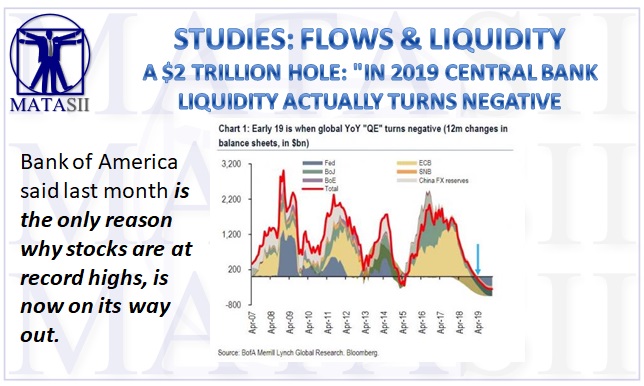

A $2 TRILLION HOLE: "IN 2019 CENTRAL BANK LIQUIDITY ACTUALLY TURNS NEGATIVE

This was a point first made by Deutsche Bank's Alan Ruskin two weeks ago, who looked at the collapse in global vol, and concluded that "as we look at what could shake the panoply of low vol forces, it is the thaw in Central Bank policy as they retreat from emergency measures that is potentially most intriguing/worrying. We are likely to be nearing a low point for major market bond and equity vol, and if the catalyst is policy it will likely come from positive volatility QE ‘flow effect’ being more powerful than the vol depressant ‘stock effect’. To twist a phrase from another well know Chicago economist: Vol may not always and everywhere be a monetary phenomena – but this is the first place to look for economic catalysts over the coming year."

He showed this great receding tide of liquidity in the following chart projecting central bank "flows" over the next two years, and which showed that "by the end of next year, the combined expansion of all the major Central Bank balance sheets will have collapsed from a 12 month growth rate of $2 trillion per annum to zero."

Shortly after, Fasanara Capital's Francesco Filia used this core observation in his own bearish forecast, when he wrote that "the undoing of loose monetary policies (NIRP, ZIRP), and the transitioning from 'Peak Quantitative Easing' to Quantitative Tightening, will create a liquidity withdrawal of over $1 trillion in 2018 alone. The reaction of the passive community will determine the speed of the adjustment in the pricing for both safe and risk assets."

Fast forward to today, when Bank of America's Barnaby Martin is the latest analyst to pick up on this theme of great liquidity withdrawal.

Looking at (and past) the ECB's announcement, Martin writes that "as expected, Mario Draghi took a knife to the ECB's quantitative easing programme yesterday. From January 2018, monthly asset purchases will decline from €60bn to €30bn, and continue for another 9m (and remain open ended). The ECB now joins an array of central banks across the globe that are either shrinking their balance sheets or heavily scaling back bond buying."

So far so good, and in itself, this structural tightening when coupled with the open-ended nature of the ECB's taper was ultimately perceived as very dovish for markets, sending not only the EUR plunging over 200 pips in the past 2 days, but sending Eurozone yields jumping, as the ECB telegraphed it was very much uncertain when, and if, it would truly be able to untangle itself from QE, especially since the ECB still can increase the 33% limit on bond purchases if needed be after 2018 to return back to a quantitative easing paradigm, one which may well include the direct purchase of equities and ETFs, as in the case of the SNB and BOJ.

Furthermore, as Martin adds, heading into the ECB decision "the market had a warm reception for yesterday's big QE cut: 5yr bund yields declined 5bp, European equities finished the day up 1.3% and iTraxx credit spreads ended 2bp tighter. In fact, we think markets were very relaxed heading into yesterday's landmark decision. Chart 2 shows that European rates volatility reached an all-time low of 33.2 towards the end of last week. Such was the market's comfort with the notion that Draghi would offset the drop in QE with heavy doses of forward guidance…and he indeed delivered lots on this front yesterday".

However, as Ruskin and Filia warn, Martin underscores that it is the bigger point that is ignored by markets, namely that it is all about the "flow" of central bank purchases. And in this context, the BofA strategist warns that it will take just over a year before the global liquidity tide not only reaches zero, but turns negative... some time in early 2019.

Chart 1 shows year-over-year changes in global asset purchases by central banks (we also include China FX reserves here). Given this year's slowdown in ECB and BoJ QE (the latter, in particular, is striking in USD terms), we are well past the peak in global asset buying by central banks. But with the Fed now embarking on balance sheet shrinkage, the start of 2019 should mark the point where year-over-year asset purchases finally turn negative - a trend change that will come after four straight years of expansion.

Still, despite virtually every strategist on Wall Street being familiar with this chart, few if any want to believe it. In fact, the favorable reception to what is fundamental a tightening shift by the ECB poses what Martin notes, is a the big risk to corporate bond markets, "for as long as the ECB's message on rates is dovish, the incessant inflow story into European credit is unlikely to die. And big inflows mean "overwhelming" credit technicals would persist for the foreseeable future (see chart 3 below). Thus, credit bubbles become a legitimate risk down the line."

To be sure, there is just one event that could end this hypnotized paralysis: inflation, which however stubbornly refuses to emerge, which is why "the market seems to have dismissed the idea that inflation could surprise to the upside" However, "should it rise quicker than expected, we sense the dovish rhetoric from central banks would quickly change. And we believe that this may be all that's needed to snuff out the great "reach for yield" trade that is currently gripping European corporate bonds."

And therein lies the rub: will inflation finally appear and prevent the world's biggest asset bubble from becoming even bigger, or - as Eric Peters warned two weeks ago - will the "Nightmare Scenario" for the Fed emerge, and even as asset prices rise ever higher, inflation remains dormant:

If we don’t see a sustained cyclical jump in wages, then yields won’t go up. And if yields don’t go up, then the asset price ascent will accelerate... Which will lead us into a 2018 that looks like what we had expected out of 2017; a war against inequality, a battle for Main Street at the expense of Wall Street, an Occupy Silicon Valley movement. Then you’ll have this nightmare for the next Federal Reserve chief, because they’ll have to pop a bubble.

In conclusion, we go back to the person who first observed the dramatic shift in central bank flow, Citi's Matt King, who had this to say:

To us, QE flows (i.e. marginal net purchases) rather than the stock of central bank holdings are the more important driver of asset prices. As we noted recently, if all major European investor types are already net selling or at least not buying € FI securities at prevailing market prices, then why should they stop or even start buying when the safety is withdrawn? Unless you have an emphatic answer, then with ECB QE falling by at least €500bn next year, according to our economists, and the Fed reducing its holdings of securities by almost $500bn at the same time, it would perhaps be best to tread cautiously.