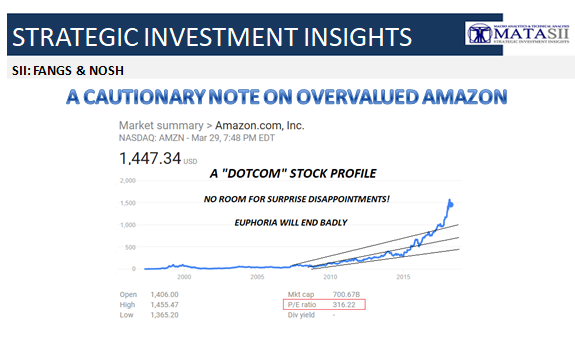

A CAUTIONARY NOTE ON OVERVALUED AMAZON

Summary

- Amazon, while extremely successful, is vulnerable due to its reliance on tax avoidance and pricing leverage (sometimes involving losses) to steal market share from competitors.

- If a single piece of the puzzle gets broken, Amazon's stock trades at such a high multiple that it could come crumbling down.

It took the threat of a trade war, but the market is finally waking up to the gross overvaluations of many leading stocks. That's right. I'm talking about things like Amazon (AMZN), Netflix (NFLX), and Tesla (TSLA). I'm talking about stocks that were elevated to absurd valuation levels thanks to an almost bubbly stock market, and the wild speculation that has run amok amidst an interest rate environment that has made cash easy to come by.

Now, as investors are forced to look at their portfolios with the thought that our Administration might start favoring American workers over American investors (a sentiment that is difficult to dislike), these highly inflated stocks are a little less appealing.

It's a fascinating turn of the events. The United States cuts taxes, driving markets up big time. Then, the White House takes aim at companies that are alienating American industry in pursuit of their own gains. It's an interesting balancing act. Regardless of anyone's personal feelings, it is certainly shaking the markets. Personally, I think it is merely exposing a symptom of a more pandemic issue within the market. Investors have mistakenly allowed many stocks to become unrealistically valued.

I have been a grumpy grump about expensive tech companies for over a year. It's as if investors no longer care about earnings. It's all about future potential, fundamentals be damned. Well, that attitude almost always gets people burned in the end. The great internet bubble of the 90s rings a bell. I believe we're seeing the beginning of a crack in the facade. There is no greater example than Amazon.

The stock is down 11% over two weeks (at the time of writing). Obviously, this pales in comparison to the collective 454% in gains that the stock has delivered over the past 5 years. But of those gains, how much of it has actually been backed by earnings? The answer is not very much.

The stock trades over 230 times its full-year 2017 earnings of $6.15. The enthusiasm is fair considering the $1.86 billion in net income that the company delivered in the Q4'17. But consider the nature of their climb and it doesn't seem sustainable long term.

Their income really comes from Uncle Sam

The company benefits greatly from tax incentives. Heck, for the longest time, they successfully avoided sales tax to subsidize their growth strategy. New Jersey offered $7 billion in tax breaks trying to get their hands on the company's second headquarters. $7 billion, to aid a company that is reducing overall retail employment. Think about that.

Because the company operates on extremely slim margins to create its price incentives, they need these tax loopholes to create their profits. The company paid zero in federal taxes in 2017. That type of avoidance has come without intense scrutiny. This week has been plagued by rumors Donald Trump wants to attack Amazon's practices, but it's still unclear what they would entail, and whether it will happen. Outside the US, the European Union is already attacking the company head-on. Citing its business in Luxembourg, Amazon has taken heat for using the small nation to avoid taxes on its European goods.

Currently, the EU is pushing a digital tax that would definitely change the landscape for Amazon's business there. Their commission data points out that digital companies are bringing their taxes down to 9.5%, while typical business pays over 23%. The tax would basically allow member states to tax Amazon's business within their countries, regardless of its there's a physical presence. Basically, they're saying that online sales are the same as brick and mortar sales in regards to taxes. Make no mistake, this would have huge implications for Amazon's already tight margins. The move is not unjustified, as big players like Amazon and Apple (AAPL) have never hesitated to avoid taxes in the European Union.

Let's not forget that the Supreme Court is actually scheduled to hear arguments on states collecting online sales taxes in April. This could expedite everything regarding Amazon's tax moves and create some precedent for some big changes.

Don't forget the other kids in the sandbox

The other thing that investors need to keep in mind is Amazon's competition. While competitors were certainly caught unprepared for the new equilibrium between brick and mortar vs. digital sales, many of these companies are regaining their footing. On the clothing/women's fragrances side, Macy's (M) has stabilized its slowdown. Their holiday sales were strong and incorporated growing digital sales. The stock also sells at much more affordable valuation.

On the tech side, Best Buy (BBY) has mounted a remarkable comeback since 2014. Through price cuts and a remarkably capable CEO, the company has mounted a strong challenge against Amazon's attempt at dominance. In a way, the retailer is making a point that I've long pushed. Anyone can do what Amazon does regarding digital sales. It's not a protected business strategy. You simply need the logistical means to ship your goods, with the scale to leverage prices. Best Buy has that ability. They have the store locations needed to ship online orders from their stores. It's a model that I actually suspect Jeff Bezo's envies, considering he's trying hard to push into brick and mortar locations.

Both Best Buy and Macy's trade at multiples of less than 20. That's a stark contrast to Amazon. Once more, they're producing their own digital sales growth. Best Buy delivered a record-setting $2.8 billion in online sales in the fourth quarter. Macy's reported digital sales growth of 10% in the fourth quarter, marking its 34th quarter of online gains. The Amazon bulls can bark all they like and there's a lot to bark about. But the growth of these rivals will eat right into Amazon's ability to grow market share.

There are a lot of "what ifs" here

The company is reliant on

- tax avoidance and

- large percentage sales gains

.. to drive its stock. Because of its low margin model, the retailer needs those big market share gains in order to put together meaningful gains in income. If you pull a brick out of the model, that stock price suddenly won't seem to be attainable.

In the fog of what has been unstoppable enthusiasm for the stock, I fear many investors are failing to keep these issues in mind.

I would also leave you with the sobering fact that Amazon has over $36 billion in long-term debt. Even with $30 billion of cash on hand, that's a lot of payments to make if Amazon loses its current tax "situation and net incomes get crunched. Food for thought before you plunge your hard-earned money into a stock that is so overpriced.