THE MARSHALLIAN K MEASURE

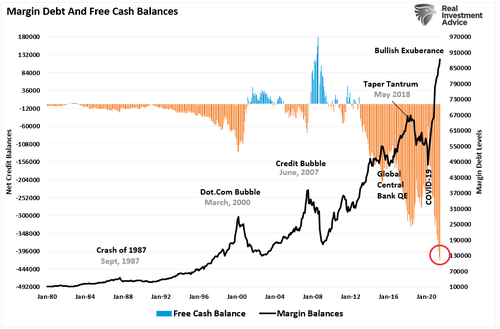

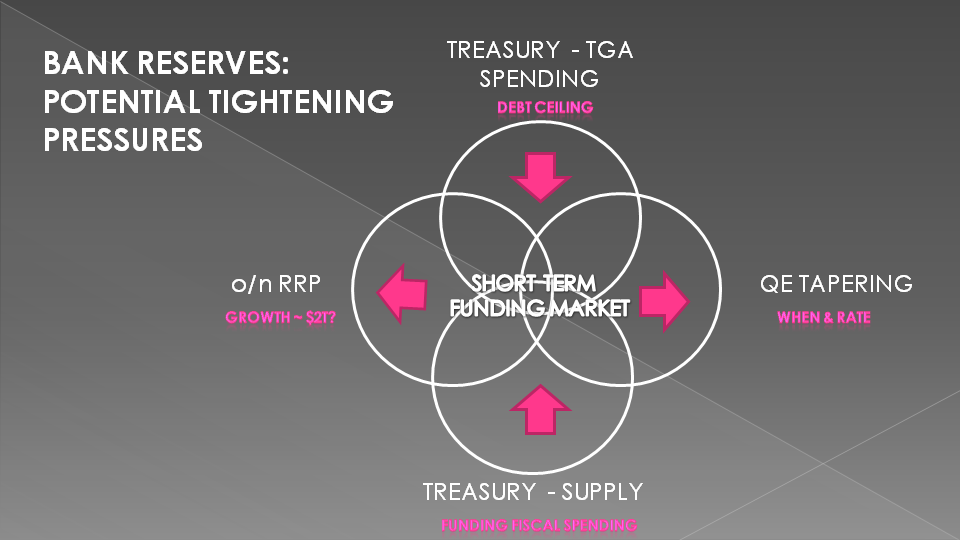

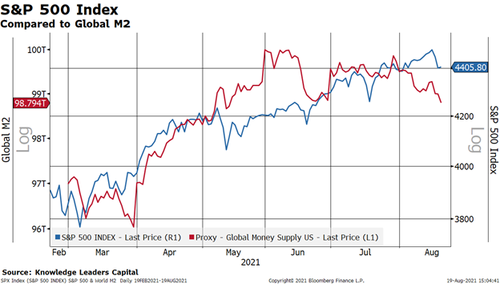

Liquidity Is evaporating even before a potential Fed Tapering hits markets. The Marshallian K shows liquidity not only deteriorating but actually contracting — and at a time when hopes (as embedded in valuations) have never been higher!

WHAT IS THE MARSHALLIAN K MEASURE?

It is the gap between the rates of growth in money supply and gross domestic product.

The signal is obscure, but has sent meaningful signs in the past. As a measure of U.S. financial liquidity its declines foreshadowed two of the decade’s worst equity routs and is flashing alarms even before the Federal Reserve embarks on its planned winding down of asset purchases.

-

- The signal just turned negative for the first time since 2018, meaning GDP is rising faster than the government’s M2 account.

- The shortfall comes from an expanding economy that’s quickly depleting the nation’s available money.

- The deficit could become a problem for markets at a time when excess liquidity is seen as underpinning rallies in everything from Bitcoin to meme stocks.

How big a threat is this?

-

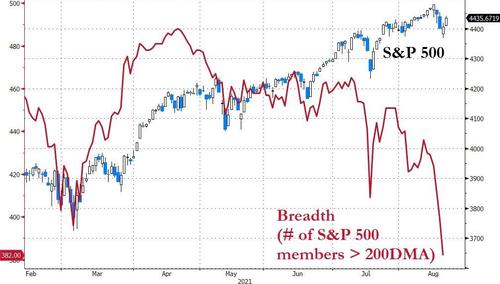

- While stocks kept rising during frequent negative Marshallian K readings in the 1990s, the pattern since the 2008 global financial crisis — a period when the central bank was in what Ramsey calls a “perpetual crisis mode” — begs for caution.

- The Marshallian K fell below zero in 2010, a year when the S&P 500 Index suffered a 16% correction. A similar dip in 2018 portended a selloff that almost killed that bull market.

- The Leuthold study is the latest attempt to handicap the market’s outlook from the perspective of liquidity. But not everyone is worried. In June, research from UBS Group AG showed that should the Fed turn off the spigot on its annual $1.4 trillion in quantitative-easing spending, the hit to the S&P 500 would be a paltry 3% decline in prices.

The recovering economy is now drinking from a punch bowl that the stock market

once had all to itself.