SII

COMMODITIES – AGRICULTURAL GRAINS

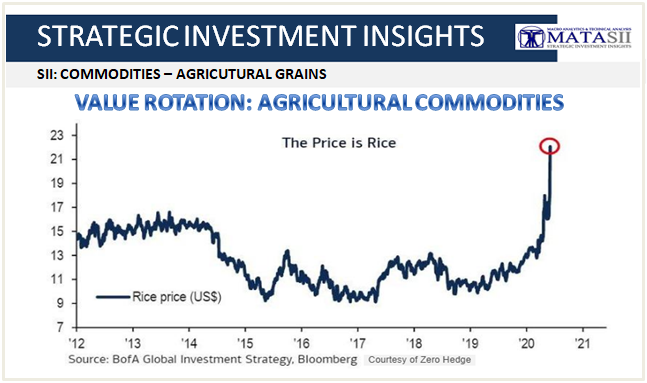

VALUE ROTATION: AGRICULTURAL COMMODITIES

-

- Our research has lead us to conclude that the escape from failing Fiat Currencies will lead to rising nominal interest rates.

- Rising interest rates will be accompanied by a large fall in overpriced bond and stock markets as speculative positions are unwound with the undermining of bank solvency ratios.

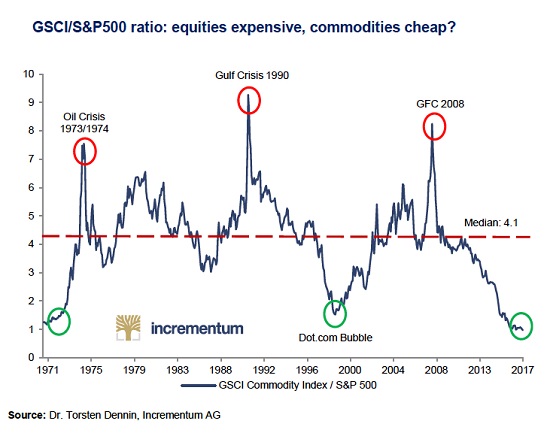

- The inevitable outcome will amongst other hard asset areas be an increasing flight to Commodities, including Gold and Silver. This will expectantly be despite rising interest rates for Fiat Money.

-

- With some $27 trillion in foreign securities and dollar deposits, the US dollar is particularly vulnerable to natural liquidation by foreigners as they continue repatriating funds to their home currencies as bi-lateral trade agreements expand due to the weaponization of the US$ through sanctions – a process we outlined in the 2019 Thesis Paper: “De-Dollarization”.

- For this and other reasons it can be expected that markets will consequentially begin to discount rising dollar interest rates, thereby undermining financial asset values around the world.

- It will be a trend resisted strongly by the authorities, but once they are on the run from market forces there will be no macroeconomic option between raising interest rates and seeing the currency collapse. Interest rates will be forced to rise.

- The resulting modern states’ overriding policy direction has now been unwittingly trapped into effectively stripping the wealth of its electorate instead of being driven by a genuine and considered concern for its welfare.

- Monetary inflation has become runaway and is being forced into transferring wealth to the state from producers and consumers. This is about to further accelerate!

- Monetary & Fiscal Policy now unknowingly (though well understood by Wall Street and Global Banks) has unfortunately a single economically inevitable destructive objective in mind.

-

-

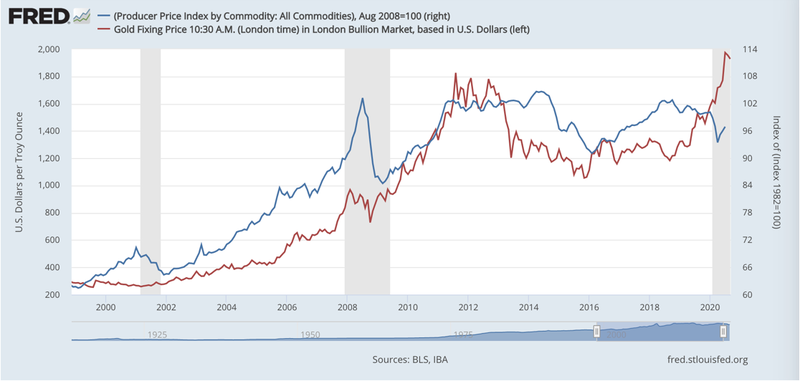

Since the turn of the millennium there had been a reasonable directional correlation between the price of gold and PPI prices until October 2018. At that point, PPI prices began to decline while the gold price turned higher from under $1200. It was clear that global trade was likely to decline, due to the tariff war between the US and China, with consequences for raw material demand.

-

In late March this year, the outlook changed from deflationary concerns to unlimited monetary inflation, driven by the Fed cutting its funds rate to zero on 16 March and the FOMC issuing a “whatever it takes” statement on 23 March. These events also marked the end of the PPI decline, and we can expect the correlation with gold prices to return, in which case the PPI index has some significant catching up to do.

In late March this year, the outlook changed from deflationary concerns to unlimited monetary inflation, driven by the Fed cutting its funds rate to zero on 16 March and the FOMC issuing a “whatever it takes” statement on 23 March. These events also marked the end of the PPI decline, and we can expect the correlation with gold prices to return, in which case the PPI index has some significant catching up to do. -

This being the case, when the interest rate cycle turns the potential for higher raw material prices measured in dollars could be truly spectacular, even more so in the event that the gold price rises at the same time, which seems even more certain in the event that financial markets become destabilized by higher interest rates.

