GLOBAL CAR SALES HIT SPEED BUMP AS DEMAND SLOWS & TRADE TENSIONS LOOM

Auto makers grapple with higher steel and aluminum prices and stiffer emissions regulations in Europe and China

-- SOURCE: 08-28-18 WSJ - "Global Car Sales Hit Speed Bump as Demand Slows and Trade Tensions Loom" --

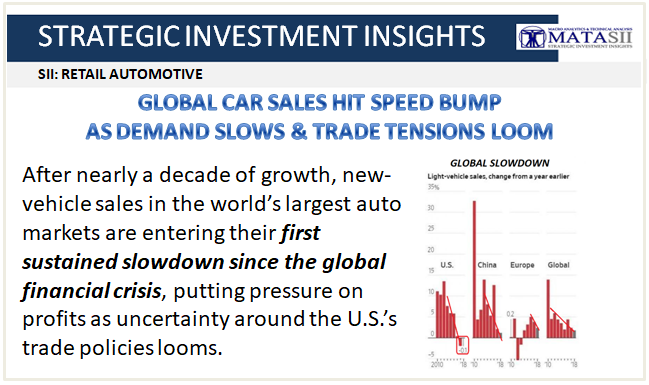

After nearly a decade of growth, new-vehicle sales in the world’s largest auto markets are entering their first sustained slowdown since the global financial crisis, putting pressure on profits as uncertainty around the U.S.’s trade policies looms.

China’s once-booming car market is cooling, in part because of escalating trade tensions with the U.S. American demand for cars and trucks—long a bright spot for the global auto industry—has topped out, following a seven-year growth streak that helped lift earnings for many car makers and auto-parts suppliers world-wide.

In Europe, where new-vehicle sales have benefited from the continent’s recovery, the car market is also softening as demand returns to prerecession levels. That is making profits harder to come by in a region where many car companies have long struggled to make money.

To be sure, global demand remains robust, driven by continued economic strength, but headwinds are gathering.

Slow Down

Trade conflicts and rising costs dent auto-industry growth.

Notes: Light vehicles weigh less than six tons. 2018 figures are estimates.

Source: LMC Automotive

President Trump’s trade policies are undermining consumer confidence in many markets outside the U.S. and are widely seen as the biggest threat to continued economic growth.

An easing of tensions between the U.S. and its major trading partners could still prevent the slowdown in auto sales growth from becoming a more rapid decline, say analysts.

Evidence of that came Monday, when an agreement between the U.S. and Mexico to rewrite portions of the North American Free Trade Agreement buoyed investors, lifting U.S. stocks, global currencies and commodities. Shares of General Motors Co. and Ford MotorCo. surged. On Tuesday, German auto stocks including Volkswagen AG , BMW AG andDaimler AG —which have big factories in the U.S. and Mexico—outperformed the country’s broader DAX index.

But the U.S. is still threatening Europe with new tariffs and ratcheting up tariffs on China, the biggest auto market by sales, which has responded with a 40% import tax on U.S.-built vehicles. An all-out trade war could push the auto industry off a cliff, say analysts. Oxford Economics, a global forecasting group, estimates that a “moderate trade war scenario” could result in a decline in global gross domestic product in real terms by about 0.5% in 2019, which could sap demand for new vehicles.

This worry has put several car makers, including Ford and Fiat Chrysler AutomobilesNV, into caution mode as they temper their financial expectations. Daimler in June issued an unexpected profit warning, saying China’s retaliatory import duties on vehicles built in the U.S. would dent sales and profits for the sport-utility vehicles it makes at an Alabama plant.

Last week, Continental AG , the world’s second-largest auto-parts supplier, also warned investors its profits could take a hit this year, blaming softer demand for cars in Europe and China.

“The slowdown comes at a very difficult time as [the industry] transitions to more electrification and the robocar arms race sucks up research and development money,” said Dave Sullivan, an analyst with consulting firm AutoPacific Inc.

The weakening outlook comes as firms grapple with higher steel and aluminum prices stemming from new tariffs imposed by the Trump administration this year. Stiffening emissions regulations in Europe and China are also forcing auto manufacturers to spend billions of dollars on new technologies to curb tailpipe pollution.

Global auto sales have increased steadily since 2010, rising on average more than 5% annually. This year, car sales are on track to hit 97 million vehicles world-wide, but the growth rate is expected to slow to 1.8% over 2017, according to forecasting firm LMC Automotive.

Mr. Trump has threatened to impose additional tariffs on the auto industry and has said he sees such threats as a way to extract concessions from the country’s trading partners. In May, the White House asked the Commerce Department to investigate whether it could use a national-security law to impose tariffs of up to 25% on cars and auto parts imported into the U.S.

Such actions could further crimp car sales, auto makers and analysts say.

“This would produce a near standstill in the vehicle markets,” said Justin Cox, a senior analyst with LMC Automotive. The firm forecasts that, if the trade dispute escalates, new-car sales in 2020 are likely to come in three million vehicles lower than current forecasts.

In China, the slowdown in the new-car market comes after years of rapid growth driven in part by the wealth amassed by an expanding middle class. Auto makers have spent billions building factories and diversifying their lineups in China, now the world’s largest auto market by sales with 28.6 million new-vehicle sales last year, according to LMC.

But the government recently ended a popular tax incentive on new-car purchases that had helped fuel demand.

China’s move to impose a retaliatory import duty of 40% on cars imported from the U.S. also has hurt business, especially for BMW and Mercedes-Benz maker Daimler—both of which sell American-built SUVs in the country that are subject to the tariff. BMW has raised prices on its U.S.-made vehicles sold in China.

New-car sales in China fell 5.3% to 1.59 million in July, compared with the year-earlier period, surprising investors and causing auto makers to rethink their forecasts. For the full year, sales are forecast to grow 1.2% over last year, according to LMC Automotive, down from a 13% growth rate in 2016 and 2.1% in 2017.

Ford in July cut its full-year profit guidance after reporting weaker-than-expected results in China and Europe, two key markets where it lost money in the second quarter. FCA also has reduced its profit forecast for 2018, blaming poor performance in China.

Both Ford and FCA had been counting on the Chinese market to reduce their dependence on North America. U.S. auto sales, having peaked in 2016 at a record 17.5 million, are on track to decline in 2018 for a second year in a row.

In Europe, new-car demand has nearly returned to its pre-financial crisis peak. Sales of new cars in the European Union were up 2.9% in the first half, but that is down from the 4.7% growth posted in the first half of 2017.

Trade tensions with the U.S., the threat of a diesel-engine ban on the continent and weaker consumer confidence in the U.K.—Europe’s second-largest car market—in the wake of the vote to leave the EU have sapped sales growth within the past year.

Auto makers will need to look at Eastern Europe and emerging markets, such as India and Africa, for new pockets of growth, analysts say.

“More auto makers are going to explore how to grow further in inland China and what it will take to grow in Africa,” said Mr. Sullivan with AutoPacific.

Write to William Boston at [email protected]

Appeared in the August 29, 2018, print edition as 'Global Auto Sales Slow, Pressuring Profits.'

RELATED

- America Has Fallen Out of Love With the Sedan

- Continental Shares Plunge After 2nd Profit Warning in a Year (Aug. 22)

- Trump Auto-Tariff Timetable Likely to Slip (Aug 21)

- Trump Threatens Tariffs on Canadian-Made Cars (Aug. 10)

- Big Auto Makers Trim Forecasts (July 25)

- The Many Ways Trump’s Trade Disputes Are Affecting the Auto Industry (July 19)

- Trump Cites Car-Tariff Threat as Biggest Trade Leverage (July 2)