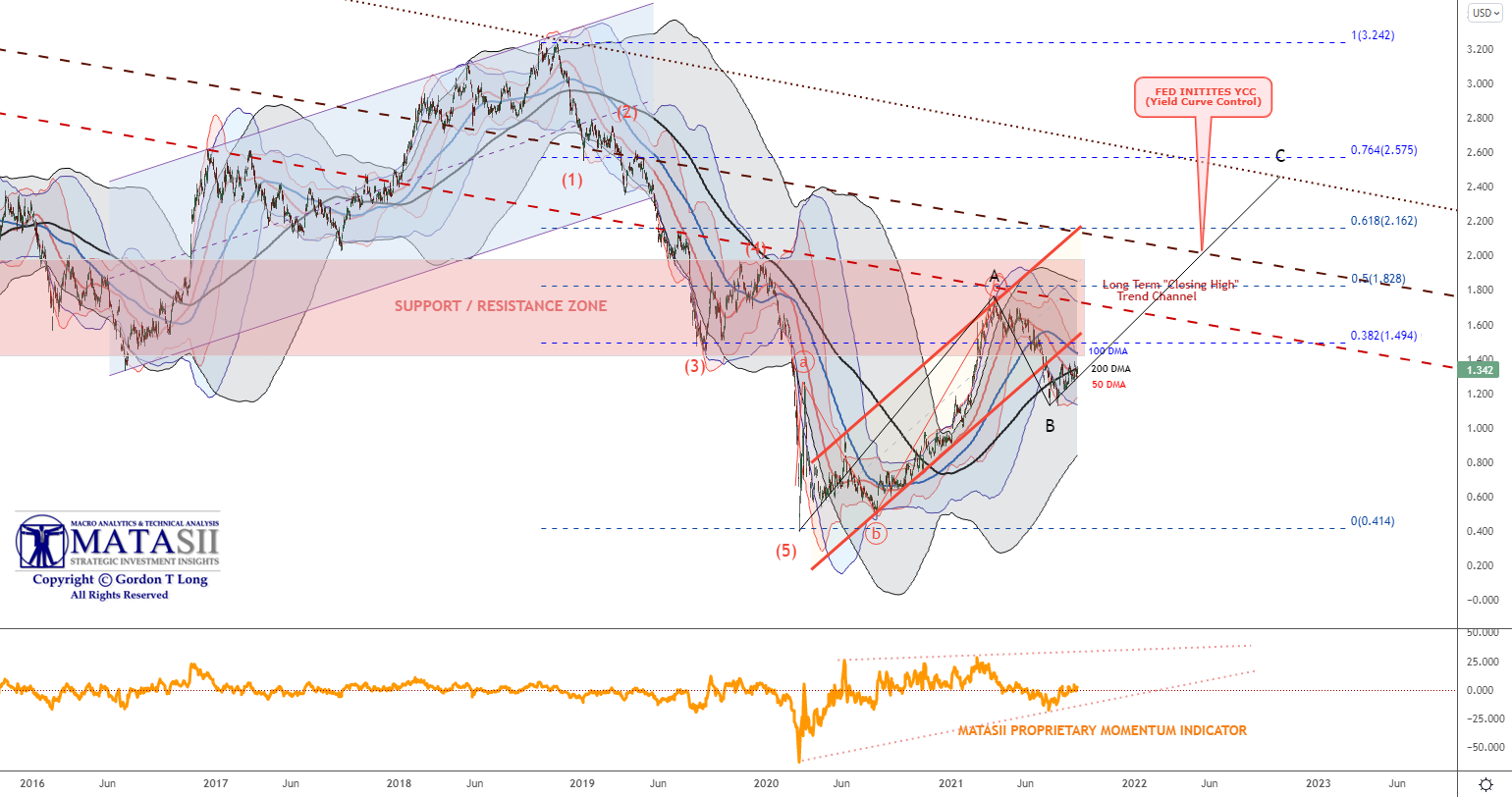

THE MATASII RISK-OFF MEASURE

The chart below is one of the ways we at MATASII.com monitor RISK-On and RISK-Off shifts. When the JNK:TLT ratio on a log scale is rising we consider it a RISK-ON environment. When it falls (as you see clearly with the 2008 GFC and the 2020 Covid shock), then we have a RISK-Off environment. You can see by the pink boxes we normally have six months of warnings before signs start to really show for a major RISK-OFF pivot. Such is the current situation.

You will notice that since the 2008 Financial Crisis the overall ratio is in decline. We will have more to say on the critical significance of this in our upcoming October UnderTheLens video.

