MACRO

MONETARY & FISCAL POLICY

TOO MANY TO SAVE?

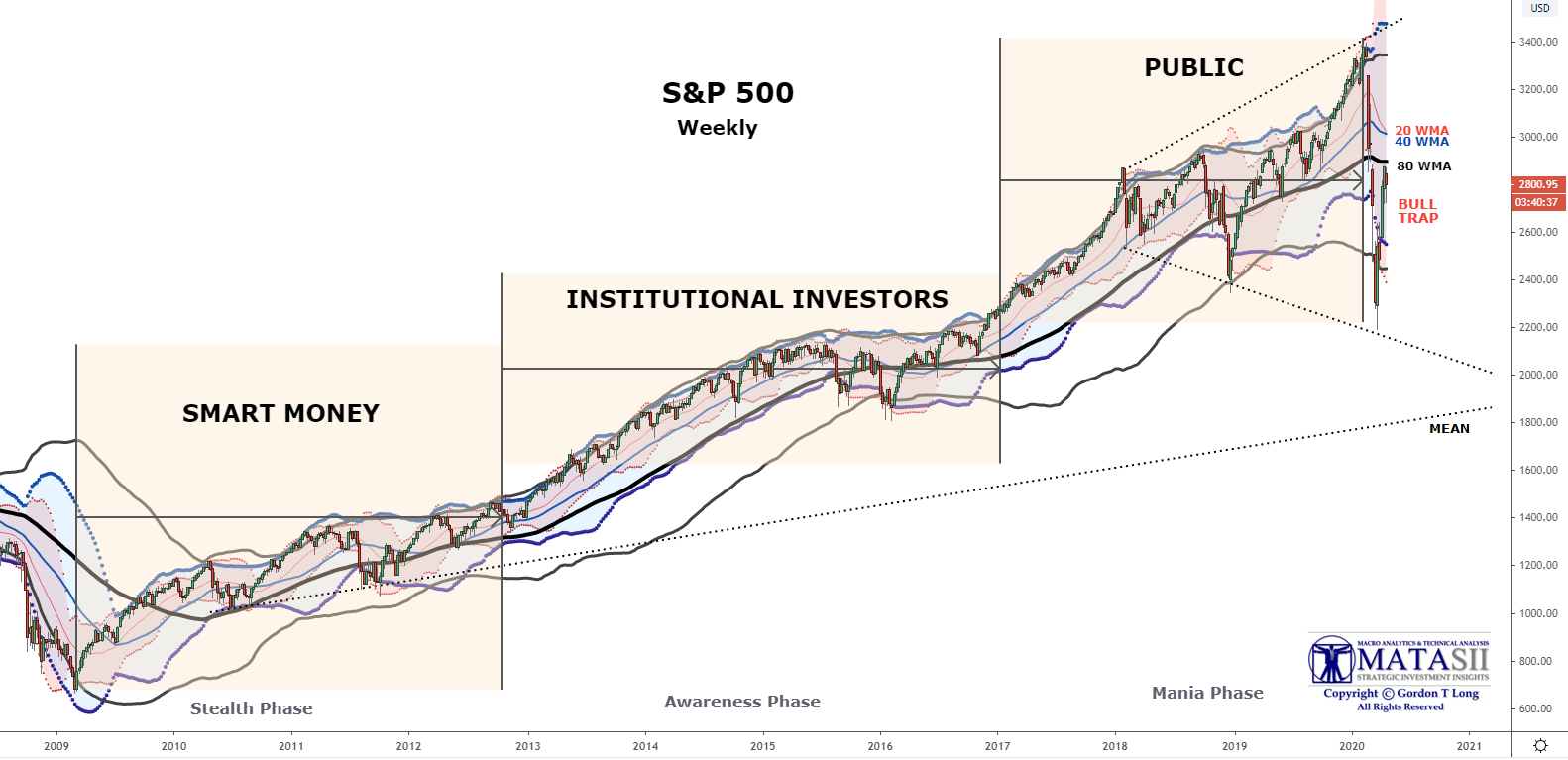

- SMART MONEY: While everyone is demanding “Bailouts”, the Smart Money is “Bailing”! Smart Money and Institutions are quickly realizing that “Bailing” only works for certain size boats. No competent Captain would command the crew and passengers to begin “Bailing” in an attempt to try to arrest the ‘Titanic’ from sinking?

- Who isn’t asking for a Bailout, Loan, Debt Forgiveness or some form of Government assistance? Are governments actually capable of supplying this level of relief without destroying a fragile and unbalanced global financial system?

- What are the longer term consequences of attempting or succeeding in meeting the expectations and demands of society?

