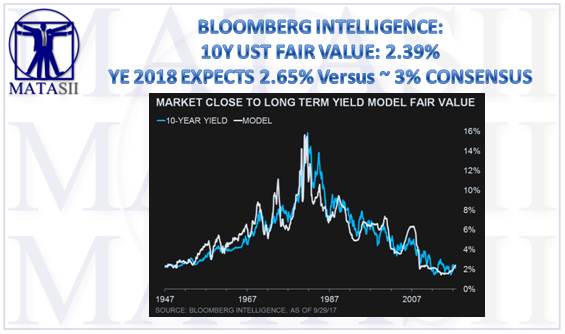

BLOOMBERG INTELLIGENCE: 10Y UST FAIR VALUE: 2.39% - YE 2018 EXPECT 2.65% VERSUS ~3% CONSENSUS

The Bloomberg Intelligence fair-value models for yield and curve highlight that yields are near fair value, while curves are flatter than the regression models suggest. BI forecasts yields to remain below consensus through 2018.

The BI Long Term Yield Model shows fair value at 2.39% given the Fed's balance-sheet level, the funds rate, GDP growth and CPI. A year ago, the model predicted yields should have been 1.85% when the market was at 1.60%. As the Fed continued to hike and GDP growth modestly accelerated, the model predicted yields should have climbed.

The model predicts yield will continue to rise if consensus economic and Fed-hike forecasts are realized. However, the market remains skeptical that the Fed will hike in line with either the Fed's dot plot or the consensus. Currently consensus sees three hikes before YE 2018, the market fewer than two.

The BI Yield Curve model shows that curves are flatter than economic fundamentals suggest. Part of this is the impact of the Fed's balance-sheet runoff. The market appears to be pricing for about a year's worth of the Fed's portfolio runoff. Curve flattening has been the likely result of the Fed decision to run off its balance sheet, causing the Treasury to issue more T-bills and short maturity coupons near term.

Between the anticipation of additional supply and the pricing of modest hikes, the front end should continue to modestly sell off. The long end should be impacted more by geopolitical risks such as North Korea and economic-data surprises.

Forward yield curves have moved toward our forecast over the past month, as the Fed statement was somewhat hawkish and optimism grows over a possible tax plan out of Washington. Given economic forecasts that have broadly followed the expected path, the BI yield outlook is unchanged from last month.

Curves may steepen modestly on the back of fiscal stimulus; however it's possible that as the market prices in more Fed hikes, flattening will follow, led by short-term rates. BI yield forecasts remain well-below the consensus across the curve. End of 2018 consensus is for the 10-year Treasury yield to be 2.93% vs. the BI forecast of 2.65%.