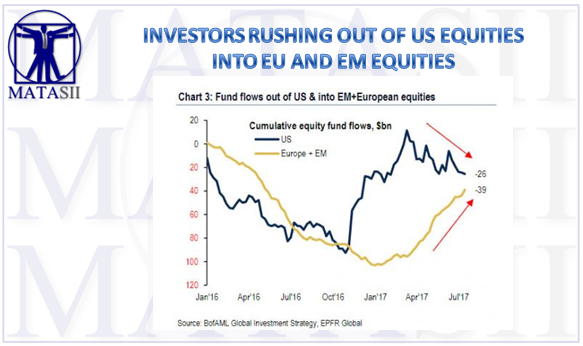

INVESTORS RUSHING OUT OF US EQUITIES INTO EU AND EM EQUITIES

EPFR reported that there was a whopping $9.9bn inflow into equities and $10.7bn into bonds (nearly all corporate bonds), as global stock markets and credit indexes hit all-time highs.

Where is all this new money going? For those following EM and Europe moves in recent weeks, it will come as no surprise, that of the $24BN in outflows from US stocks in the past 3 months, $19BN have gone into European stocks & $20BN into EM stocks, driven by more attractive rates & EPS outlook.

For now, all those rushing into the "hottest" new thing have been rewarded: annualized YTD returns for some of the biggest uses of cash include

- Tech stocks at 55%,

- EM stocks 50%,

- Biotech 36%, E

- AFE stocks 33%,

- European HY 27%,

- Banks 27%,

- US stocks 18%, and

- US CCC HY 16%.

All this is taking place amid a backdrop of what Hartnett calls "lovey-dovey central banks" - Fed/ECB/BoJ all turned dovish in recent weeks, and the only bond sectors with outflows this week were Treasuries and floating-rate bank loans (latter previously big YTD inflow winner in anticipation higher rates).

This was offset by the biggest inflows into Junk Bonds in 3 months as investors aggressively buy "yield" theme.