IN-DEPTH: TRANSCRIPTION - PRIVATE DEBT & THE FEEDING OF ZOMBIE CORPORATIONS - PART II

COVER

AGENDA

SLIDE 5

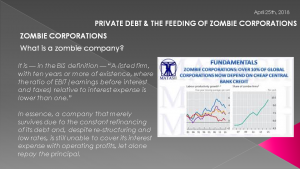

What is a a Zombie Corporation? The best definition is from the Bank of International Settlements: " It is a listed firm, with ten years or more of existence, where the ratio of EBIT (earnings before interest and taxes) relative to interest expense is lower than one.” More simply said - a Zombie company is one that merely survives due to the constant refinancing of its debt and, despite re-structuring and low rates, is still unable to cover its interest expense with operating profits, let alone repay the principal. I found it interesting that the BIS is now so focused on this subject that it has begun tracking and categorizing them.

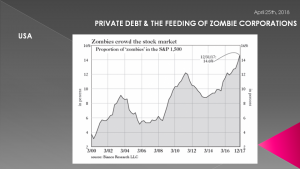

The chart shown here is from BIS Research where they now astoundingly assert that over 10% of all global corporations presently fall in that category

SLIDE 6

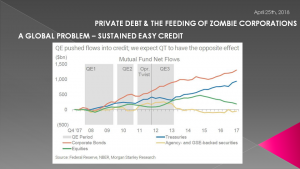

The Global growth in Zombie Corporations has one common central ingredient - easy credit for too long a period of time. Instead of companies failing, they simply mutate to a new form of financial "Life Support".

One of the core foundations of capitalism is rewarding ingenuity and productivity while the weak or obsolete enterprises are left to fail. This is a requirement for capitalism to flourish.

The word "bankruptcy" is seldom heard anymore - we should ask why? Not only why there aren't more failures, but also why are failing companies kept on financial life support - what are the incentives for this?

SLIDE 7

We are going to answer these questions in a moment where we will see there are differing reasons by economic region but the underlying catalyst is all the same - easy credit for too long a period of time.

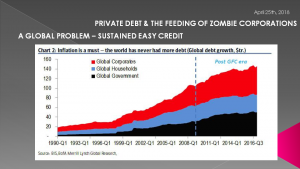

You can see from this chart that corporations have been the biggest beneficiaries of this credit, yet it gets little public scrutiny or visibility - likely because stocks are going up. Few pay attention to problems until stocks start going down and then everyone begins asking why?

Again as you can see here it is a global corporate issue!

SLIDE 8

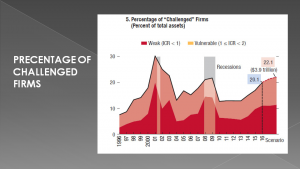

Which has manifested itself into the global problem of "Challenged Firms". Note that this study shows 20% of global corporations are now considered challenged versus the BIS's 10%.

We can expect as this chart also suggests that both numbers will likely and significantly rise during the next recession. A recession that after a historically long 9 year cycle has a high probability of soon occurring.

SLIDE 9

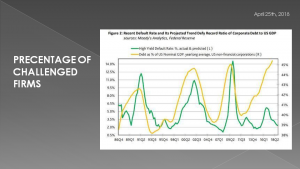

The high yield Junk Bond market (which is one of our Strategic Investment Insights) is likely to be the first evidence of this but also we have determined will also be the 'CCC' low end of the IG (Investment Grade) Bond market.

SLIDE 10

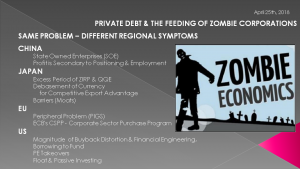

As I mentioned, though we have the same global catalyst we have different "Regional" symptoms! All soon coming together to take the economy with it as we potentially have a global Zombie Economy emerging.

Before we step through the regional differences lets consider some cross-regional commonalities.

SLIDE 11

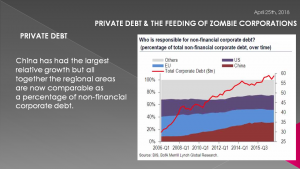

China has had the largest relative growth but all together the regional areas are now comparable as a percentage of non-financial corporate debt - and still growing.