-

It is an outcome consistent with a loss of purchasing power for fiat currencies to the extent it encourages economic actors to reduce and then abandon their currency balances entirely..

-

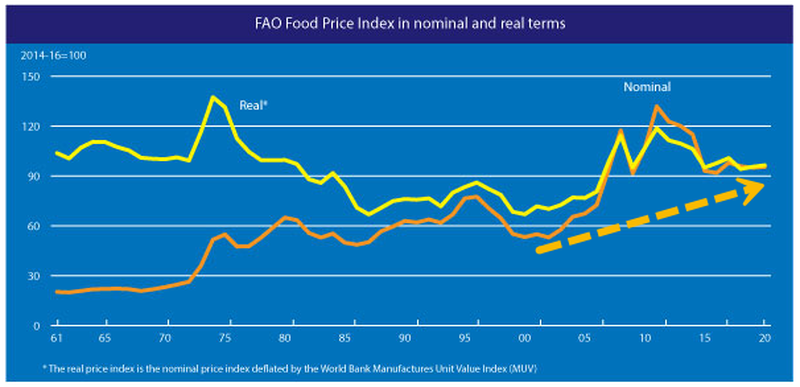

- Given higher lending costs for a large chunk of producers, higher food prices would seem a foregone conclusion. That won’t be happy news for the legions of unemployed consumers struggling to make ends meet. This underscores a key point – the ramifications of commodity price disruptions are very often not just economic. They become political, too. Social unrest and even revolutions often start when the prices of food and fuel spike. Bread riots were one of the catalysts for the Arab uprising of 2011. In the US, the oil price spike that began the same year led to senate hearings about whether the problems of the 2008 financial crisis, including risky trading on the part of big banks, had yet been solved.

-

- $1.41BN: Central bank asset purchases every hour since COVID-19 March lock-downs

- $1.6BN: Nasdaq 100 market cap gain every hour since COVID-19 March lock-downs

- 34 days: Equity bear market in 2020 shortest ever

- $2000: gold best performing asset class in 2020, first year since 2010

- 50%: annualized return from 30-year US Treasury this year

- 100 years: corporate bonds hit 100-year highs versus commodities April 20

-

100 years: US stocks almost at 100-year highs versus US government bonds

- The gap between current prices and discounted present value of likely future cash flows is the highest ever.

- 59%: US equities as share of MSCI global equity index (ACM) at all-time high

- 42%: Chinese equities as share of Emerging Markets at all-time high

- 21%: gain in global stocks (ACWI ex. US) required to match 2007 high

- 25%: market cap of FAANG as % US stocks, of US stocks, record concentration.

- $9.3TN: market cap of US tech sector entire > market cap of Europe’s stock market.

- 24x: trailing PE ratio of S&P500, surpassed only Dec 21 (25x) & Jun 99 (30x)

- 1.7%: dividend yield on 5&P500 now same as 5-year breakeven inflation rate.

- 2021: global consensus forecasts for 2021…GDP 5.1%, EP5 29.0%…up big.

- 2021: global consensus forecasts for 2021…CPI 1.3%, bond yield 0.5%…unchanged.

- $258Tn: size of global debt at record high, 2.3x of global GDP.

- $212Tn: value of global bonds & equities, an all-time high, 2.3x global GDP.

- $14tn: value of global negatively yielding bonds.

- 40%: Bank of Japan owns 40% of JGB market; Fed owns 14% of Treasury market

|

| Courtesy of Zero Hedge |

-

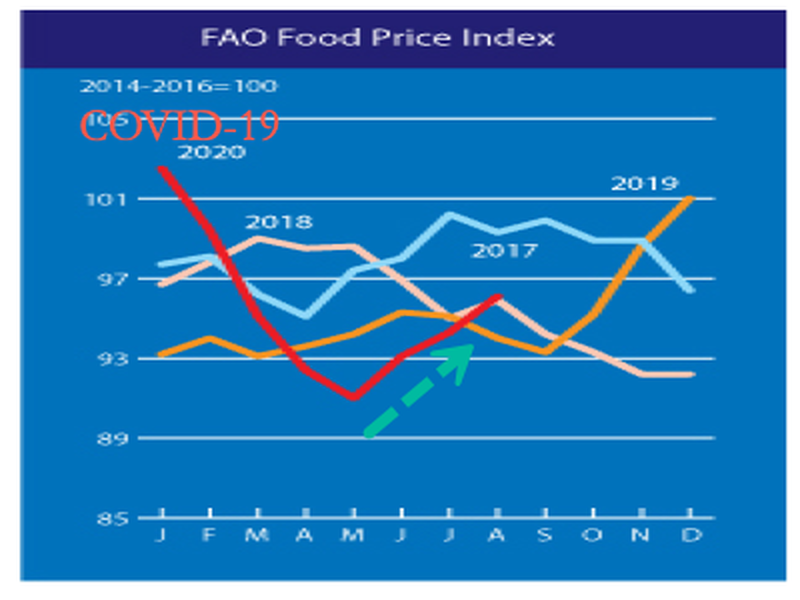

- World Food Prices Rise For Third Consecutive Month In August

- The Price Of Half The World’s Staple Food Is Up 70% In 2020

- Inflation Is Higher Than You Think in Covid Era, Thanks to Food

- Is China On The ‘Brink’ Of A Major Food Shortage?

- China Faces Food Shortage As Droughts, Flooding, And Pests Ruin Harvest

|

| Courtesy of Zero Hedge |

|

| Courtesy of Zero Hedge |

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.