It will take a relative fall in JNK and rise in Bonds to trigger a MAJOR RISK-off event. We feel a RISK-ON will briefly occur first at yields rise due to inflation and prices will fall. As 10Y Treasury Notes approach 2% nominal rates the RISK -OFF TRADE will then occur with a flight to relative safety within the US bond market. This is shown below by the green arrows and further below by what is driving Treasury yields.

|

|

|

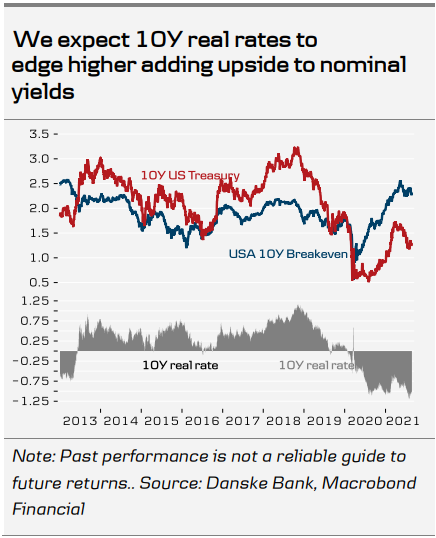

INFLATION BREAKEVENS GOING HIGHER

Markets are treating Inflation as both Cyclical and Transitory. It is not! It is Secular and will be Persistent!

Though Supply Chain issues may prove to be transitory (and we suspect many are permanent), inflation is not transitory for at least five secular reasons:

- Owner Occupied Rent (OER),

- Labor Costs (Why bond yields rose on August’s Non Farm Payrolls),

- Import Costs,

- Financing Costs,

- Three Level Government Charges (Explosion in Taxation).

Minimally 10Y Breakevens are headed moderately higher and likely worse. As the Long Term FRED chart to the upper right shows we can expect 10Y Breakevens to break through 2.5% and push 10Y Yields towards 2.0% nominal rates.

|

|

|

|

CONCLUSION

There is a MAJOR global accident ready to happen in

High Yield (Junk) Credit and IG Triple CCC Corporate Debt!

-

- As of August 2020, ICMA estimates that the overall size of the global bond markets, in terms of USD equivalent notional outstanding, is approximately $128.3tn. This consists of $87.5tn SSA (Sovereign, State, Agency) bonds (68%) and $40.9tn corporate bonds (32%).

- The SSA bond markets are dominated by the US ($22.4tn), China ($19.8tn) and Japan ($12.4tn). Between them they total 62% of the global SSA market. Sovereign bonds constitute 73% ($63.7tn) of the global outstanding SSA market.

- In terms of country of incorporation, the global corporate bond markets are dominated by the US ($10.9tn) and China ($7.4tn). Between them they comprise 45% of the total global corporate bond market. 53% ($21.5tn) of outstanding corporate bonds are issued by financial institutions.

- High-yield debt issuance has totaled $298.7 billion in 2021, up 51.1% from the same point in 2020, a year itself that saw a record-smashing $421.4 billion in junk issuance, according to SIFMA data. At the same time, investment-grade issuance has plunged 32.7% this year.

|

|

|

CHINA: “Following the news of Evergrande’s dollar bonds due in 2023 slumping to a new low this week of 23.81 cents on the dollar (slightly rebounding to 25 cents on the dollar Friday) – Evergrande has become one of the biggest financial risks in China – the epicenter of a potential default shockwave given its massive pile liabilities to banks, shadow lenders, companies, investors, vendors, and home buyers.

In two separate protests, mobs of China Evergrande Group customers and employees demonstrated this week as the world’s largest developer faces soaring probabilities of default. According to Bloomberg, the first demonstration was held in Guangzhou as more than 100 home-buyers attended a demonstration in front of the Nansha district’s housing bureau Thursday wearing shirts that read “Resume construction, Evergrande.” Many of these customers are becoming increasingly angry as multiple large condominium projects have been halted for months, including the massive 5,000 apartment complex called Evergrande Peninsula since May.

The developer is stuck between a rock and a hard place as it struggles to restart stalled construction work due to its whopping $148 billion owed in trade and other payables to suppliers as of June. The company has more than $300 billion in liabilities and has been dubbed “China’s Lehman.” However, Beijing gave the company a lifeline Thursday by renegotiating payment deadlines with banks and other creditors.”

CHINA: Mobs Of Angry Evergrande Homebuyers And Employees Begin To Protest

|

|