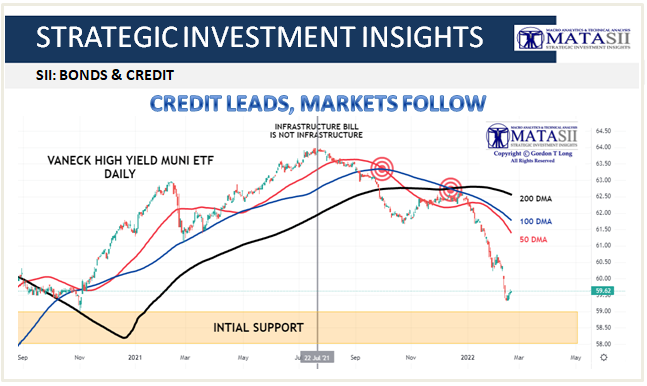

Gordon T Long Global Macro Research | Macro-Technical Analysis STRATEGIC INVESTMENT INSIGHTS BONDS & CREDIT CREDIT LEADS, MARKETS FOLLOW! There is nothing more certain, other than “Death and Taxes”, than the fact that Credit Leads and Markets follow! I have witnessed this truism since the 1987 ‘Black Monday’ market crash and long ago made […]

SII Bonds & Credit

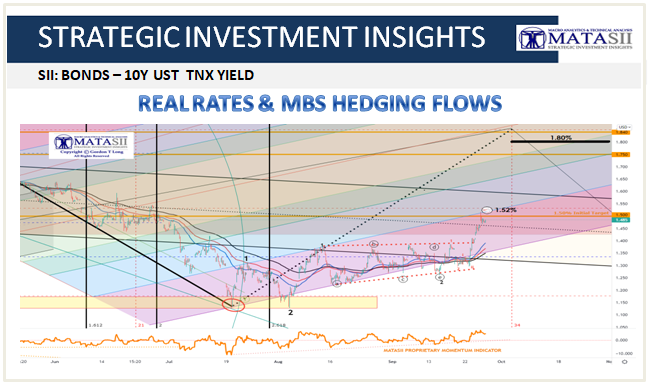

REAL RATES & MBS HEDGING FLOWS

REAL RATES & MBS HEDGING FLOWS 10Y TNX was trading at 1.55 earlier this AM before falling off (currently 1.52 from a close yesterday of 1.485). The current rise is about a rapidly increasing REAL RATES. Credit is becoming more expensive! Real Rates increase based on Credit Availability and Demand. What causes real interest […]

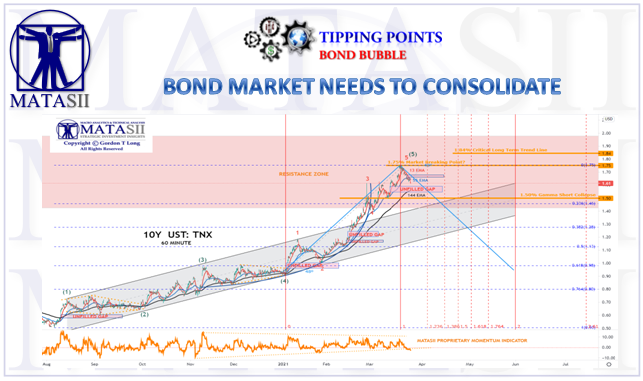

BOND MARKET NOW NEED TO CONSOLIDATE

Gordon T Long Global Macro Research | Macro-Technical Analysis TIPPING POINTS BOND BUBBLE BOND MARKET NEEDS TO CONSOLIDATE BOND MARKET NEEDS TO CONSOLIDATE The historic lift in bond yields has rapidly changed the investment landscape. Bond holders have experienced ~3.7% losses so far in 2021. It has been one of the worst year-beginning starts […]

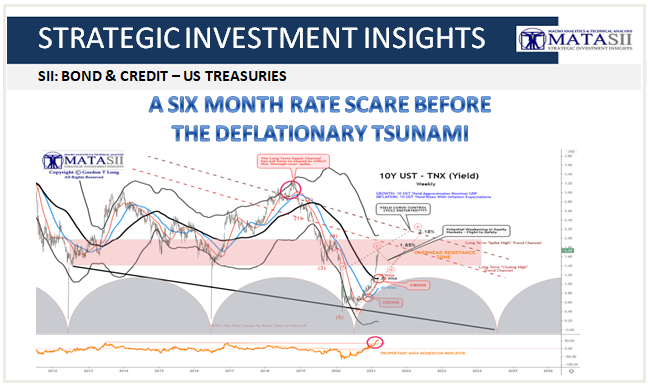

A SIX MONTH RATE SCARE BEFORE THE DEFLATIONARY TSUNAMI

Gordon T Long Global Macro Research | Macro-Technical Analysis STRATEGIC INVESTMENT INITIATIVES BONDS & CREDIT IS THIS A RATE SCARE RATHER THAN A ‘TRANSITORY’ INFLATION SCARE? What exactly are we afraid of? It was always a safe bet that there would be an inflation scare at some point early this year. Just the base […]

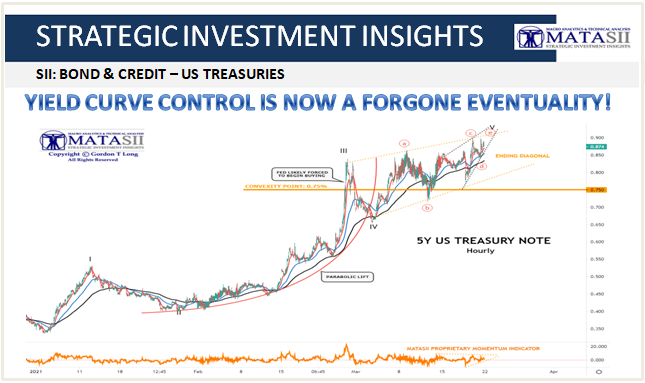

YCC IS NOW A FORGONE EVENTUALITY!

