SII

COMMODITIES – BONDS & CREDIT

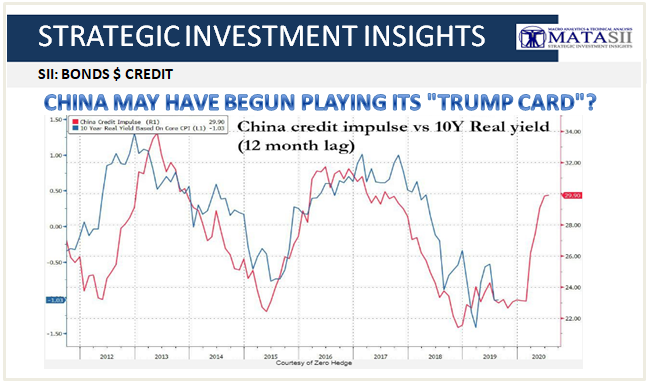

CHINA MAY HAVE BEGUN PLAYING ITS “TRUMP CARD”?

With some $27 trillion in foreign securities and dollar deposits, the US dollar is particularly vulnerable to natural liquidation by foreigners as they continue repatriating funds to their home currencies as bi-lateral trade agreements expand due to the weaponization of the US$ through sanctions – a process we outlined in the 2019 Thesis Paper: “De-Dollarization”.

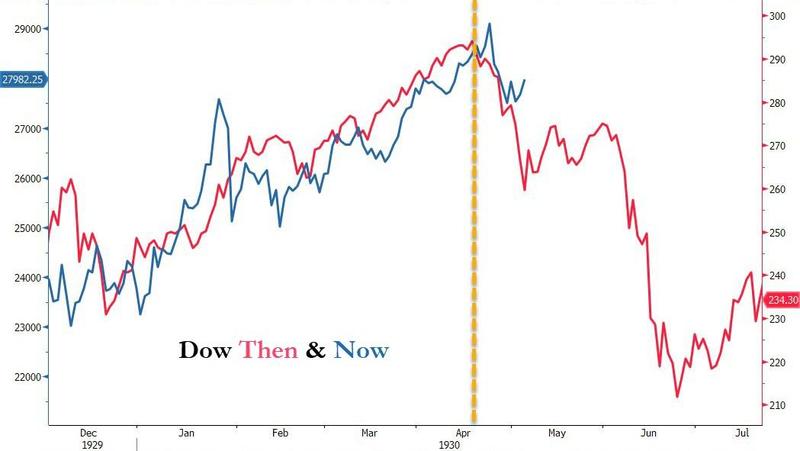

With some $27 trillion in foreign securities and dollar deposits, the US dollar is particularly vulnerable to natural liquidation by foreigners as they continue repatriating funds to their home currencies as bi-lateral trade agreements expand due to the weaponization of the US$ through sanctions – a process we outlined in the 2019 Thesis Paper: “De-Dollarization”. - For this and other reasons it can be expected that markets will consequentially begin to discount rising dollar interest rates, thereby undermining financial asset values around the world.

- Rising interest rates will be accompanied by a large fall in overpriced bond and stock markets as speculative positions are unwound with the undermining of bank solvency ratios.

- The inevitable outcome will amongst other hard asset areas be an increasing flight to Commodities, including Gold and Silver. This will expectantly be despite rising interest rates for Fiat Money.

-

- CHINA HAS SYSTEMATICALLY LOCKED IN GLOBAL COMMODITY SUPPLIERS OVER LAST 15 YEARS,

- Dominant Investment positions in Africa, South America and Asia

- CHINA HAS ACCUMULATED MASSIVE GOLD HOLDINGS,

- China now holds 62.26 million ounces – about 1,945 tons – of gold, according to data from the People’s Bank of China. The sum is worth approximately $93.4 billion at current prices. The country has added about 94 tons of gold to its reserves in the past eight months.

- Gold mining in the People’s Republic of China has made that country the world’s largest gold producer by far with 463.7 tonnes in 2016 (Wikipedia)

- CHINA HAS SECURED A STRATEGIC POSITION WITHIN THE IMF’S SDR RESERVE SYSTEM

- CHINA HAS DEVELOPED STRONG REGIONAL AND GLOBAL ECONOMIC ALLIANCES

- BRICS,

- ASEAN,

- Shanghai Accord.