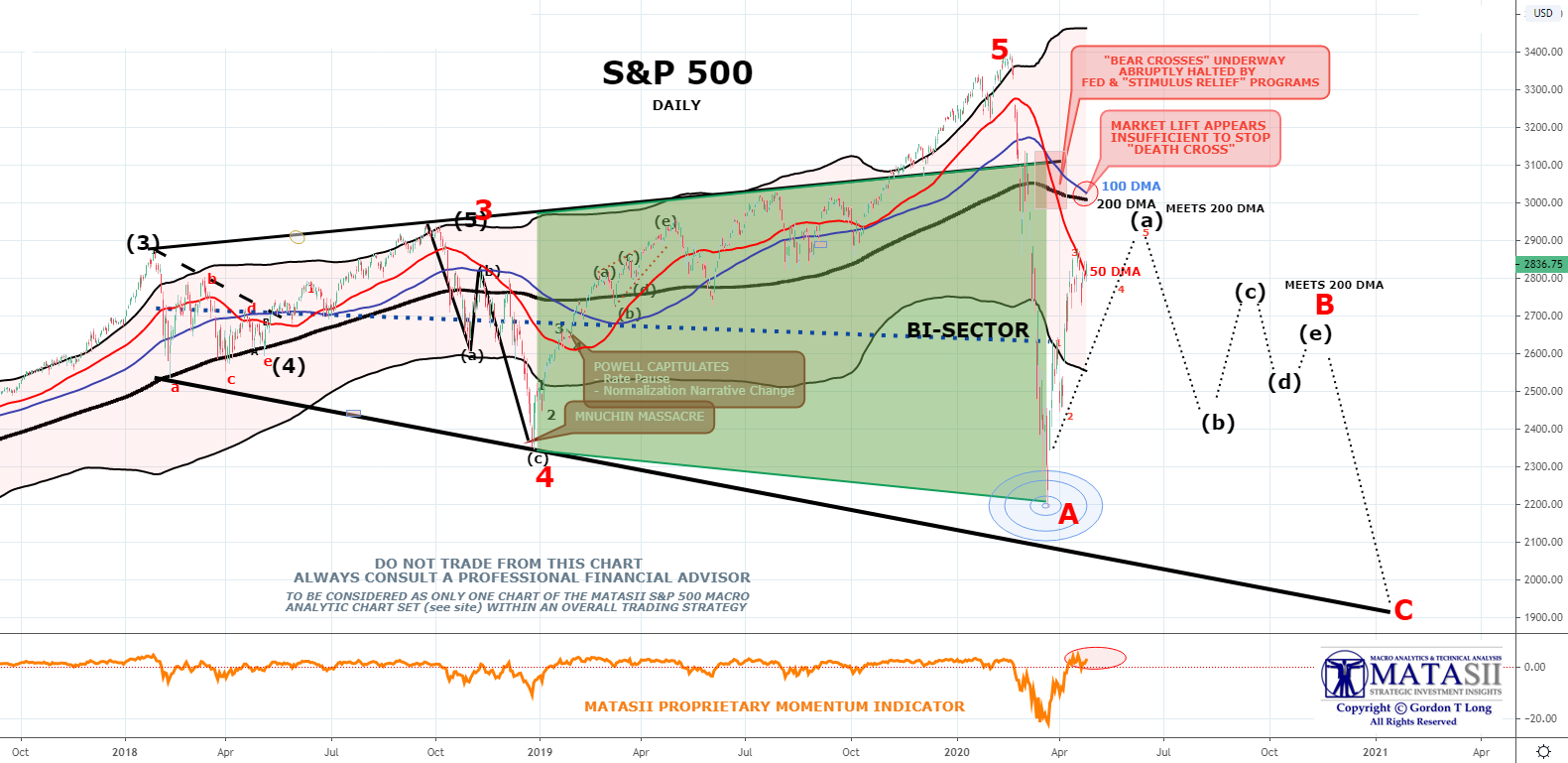

- MONETARY POLICY: Is attempting through a litany of ‘Facilities’ employed during the last Financial Crisis, along with never previously used policy initiative for DOLLAR SWAPS, BOND BUYING and OUTRIGHT LENDING to keep markets liquid and prevent insolvencies from occurring. Corporate Bonds of both IG and HY, Small Business Loans, Currency Swaps to almost all Global Banks are just some areas of the expanding reach of the Federal Reserve, in a doubling of its Balance Sheet. These are discussed in this months UnderTheLens Video

- FISCAL POLICY: Nearly $3 Trillion of Fiscal spending is presently being distributed in some amount (without repayment clauses) to almost every Citizen and Business in America.

