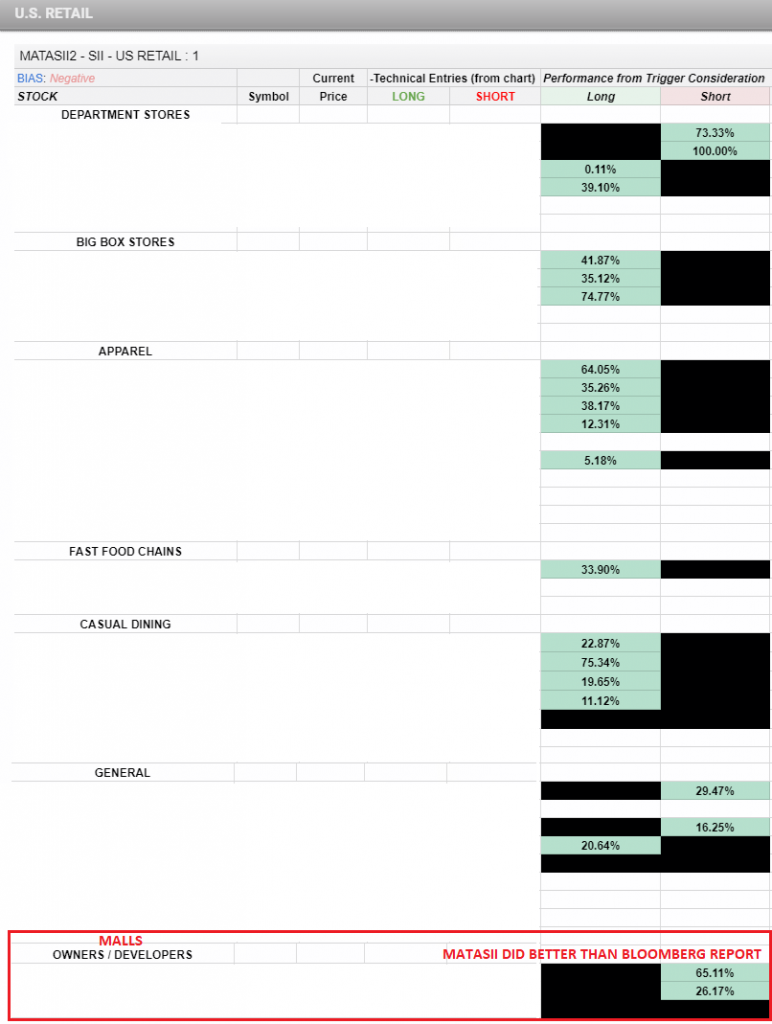

ANOTHER MATASII SII WINNER: SHORT TRADES ON US MALLS HAS BEST MONTH SINCE 2017

MATASII SII RETAIL RESULTS

A PUBLIC SOURCED ARTICLE FOR MATASII (SUBSCRIBERS-SII & PUBLIC ACCESS) READERS REFERENCE

SII - RETAIL

11-02-18 - Bloomberg - "Short Trade Betting on U.S. Mall Death Has Best Month Since 2017"

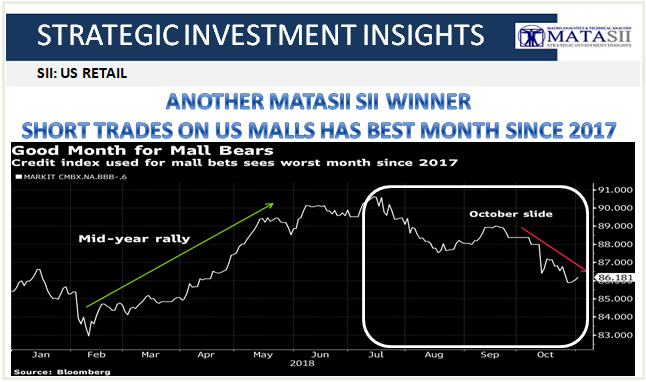

October was a good month for some traders placing bearish bets on U.S. shopping malls.

One low-rated segment of an index that most closely tracks the performance of U.S. mall loans saw its biggest decline in more than a year in October, presumably pleasing those who are paying hefty monthly premiums to bet against it.

The BBB- segment of the CMBX Series 6 index declined 2.63 percent in October, its biggest slide since August 2017. That tranche tracks an outsize number of mall mortgages, and traders can buy credit default protection on the index, essentially providing a roundabout way to short malls.

More than 4,000 CMBX Series 6 BBB- trades were executed in October, according to Bloomberg data. Not every CMBX trade is a short.

Deutsche Bank recommended shorting both CMBX Series 6 and CMBX Series 7 in early 2017. The BBB- basket of CMBX Series 7 fell less than 1 percent in October.

CMBX is a series of credit indexes that track the performance of commercial mortgages. The indexes are synthetic, meaning traders don’t actually own shares of the underlying loans, but instead make or lose money based on certain trigger events like defaults.