We have highlighted on numerous occasions in prior video releases how the reality of fundamentals and valuations have effectively ‘disconnected’ from the equity and bond markets. This is not unexpected since markets historically shift from extremes of confidence versus insecurity and greed versus fear. When we examine the S&P 500 Price-to-Sales Ratio (

click here) we observe it now exceeds even the historic dotcom bubble levels! Could this mean a shift in sentiment and trend is imminent?

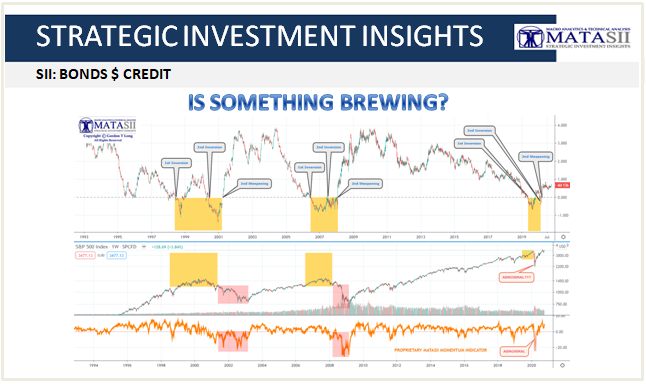

Professional Market Technicians will often highlight the observation of “Fractals” appearing at different levels of degree (time spans) when such major market trends occur. We are now witnessing such a technical occurrence taking place. We have highlight this in the Addendum to the video in the first block below.

What is particularly interesting about this particular market “Fractal” is that has taken the form of a “Megaphone” pattern. This is a well recognized technical pattern occurring at major market tops! Indications are that something is brewing in the Equity Markets in the short-to-near-term!

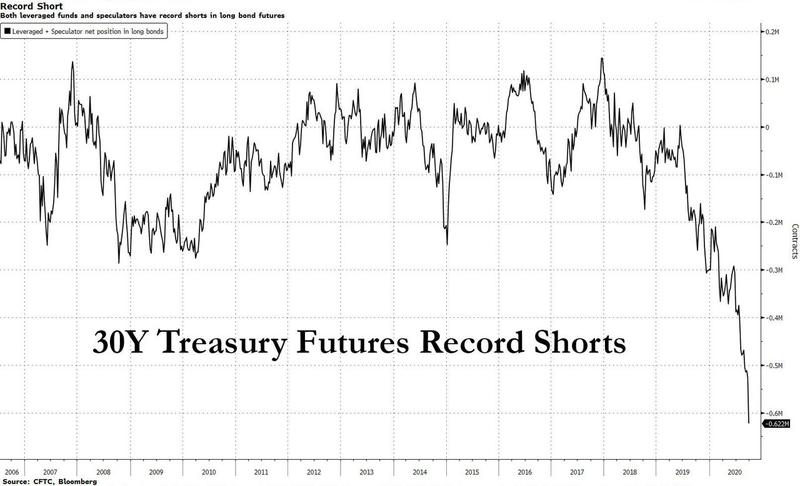

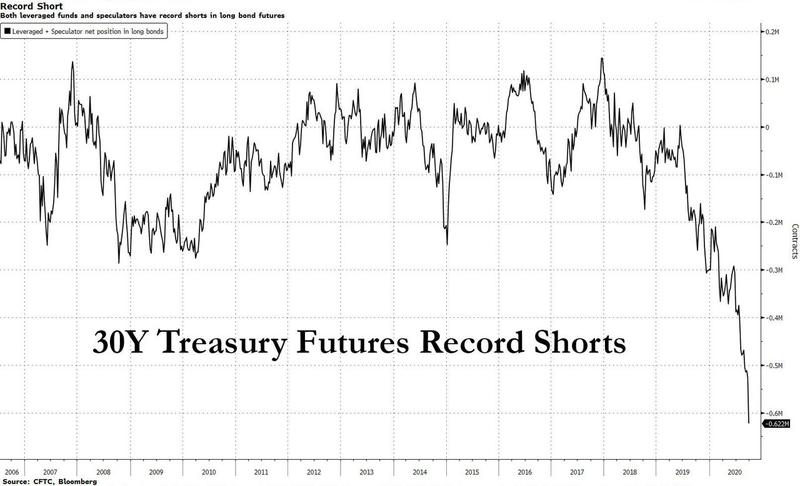

TOO MANY PEOPLE ON THE SAME SIDE OF THE TREASURY BOAT??

Contrarian investors look for situations when the majority of traders begin believing a certain view or belief. This is evidenced by lopsided trade positions. Such a situation is now occurring in Treasury Futures (chart to the right) where record short positions have recently been taken out. This is a bet that Treasury Yields are headed higher! As a consequence are we about to see a rate scare bet pay off, or is this an opportunity for contrarian investors?

A COMING RATE SCARE?

As we spelled out in the last newsletter:

“Both these benchmarks (Chinese Credit Impulse and Real 10Y US Treasury Yield) should be kept on your “radar screen” between now and the US Presidential Inauguration in January 2021.”

The Chinese Credit Impulse analogy shows a historical correlation which suggests US Treasury Real Yields will begin rising in Q1 2021 and could approach 1.40% Yield on the 10Y US Treasury by late Q3. This would further support the record short positions now evident in 30Y Treasury Future Shorts.

However the Yield Curve (chart block below) suggests the recent steepening in the nominal yield curve has not correlated with a market sell-off that would be expected based on historical patterns. Something is amiss which can likely be attributed to unprecedented Covid-19 central bank policy initiatives. The Bond market has effectively been taken over by the Federal Reserve who must now be aware and highly concerned with the sentiment in the Treasury Futures Market!

The Fed knows only too well it can’t overcome the global impact of the Chinese Credit Impulse. However, it could squeeze the current shorts before the Chinese Credit Impulse’s 12 month lag kicks in. A Fed induced short squeeze during the US Presidential turmoil would take bond prices higher and have lower yields from which to potentially absorb the Chinese Credit Impulse while still maintaining relatively low yields required to financing an exploding US debt.

“the risk for rates to move higher in a non-linear manner is greater ….. the second part the correction narrative may now be ready to play out – the rate scare …. in addition to the obvious catalyst of a fiscal deal getting passed sooner than what is now expected, we also have the election uncertainty holding back the move we expect …. 2020 now looks very similar to 2016 in many ways … global recession with policy stimulus driving a solid recovery and cyclicals outperforming defensives. However, rates diverged just like they are today held back by Brexit and the election. This time it’s COVID and the election.” Michael Wilson, Head of Global Equity Strategy at Morgan Stanley.