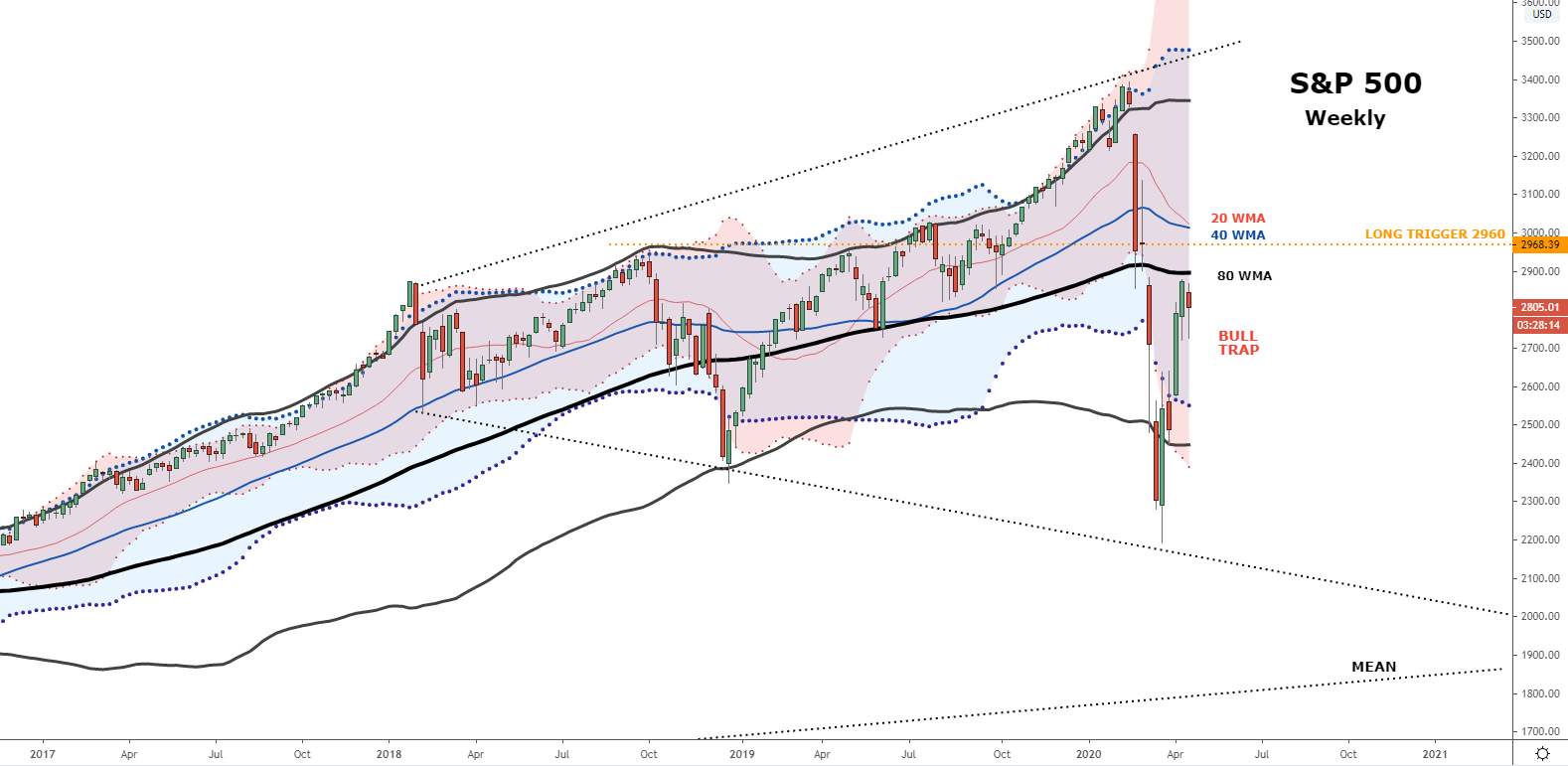

- There is certainly no guarantee, based on the amount of liquidity currently being pumped into the system by central banks and government deficit spending, that market can’t be manipulated higher. However, an almost total collapse in Employment, Earnings and GDP Globally doesn’t bode well for equities going forward.

- Market Momentum is decreasing, while lending standards are tightening, credit ratings are being slashed, bankruptcies and business distress incidents are increasing. It is becoming increasingly evident that the process of getting economies back to work is going to take longer and be more phased than originally anticipated.

- As the Weekly S&P 500 chart below shows, the 20 WMA is about to cross the 40 WMA to the downside as price attempts to reach the longer term 80 WMA.

- The 200 DMA and 80 WMA appear to be strong indicators of overhead resistance. The degree of massive relief and liquidity injections undertaken should be showing stronger results according to our analysis.

- Economies around the world are not taking as aggressive actions as the US. With companies today typically depending on more than 50% of their revenues being generated from International operations it raises questions as to whether the US efforts will be sufficient.

- The problem may well be far larger than sovereign budgets and currencies can surmount. As we have pointed out in prior videos we worry about a $600 Trillion Interest and Currency SWAP market now in disarray due to the historic Oil debacle.

- The question is whether the global GDP approximating only $80T is actually sufficient to handle the severe disruptions occurring in the unregulated, off-balance sheet, OTC Swap’s market???

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.