MORGAN STANLEY: "CLIENT CASH IS AT ITS LOWEST LEVEL" AS INSTITUTIONS DUMP STOCKS TO RETAIL

The "cash on the sidelines" myth is officially dead.

Recall that at the end of July, we reported that in its Q2 earnings results, Schwab announced that after years of avoiding equities, clients of the retail brokerage opened the highest number of brokerage accounts in the first half of 2017 since 2000. This is what Schwab said on its Q2 conference call:

New accounts are at levels we have not seen since the Internet boom of the late 1990s, up 34% over the first half of last year. But maybe more important for the long-term growth of the organization is not so much new accounts, but new-to-firm households, and our new-to-firm retail households were up 50% over that same period from 2016.

In total, Schwab clients opened over 350,000 new brokerage accounts during the quarter, with the year-to-date total reaching 719,000, marking the biggest first-half increase in 17 years. Total client assets rose 16% to $3.04 trillion. Perhaps more ominously to the sustainability of the market's melt up, Schwab also adds that the net cash level among its clients has only been lower once since the depths of the financial crisis in Q1 2009:

Now, it's clear that clients are highly engaged in the markets, we have cash being aggressively invested into the equity market, as the market has climbed. By the end of the second quarter, cash levels for our clients had fallen to about 11.5% of assets overall, now, that's a level that we've only seen one time since the market began its recovery in the spring of 2009.

While some of this newfound euphoria may have been due to Schwab's recent aggressive cost-cutting strategy, it is safe to say that the wholesale influx of new clients, coupled with the euphoria-like allocation of cash into stocks, means that between ETFs and other passive forms of investing, as well as on a discretionary basis, US retail investors are now the most excited to own stocks since the financial crisis.

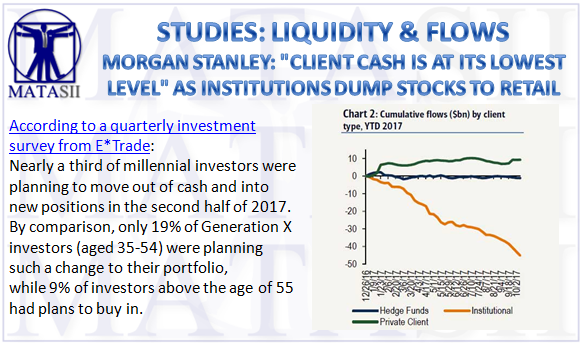

In a confirmation that retail investors had thrown in the towel on prudence, according to a quarterly investment survey from E*Trade,

- Nearly a third of millennial investors were planning to move out of cash and into new positions in the second half of 2017.

- By comparison, only 19% of Generation X investors (aged 35-54) were planning such a change to their portfolio,

- while 9% of investors above the age of 55 had plans to buy in.

In short, retail investors - certainly those on the low end which relies on commodity brokerages to invest - are going "all in."

This was also confirmed by the recent UMichigan Consumer Survey, according to which surveyed households said there has - quite literally - never been a better time to buy stocks.

What about the higher net worth segment? For the answer we go to this morning's Morgan Stanley earnings call, where this exchange was particularly notable:

Question: Hey good morning. Maybe just on the Wealth Management side, you guys had very good growth, sequential growth in deposits. There's been some discussion in the industry about kind of a pricing pressure. Can you discuss where you saw the positive rates in Wealth Management business and how you're able to track, I think, about $10 billion sequentially on deposit franchise?Answer: Sure. I think, as you recall, we've been talking about our deposit deployment strategy for quite sometime, and we've been investing excess liquidity into our loan product over the last several years. In the beginning of the year, we told you that, that trend would come to an end. We did see that this year. It happened a bit sooner than we anticipated as we saw more cash go into the markets, particularly the equity markets, as those markets rose around the world. And we've seen cash in our clients' accounts at its lowest level.

In other words, when it comes to retail investors - either on the low, or high net worth side - everyone is now either all in stocks or aggressively trying to get there.

Which reminds us of an article we wrote early this year, in which JPM noted that "both institutions and hedge funds are using the rally to sell to retail." Incidentally, the latest BofA client report confirmed that while retail investors scramble into stocks, institutions continue to sell. To wit:

Equity euphoria continues to remain absent based on BofAML client flows. Last week, during which the S&P 500 climbed 0.2% to yet another new high, BofAML clients were net sellers of US equities for the fourth consecutive week. Large net sales of single stocks offset small net buys of ETFs, leading to overall net sales of $1.7bn. Net sales were led by institutional clients, who have sold US equities for the last eight weeks; hedge funds were also (small) net sellers for the sixth straight week. Private clients were net buyers, which has been the case in four of the last five weeks, but with buying almost entirely via ETFs. Clients sold stocks across all three size segments last week."

Meanwhile, a familiar buyer has returned: "buybacks by corporate clients picked up as US earnings season kicked off, with Financials buybacks continuing to dominate this flow."

And just like during the peak of the last bubble, retail is once again becoming the last bag holder; now it is only a question of how long before the rug is pulled out. For now, however, enjoy the Dow 23,000.