|

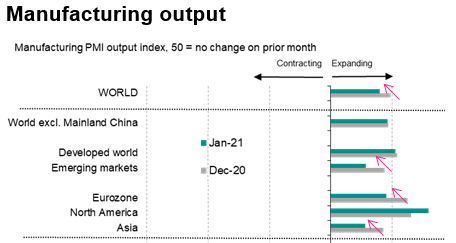

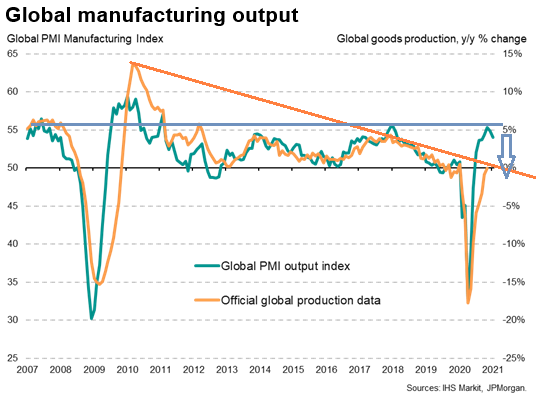

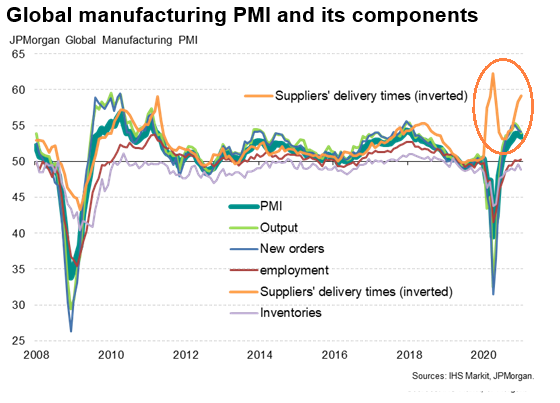

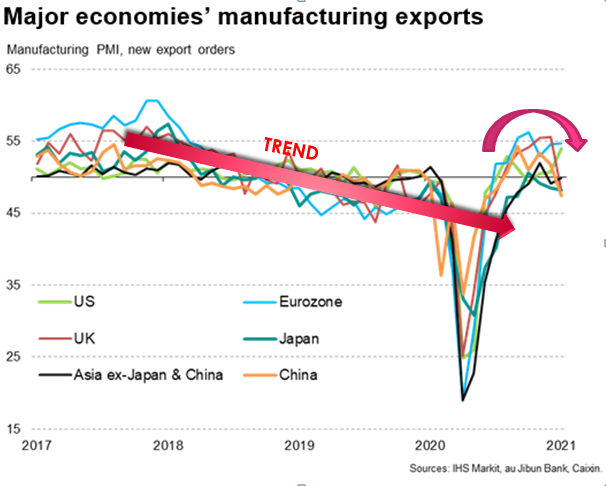

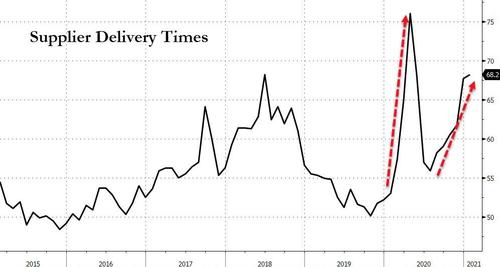

The Global Manufacturing PMI came in at 53.5 in January, down from 53.8 in December. Production growth remains strong but is easing as exports are close to stalling, led by renewed fall in China. Supply chain delays are close to their highest since 2004 while Prices are rising at their steepest rate in nearly a decade.

WE HAVE EXPERIENCED A RECOVERY ‘SURGE SHOCK’ THAT IS STALLING ON ‘SHORTAGES’

The IHS Markit reported “US manufacturing started 2021 on an encouragingly strong footing, with production and order books growing at the fastest rates for over six years … demand from both domestic and export customers picked up sharply in January, buoyed by several driving forces.

- Consumer demand has improved,

- Businesses are investing in more equipment and restocking warehouses,

- Businesses are preparing for better times ahead as vaccine roll outs allow life to increasingly return to normal over the course of 2021.”

However,

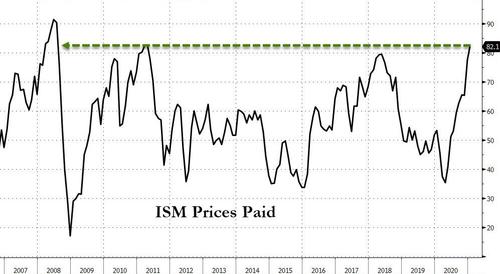

“Manufacturers are encountering major supply problems, however, especially in relation to sourcing inputs from overseas due to a lack of shipping capacity. Lead times are lengthening to an extent not previously seen in the survey’s history, meaning costs are rising as firms struggle to source sufficient quantities of inputs to meet production needs. These higher costs are being passed on to customers in the form of higher prices, which rose in January at the fastest rate since 2008. These price pressures should ease assuming supply conditions start to improve soon, but could result in some near-term uplift to consumer goods price inflation.”

Chris Williamson,

Chief Business Economist at IHS Markit

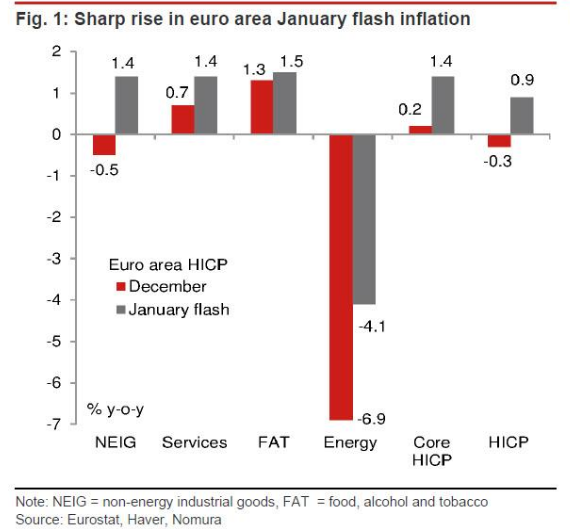

The Euro area HICP inflation rose strongly in January, with all of the big four surprising to the upside. The most notable rise came from Germany, where inflation rose to 1.6% y-o-y from -0.7%, but there were significant rises too in France (to 0.8% from zero), Italy (to 0.5% from -0.3%) and Spain (to 0.6% from -0.6%). Overall, euro area inflation in January rose to 0.9% from -0.3%, an upside surprise of 0.3pp, while core inflation rose to 1.4% from 0.2% in the previous month, an upside surprise of 0.5pp.

SHORTAGES ARE RESULTING IN RISING SUPPLY COSTS

SUPPLY CHAIN DISRUPTIONS – SHORTAGES

- COUNTRY SPECIFIC: Emerging Markets, Europe and Asia (See chart – top of page)

MATERIAL COSTS

|

TRANSPORTATION BOTTLENECK COSTS

TRANSPORTATION BOTTLENECK COSTS