GOLD LIKELY TO SOON BE LIFTED BY RISING DE-DOLLARIZATION SURGE

The reaction to the "Weaponization" of the US Dollar via US Sanctions has accelerated the on-going global De-Dollarization efforts. We outlined the rapidly unfolding developments earlier this year in our 151 page Annual Thesis paper entitled De-Dollarization (Free Copy Here). Documented De-Dollarization efforts are now underway in China, Russia, Venezuela, Iran, Indian Turkey, Syria, Qatar, Pakistan, Lebanon, Libya, Egypt, Philippines and more.

Situational Analysis

The real power of the dollar is its relationship with sanctions programs. Legislation such as the International Emergency Economic Powers Act, The Trading With the Enemy Act and The Patriot Act have allowed Washington to weaponize payment flows. The proposed Defending Elections From Threats by Establishing Redlines Act and Defending American Security From Kremlin Aggression Act would extend that armory.

When combined with access it gained to data from Swift, the Society for Worldwide Interbank Financial Telecommunication’s global messaging system, the U.S.exerts unprecedented control over global economic activity. Sanctions target persons, entities, organizations, a regime or an entire country. Secondary curbs restrict foreign corporations, financial institutions and individuals from doing business with sanctioned entities. Any dollar payment flowing through a U.S. bank or the American payments system provides the necessary nexus for the U.S. to prosecute the offender or act against its American assets This gives the nation extraterritorial reach over non-Americans trading with or financing a sanctioned party. The mere threat of prosecution can destabilize finances, trade and currency markets, effectively disrupting the activities of non-Americans.

The countries cited above are reacting to this. Gold is non-digital and does not move through electronic payments systems, so it is impossible for the U.S. to freeze on interdict.

Central banks are stocking up on gold. According to the World Gold Council, net buying by central banks reached 145.5 tons in the first quarter of 2019. That’s a 68% increase over last year. And it’s the most gold central banks have bought in the first quarter since 2013.

High Probability Market Ramifications

Soon both the buying of Gold by major players such as Russia, China, India, Iran & Turkey along with an emerging gold backed Cryptocurrency for international settlements will take gold towards testing prior 2011 highs.