SLIDE 12

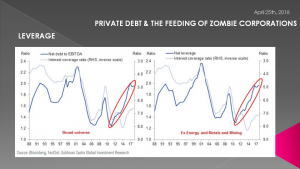

The growth in leverage that corporations are now employing does not bode well for future stability if interest rates were to rise or cash flows to fall as regional economies slowed or possibly the overall global economy slowed down. Something we are currently seeing signs of which outlined in last month's Macro Outlook.

This graphic illustrates Investment Grade Corporate Debt.

SLIDE 13

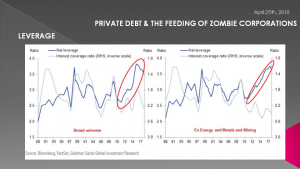

It is obviously worse for Non-Investment Grade debt or High Yield debt. This is the speculative domain of a desperate, yield chasing investment speculators.

SLIDE 14

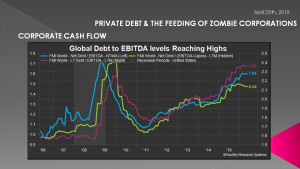

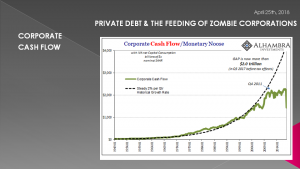

Going into 2016 the concern with cashflows or EBITDA to debt levels was already a growing concern as the problem became more acute.

SLIDE 15

Recently released numbers are showing the problem to be more readily apparent! We are on the edge of a cliff or possibly already over it!

SLIDE 16

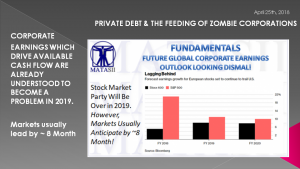

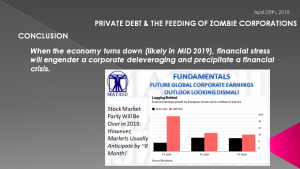

Corporate Earnings which drive available cash flow are forecast to become a problem in 2019.

Markets usually lead by ~ 8-10 months.

SLIDE 17

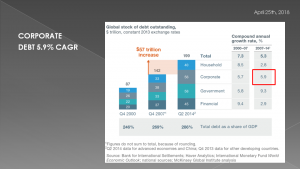

The latest global debt numbers suggest corporate debt is still growing at a significant 5.9% compound rate, second only to sovereign governments. Meanwhile banks are pulling in the reins on a relative basis

SLIDE 18

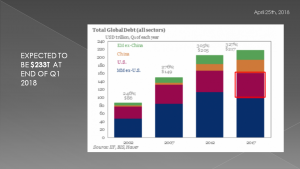

Total Global debt at 233T suggests to us that the users of corporate products and services may already be (or soon will be) tapped out!!

SLIDE 19

Lets now step through the regions.

In our last UnderTheLens we examined China. I will refer listeners who haven't already heard Part I to listen to the detailed info on China. For those that haven't done so, the message is simple.

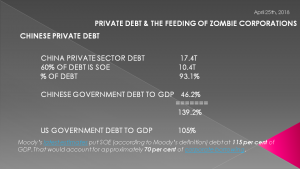

The dominance of SOE's (that is State Owned Enterprises) in China is not fully appreciated by the world. This quasi Capitalist / Communist country that is China has a differing approach towards corporations.

Most of the 150,000 Chinese SOE are living off cheap, available funding, with protected and subsidized markets - many with monopolies. Employment is more important to the Chinese Communist party than profits. Profits are secondary to employment. This is opposite to the rest of the world and has profound implications for fair & open trade.

Chinese Private Debt is now officially 93% of GDP and many such as Moody's suspect much higher when Shadow Bank lending is properly accounted for.

SLIDE 20

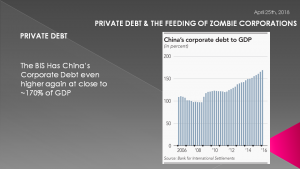

The BIS now has China’s Corporate Debt estimated to be even higher at close to ~170% of GDP....

SLIDE 21

.. and racing higher at an almost unstoppable level. If you listen to the detail in Part I you will see it is a run away freight train that will in all likelihood sometime in the next 24 months spectacularly derail.

SLIDE 22

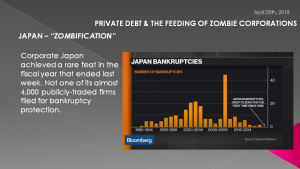

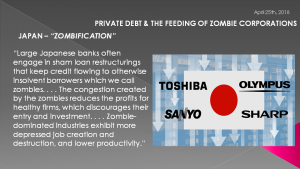

In many ways Japan is the casualty of similar explosive trade growth as China, earlier in the 1980's & 90's. Since then Japan has suffered through two decades of the 'Zombification' of both its economy and many of its formerly strong Japanese Corporations.