- CHINA HAS AGGRESSIVELY BUILT A MILITARY FORCE BIGGER THAN THE USA FOR AN INEVITABLE CONFLICT:

- Chinese Active Military Manpower: 2,300,000 US: 1,281,900

- Chinese Reserve Military Manpower: 8,000,000 US: 811,000

- Chinese Air Force – Fighters 1,150 US: 457

- Chinese Navy – Ships 780 US: 437

- Chinese Rocket Artillery 1,770 US: 1,197

- CHINESE NUCLEAR CAPABILITIES

- China has been outside the Strategic Arms Limitation Talks (SALT II signed in 1979), negotiations between the United States and the Soviet Union that were aimed at curtailing the manufacture of strategic missiles capable of carrying nuclear weapons. China has therefore has had free reign to develop and deploy Long Range and Intermediate Range Nuclear missiles while Russia and US were constrained. Trump was forced recently to exit the agreement for this reason.

- CHINA HAS SYSTEMATICALLY LOCKED IN GLOBAL COMMODITY SUPPLIERS OVER LAST 15 YEARS,

-

- CHINA HAS RECENTLY THREATENED SELLING ITS US TREASURY HOLDINGS

- CHINA KNOWS THAT THIS CREDIT IMPULSE WILL WRECK HAVOC AFTER THE US ELECTION :

|

| Courtesy of Zero Hedge |

| Courtesy of Zero Hedge |

-

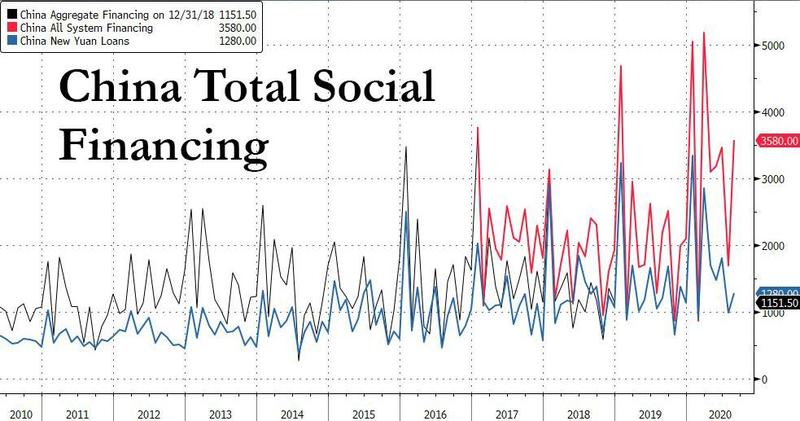

- New CNY loans: 1280bn yuan, exp. 1250 billion. Outstanding yuan new loan growth: 13.0% yoy in August, in line with the 13% increase in July 13.0%.

- Total social financing: 3580bn yuan, vs. consensus: RMB 2585bn.

- TSF stock growth: 13.4% yoy in August, higher than 13.0% in July. The implied month-on-month growth of TSF stock accelerated to 14.8% from 12.6% in July.

- M2: 10.4% yoy in August, below the consensus of 10.7% yoy. July, and down from 10.7% yoy in July.

-

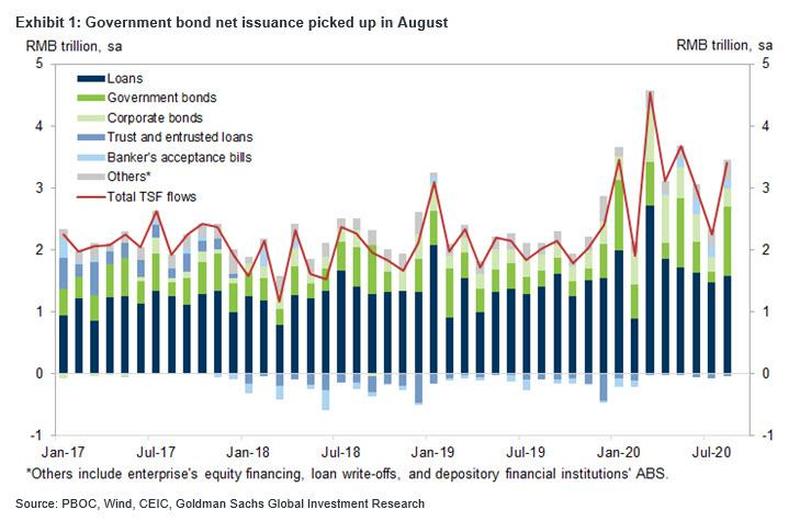

- August credit data surprised the market to the upside, although even though the sequential growth of TSF rose to 14.8% mom annualized from 12.6% in July.