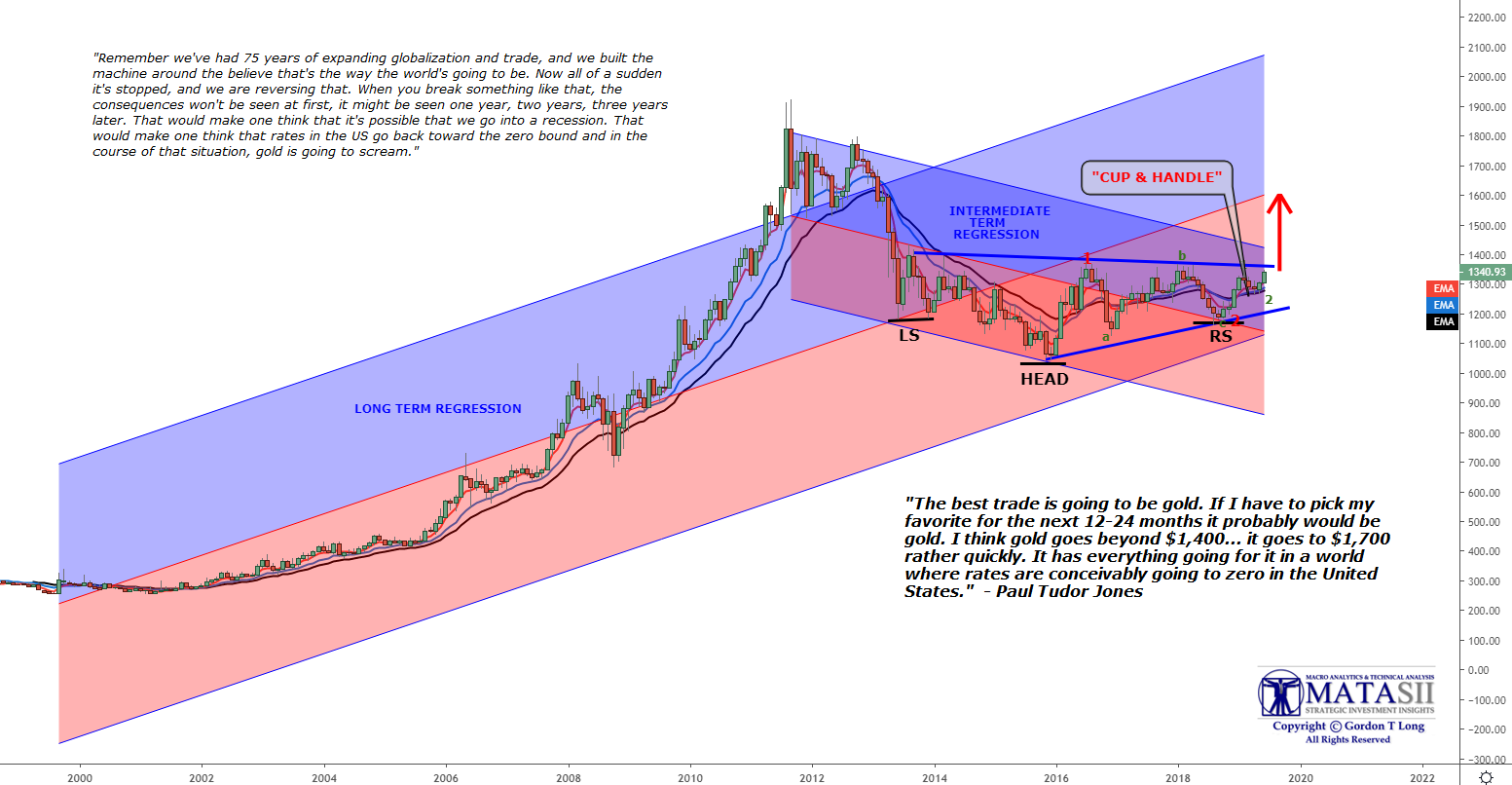

Major Investors such as Paul Tudor Jones recently went on record as saying:

"The best trade is going to be gold. If I have to pick my favorite for the next 12-24 months it probably would be gold. I think gold goes beyond $1,400... it goes to $1,700 rather quickly. It has everything going for it in a world where rates are conceivably going to zero in the United States."

"Remember we've had 75 years of expanding globalization and trade, and we built the machine around the believe that's the way the world's going to be. Now all of a sudden it's stopped, and we are reversing that. When you break something like that, the consequences won't be seen at first, it might be seen one year, two years, three years later. That would make one think that it's possible that we go into a recession. That would make one think that rates in the US go back toward the zero bound and in the course of that situation, gold is going to scream. "

Of course we have heard this sort of talk ever since gold hit its prior high in 2011!

Technical Support

However, this time the technical charts are starting to sing the same tune with lyrics such as "Reverse Head & Shoulders", "Cup & Handle" and "Bullish Ascending Triangle"!

All of this leaves us currently at critical overhead resistance levels, which if broken will likely take gold denominated in US$ towards previous highs.

What the gold buying strategies of Russia, China, India, Iran, Turkey et al have in common is a desire to escape from dollar hegemony and the imposition of dollar-based sanctions by the U.S. The practical implication for gold investors is a firm floor under gold prices since these players can be relied upon to buy any dips. DOWNSIDE IS LIMITED

Downside Is Limited - Upside Is Good

According to James Rickards:

The primary factor that has been keeping a lid on gold prices is the strong dollar. The dollar itself has been propped up by the Fed’s policy of raising interest rates and reducing money supply, so-called “quantitative tightening” or QT. These tight money policies have amplified disinflationary trends and pushed the Fed further away from its 2% inflation goal.

However, the Fed reversed course on rate hikes last December and has announced it will end QT next September. These actions will make gold more attractive to dollar investors and lead to a dollar devaluation when measured in gold.

The price of gold in euros, yen and yuan could go even higher since the ECB, Bank of Japan and People’s Bank of China will still be trying to devalue against the dollar as part of the ongoing currency wars. The only way all major currencies can devalue at the same time is against gold, since they cannot simultaneously devalue against each other.

A situation in which there is a solid floor on the dollar price of gold and a need to devalue the dollar means only one thing – higher dollar prices for gold. A breakout to the upside is the next move for gold.

[SITE INDEX -- SII - HARD ASSETS]

A PUBLIC SOURCED ARTICLE FOR MATASII

READERS REFERENCE: (SUBSCRIBERS-SII & PUBLIC ACCESS)

SII - HARD ASSETS

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.