|

SOME SIMPLE ARITHMETIC

THE LAW OF BIGGER NUMBERS

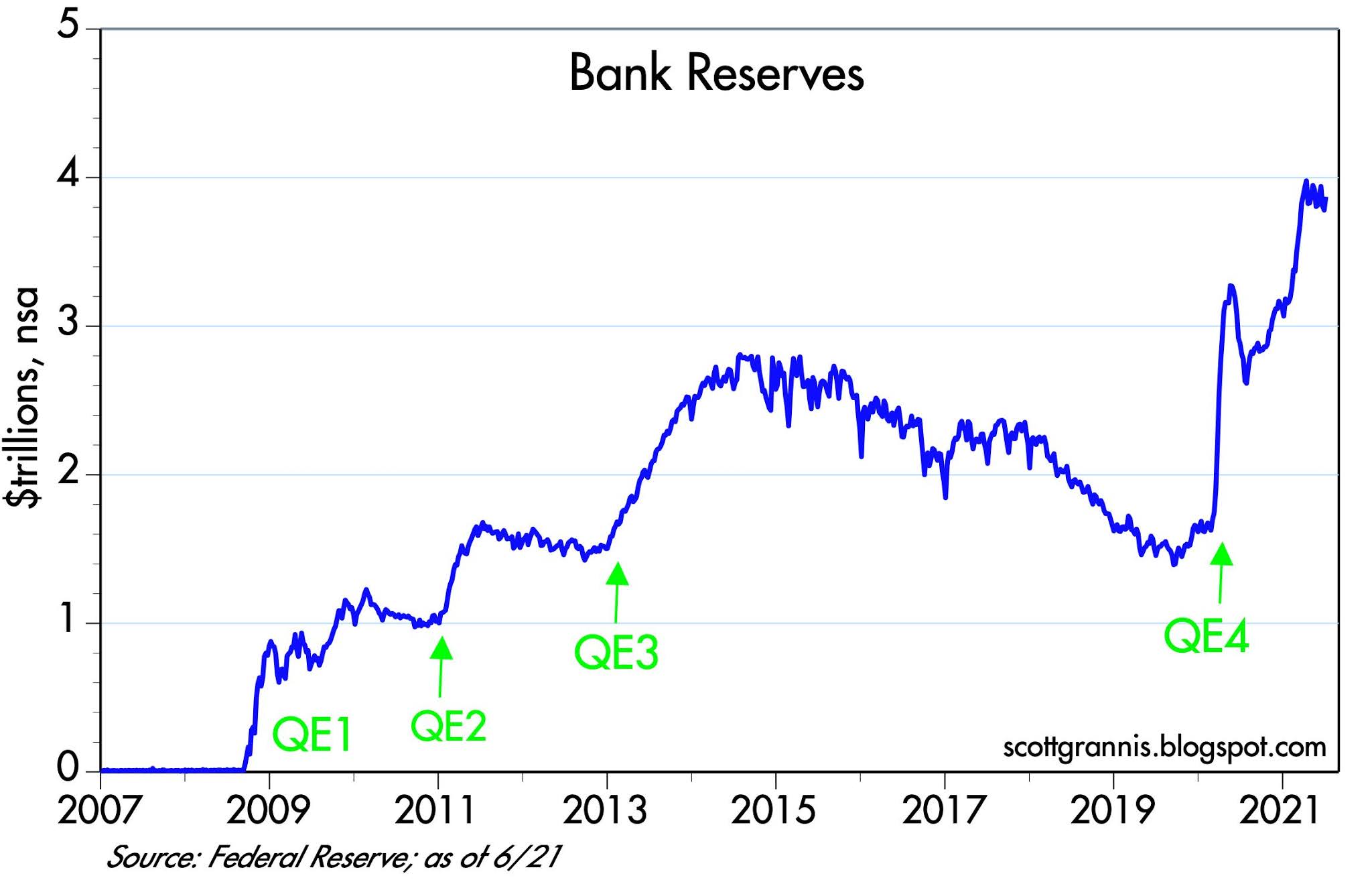

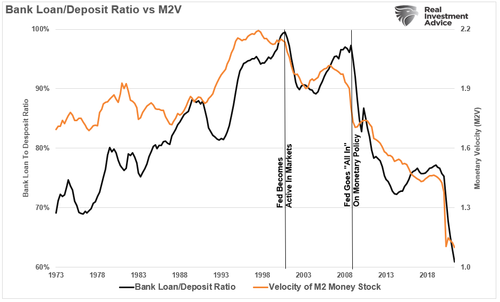

Prior to the financial crisis, bank profits depended on each bank holding a productive loan portfolio, with the result that banks minimized their excess reserves.

Starting in late 2008, the Fed began to pay interest on reserves, providing banks risk-free income as an alternative to lending, which had suddenly become far riskier (growing percentage of Zombie corporations and leverage used). The Federal Reserve’s interest rate on reserves (IOER) was 2.5%, significantly more than what banks were paying on most checking accounts.

Banks, Shadow Banks and the Wealthy as a result couldn’t can’t get enough of this easy money as the chart to the right (top) shows

With rates paid by the Fed on excess bank reserves 2.5% it may seem like a minor anomaly, but here is the slight of hand. What is 2.5% of $4Trillion?

ANSWER: $100B Net

