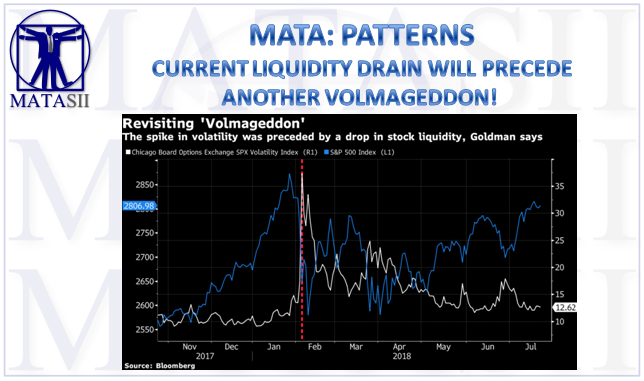

CURRENT LIQUIDITY DRAIN WILL PRECEDE ANOTHER VOLMAGEDDON!

LIQUIDITY IS STEADILY BEING REDUCED FROM THE MARKETS

07-24-18: Outflows of U.S. mutual funds and ETFs in June totaled $22.1 billion, the greatest amount in nearly three years, according to Morningstar's latest report. The bulk of the outflows were from U.S. equity, with $20.8 billion of outflows, $17.1 billion from active funds and $3.7 billion on the passive side. Outflows from international equity funds totaled $9.8 billion, the most since 2008, largely due to emerging-market outflows. Only taxable-bond and municipal-bond funds had inflows, $15.5 billion and $2.6 billion, respectively. Among top U.S. fund families, Vanguard led the way with $7.4 billion in inflows, but its growth continues to slow. Related ETFs include VXUS, EEM.

SHRINKING LIQUIDITY LEADS TO VOLATILITY

-- SOURCE: 07-24-18 Bloomberg - "Goldman Warns of Liquidity-Fueled Sell-off After ‘Volmageddon’" --

- Weakened liquidity might have set stage for volatility surge

- February event stands as warning to consider hedges: Goldman

More than five months after February’s so-called volmageddon, the causal connection with a sudden slide in U.S. equity liquidity is only now becoming clear, according to Goldman Sachs Group Inc.

They argue that the sharp spike in the Cboe’s Volatility Index on Feb. 5, which knocked out two volatility-related products and spurred a wide retreat in stocks, might have been preceded by “weakened liquidity conditions” in the U.S. equity market. The problem hasn’t gone away and investors should consider hedging strategies to protect their portfolios from further volatility, Goldman said.

Liquidity as measured by the difference between bid and ask prices for S&P 500 E-mini futures -- one of the most widely-traded and liquid U.S. equity futures contracts -- dropped sharply in the run-up to Feb. 5, and has yet to fully recover, according to Goldman’s analysis. “The week of Jan. 29 was the worst week for bid/ask depth in years for SPX futures and key U.S. equity ETFs,” Goldman said. SPX is the ticker for the S&P 500.

While analysts and investors have long complained of diminished liquidity -- roughly defined as the ability to buy or sell an asset without affecting its price -- in the corporate-bond market, the notion that stocks may be experiencing a similar problem is likely to fuel concerns that broader markets are becoming more susceptible to wild swings.

“To the extent liquidity is the new leverage, if we start off our next sell-off with already-diminished equity market liquidity, how much liquidity will there be at the depths of the sell-off,” Goldman analysts Rocky Fishman and John Marshall asked in their note.

The record one-day spike in the Volatility Index -- also known as the VIX or Wall Street’s fear gauge -- on Feb. 5 led to the collapse of two exchange-traded products that had allowed investors to bet on prolonged stretches of market calm. It also sparked one of the most violent moves in U.S. equities in history, with the Dow Jones Industrial Average slumping more than 6 percent in just six minutes.

A 50 percent drop in median bid-ask depth for U.S. equity futures compared to the fourth quarter of 2017 may have contributed to the sell-off, Goldman said. The figure is a measure of the amount of contracts market participants are willing to transact at each bid-and-ask level.

HFT Pullback?

Orders that otherwise might have had little impact on the overall market could have produced outsized effects if liquidity had been poor heading into early February, the analysts said. Algorithmic and high-frequency traders (HFTs), a group whose usefulness in market-making has long been debated, might have retreated from the market, leaving it more vulnerable to a flash crash.

“During the tax reform-led rally in January, implied volatility markets started to break their pattern of vol falling when markets rise -- as implied volatility was rising despite a rising spot market,” Goldman wrote. Then a strong jobs report in early February triggered worries about a jump in U.S. interest rates. That report “could have constituted the type of complex macro surprise that often leads to HFTs prudently pulling back,” the Goldman analysts wrote.

The analysts are advising investors to buy hedges against volatility, even as stability has returned to the market and the VIX has dropped back to 12.62.

“Option pricing’s assumption of frictionless markets may not hold up as well as in the past. We recommend adding to hedges while they are affordable,” the analysts conclude. “The possibility of a severe trade war driving the SPX as low as 2,200 by year-end adds urgency to hedging.”