- Among major TSF components, government bonds net issuance contributed the most to the acceleration in August. Corporate bond issuance increased from last month despite higher interbank interest rates, suggesting further growth recovery

|

| Courtesy of Zero Hedge |

-

- Shadow banking rose after the steep drop in July, as Beijing appears to be easing its crackdown on sources of shadow funding. Banker’s acceptance bills increased RMB 144bn in non-seasonally adjusted terms, reversing the contraction in July. The decline in trusted and entrusted loans remained modest in August. In total some 71 billion yuan in shadow debt was created.

-

- On loan extension, the increase in mid-to-long term loans to households remained relatively strong, consistent with the strong property sales suggested by high frequency indicators. The increase in mid-to-long term loans to non-financial enterprises picked up in August in seasonally adjusted terms.

- Finally, in an odd divergence, despite the biggest increase in TSY growth since the start of 2018, M2 growth moderated further to 10.4% yoy in August from 10.7% in July. While it remained well above 2019 levels, it begs the question of just where this newly created credit is ending up if not in the broader monetary aggregate.

- The next phase of the economic recovery is likely to be driven by commodity-intensive infrastructure investment as a result of needed government fiscal economic stimulus,

- “There is a massive infrastructure deficit in a lot of developed countries and that is something that could be addressed in this period” — Nitesh Shah, Director of research at New York-based WisdomTree Investments reported to CNBC

- Shah also reported: “You can actually get through a lot of the infrastructure programs that you’ve been waiting decades to actually get through the door in this time. I’m not as optimistic on a big ‘V-shaped,’ rigorous recovery but even some sort of recovery is good for the industrial space.”

- “Ultimately, if you look at the response economies are making to (the coronavirus crisis), we’ve had the fiscal response, we’ve had central banks slashing interest rates, we’ve had central banks pumping more money into economies, the next phase is massive investment in infrastructure and that’s going to come globally.” — Andy Critchlow, head of news in EMEA at S&P Global Platts, reported on CNBC’s “Squawk Box Europe”

- Looking ahead to 2021, Critchlow suggested some of the world’s largest economies could soon announce “big” infrastructure developments.These projects were likely to be led by China, India and the U.S., he argued, noting that both candidates in the upcoming U.S. presidential election had pledged to spend an “awful lot of money” on infrastructure. “That’s got to be good for oil demand and it’s got to be good for commodities across the board.”

- “There is a massive infrastructure deficit in a lot of developed countries and that is something that could be addressed in this period” — Nitesh Shah, Director of research at New York-based WisdomTree Investments reported to CNBC

- The Trump campaign announced the president’s second term agenda last month, pledging to “build the world’s greatest infrastructure system.”

- Trump’s prior commitments to “old school” infrastructure projects, such as roads and bridges, would likely be “steels-intensive.”

- Democratic presidential candidate Joe Biden has pledged to spend $2 trillion “to build a modern, sustainable infrastructure and an equitable clean energy future.” Biden has said, if elected, he plans to rebuild roads, bridges, green spaces and water systems as well as providing universal broadband.

- Biden’s commitment to develop solar and wind technologies would likely benefit copper and, to a lesser degree, silver, he added.

- Analysts are currently watching for example iron ore very closely because industrial commodities are likely to move higher if we get an economic bounce-back driven by infrastructure spending,

- Note: In 2008-2009 in response to the financial crisis we got a rally in some of the industrial commodity markets

- China, which has been in recovery mode for months now, published data on Tuesday that showed industrial output growth accelerated to 5.6% in August when compared to a year earlier. It bolsters the view that Beijing’s demand recovery continues to gather pace, with government stimulus helping to fuel a rebound,

- We’ve already seen a metals-intensive response in China, highly metals-intensive,

- “It has been absolutely stunning how strong China has rebounded on the construction side of things reflecting on the “spectacular” rally seen across the industrial commodity space as a result” – Max Layton, head of EMEA commodities research at Citi, told CNBC

- Spot iron ore prices climbed to fresh six-and-a-half-year highs trading close to $129 a dry metric ton on the back of a construction boom in China.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.