The time is right to tap into hydrogen’s potential to play a key role in tackling critical energy challenges. The recent successes of renewable energy technologies and electric vehicles have shown that policy and technology innovation have the power to build global clean energy industries.

Hydrogen is emerging as one of the leading options for

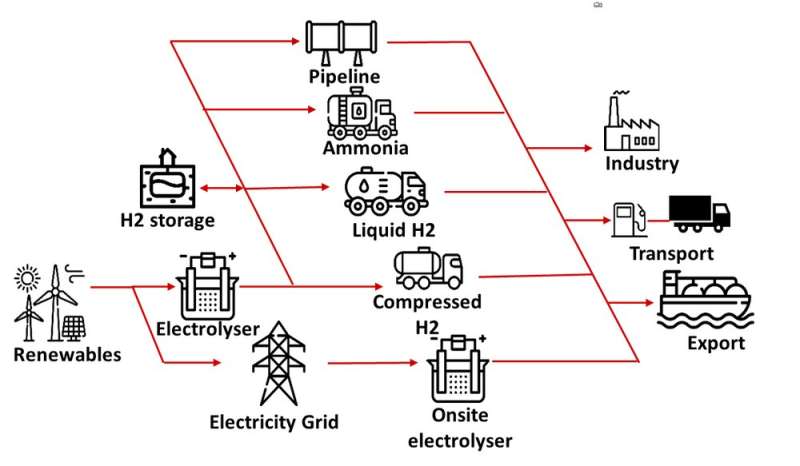

storing energy from renewables with hydrogen-based fuels, potentially transporting energy from renewables over long distances – from regions with abundant energy resources, to energy-hungry areas thousands of kilometers away.

Green hydrogen featured in a number of emissions reduction pledges at the UN Climate Conference, COP26, as a means to decarbonize heavy industry, long haul freight, shipping, and aviation. Governments and industry have both

acknowledged hydrogen as an important pillar of a net zero economy.

The

Green Hydrogen Catapult, a United Nations initiative to bring down the cost of green hydrogen announced that it is almost doubling its goal for green electrolysers from 25 gigawatts set last year, to 45 gigawatts by 2027. The European Commission has

adopted a set of legislative proposals to decarbonize the EU gas market by facilitating the uptake of renewable and low carbon gases, including hydrogen, and to ensure energy security for all citizens in Europe. The United Arab Emirates is also raising ambition, with the country’s new hydrogen strategy aiming to

hold a fourth of the global low-carbon hydrogen market by 2030. Also Japan

recently announced it will invest $3.4 billion from its green innovation fund to accelerate research and development and promotion of hydrogen use over the next 10 years.

GREY, BLUE OR GREEN HYDROGEN

You might encounter the terms ‘grey’, ‘blue’, and ‘green’ being associated when describing hydrogen technologies. It all comes down to the way it is produced. Hydrogen emits only water when burned, but creating it can be carbon intensive. Depending on production methods, hydrogen can be grey, blue or green – and sometimes even pink, yellow or turquoise.

Green hydrogen is defined as hydrogen produced by splitting water into hydrogen and oxygen using renewable electricity. This is a very different pathway compared to both grey and blue. However, green hydrogen is the only type produced in a climate-neutral manner making it critical to reach Net Zero by 2050.

Green hydrogen is an important piece of the energy transition. To realize this, it is well understood that we first need to:

- Further accelerate the deployment of renewable electricity to decarbonize existing power systems,

- Accelerate electrification of the energy sector to leverage low-cost renewable electricity,

- Decarbonize sectors that are difficult to electrify – like heavy industry, shipping and aviation – through green hydrogen.