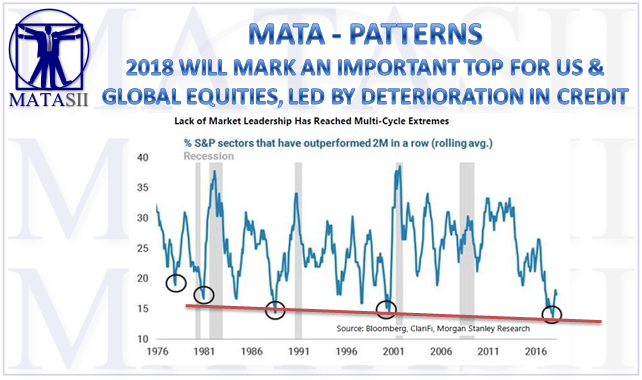

2018 WILL MARK AN IMPORTANT TOP FOR US & GLOBAL EQUITIES, LED BY A DETERIORATION IN CREDIT

Rarely have we experienced such low leadership, as shown in the Exhibit above. Experience tells us that these leaderless periods typically occur during important transitions in the market.

So what is that transition today and how can we harness it to make money?

- The market is digesting the fact that the tax cut last year has created a lower quality increase in US earnings growth that almost guarantees a peak rate of change by 3Q.

- Furthermore, the second order effects of said tax cuts are not all positive. Specifically, while an increase in capital spending and wages creates a revenue opportunity for some, it also creates higher costs for most. The net result is lower margins, particularly since the tax benefit is 100 percent “below the line.”

- Now, with the pricing mechanism for every long duration asset— 10-year Treasury yields—rising beyond 3 percent, we have yet another headwind for risk assets.

- Perhaps most importantly for US equity indices, these higher rates are calling into question the leadership of the big tech platform companies—the stocks that may have benefited from the QE era of negative real interest rates more than any area of the market.

When capital is free, growth is scarce, and the discount rate is negative in real terms, market participants reward business models that can use that capital to grow. Dividends and returns on that capital today are less important with the discount rate so low. But, with real interest rates rising toward 1 percent, that reward structure may be getting challenged.

The good news is that valuations have adjusted significantly for the many of these companies and the broader equity market. With the S&P 500 trading at 16x forward EPS, this valuation adjustment looks completes, and several of these former tech leaders will likely re-emerge.

The market will also continue its search for new leadership. On that front, Energy stocks have taken a step forward and appear to be a good candidate. Sustainably higher oil prices combined with more capital discipline should attract greater interest from investors that have basically abandoned the sector.

Going back to the Exhibit above, once the leadership breadth bottoms from such low levels and the Fed is hiking rates:

- Late-cycle sectors like Energy, Industrials, and Healthcare tend to lead.

- This is eventually followed by outright defensive sector leadership of Utilities, Telecom and Staples.

That very much aligns with our thinking that

2018 will mark an important cyclical top for US and global equities, led by a deterioration in credit.

Narrowness of breadth and a lack of leadership suggest that this topping process is in the works and will ultimately lead to a fully defensive posture in the market later this year.

For now, in the US we recommend a rotation to late-cycle sectors like Energy and Industrials with Financials as a way to participate in rising interest rates. Tech is likely to participate, too; it just won’t be as dominant as last year, in our view.