This is risk free, guaranteed and issued as a credit to the banks excess reserve account. To put this in perspective the net earnings of the US five largest banks is expected to be by the end of 2021 less than $160B with growing loan loss reserves.

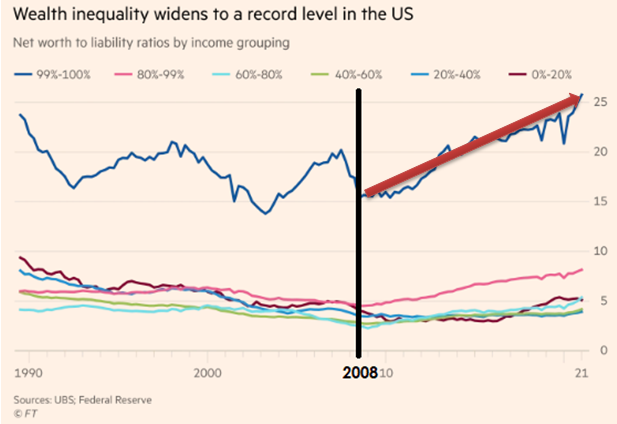

With these profits assured and zero bound rates the banks were willing to lend to primarily those who could leverage cheap money without taking on traditional risk. This normally meant those living off government contracts, have revenue guarantees and the already wealthy with solid collateral wanting to take on calculated market risk and cleverly reduce taxable income. The result has been that the rich got richer while “mainstreet” effectively got chocked from the money spigot.

BUT NOW THE FED HAS CHANGED THE RULES FOR THE BANKS!

The Fed reduced the interest it paid on reserves to 0.1% in early 2020, but recently raised it to 0.15%. Once the Fed stops paying interest on these huge ‘buffer stocks’ of bank reserves, the Fed felt the banks would be more incentivized to lend them out knowing if this did happen inflation would be expected to skyrocket.