Gordon T Long Global Macro Research | Macro-Technical Analysis STRATEGIC INVESTMENT INITIATIVES BONDS & CREDIT YCC IS NOW A FORGONE EVENTUALITY! You can only play so many games before you are often trapped in a situation of your own creation. This is the situation the Fed finds itself in. Nothing makes this clearer than […]

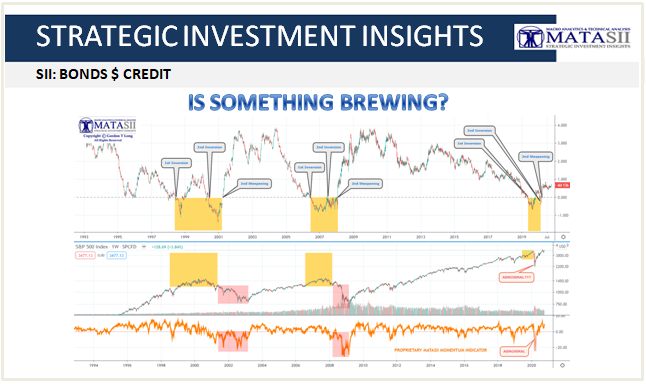

IS SOMETHING BREWING?

Gordon T Long Global Macro Research | Macro-Technical Analysis SII BONDS & CREDIT IS SOMETHING BREWING? We have highlighted on numerous occasions in prior video releases how the reality of fundamentals and valuations have effectively ‘disconnected’ from the equity and bond markets. This is not unexpected since markets historically shift from extremes of confidence versus […]

US TREASURY BENCHMARK SIGNALING PONTENTIAL YIELD BREAKOUT

Gordon T Long Global Macro Research | Macro-Technical Analysis SII BONDS & CREDIT US TREASURY BENCHMARK SIGNALING PONTENTIAL YIELD BREAKOUT We are witnessing some notable movements in two key benchmarks we are following. The 10Y US Treasury Yield is showing initial signs of a potential broken-out to the upside from a tight consolidation pattern. […]

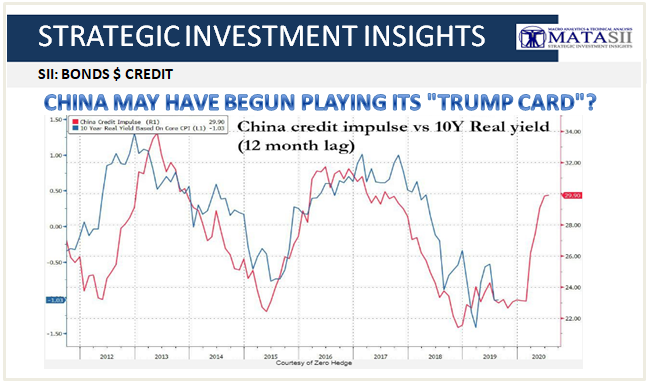

CHINA MAY HAVE BEGUN PLAYING ITS “TRUMP CARD”?

Gordon T Long Global Macro Research | Macro-Technical Analysis SII COMMODITIES – BONDS & CREDIT CHINA MAY HAVE BEGUN PLAYING ITS “TRUMP CARD”? What most are forgetting is that when it comes to any global reflationary spark, China – and its $40 trillion financial system which is double that of the US – has been […]

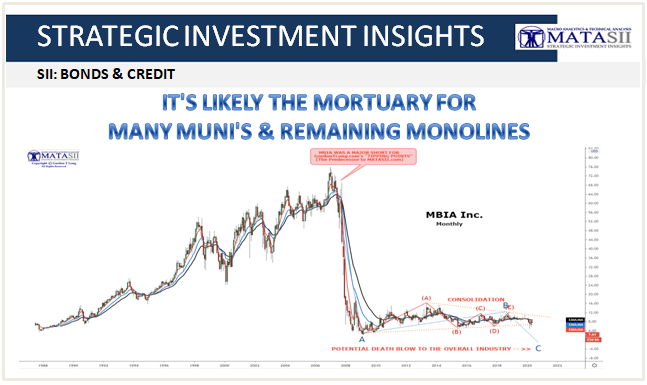

IT’S THE MORTUARY FOR MANY MUNI’S & REMAINING MONOLINES

Gordon T Long Global Macro Research | Macro-Technical Analysis SII BONDS & CREDIT IT’S THE MORTUARY FOR MANY MUNI’S & REMAINING MONOLINES The Muni Bond Market and still solvent Monoline insurers were already facing serious funding and credit rating problems prior to Covid-19, which has made the situation even more tenuous, despite the Fed’s Municipal […]