FAKE NEWS: WARREN BUFFETT SAYS STOCKS ARE FAIRLY VALUED??

You know markets must be near a top when CNBC starts distorting its facts to increase viewership. CNBC viewership growth has been problematic for a few years now following two major market draw-downs since the Dotcom Bubble popped and investors lost interest in the markets. With markets at historic highs CNBC is trying to re-ignite the "animal" instincts of former viewers.

The latest was the October 3rd feature interview with Warren Buffett when the syndicated media outlets headlined that Buffett stated the markets were"fairly" valued to "undervalued". Few heard the actual interview. The 20 something reporters with one college Economic course appear not to have properly grasped what he was saying. To put his comments in perspective they need to understand:

- When Bond yields are low (as Buffett says they are now), then Bond prices are high. In fact they are historically high because the central banks are buying close to $300B per month to artificially keep rates low so governments can afford their debt payments. Stocks in comparison (because they are not being bought by the government) are cheaper on a relative basis.

- Buffett pays no attention to the market because he buys strictly for the long term (the extreme long term by comparison to most of today's speculators). Bond yields will eventually go up (prices down) thereby making stocks a better buy in the long term compared to the current artificial price of US Treasury Bonds. Buffett always says that the market in the short term in a "slot machine" but in the long term is a "Weighing Machine". He therefore ignores the markets.

- In many ways Buffett was answering the sort of prejudiced interrogation question: "Yes or No, Have you stopped beating your wife yet?". Buffett is comparing Bonds to Stocks as if these are the only choices available to investors? They are actually both highly over-valued. They may be the only two types of Wall Street advertisers CNBC caters to, but the universe of alternative investments is large -ranging from Hard Assets to Real Estate to Private Placements.

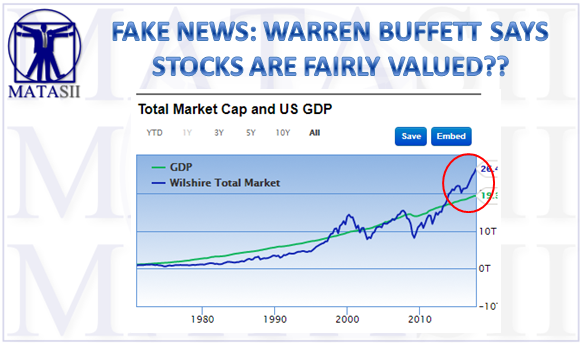

- The Buffett Indicator (Market Cap as measured by the Wilshire 5000 to GDP) which he uses to assess market valuations is not even raised or referenced in the interview. If it had been, here is what it would have said regarding current market valuations

BUFFETT INDICATOR

With this understanding, here is the full narrative of what Buffett actually said:

Well, valuations make sense with interest rates where they are. I mean, in the end you measure laying out money for an asset in relation to what you are going to get back, and the number one yard stick is U.S. governments.

When you get 2.30 on the ten-year, I think stocks will do considerably better than that. If I have a choice of the two, I'm going to take stocks at that point. On the other hand, if interest rates were on the ten-year were five or six, you know, a whole different valuation standard for stocks. And we've talked about that for some time now.

Interest rates are gravity. If we knew interest rates were going to be zero from now until judgment day, you could pay a lot of money for any other asset. You would not want to put your money out at zero. I would have thought back in 19 -- I mean, 2009 that rates would not be this low eight years later. It's been a powerful factor, and the longer it persists, the more people start thinking in terms of something close to the rates they've seen for a long time. The one thing I'm sure of is that over time stocks from this level will beat bonds from this level. If I can be short the 30-year bond at 3 percent or something and long the S&P 500 and just have it put away for 30 years, stocks are going to far outperform bonds. The question is which variable is going to change. Everybody expects interest rates to change. But they've been expecting that for quite a while.

I don't try to guess the stock market: I find businesses I like. But if I were to guess: if interest rates -- if the ten-year moved up to 5 percent, stocks would be somewhat cheaper.

It's been so wide I've written about it in annual reports. Stocks have been so much more attractive than bonds for a long time now and that's partly intentional on the part of the fed. I mean, they want assets to increase in value and the way to do it was to reduce that gravity force of higher interest rates.

I think they expect it to increase, but the question is how much. If three years from now interest rates are 100 basis points higher than this, stocks will still be cheap at these prices. If it's 300 or 400 basis points, they won't look cheap. Janet Yellen doesn't know what she would do three years from now. She's got more of a job than --that's a simple factor of the stock market. It's interesting because the fed has said that they would like to see 2% inflation. That's fairly recent. Paul Volcker would not have slept if he'd ever heard that in the 80s.

If the U.S. government is borrowing at ten years from you at 2.3%, and their own instrument, the fed, is saying 'we would really like money to become more 2% a year or less,' they're not promising you very much in terms of real terms for saving.