|

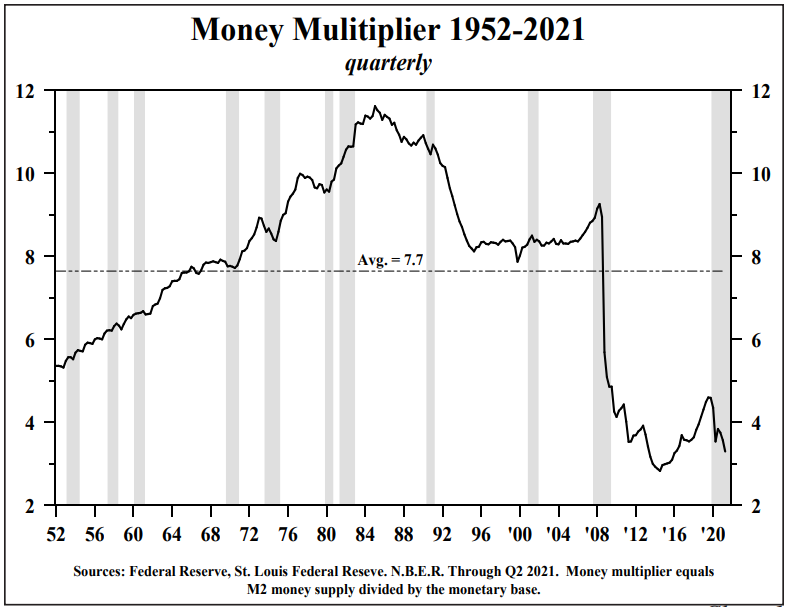

FIRST: THE MONEY MULTIPLIER

FIRST: THE MONEY MULTIPLIER

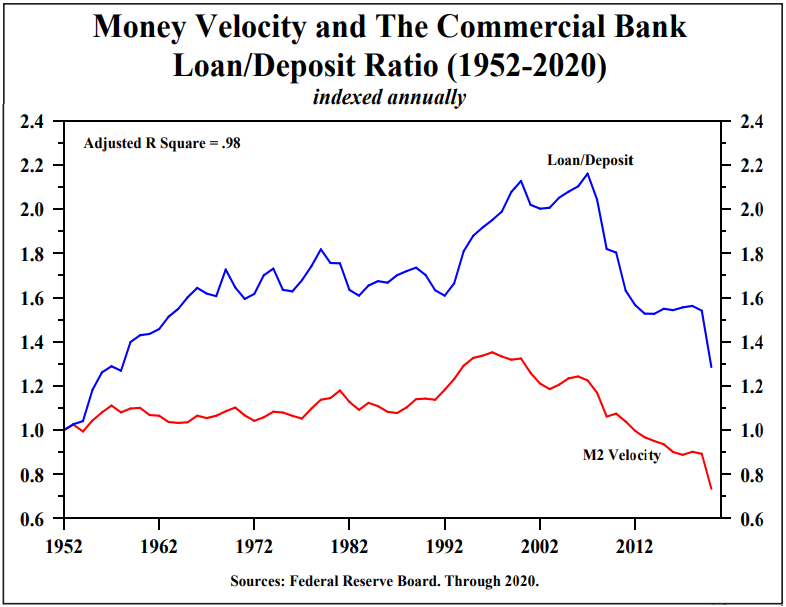

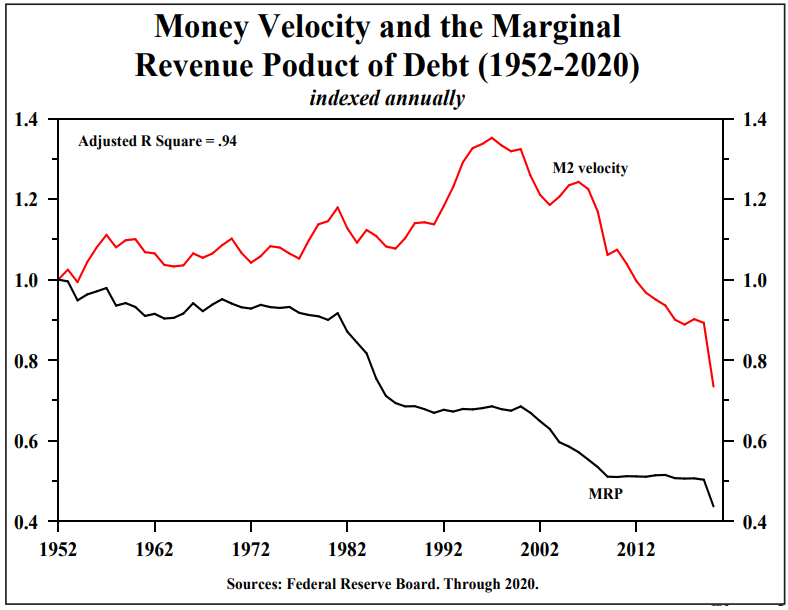

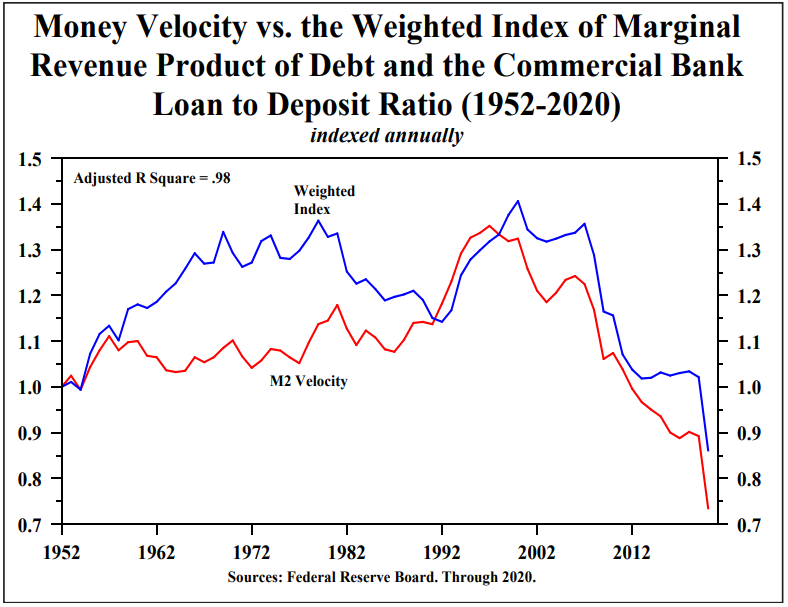

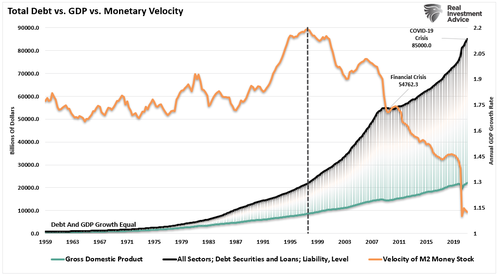

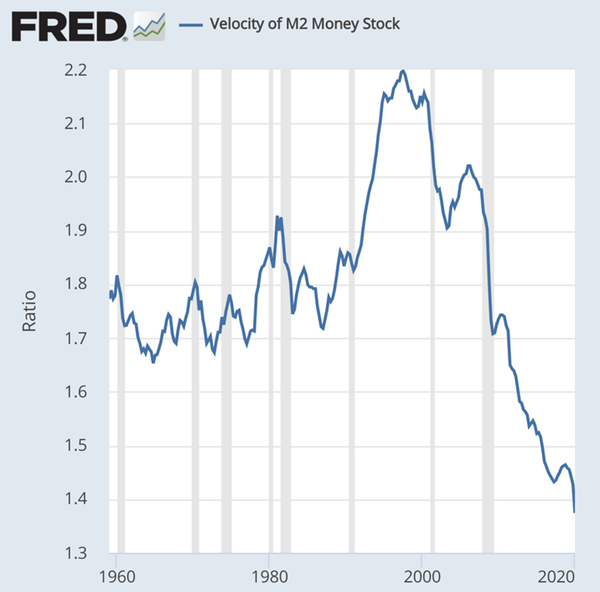

This would suggest that due to the banks not lending in sufficient scope the money multiplier isn’t stimulating economic growth sufficiently. But this is the stock of money growth not how effectively or the rate at which it is being employed. For that we consider the Velocity of Money.

This would suggest that due to the banks not lending in sufficient scope the money multiplier isn’t stimulating economic growth sufficiently. But this is the stock of money growth not how effectively or the rate at which it is being employed. For that we consider the Velocity of Money.