The collapse of asset values and the efforts by the Japanese government to keep Japanese banks solvent lead to the earliest forms of the Financial Repression policies of ZIRP and QQE. These in-turn, as a result of Unintended Consequences & Moral Hazard, lead to the growth in Zombie Corporations.

The term "zombie company" was actually first applied to Japanese firms supported by Japanese banks during the period known as the "Lost Decade" - after the collapse of the Japanese asset price bubble in the 1990. Japanese banks to this day continue to support weak or failing firms.

The retailer Daiei is an example of a large company that expanded greatly during the period leading to the 1990 crash, and under different circumstances would have been expected to have entered receivership or bankruptcy. The finance minister at the time was reported as describing the 96,000 employee firm as being 'too big to fail'. We have certainly heard that expression many times a decade later in the US with the same prescription for a solution - which has also yet to be proven successful.

SLIDE 23

Corporate Japan achieved a rare feat in the fiscal year 2016. Not one of its almost 4,000 publicly-traded firms filed for bankruptcy protection.

Economists have been shouting about this problem for years now. Way back in 2003, a paper called “Unnatural Selection: Perverse Incentives and the Misallocation of Credit in Japan.” found:

“Japanese firms are far more likely to receive additional credit if they are in poor financial condition, and these firms continue to perform poorly after receiving additional bank financing. Troubled Japanese banks allocate credit to severely impaired borrowers primarily to avoid the realization of losses on their own balance sheets.”

SLIDE 24

In 2008 — before the global financial crisis had hit Japan another paper, “Zombie Lending and Depressed Restructuring in Japan,” declared:

“Large Japanese banks often engage in sham loan restructurings that keep credit flowing to otherwise insolvent borrowers which we call zombies. . . . The congestion created by the zombies reduces the profits for healthy firms, which discourages their entry and investment. . . . Zombie-dominated industries exhibit more depressed job creation and destruction, and lower productivity.”

Yet another 2009 paper, found that the Japanese government’s bailouts of major banks made these problems worse. These papers all came before the creation of the INCJ and other similar government bailout funds. The government hopes that the INCJ and its ilk will impose more stringent conditions on the companies it rescues, but the bailout funds obviously offer an incentive for bad behavior. Japan still just can’t let its bad companies die.

Japanese finance is dominated by large government-backed banks that want to preserve the supremacy of their large zombie clients. So while the U.S. bailouts might have hurt productivity somewhat, the situation in Japan is just much, much worse.

If Japan wants to generate long-term growth, it needs to allow creative destruction. New companies can’t grow when they are blocked by failing incumbents. The aspiring entrepreneur watching cartoons on his TV at Waseda University must be allowed to do his thing. Japan’s cycle of bailouts must end.

But it won't! Prior to me starting this recording I listened to the BOJ Governor in a Japanese interview state emphatically that further accommodative monetary policy will be maintained for some time to come - minimally through 2019! When you don't know what to do and are expected to do something, the proven political solution is consistently to print more money!

SLIDE 25

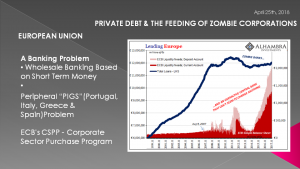

European Union Zombie Corporations are also an indirect result of the EU Banking Crisis in 2012, most visibly with Greece and Cyprus but also including Spain, Portugal and Italy - the EU southern Peripheral nations. Those countries with the poorest productivity rates, highest unemployment levels and heaviest government entitlement obligations and dependency.

Frankly this crisis which was temporarily papered over is a long ways from being solved and is still percolating just before the surface. The problems with Zombie Corporations will soon bring it to a boil once again.

SLIDE 26

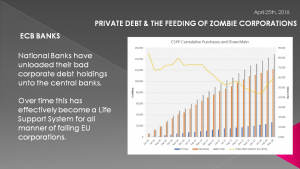

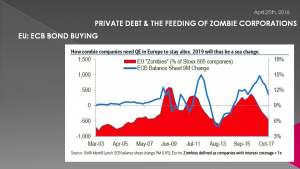

The EU and specifically the ECB adopted a unique approach to "kicking-the-can-down-the-road" by implementing what it called the CSPP or Corporate Sector Purchase Program. The Central Bank began buying corporate EU Bonds. It is still doing such today at a rate of $30B per month only recently down from $60B. This not only allowed the EU country National Banks to unload their bad corporate debt holdings unto the central banks but has effectively become a life support system for failing EU corporations.

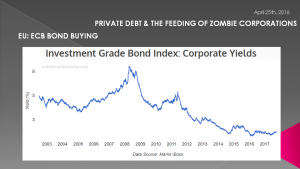

SLIDE 27

Interest rates for Corporate Bonds are presently held at ridiculously low prices, allowing them to refinance at close to zero and have the central bank absorb the supply.

Meanwhile as yields have fallen because of central bank demand, the originating banks have had bond price appreciation across the board (recall that as yields go down - bond prices or value go up).

A wonderful scheme - until of course the hens "come home to roost"!

SLIDE 28

Now many German and French corporations have become dominate participants using debt to keep corporate earnings per share up as revenue growth stagnates. The percentage of Stoxx 600 Zombie Corporations now reflects this.

SLIDE 29

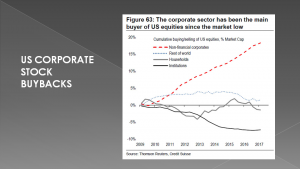

Of course the biggest "gamer" of corporate buybacks is the domain of the US based corporations.

SLIDE 30

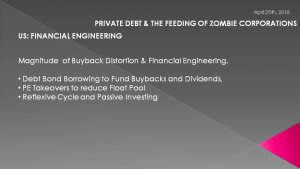

Financial Engineering is the name of the game in the US.

We have talked about this extensively in many UnderTheLens video so there is no need to dwell on the mechanics going on here! We encourage you to review the latest LONGWave video on the gaming of the Float Poll by Private Equity Corporations - who's strategies are most recognized as turning viable corporations into zombie's as they load them up with debt and strip out cash flow in the form of dividends. These corporations are unable to invest for the future for the sake of quarterly EPS results to drive near term stock prices, before they are unloaded to the trash heap or kept alive as Zombies.

SLIDE 31

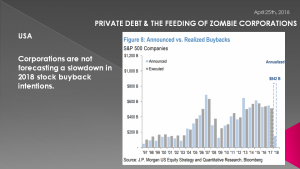

Corporations are not forecasting any slowdown in their 2018 stock buyback intentions - the game goes on!

SLIDE 32

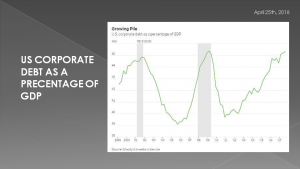

US Corporate debt levels are now at levels that preceded previous financial and market crisis.

SLIDE 33

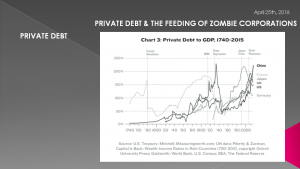

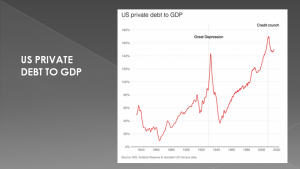

Total US Private Debt is at historical levels and hides the fact it was consumers who were forced to temporarily deleverage not corporations during the 2008 Housing centric Financial Crisis.

SLIDE 34

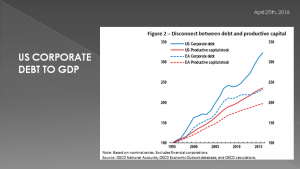

This is shown here as we have a disconnect between US Corporate debt and productive capital.

SLIDE 35

The bottom line of all this is that Zombie Corporations in the US are approaching 15% of the S&P 500 listed companies.

It begs the question - how long can this go on??

SLIDE 36

The answer may be 2019 - also remembering the market leads by ~ 8-10 months

SLIDE 37

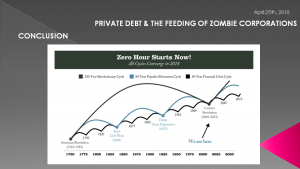

All our work in Cycle Theory suggests to us that we are nearing a multi-generational cycle event.

We can expect the reality of Global Zombie Corporations to be a prime problem during this period.

SLIDE 38

So, in closing, as I always do –remember: the answer to solving this problem will be to print more money.

It is the only answer politicians will ever agree on.